Indiana Oil Cleanup Services Contract - Self-Employed

Description

How to fill out Oil Cleanup Services Contract - Self-Employed?

If you need to be thorough, acquire, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the site’s user-friendly and convenient search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you desire, click the Purchase now button. Choose the payment plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Indiana Oil Cleanup Services Contract - Self-Employed in just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and click the Download option to retrieve the Indiana Oil Cleanup Services Contract - Self-Employed.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have selected the form for the correct city/state.

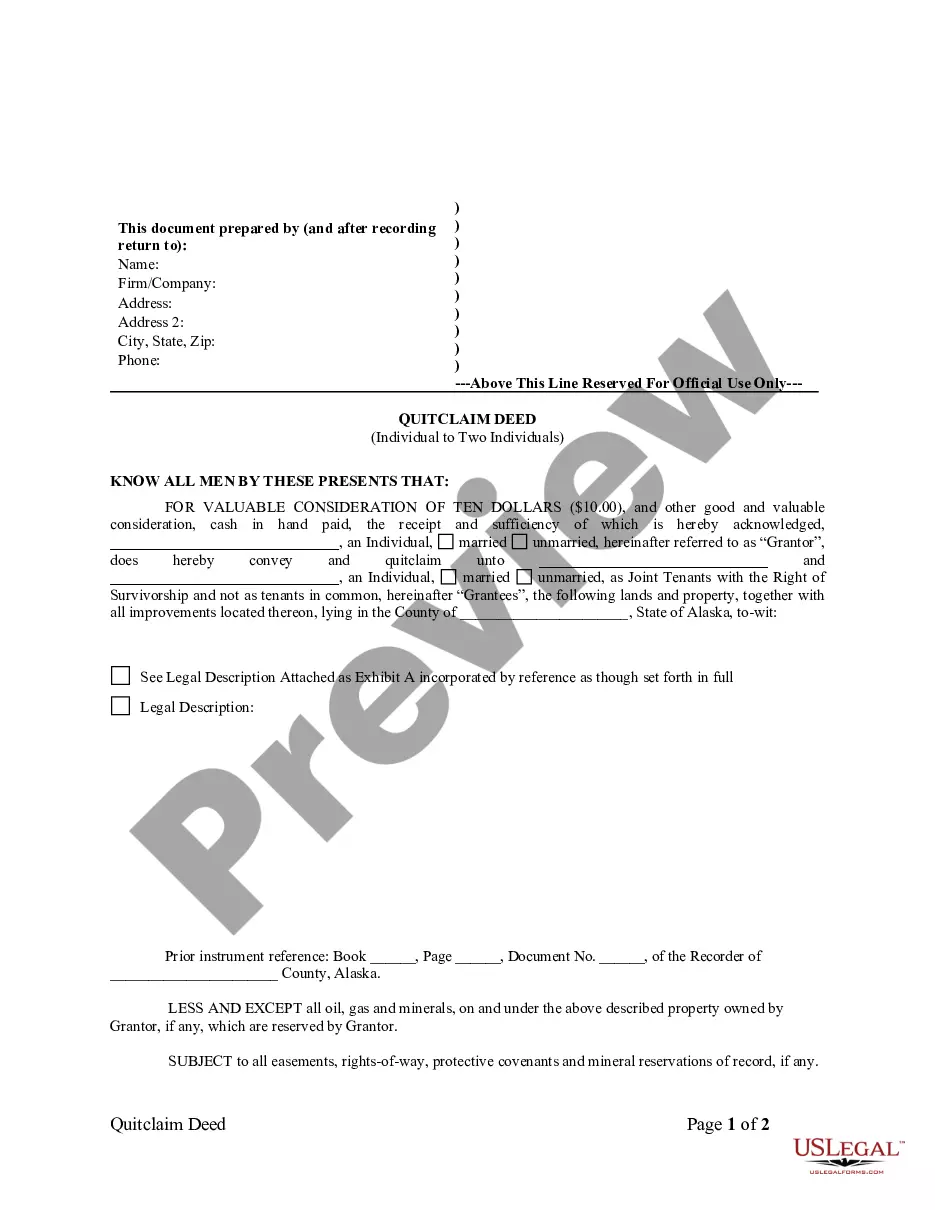

- Step 2. Utilize the Preview feature to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate other versions of the legal form template.

Form popularity

FAQ

Legal requirements for independent contractors include maintaining proper registrations, adhering to tax obligations, and following industry-specific regulations. For those engaged in specialized contracts, such as the Indiana Oil Cleanup Services Contract - Self-Employed, being aware of local and federal laws is essential. Consulting with legal professionals can help ensure you meet all necessary legal standards while maximizing your business potential.

A critical requirement for being classified as an independent contractor is having control over your work. You should decide how, when, and where you complete your tasks. This autonomy is particularly relevant when working on projects like the Indiana Oil Cleanup Services Contract - Self-Employed, as it illustrates the independent nature of your work.

The recent federal rule aims to clarify the classification of independent contractors and employees, focusing on factors such as the degree of control over work scheduling and tools. While this rule promotes clarity, it’s vital to stay informed about how it specifically affects your situation. If you are working under the Indiana Oil Cleanup Services Contract - Self-Employed, understanding these changes can help ensure compliance with both federal and state regulations.

Independent contractors must maintain control over how they perform their work. This means setting your own hours, choosing your own projects, and having the freedom to work for multiple clients. Following the criteria set by the IRS, such as providing your own tools and not being integrated into the company's staff, will ensure compliance. Understanding these rules is crucial, especially if you're involved in an Indiana Oil Cleanup Services Contract - Self-Employed.

Typically, independent contractors do not need workers' compensation insurance in Indiana, as they are not considered employees. However, if your work involves hazardous activities, like those associated with the Indiana Oil Cleanup Services Contract - Self-Employed, obtaining coverage may protect you from potential liabilities. Always evaluate your specific situation and consult a legal expert to determine what's best for you.

As an independent contractor in Indiana, you are responsible for reporting your income and paying self-employment taxes. This includes both Social Security and Medicare taxes, which can total 15.3% of your net earnings. You should keep thorough records of your earnings and expenses related to Indiana Oil Cleanup Services Contract - Self-Employed. Working with a tax professional can help you navigate your tax obligations effectively.

In Indiana, independent contractors are generally not required to obtain a business license unless they operate under a trade name. However, requirements may vary depending on the city or county where you work. It's essential to check local regulations to ensure compliance. If you're involved in specialized work, such as in the Indiana Oil Cleanup Services Contract - Self-Employed, additional permits or licenses may be necessary.

Cleaning up an oil spill is expensive due to the complexity of the task and the resources required. The Indiana Oil Cleanup Services Contract - Self-Employed necessitates specialized equipment, trained personnel, and adherence to environmental regulations, all of which contribute to increased costs. Moreover, the urgency to contain spills and prevent environmental damage often leads to additional expenses. Effective cleanup ensures compliance and protects the environment, making the investment worthwhile.

Yes, having a contract as an independent contractor is essential. It provides written proof of the project terms and helps protect your rights. Using resources like the Indiana Oil Cleanup Services Contract - Self-Employed can aid in crafting a comprehensive contract that safeguards your interests.

A basic independent contractor agreement is a document that defines the working relationship between a client and a contractor. It typically covers job duties, payment terms, and confidentiality provisions. In the context of Indiana Oil Cleanup Services Contract - Self-Employed, having this agreement ensures both parties understand their rights and obligations.