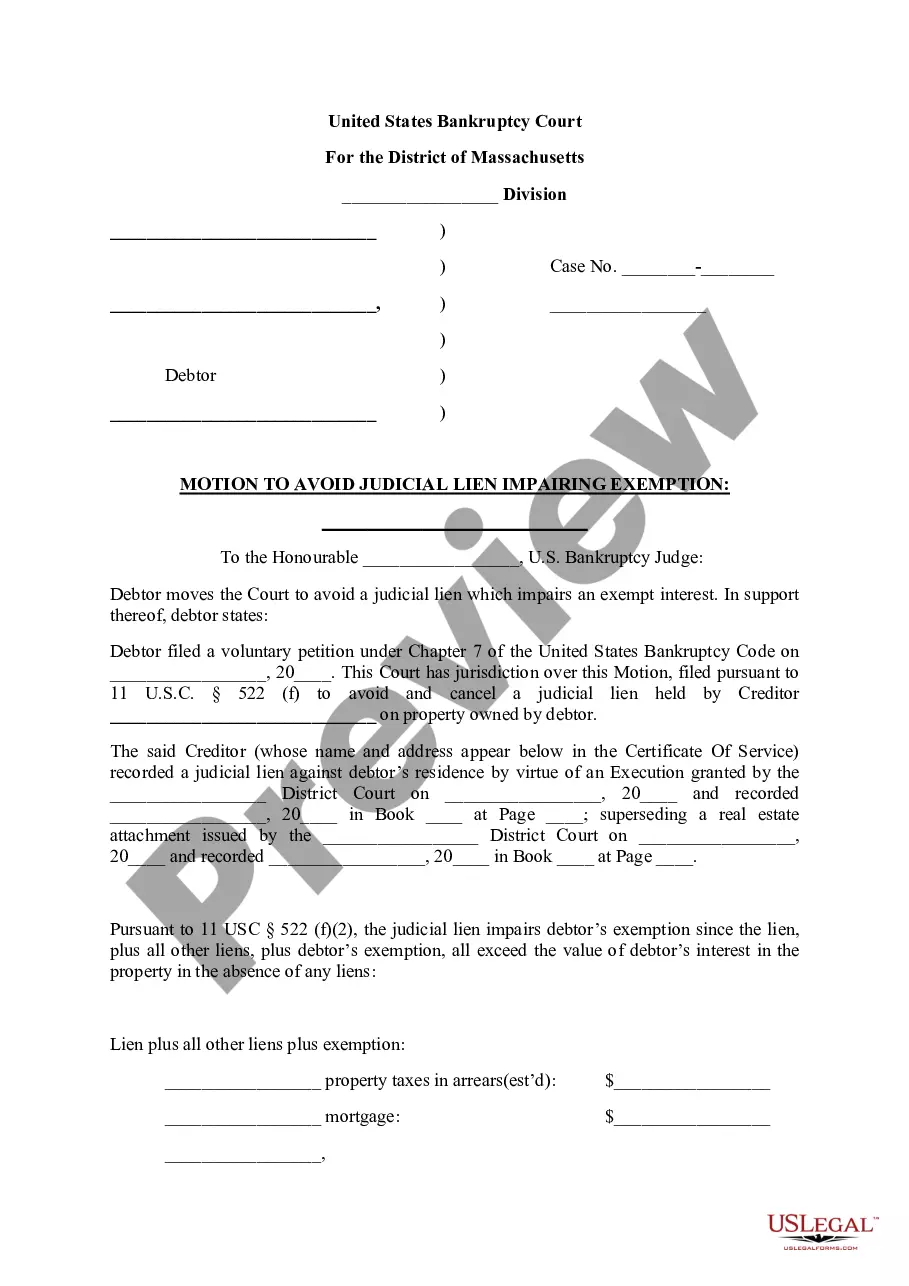

Massachusetts Motion to Avoid Judicial Lien Impairing Exemption

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Motion To Avoid Judicial Lien Impairing Exemption?

You are invited to the largest repository of legal documents, US Legal Forms. Here, you can obtain any template including Massachusetts Motion to Avoid Judicial Lien Impairing Exemption forms and save as many as you desire.

Prepare official documents in just a few hours, rather than days or weeks, without expending a fortune on an attorney. Acquire your state-specific form with just a few clicks and be confident knowing it was prepared by our skilled legal experts.

If you’re an existing subscribed user, simply Log In to your account and click Download next to the Massachusetts Motion to Avoid Judicial Lien Impairing Exemption form you need. Since US Legal Forms is an online service, you’ll typically have access to your saved templates from any device.

Print the document and fill it in with your or your business’s information. Once you’ve completed the Massachusetts Motion to Avoid Judicial Lien Impairing Exemption, send it to your attorney for confirmation. It’s an additional step but a crucial one to ensure you’re fully protected. Sign up for US Legal Forms today and access thousands of reusable templates.

- If you do not have an account yet, what are you waiting for? Review our instructions provided below to get started.

- If this is a state-specific template, verify its legitimacy in the state where you reside.

- Check the description (if available) to determine if it’s the correct example.

