Kansas Owner's Statement of Receipt of Warning by Corporation or LLC

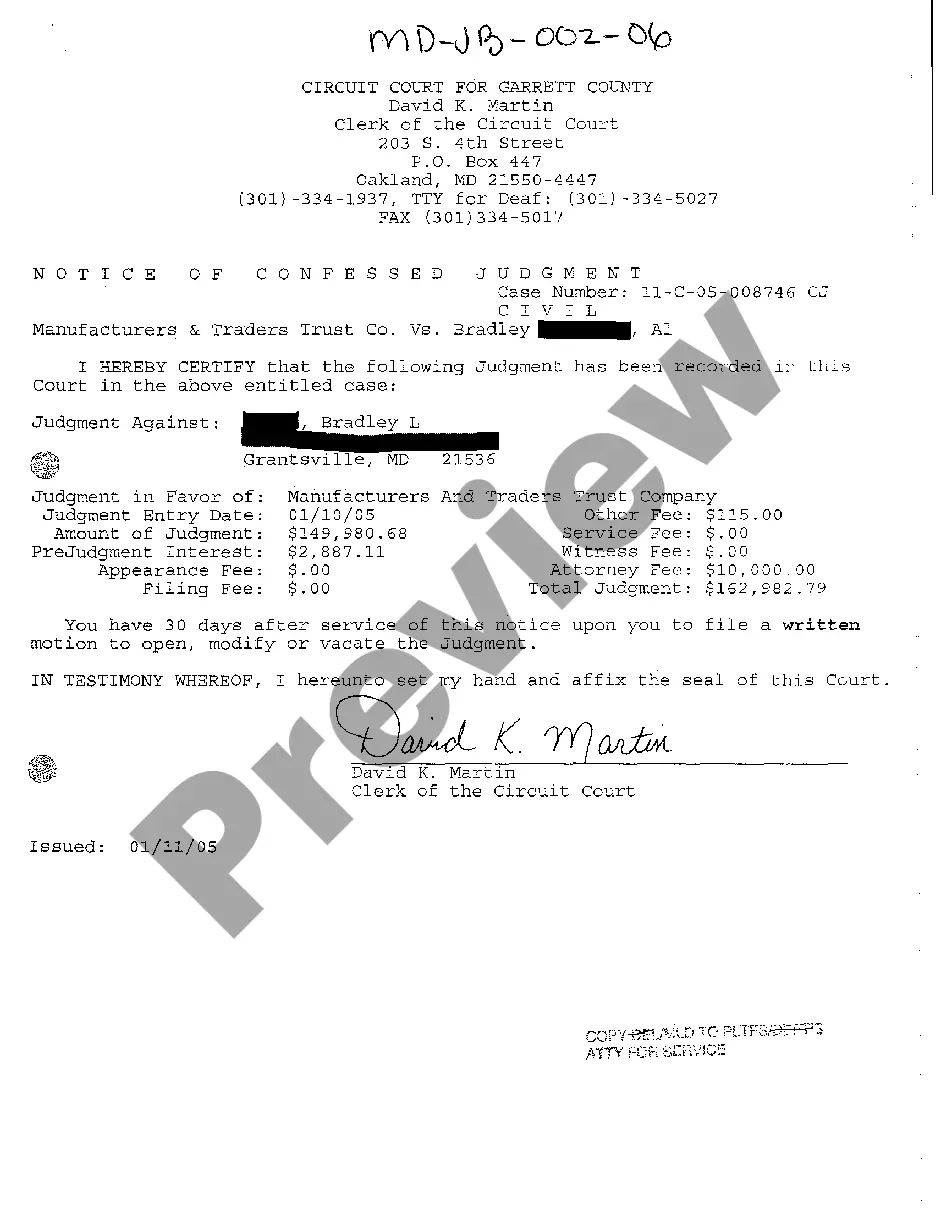

