Indiana Financial Record Storage Chart

Description

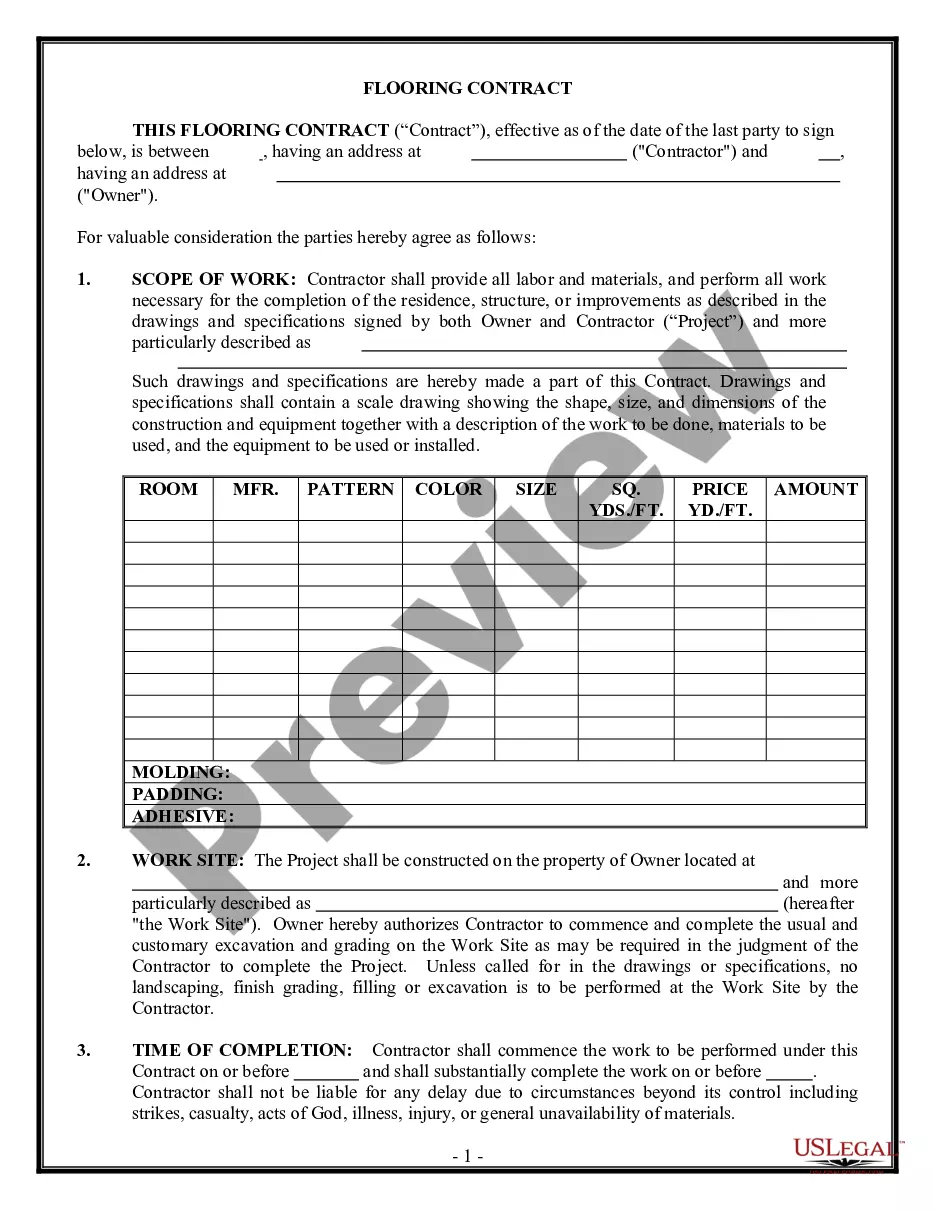

How to fill out Financial Record Storage Chart?

Locating the appropriate valid document template can be a challenge.

Clearly, there are numerous formats accessible online, but how do you acquire the official template you need.

Use the US Legal Forms website. The service provides thousands of templates, including the Indiana Financial Record Storage Chart, which can be utilized for both business and personal purposes.

First, ensure you have selected the correct form for your specific city/area. You can review the form using the Preview button and read the form description to confirm it is the right choice for you.

- All documents are reviewed by experts and meet state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Indiana Financial Record Storage Chart.

- Utilize your account to search for the official documents you have previously purchased.

- Navigate to the My documents section of your account and download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

Form popularity

FAQ

The IRS does not automatically destroy tax records after seven years; however, they may discontinue auditing returns from that time frame. It is prudent to keep copies of your tax returns and supporting documents for at least seven years to address any potential inquiries. The Indiana Financial Record Storage Chart can serve as your guide in managing these important documents effectively. Staying organized will better prepare you for any future IRS-related matters.

The seven-year retention rule is a guideline that suggests retaining specific financial and legal documents for seven years. This rule is particularly pertinent for tax and financial-related records, ensuring that you have essential documentation ready for potential reviews. Utilizing the Indiana Financial Record Storage Chart makes it easier to navigate these requirements. By integrating this practice, you can protect yourself from potential challenges in the future.

year retention policy refers to the practice of keeping certain documents for seven years for legal and financial reasons. This period is often recommended to allow enough time for audits, claims, or disputes to arise. The Indiana Financial Record Storage Chart serves as an excellent resource for businesses and individuals to understand which records fall under this policy. By adhering to this guideline, you can maintain compliance and reduce potential risks.

In Indiana, certain financial records should be retained for seven years to comply with legal obligations and for auditing purposes. This includes tax returns, bank statements, and receipts that support income and expenses. Keeping these records organized can be made easier with the Indiana Financial Record Storage Chart, which outlines essential documents. This chart provides a clear guide to help you understand what to file away.

Utility bills and bank statements are typically recommended to be retained for at least one year, although some may choose to keep them longer. The Indiana Financial Record Storage Chart advises that retaining them for seven years can preemptively address any financial discrepancies. Keeping these documents allows for easy reference and verification of payments. Utilizing digital storage solutions can make this process simpler and more efficient.

In Indiana, medical records must be retained for at least seven years according to state regulations. The regulations outlined in the Indiana Financial Record Storage Chart emphasize the importance of patient privacy and ensuring accessibility for patients. Healthcare providers must securely store these records to protect sensitive information. Always consult your healthcare provider for specific practices.

Individuals and businesses are responsible for storing their financial records. The Indiana Financial Record Storage Chart emphasizes that proper record-keeping is vital for compliance. You can manage your records effectively by using secure storage services or accounting software. Platforms like USLegalForms provide comprehensive solutions for managing and retaining your financial documentation.

You should retain various records for seven years, including tax documents, financial statements, and any correspondence with the IRS. The Indiana Financial Record Storage Chart highlights the importance of keeping thorough records. This approach provides security and reference for any financial disputes or audits. Additionally, maintaining these records aids in future tax filings.

According to the Indiana Financial Record Storage Chart, keep documents such as tax returns, supporting receipts, and business records for seven years. This also includes any records that are related to property ownership or sales. Keeping these documents is essential for audits or financial inquiries. Organizing them efficiently can save you stress in the future.

Financial records should be kept in an organized manner, either physically or digitally, as specified by the Indiana Financial Record Storage Chart. Ensure that all records are easily accessible and categorized by year or type. Using a secure storage solution helps protect sensitive information. Consider platforms like USLegal to streamline your record-keeping process.