Motion to avoid judicial lien - passive notice

Understanding this form

The Motion to Avoid Judicial Lien - Passive Notice is a legal form used in bankruptcy proceedings to request the court to eliminate a judicial lien against a debtor's property. This form is different from other bankruptcy forms as it specifically addresses the need to avoid judicial liens that may impair the debtor's exemptions. It allows the debtor to protect their interests in specific properties and is particularly relevant when the total amount of judicial and unavoidable liens exceeds the property's value or impair the exemptions claimed by the debtor.

Form components explained

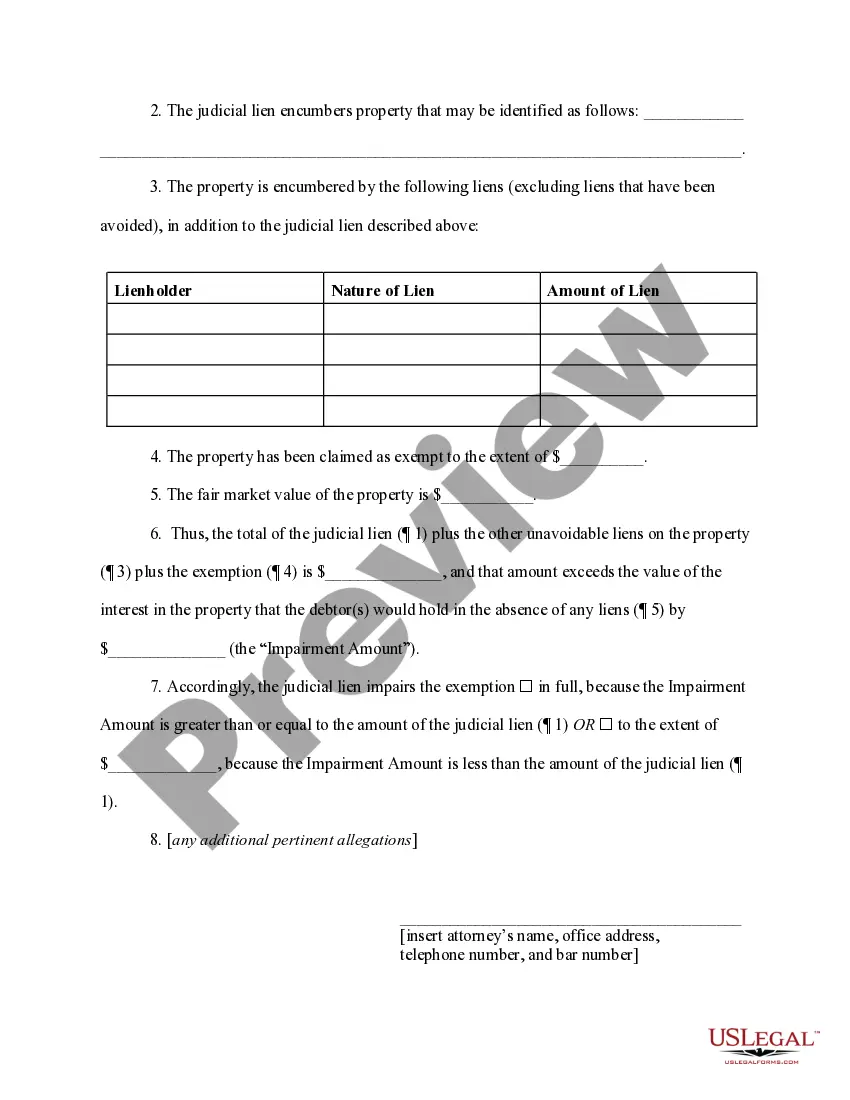

- Identification of the judicial lien, including the lienholder and amount.

- Description of the property affected by the lien.

- Details about other existing liens on the property.

- Claim of exemption amount by the debtor.

- Fair market value assessment of the property.

- A calculation of the impairment amount to determine the lien's impact on the debtor's exemptions.

- Certificate of service for filing and notifications.

Situations where this form applies

This form should be used when a debtor believes that a judicial lien is impairing their legal exemptions in a bankruptcy case. It is particularly relevant during a Chapter 7 bankruptcy when a debtor aims to protect specific assets from creditor claims. If the judicial lien exceeds the value of the property or if it encumbers property that the debtor claims as exempt, this motion can facilitate the avoidance of that lien.

Who needs this form

- Individuals filing for Chapter 7 bankruptcy who have judicial liens affecting their property.

- Debtors seeking to protect their exempt property from lien enforcement.

- Those who wish to contest the validity or impact of a judicial lien in bankruptcy court.

Instructions for completing this form

- Identify the parties involved, including the debtor(s) and lienholder.

- Provide a clear description of the property encumbered by the judicial lien.

- Detail any additional liens on the property and their respective amounts.

- Specify the claimed exemption amount and the fair market value of the property.

- Calculate the impairment amount to support the request for avoiding the lien.

- Sign and date the form, along with the certificate of service for proper filing.

Notarization guidance

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to accurately describe the property affected by the lien.

- Not including all existing liens, leading to incomplete information.

- Omitting the calculation of the impairment amount.

- Missing deadlines for filing objections, which could hinder the process.

- Failing to serve copies of the motion to all interested parties as required.

Benefits of using this form online

- Convenience of downloading and completing the form at your own pace.

- Easily editable so you can update the information as needed.

- Reliable access to attorney-drafted templates, ensuring accuracy and compliance.

Using legal forms online simplifies the process of filing necessary documentation in bankruptcy proceedings, saving time and reducing stress.