Indiana Contract Between Photographer and Model to Produce and Sell Photographs

Description

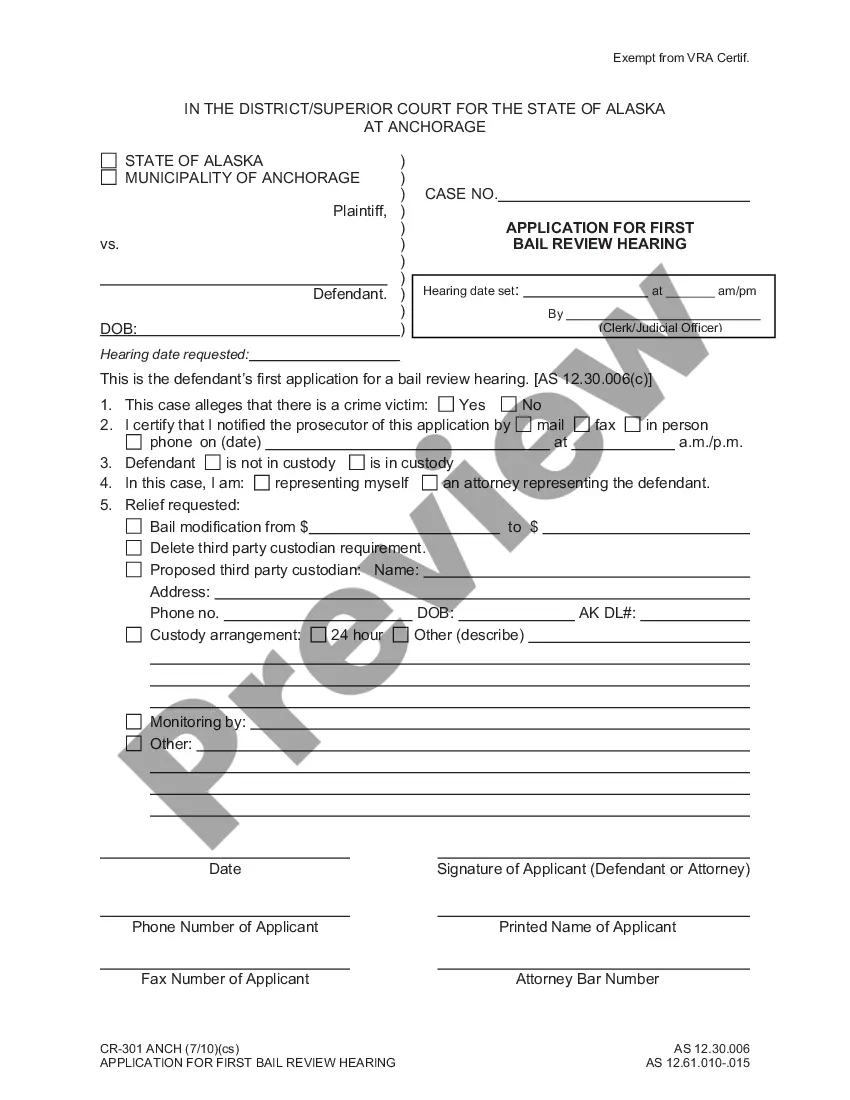

How to fill out Contract Between Photographer And Model To Produce And Sell Photographs?

Selecting the optimal authorized document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you acquire the appropriate version you require.

Utilize the US Legal Forms website.