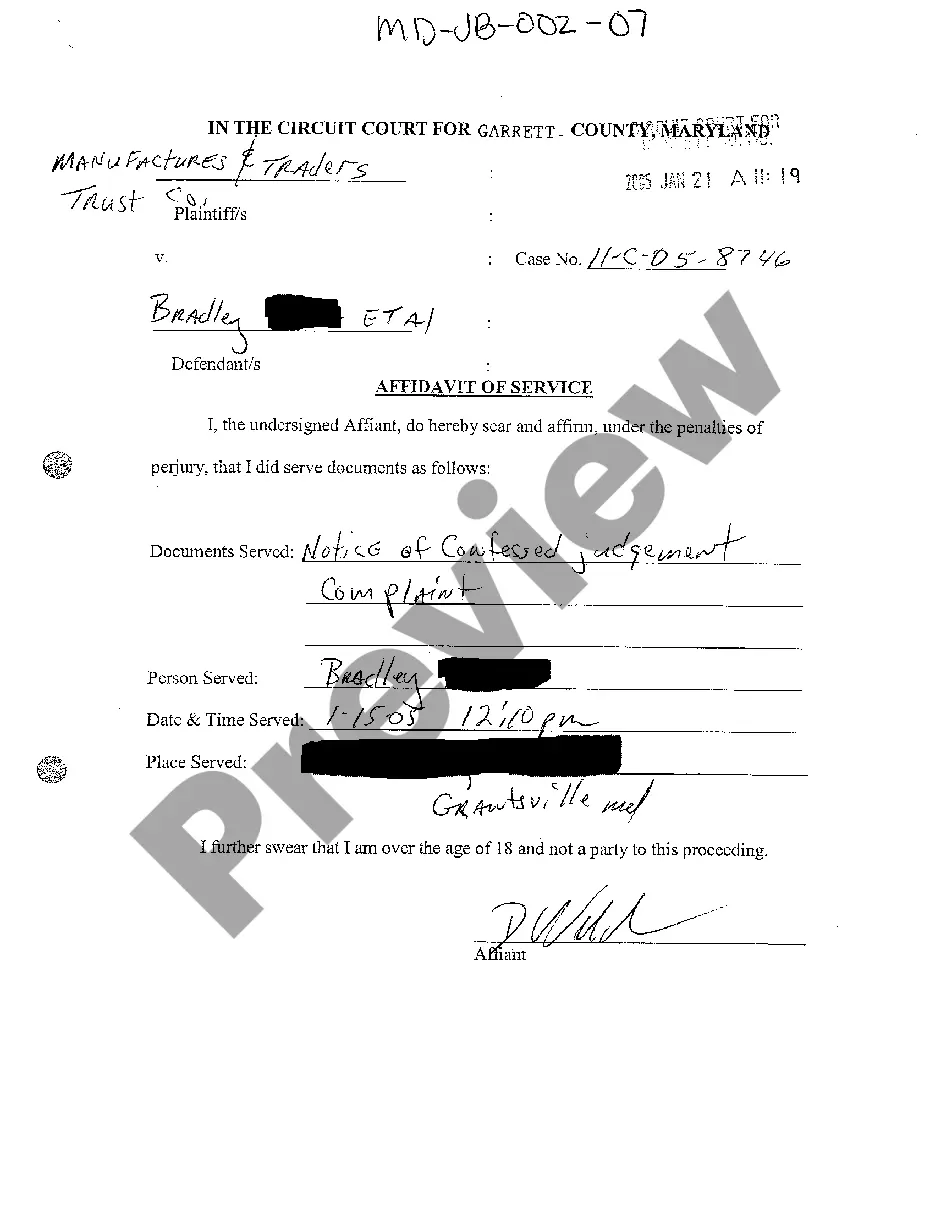

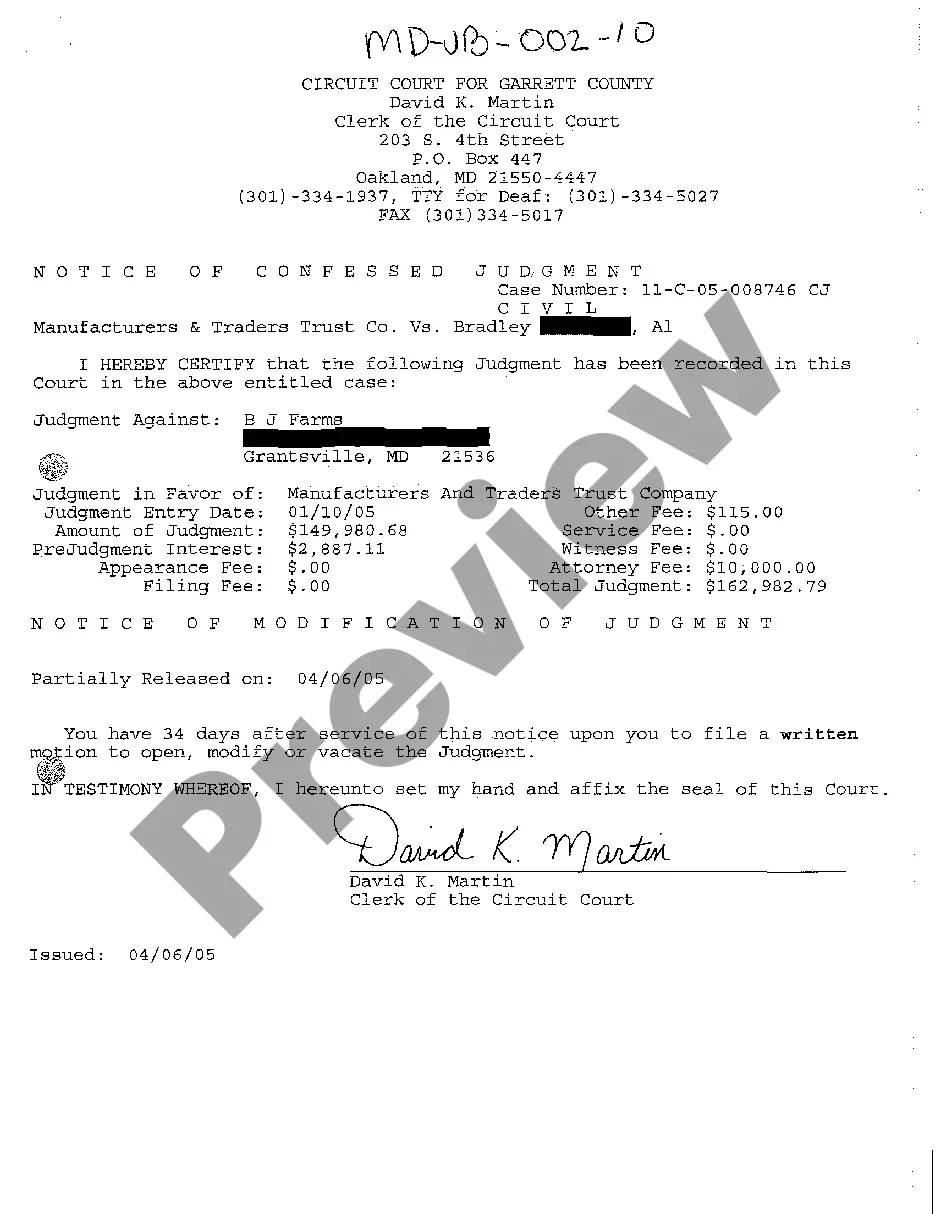

Description

