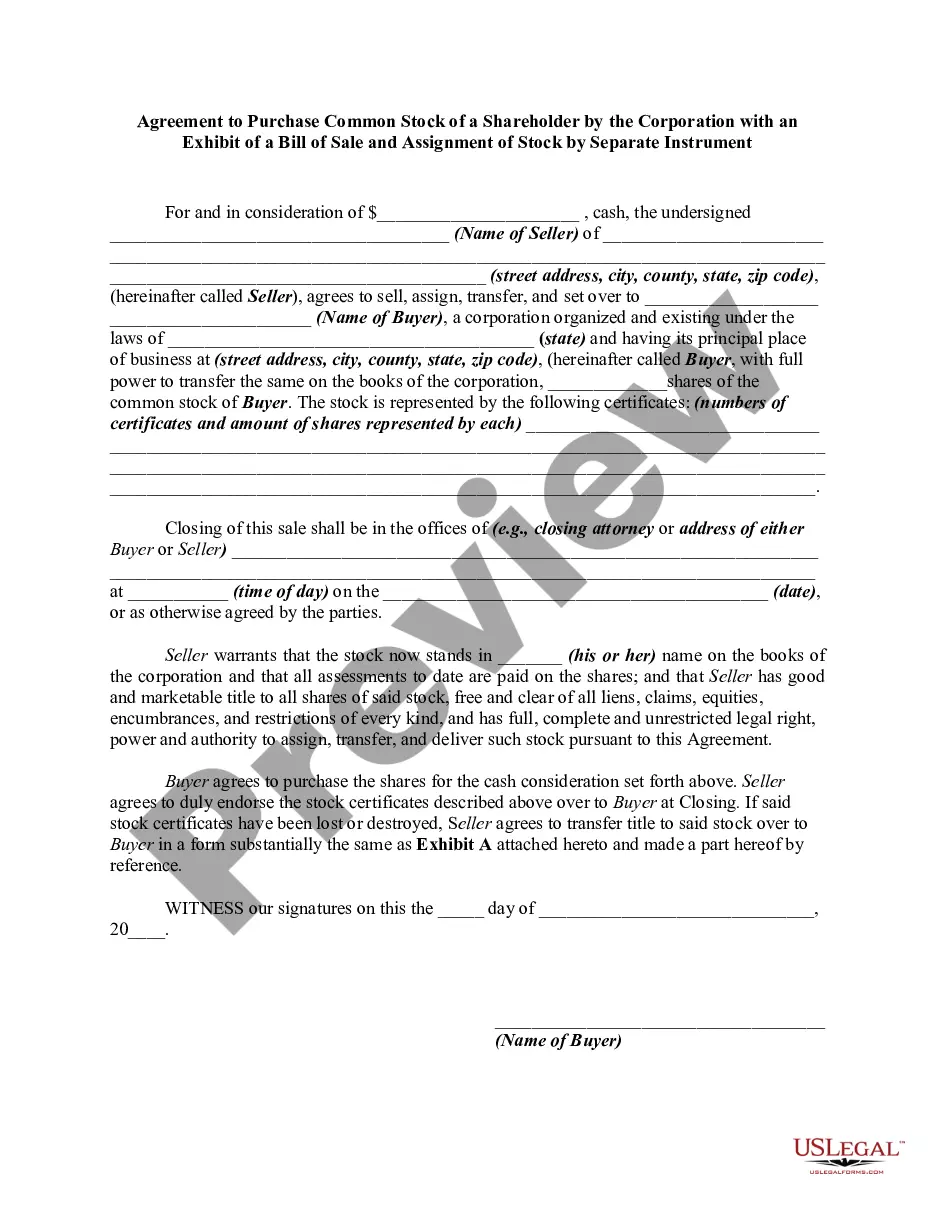

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

Indiana Bill of Sale and Assignment of Stock by Separate Instrument

Description

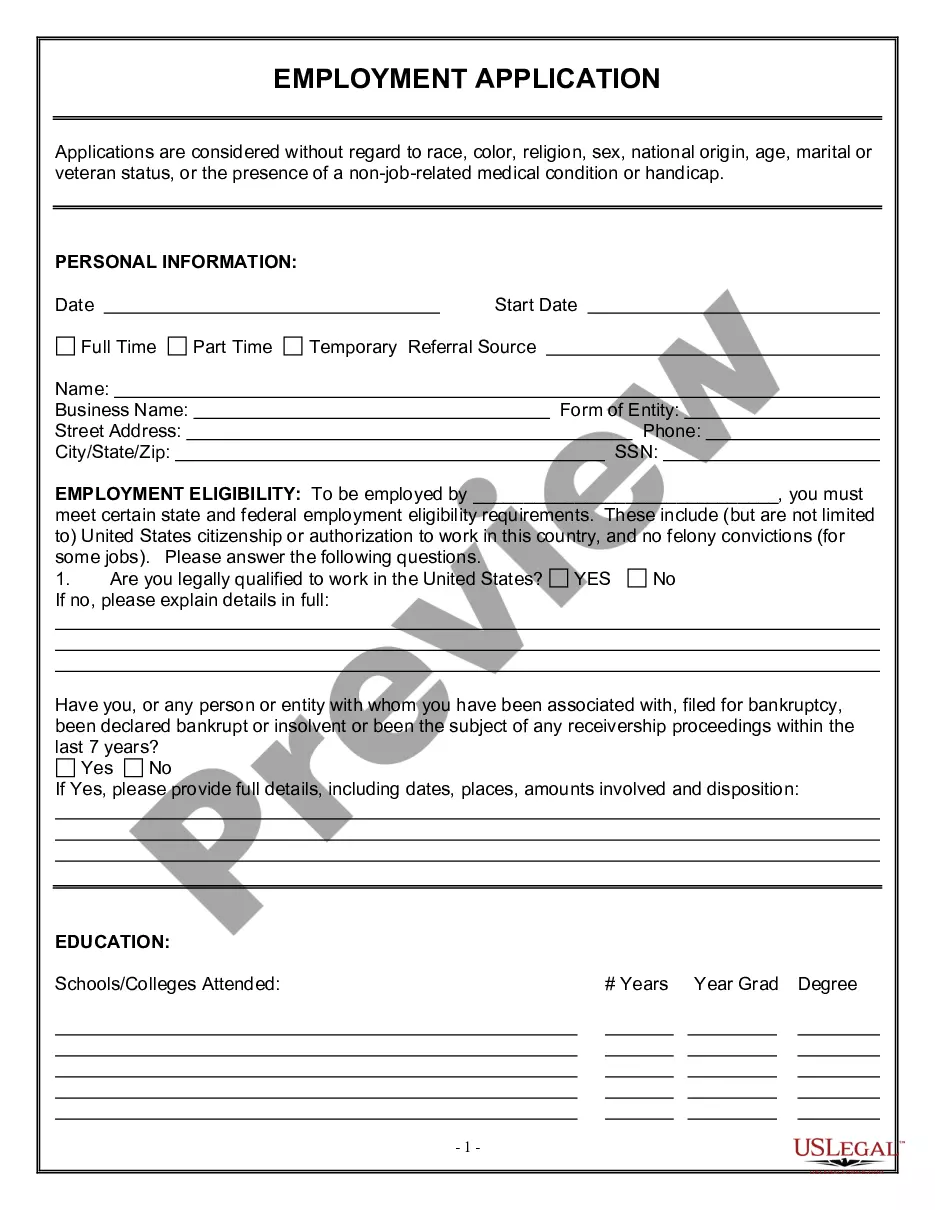

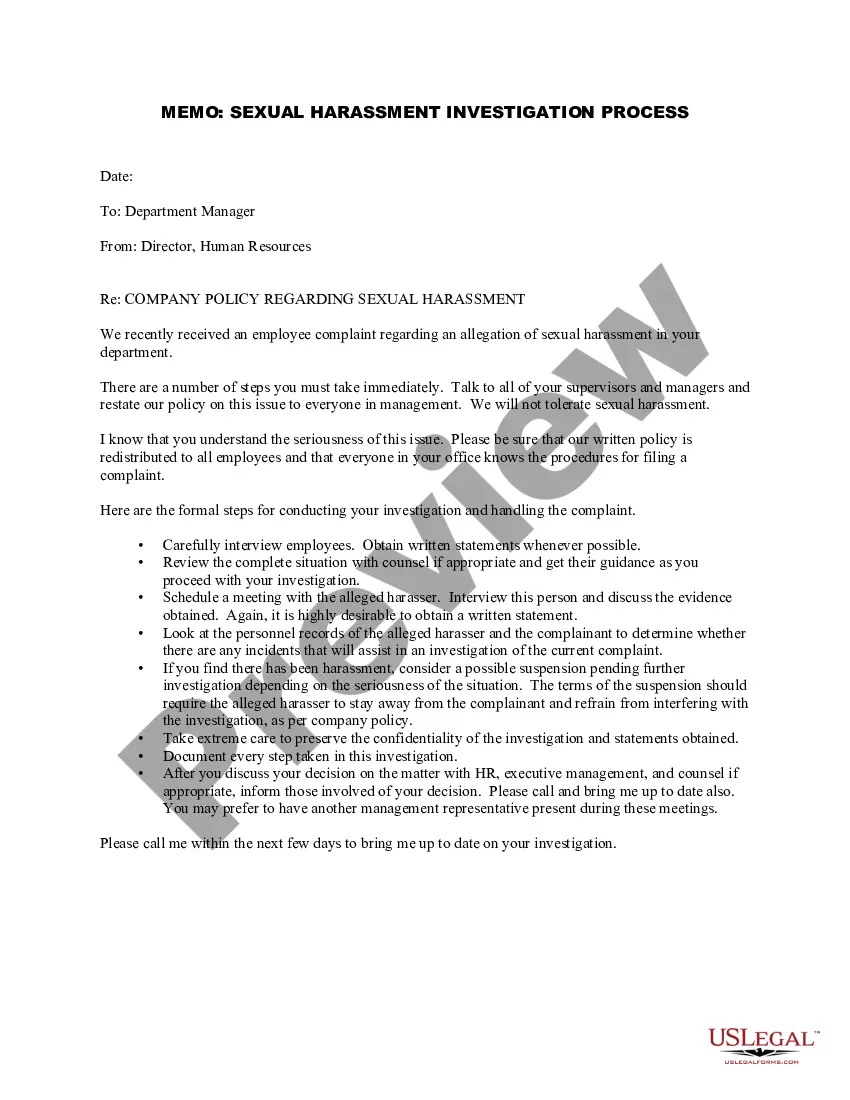

How to fill out Bill Of Sale And Assignment Of Stock By Separate Instrument?

Selecting the appropriate valid document format can be challenging. Clearly, there are numerous templates accessible online, but how do you find the valid form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Indiana Bill of Sale and Assignment of Stock by Separate Instrument, which can be utilized for business and personal purposes. All forms are verified by experts and adhere to federal and state regulations.

If you are already registered, Log In to your account and click on the Obtain button to locate the Indiana Bill of Sale and Assignment of Stock by Separate Instrument. Utilize your account to browse the legal forms you have previously ordered. Visit the My documents section of your account to retrieve an additional copy of the document you need.

Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired Indiana Bill of Sale and Assignment of Stock by Separate Instrument. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Use the service to download correctly crafted files that comply with state regulations.

- Firstly, ensure you have selected the correct form for your location/region.

- You can preview the form using the Review button and read the form description to verify it is suitable for you.

- If the form does not satisfy your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is acceptable, click the Acquire now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information.

- Create your account and complete your purchase using your PayPal account or a credit card.