- Explore more features with the Preview option.

- If the template meets your criteria, simply click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Save the document in the desired format (Word or PDF).

Form popularity

FAQ

A judgment lien in Massachusetts will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or 30 days (for liens on personal property).

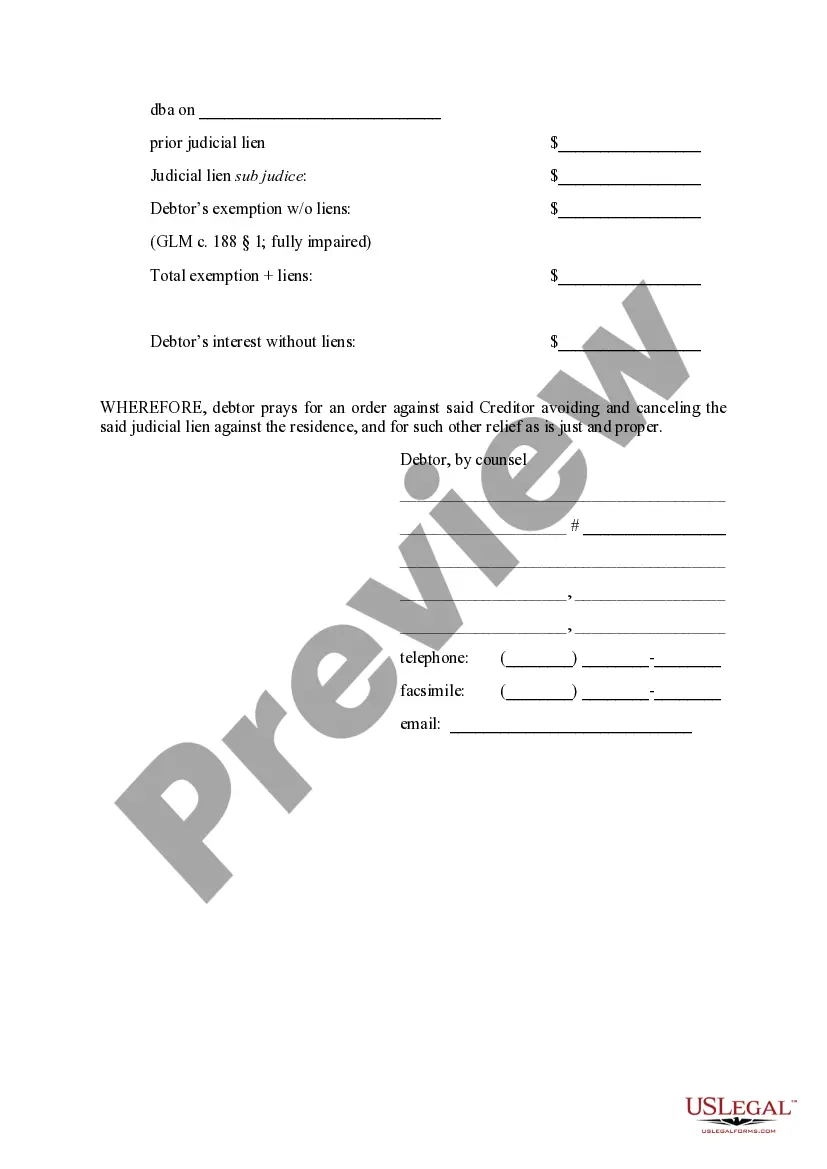

You can avoid a lien if you could apply a bankruptcy exemption to some or all of the equity in the asset, and triggering the lien would prevent you from getting the benefit of the exemption to which you are entitled. (In other words, the lien would cause you to lose some of the equity that would otherwise be exempt.)

When a person wants to avoid a lien, they obtain a judicial determination that the lien no longer encumbers a piece of property. This means they would then be able to sell the property despite the lien. In other words, a lien is seperate from a debtor's personal obligation of the loan.

Contact the creditor that filed the lien. Make payment arrangements if you cannot pay in full. Pay the lien amount in full or as agreed. Request a satisfaction of lien. File the satisfaction of lien if mailed to you. Consult a bankruptcy attorney.

A judgment is a court order. A lien is a claim of interest in a property right. A judgment can turn into a lien when the law allows this. For example, if a creditor records a court judgment, it can affect the right of an owner of real property to sell the...

If your attorney is aware of the judicial lien(s) and you do not have any non-exempt equity in property to secure the liens, your attorney can file a motion to avoid a judicial lien to prevent the judicial lien from affecting you in the future after the debt was discharge in your bankruptcy.

If you owe money to a creditor and don't pay, that party may sue you for the balance. If the court rules against you, the creditor can file a judgment lien against you.In a few states, if a court enters a judgment against a debtor, a lien is automatically created on any real estate the debtor owns in that county.

A judgment is a court order. A lien is a claim of interest in a property right. A judgment can turn into a lien when the law allows this. For example, if a creditor records a court judgment, it can affect the right of an owner of real property to sell the...

The statute of limitations on judgments in Massachusetts are 20 years and can be renewed by the court for another 5 years if the judgment is still not satisfied.