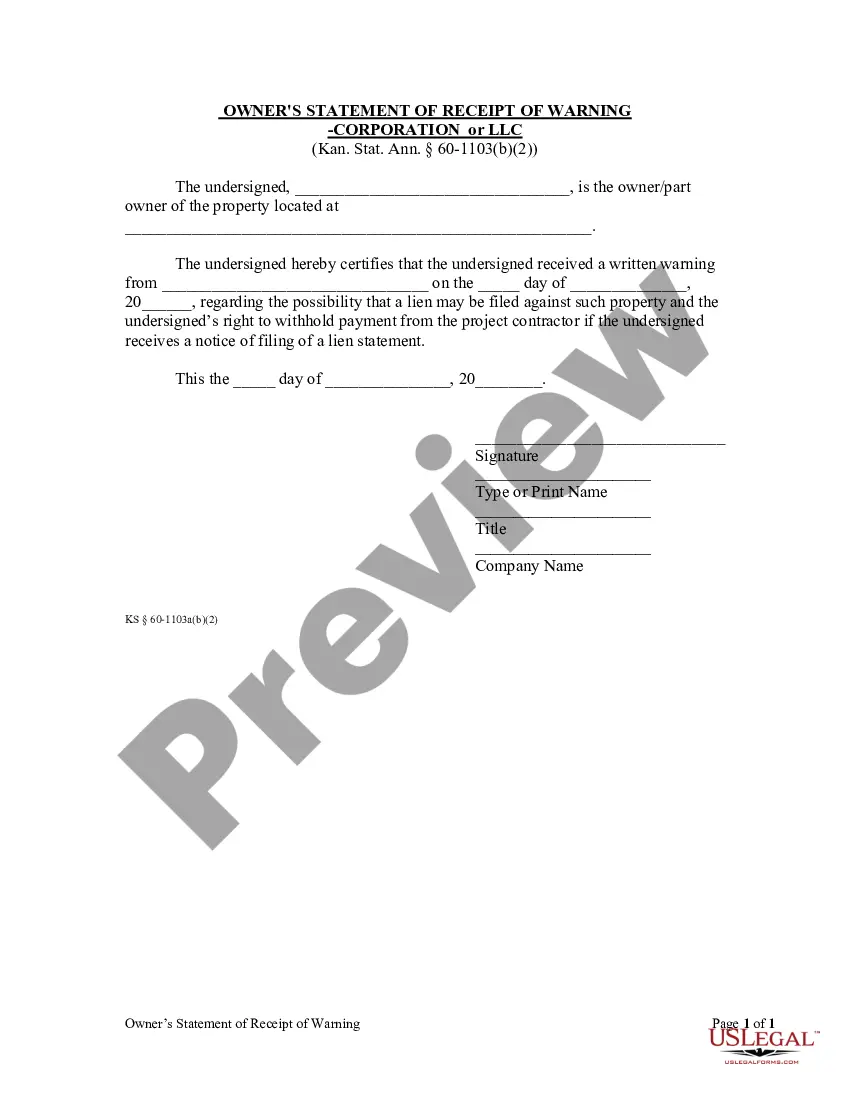

How to fill out Kansas Owner's Statement Of Receipt Of Warning By Corporation Or LLC?