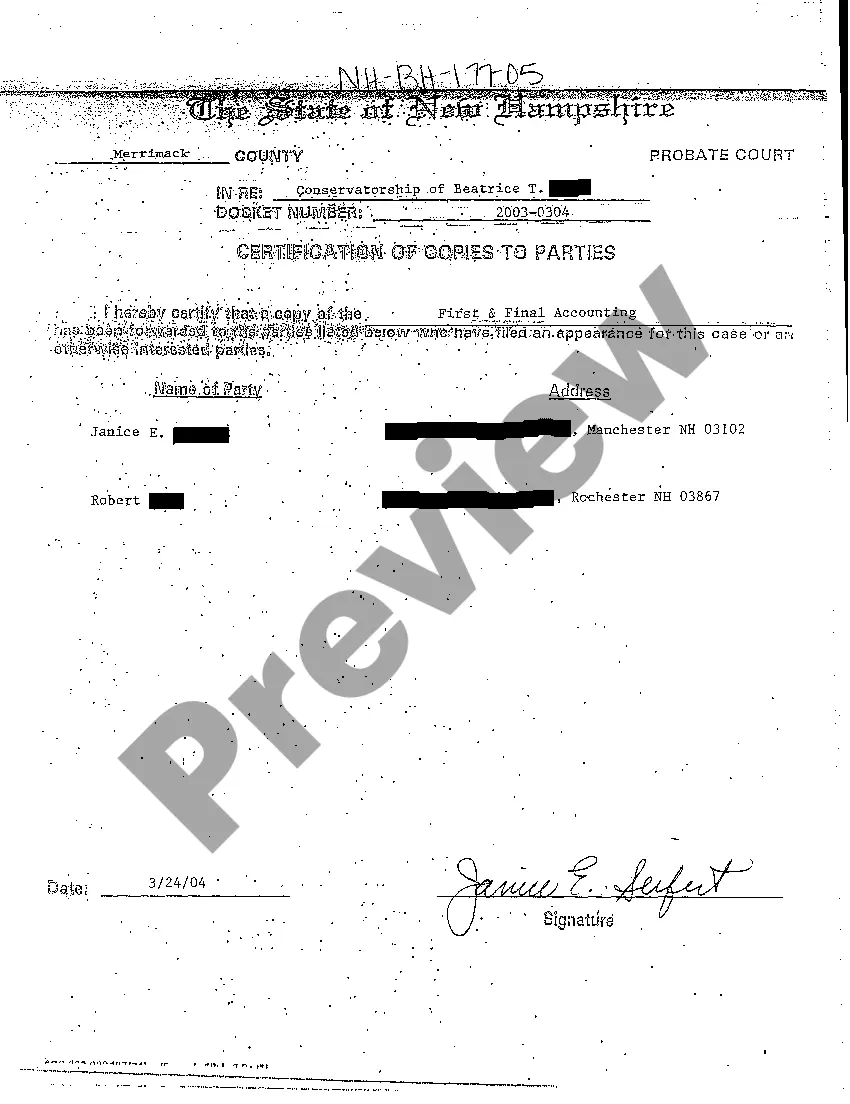

If you are a new user of US Legal Forms, here are straightforward instructions you can follow: First, ensure you have chosen the correct form for your city/region. You can review the form using the Review button and read the form description to confirm that it is suitable for you. If the form does not satisfy your requirements, use the Search field to find the correct form. Once you are confident that the form is accurate, click on the Purchase now button to obtain the form. Select the payment plan you desire and fill in the required information. Create your account and complete the transaction using your PayPal account or credit card. Choose the document format and download the authorized document template to your device. Finally, complete, modify, and print and sign the delivered Indiana Contract Between Photographer and Model to Create and Market Photographs. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Utilize the service to obtain professionally crafted documents that comply with state regulations.

- The service offers a vast selection of templates, including the Indiana Contract Between Photographer and Model to Create and Market Photographs, which can be utilized for commercial and personal purposes.

- All documents are vetted by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click on the Download button to obtain the Indiana Contract Between Photographer and Model to Create and Market Photographs.

- Use your account to browse through the authorized documents you have previously acquired.

- Visit the My documents section of your account and retrieve another copy of the document you need.

Form popularity

FAQ

Under U.S. law, copyright in a photograph is the property of the person who presses the shutter on the camera not the person who owns the camera, and not even the person in the photo.

Under copyright law, the photographer owns the copyright and can use it for any editorial use without permission of the person in the picture.

What Should Photography Contracts Include?Copyright Ownership and Transfer of Use Rights.Payment Schedule.Cancellation Policy.Summary of What Each Side Will Deliver.Start Date of Photography Contract and Shoot Date (If Applicable)Full Contact Information and Names for Client and Your Business.More items...

Even when hiring a photographer for a dedicated photo shoot, the employment is typically a contractor relationship. Therefore the photographer will still be the owner of the resulting photos. The photographer may grant you an unlimited license for these photos, but legal ownership stays with the photographer.

Many photographers mistakenly believe services aren't subject to sales tax. Actually, not only are specific services taxable in many states, but service fees may also be taxable when they are very closely connected to the production of a tangible item.

Generally, purchases of tangible personal property, accommodations, or utilities made directly by Indiana state and local government entities are exempt from sales tax.

In general, photography, videos, and related services are not retail transactions subject to sales or use tax in Indiana.

Photographs are protected by copyright at the moment of creation, and the owner of the work is generally the photographer (unless an employer can claim ownership).

Even when hiring a photographer for a dedicated photo shoot, the employment is typically a contractor relationship. Therefore the photographer will still be the owner of the resulting photos. The photographer may grant you an unlimited license for these photos, but legal ownership stays with the photographer.

Are services subject to sales tax in Indiana? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Indiana, services are generally not taxable.