Indiana Checklist - Key Record Keeping

Description

How to fill out Checklist - Key Record Keeping?

You can spend hours online searching for the authentic document template that fulfills the state and federal requirements you need.

US Legal Forms provides a wide array of legal forms that can be evaluated by professionals.

You can easily obtain or create the Indiana Checklist - Key Record Keeping from our services.

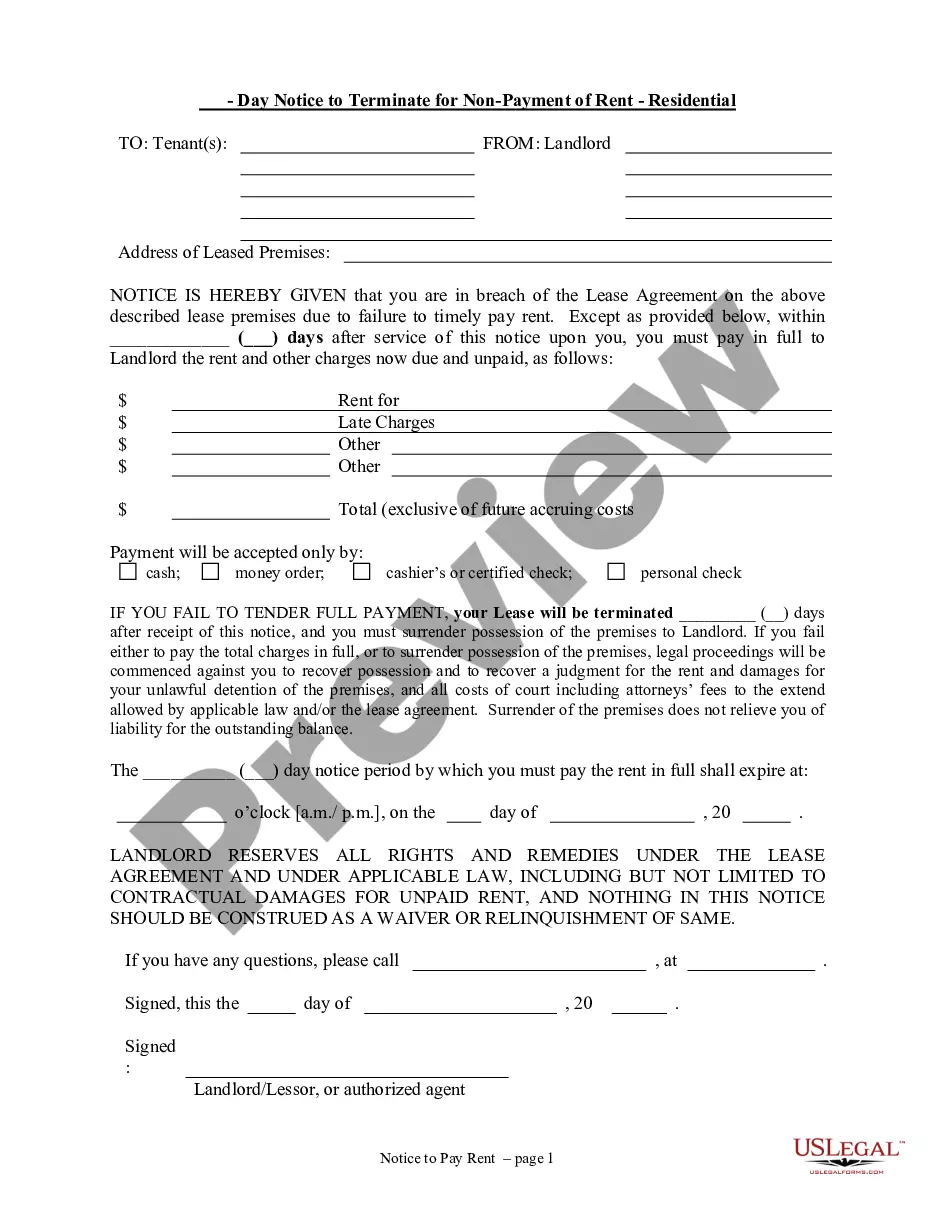

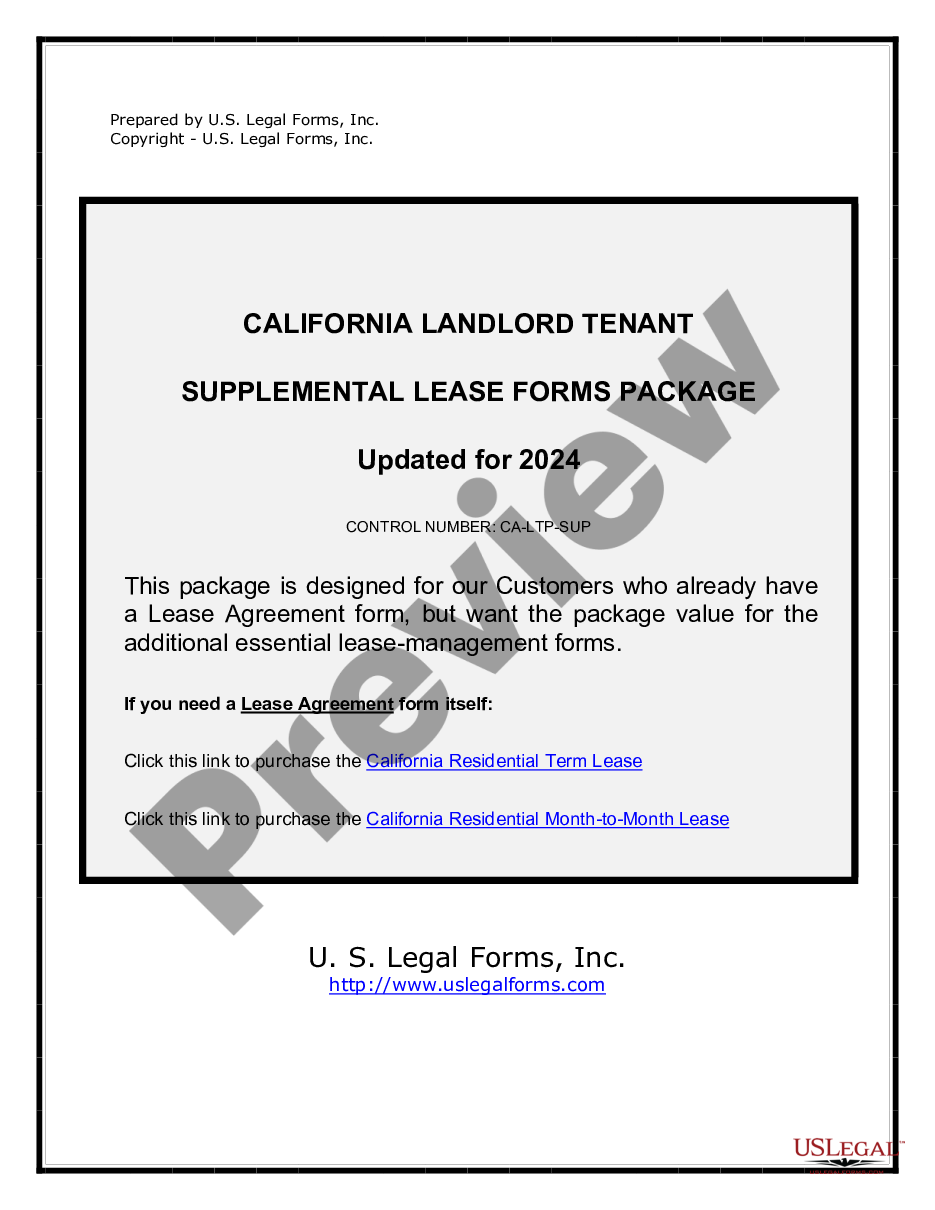

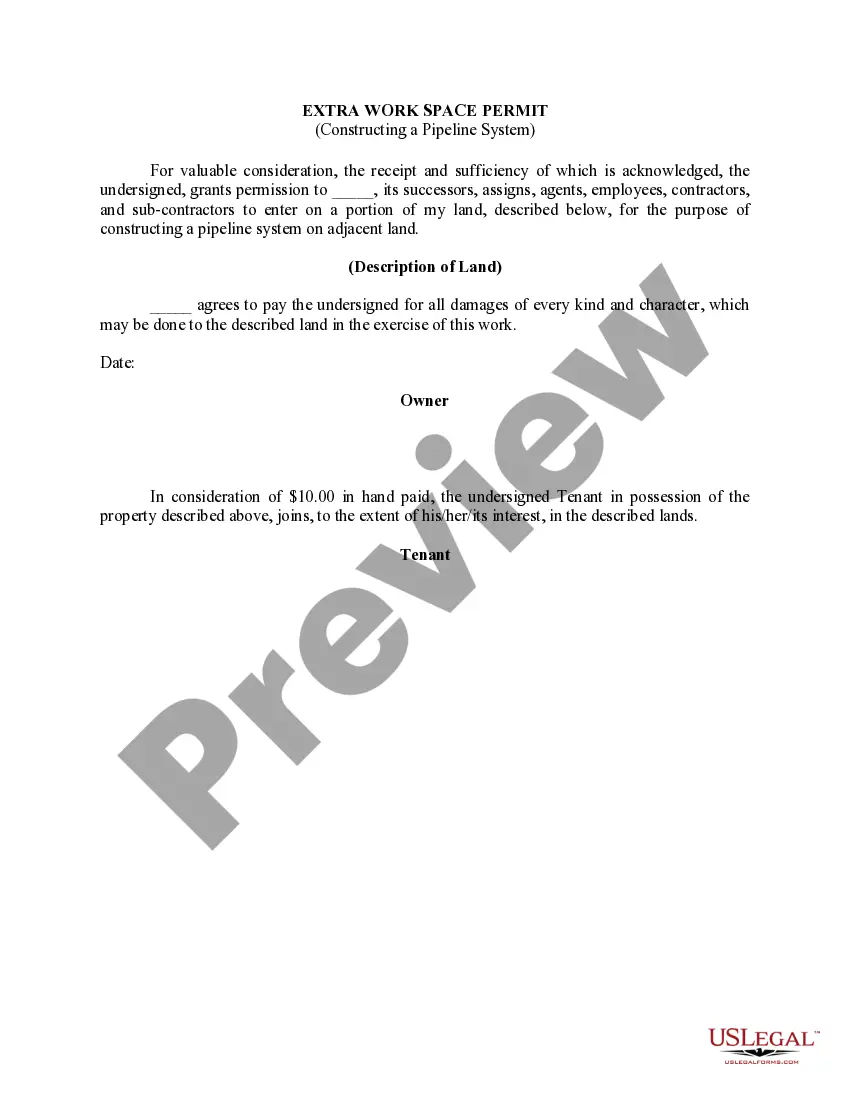

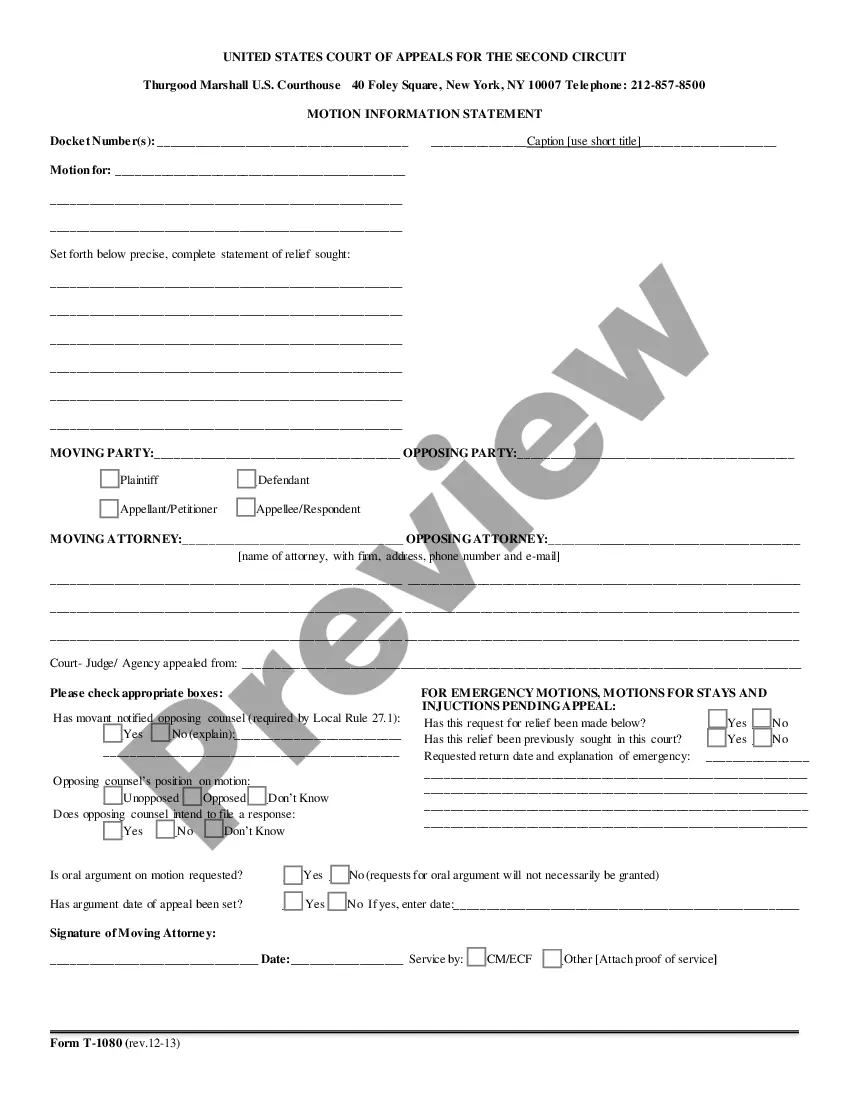

If available, utilize the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Indiana Checklist - Key Record Keeping.

- Every legal document template you purchase is yours permanently.

- To retrieve an additional copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow these straightforward instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form description to confirm that you have selected the correct form.

Form popularity

FAQ

To achieve effective records management, consider these eight essential steps: first, identify the types of records you need to manage. Next, develop a classification system to organize them. Then, implement security measures to protect sensitive information. After