Texas Petition for Release of Excess Proceeds and Notice of Hearing

Definition and meaning

The Texas Petition for Release of Excess Proceeds and Notice of Hearing is a legal document used when a property is sold at a tax foreclosure sale, and there are surplus funds after all taxes, penalties, and costs have been paid. This petition allows the original owner or their legal representative to request the release of these excess proceeds from the sale.

Who should use this form

This form is typically used by individuals or entities that have owned real property which was sold due to unpaid property taxes in Texas. If you believe you are entitled to excess proceeds from such a sale, you should consider using this form. It's crucial to ensure that you are on the list of parties entitled to notice following the sale.

How to complete a form

To properly complete the Texas Petition for Release of Excess Proceeds and Notice of Hearing, follow these steps:

- Fill in the name of the petitioner who is seeking the release of funds.

- Provide the relevant county and court information.

- List all parties who are entitled to notice.

- Include the date of court judgment and details about the property sold.

- Specify the amount of excess proceeds and the date they were deposited.

- Sign and date the petition.

Legal use and context

This form serves a specific legal purpose under Section 34.04 of the Texas Property Tax Code. It is relevant in the context of tax foreclosure sales where there are excess proceeds available after the sale of real estate. The petition must be filed appropriately within the assigned court to retrieve the funds legally owed to the petitioner.

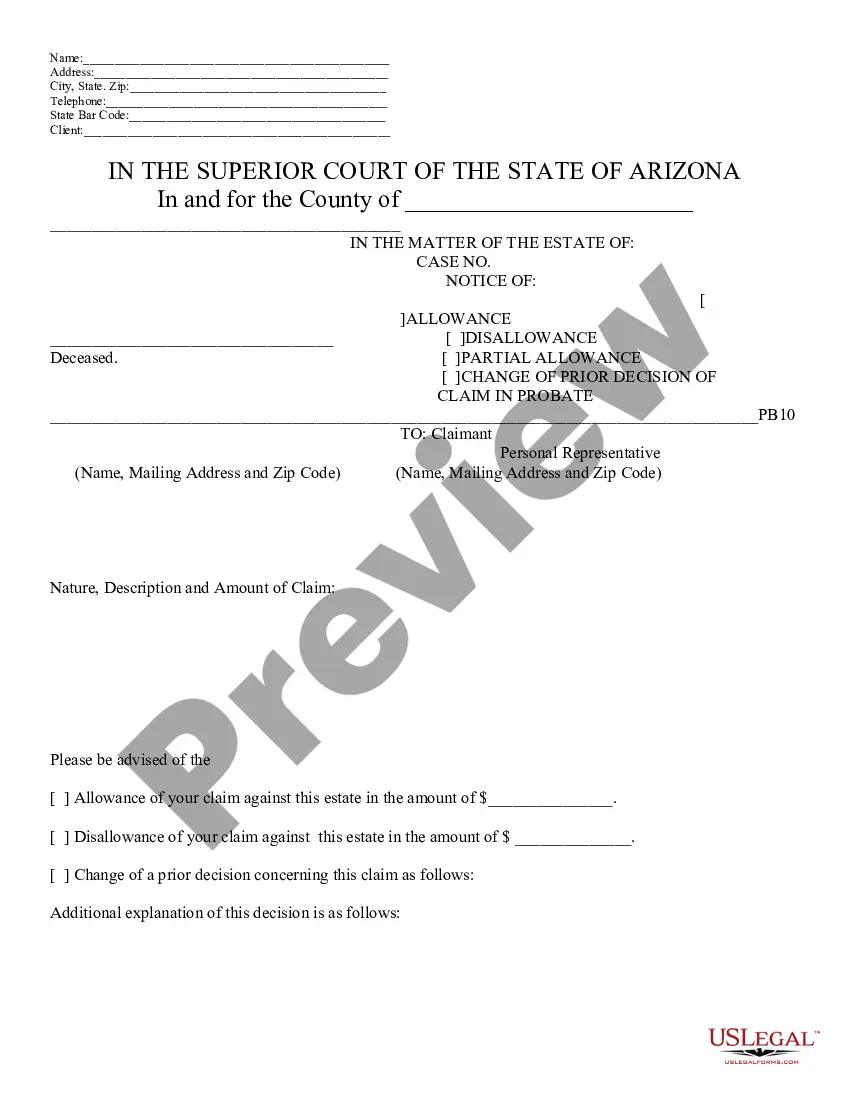

Key components of the form

The petition includes several key components:

- Petitioner’s name and contact information.

- Name of the court and case number.

- List of parties entitled to notice.

- Details of the property sold including billing number and legal description.

- The requested amount of excess proceeds.

Common mistakes to avoid when using this form

When completing the Texas Petition for Release of Excess Proceeds, avoid the following common errors:

- Failing to provide accurate and complete property information.

- Omitting the required notice to other interested parties.

- Not adhering to the required deadlines for filing the petition.

- Neglecting to sign the petition where indicated.

Form popularity

FAQ

Surplus funds or surplus refer to the funds remaining after payment of all disbursements required by the final judgment of foreclosure and shown on the certificate of disbursements. as stated by the Florida Statute 45.032.Let's say you owed $100,000 on your mortgage, and it sold at a foreclosure sale for $175,000.

The lender has no claim to excess proceeds if a foreclosure sale ends in an overage. They can only recoup the amount of their lossesloan balance and associated costs. If their aren't any pending liens or judgments on the home, the borrower gets the overage. You have a right to claim the money.

If a foreclosure sale results in excess proceeds, the lender doesn't get to keep that money. The lender is entitled to an amount that's sufficient to pay off the outstanding balance of the loan plus the costs associated with the foreclosure and salebut no more.

In Foreclosure, Equity Remains YoursIf you cannot get new financing or sell the home, the lender can sell the home at auction for whatever price they choose. If the home does not sell at auction, the lender can sell the home through a real estate agent. Remember that equity is what you own of your home's value.

Banks are willing to negotiate foreclosures because they are losing money on the property when it sits vacant.Banks can negotiate directly with buyers without the assistance of a real estate agent. Because they own the property, banks can set the price for any value they deem acceptable.

Will I Get Money Back After a Foreclosure Sale? If a foreclosure sale results in excess proceeds, the lender doesn't get to keep that money. The lender is entitled to an amount that's sufficient to pay off the outstanding balance of the loan plus the costs associated with the foreclosure and salebut no more.

§ 33-727. This statute generally provides that proceeds from a mortgage foreclosure sale go first to creditors according to their priority, and only to the owner after creditors are paid in full.

(a) A person, including a taxing unit, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property.