Form popularity

FAQ

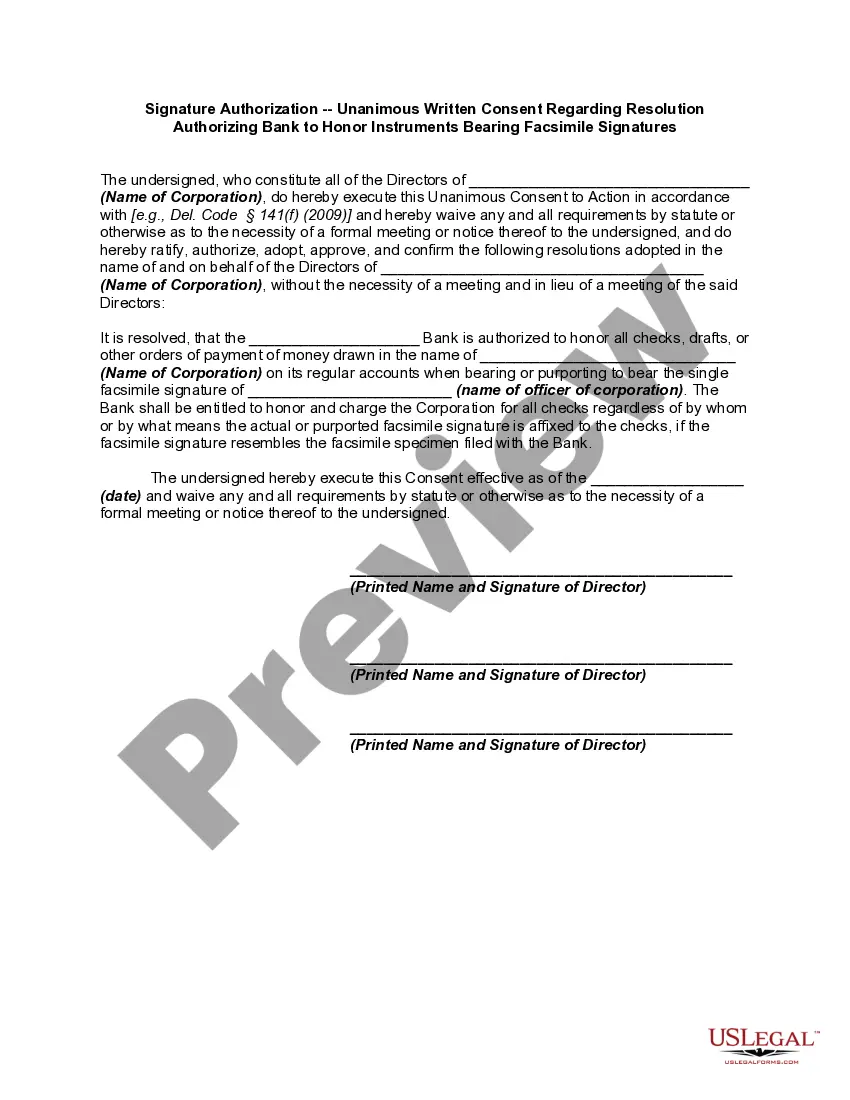

A bill of sale does not need to be notarized in Indiana, but it can be beneficial. Using the Indiana Bill of Sale and Assignment of Stock by Separate Instrument with notarization can enhance its credibility. Notarization assures the authenticity of the signatures, safeguarding both the buyer and seller in case of disputes. Ultimately, it is best to follow the preferences of both parties regarding notarization.

You can indeed register a trailer in Indiana with a bill of sale. Similar to vehicles, the Indiana Bill of Sale and Assignment of Stock by Separate Instrument provides necessary proof of ownership for trailers. While it’s recommended to also have the trailer's title, the bill of sale can streamline the registration process. Always verify with the Indiana BMV for any additional requirements specific to trailers.

Yes, you can sell your car to your son for $1 in Indiana. However, it is advisable to use an Indiana Bill of Sale and Assignment of Stock by Separate Instrument to document the transaction, as it shows the transfer of ownership. Keep in mind that Indiana has a use tax that may apply, so it’s important to report the sale accurately. Consult with a tax advisor for specifics on this situation.

In Indiana, you generally cannot obtain a title using just a bill of sale. The Indiana Bill of Sale and Assignment of Stock by Separate Instrument does not replace the need for a title when transferring ownership. A title is essential to indicate who owns the vehicle legally. If the title is lost, you may have to apply for a duplicate title before proceeding with the sale.

To sell a car in Indiana, you typically need the title, a bill of sale, and an odometer disclosure statement. The Indiana Bill of Sale and Assignment of Stock by Separate Instrument acts as a receipt to document the transaction clearly. It’s essential to provide clear information about the vehicle, including its condition and mileage. Always check with the Indiana BMV for any additional documentation that may be required.

In Indiana, a notarized bill of sale is not mandatory for every transaction. However, using the Indiana Bill of Sale and Assignment of Stock by Separate Instrument can add an extra layer of authenticity, especially for high-value items. It's wise to have it notarized if both parties agree, as this can help prevent potential disputes in the future. Always ensure that the document contains all crucial details.

The assignment of shares pertains to the legal act of conveying ownership rights, whereas the transfer of shares typically refers to the physical act of changing who possesses the shares. Both processes involve documentation to ensure clarity and legality. Using tools like the Indiana Bill of Sale and Assignment of Stock by Separate Instrument provides assurance that both assignments and transfers are executed correctly and recognized by relevant authorities.

A stock power serves as a tool for transferring ownership of stock, while a stock certificate is a physical document representing ownership of shares. The stock power does not require the physical existence of the certificate, particularly useful when the certificate is lost. When dealing with an Indiana Bill of Sale and Assignment of Stock by Separate Instrument, understanding these definitions helps streamline the ownership transfer process.

An assignment of stock is a legal document that signifies the transfer of ownership rights of stock from one individual or entity to another. This document captures important details, including the names of the parties involved and the number of shares being transferred. Utilizing an Indiana Bill of Sale and Assignment of Stock by Separate Instrument can make this process more efficient and legally sound.

A transfer of stock ownership form is a document that facilitates the legal transfer of stocks from one party to another. This form records the details of the transaction, ensuring that all necessary information is documented. When combined with the Indiana Bill of Sale and Assignment of Stock by Separate Instrument, this form offers a streamlined process for transferring stock ownership while maintaining legal compliance.