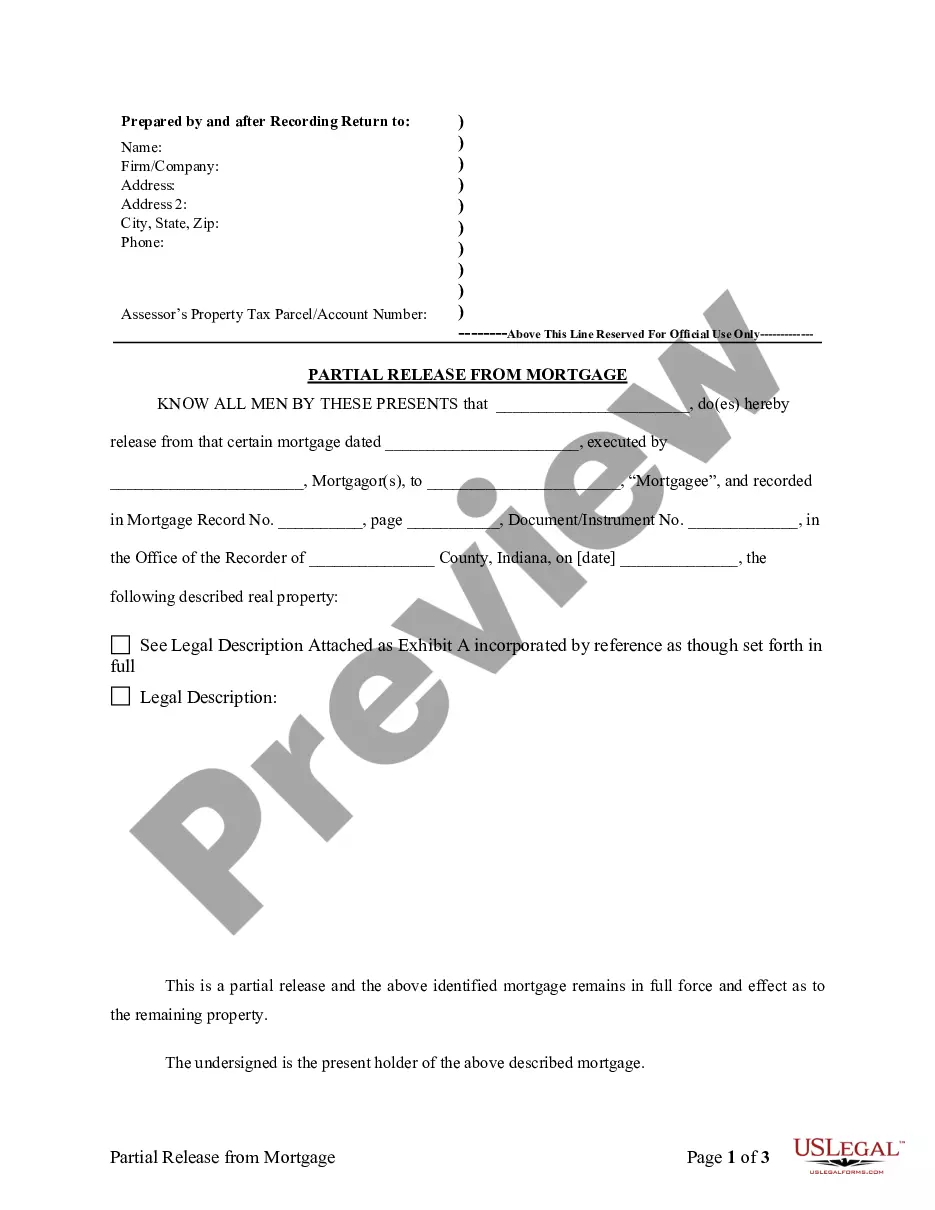

This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security.

Indiana Partial Release of Property From Mortgage by Individual Holder

Description

How to fill out Indiana Partial Release Of Property From Mortgage By Individual Holder?

Searching for Indiana Partial Release of Property From Mortgage by Individual Holder templates and finalizing them may pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate sample specifically for your state within just a few clicks.

Our legal experts create each document, so you merely have to complete them. It really is that straightforward.

Select your plan on the pricing page and create your account. Decide whether to pay by card or via PayPal. Download the file in your preferred format. Now you can print the Indiana Partial Release of Property From Mortgage by Individual Holder form or edit it using any online editor. Don’t worry about typos as your template can be utilized and submitted as many times as needed. Explore US Legal Forms to access over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's page to download the document.

- Your saved templates are stored in My documents and are accessible anytime for future use.

- If you haven’t subscribed yet, you must register.

- Review our detailed instructions on how to obtain your Indiana Partial Release of Property From Mortgage by Individual Holder template in a matter of minutes.

- To find a valid form, verify its eligibility for your state.

- Use the Preview feature (if it’s available) to review the example.