that, establish retention schedules based on the Indiana Checklist - Key Record Keeping. Regularly review and update your records, train staff on proper handling procedures, and utilize technology for efficiency. Finally, ensure compliance with applicable laws and regulations. By following these steps, you can enhance your records management process.

Yes, HR departments typically retain employee records for longer than six years, depending on various factors. For organizations in Indiana, following the Indiana Checklist - Key Record Keeping is essential. This guideline helps ensure compliance with state laws while also providing a reliable framework for managing important documents. It is crucial to consult applicable regulations and internal policies to determine the specific retention schedule.

In Indiana, the recommended duration for keeping employee files is generally seven years, as this includes all pertinent documentation regarding employment, health benefits, and payroll. Maintaining these files for this length of time aligns with the Indiana Checklist - Key Record Keeping requirements, ensuring you're ready for any potential disputes or audits. Let uslegalforms assist you with organizing and accessing your employee records easily.

The IRS typically requires you to keep employee records for at least four years after filing your taxes. More specifically, documents related to income, tax withholding, and employment status must be accessible during this period. Incorporating the Indiana Checklist - Key Record Keeping in your strategy helps guarantee compliance with federal regulations. Our uslegalforms platform offers tools to help you manage these timelines effortlessly.

In Indiana, businesses must retain employee records for a minimum of three years after the individual's employment ends. However, for payroll records, the state recommends keeping them for seven years. Following the Indiana Checklist - Key Record Keeping ensures you meet all local requirements, protecting your business in case of legal matters. Our resources simplify this process, making compliance easier.

For effective compliance, you should keep specific employee records for at least seven years. This includes records related to payroll, tax withholding, and any documentation regarding employee performance or disciplinary actions. Adhering to this timeline is essential in the Indiana Checklist - Key Record Keeping to ensure you are prepared for any audits or legal inquiries. Consider using our uslegalforms platform to streamline your record-keeping process.

To obtain your Indiana driving record, you can request it online via the Indiana BMV portal. You may also choose to submit a written request by mail or visit a local BMV office in person. This process is crucial for anyone following the Indiana Checklist - Key Record Keeping, as it helps ensure that all your driving-related documentation is current.

A driving record consists of a detailed account of your driving behaviors, including traffic violations, accidents, and license status. On the other hand, driving history refers to the overall pattern of your driving habits over time. Understanding this distinction is helpful when using the Indiana Checklist - Key Record Keeping, as both records serve different purposes.

Yes, you can check your driver's license status online through the Indiana BMV's official website. Simply enter the required information to receive your current status. This easy access is a critical part of the Indiana Checklist - Key Record Keeping, enabling you to stay updated on your driving credentials.

In Indiana, you are required to keep payroll records for at least three years. This ensures compliance with state and federal regulations. Maintaining essential records like payroll is an important aspect of the Indiana Checklist - Key Record Keeping, as it protects your business and employees alike.