Indiana Subsidiary Application is a legal document used to form and register a subsidiary in the State of Indiana. A subsidiary is a separate legal entity from its parent company and is typically used to limit the liabilities of the parent company. It is the responsibility of the parent company to file the necessary paperwork with the Indiana Secretary of State in order to legally establish the subsidiary. There are two types of Indiana Subsidiary Applications: an Application for Registration of a Foreign Corporation and an Application for Registration of a Domestic Corporation. The Application for Registration of a Foreign Corporation is used when the parent company is located outside of Indiana and the Application for Registration of a Domestic Corporation is used when the parent company is located within Indiana. Both applications require the parent company to provide information such as the names of the directors and officers, the registered office address, the total authorized capital stock, and the purpose of the subsidiary. Once the application is approved, the parent company must submit a Certificate of Good Standing from the Secretary of State of the state in which it is registered, a Certificate of Existence, and a Certificate of Authorization. These documents must be submitted to the Indiana Secretary of State in order to officially register the subsidiary.

Indiana Subsidiary Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Subsidiary Application?

If you’re searching for a method to correctly prepare the Indiana Subsidiary Application without enlisting a legal advisor, then you’re in the correct location.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for every personal and commercial circumstance.

Another fantastic aspect of US Legal Forms is that you will never misplace the documents you acquired - you can access any of your downloaded forms in the My documents section of your profile whenever you require it.