- If there's a description, read it to understand the details.

- Click Buy Now if you locate what you're searching for.

Form popularity

FAQ

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

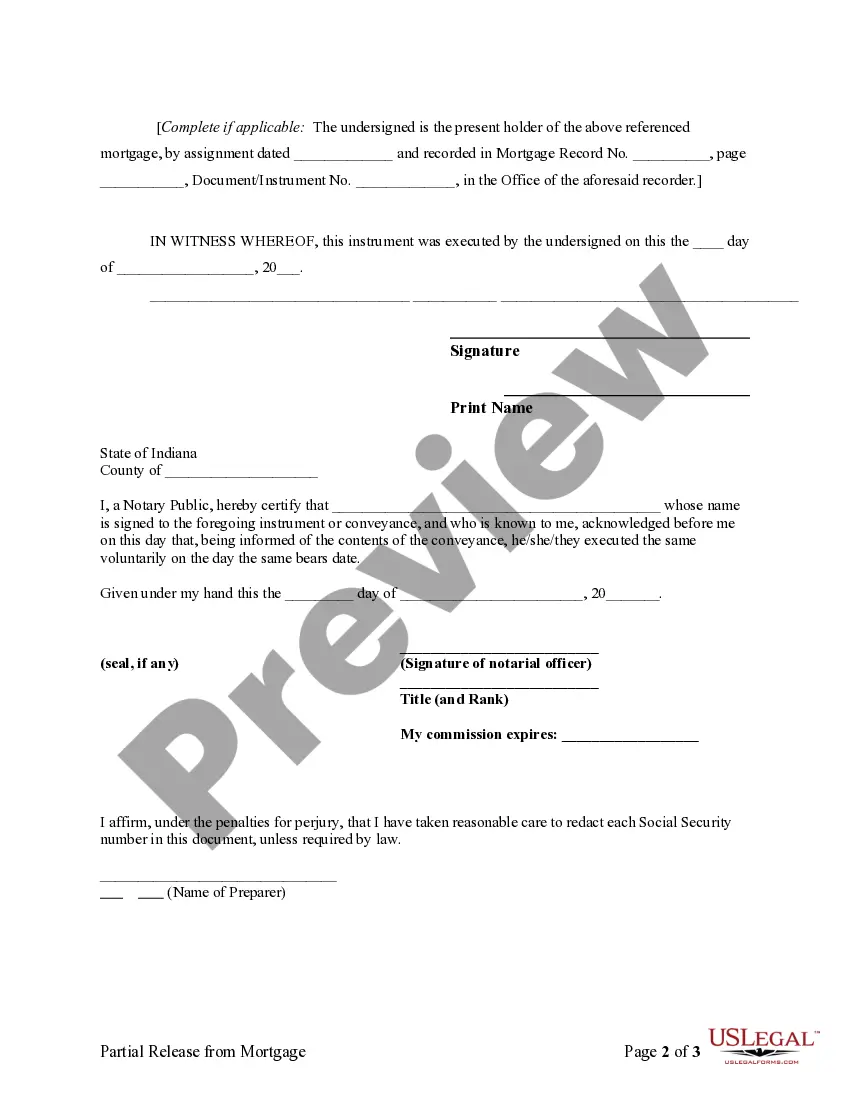

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

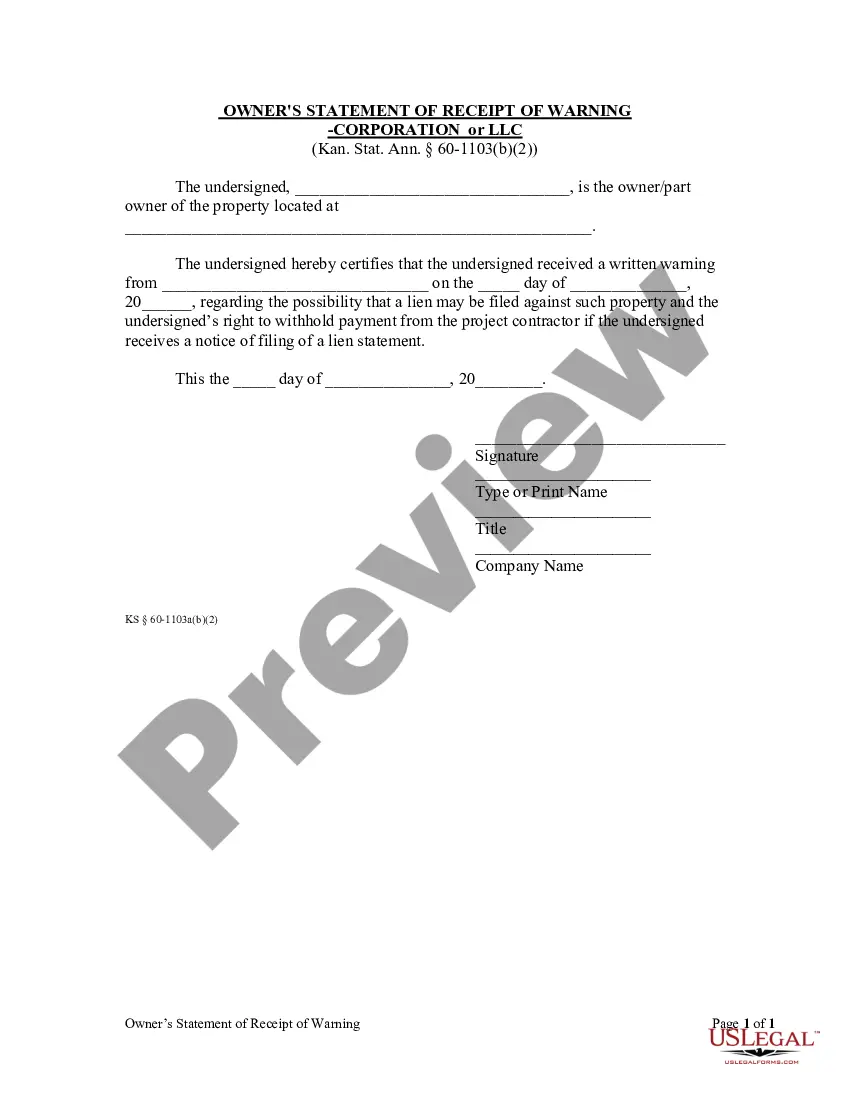