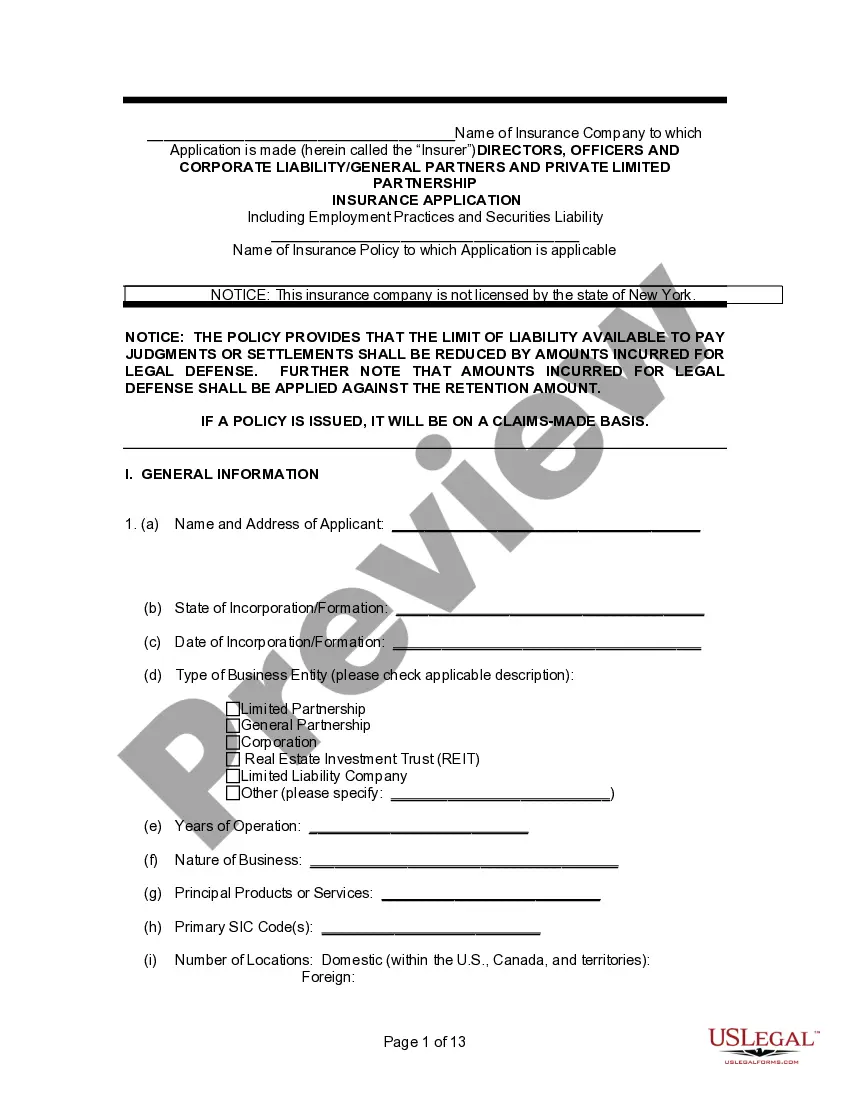

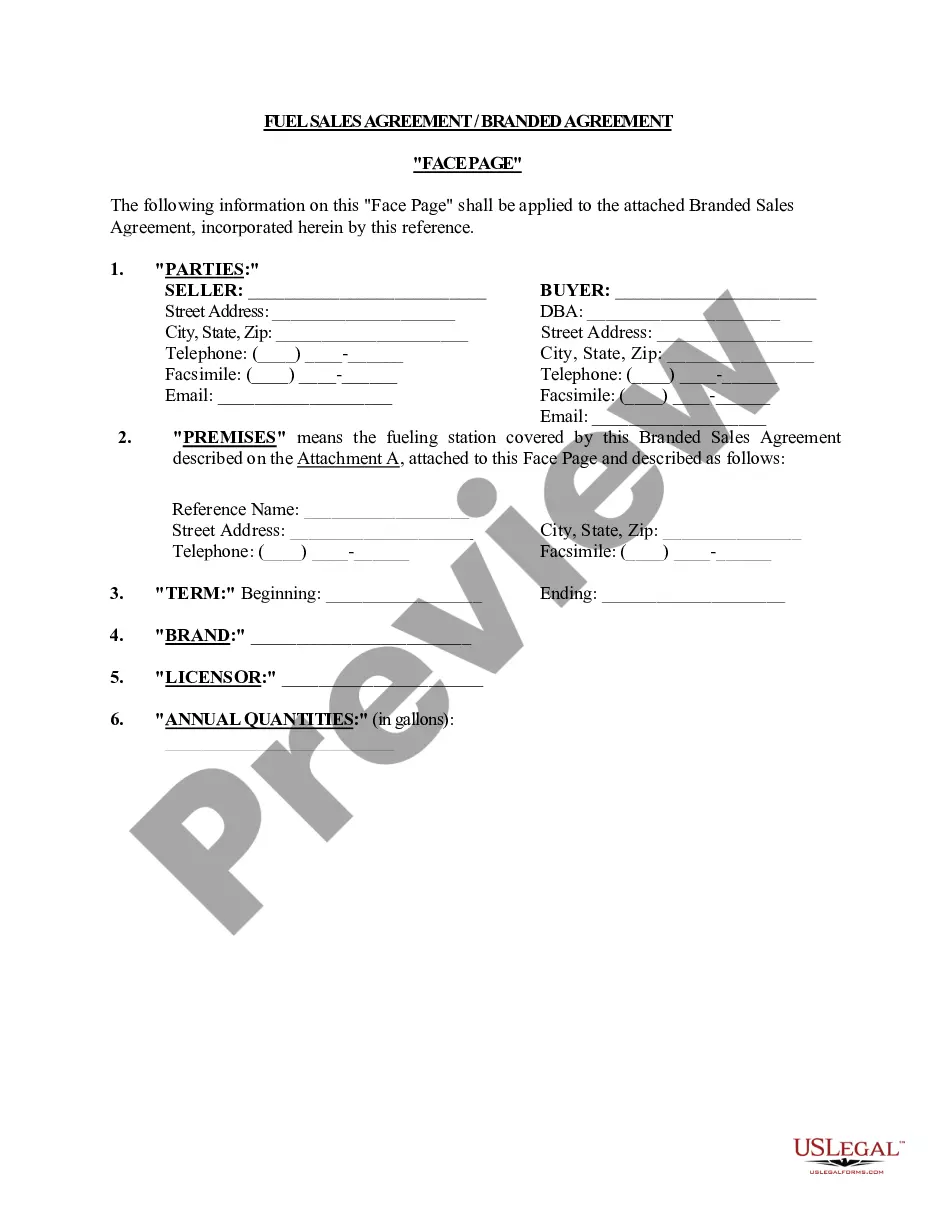

- Ensure the document you view on the page aligns with your legal circumstance and state regulations by reviewing its textual description or examining the Preview mode.

- Input the form title in the Search tab at the top of the page and select your state from the list to discover another template if there are any discrepancies.

- Repeat the content verification process and click Buy now when you are assured about the paperwork meeting all the criteria.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you don’t have one yet.

- Utilize your credit card or the PayPal option to settle your US Legal Forms subscription. The document will be ready for download immediately afterward.

- Select the format in which you wish to receive your Indiana Subsidiary Application and download it by pressing the corresponding button.

- Upload your template to an online editor for quick completion and signing, or print it out to prepare your physical copy manually.

Form popularity

FAQ

To set up an S Corporation, you must first establish a corporation by filing articles of incorporation in your state. After that, you’ll need to file Form 2553 with the IRS to elect S Corporation status. This process might seem daunting, but it is crucial for a smooth Indiana Subsidiary Application. US Legal Forms can assist you with the necessary forms and instructions.

The best number of deductions to claim on your W-4 depends on your personal financial situation. For most people, it's beneficial to claim fewer deductions to ensure adequate withholding and avoid a tax bill at year-end. The Indiana Subsidiary Application can assist you in evaluating your circumstances and determining the most tax-efficient strategy for your claims. Always consider consulting with a tax professional for tailored advice.

Incorporate in Indiana Form and file your Indiana Articles of Incorporation. Pay the filing fee: $98 online, $100 by mail. Apply for a federal tax ID (EIN) Hold your organizational meeting and create bylaws. Open a bank account for your Indiana corporation. Register at Indiana's Department of Revenue.

Forming an LLC or S Corp In Indiana, that means choosing an entity name, filing articles of incorporation, and paying a filing fee. In order to become an S Corp, the corporation must then file what is known as an ?S Election??Form 2553?with the Internal Revenue Service (?IRS?).

Step 1: Name Your Indiana LLC.Step 2: Choose a Registered Agent.Step 3: File the Indiana Articles of Organization.Step 4: Create an Operating Agreement.Step 5: File Form 2553 to Elect Indiana S Corp Tax Designation.

Purpose: Form BT-1 is an application used when registering with the Indiana Department of Revenue for Sales Tax, Withholding Tax, Out-of-State Use Tax, Food & Beverage Tax, County Innkeepers Tax, Motor Vehicle Rental Excise Tax, and Prepaid Sales Tax on Gasoline, or a combination of these taxes.

Once your LLC or corporation formation is approved by Indiana, you need to file Form 2553, Election by a Small Business Corporation, with the IRS to get S corp status.

To have a California S corporation, you'll need to create either a limited liability company (LLC) or a C corporation (the default form of corporation) if you haven't already done so. Then, you'll file an election form with the Internal Revenue Service (IRS).

The process of adding a member to an Indiana LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

In Indiana, S-corporations are covered under the federal S-corporation election and therefore do not pay any corporate income tax to the state.