The subcontractor would file a lien waiver before a lien is filed. By doing so, the subcontractor is giving up his or her right to a lien against the property. In comparison, a lien release (also known as release of lien, cancellation of lien, or a lien cancellation) would come into play after the filing of a lien.

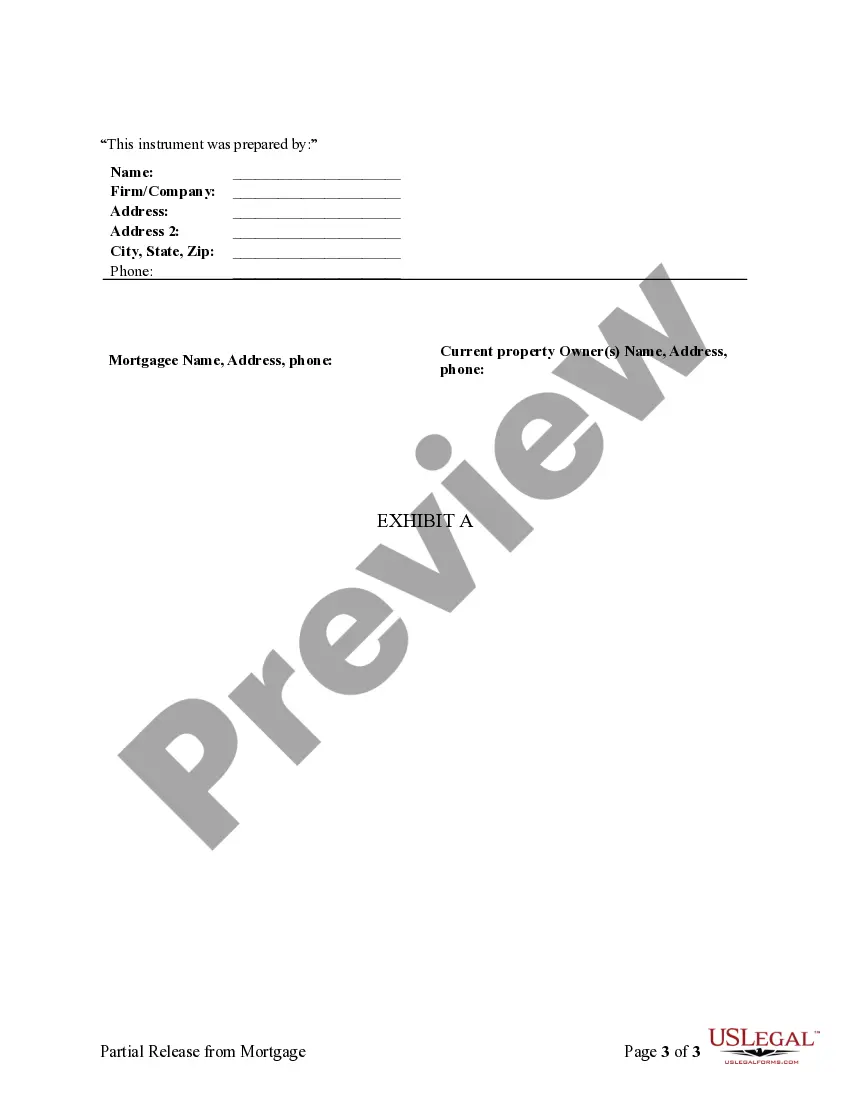

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.