Searching for the Kansas Owner's Statement of Receipt of Warning by Corporation paperwork and filling it out can be quite challenging.

To conserve significant time, expenses, and effort, utilize US Legal Forms and locate the proper template specifically for your state in just a few clicks.

Our attorneys prepare all documents, so you merely need to complete them. It really is that straightforward.

Select your payment method with a credit card or through PayPal. Download the document in the format you prefer. Now you can print the Kansas Owner's Statement of Receipt of Warning by Corporation template or complete it using any online editor. Don’t stress about making typographical errors because your form can be utilized, sent, and printed as many times as you like. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage and save the template.

- All your saved templates are housed in My documents and they are accessible at any time for future use.

- If you’ve yet to subscribe, you must register.

- Review our detailed instructions on how to obtain the Kansas Owner's Statement of Receipt of Warning by Corporation form in a matter of minutes.

- To acquire an eligible template, assess its relevance for your state.

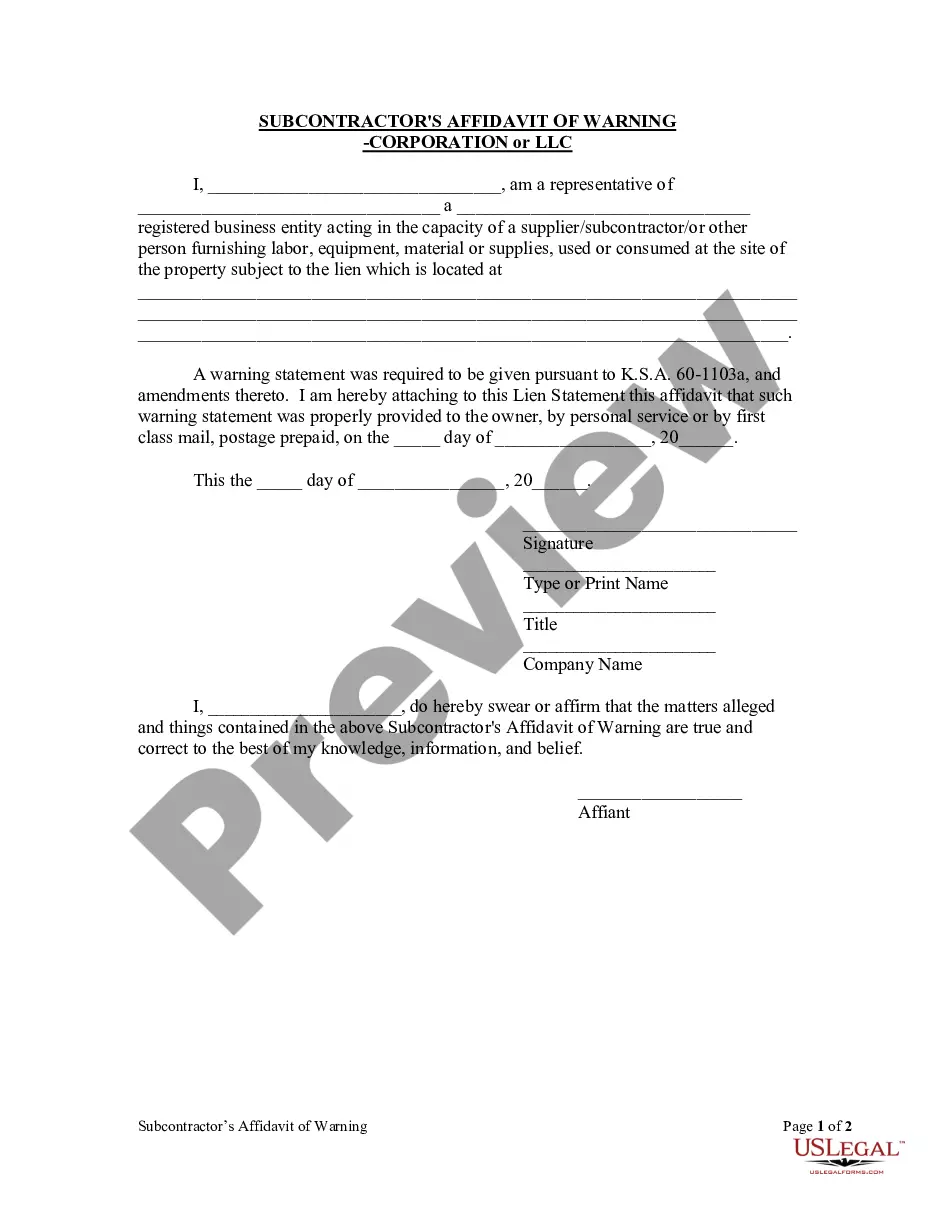

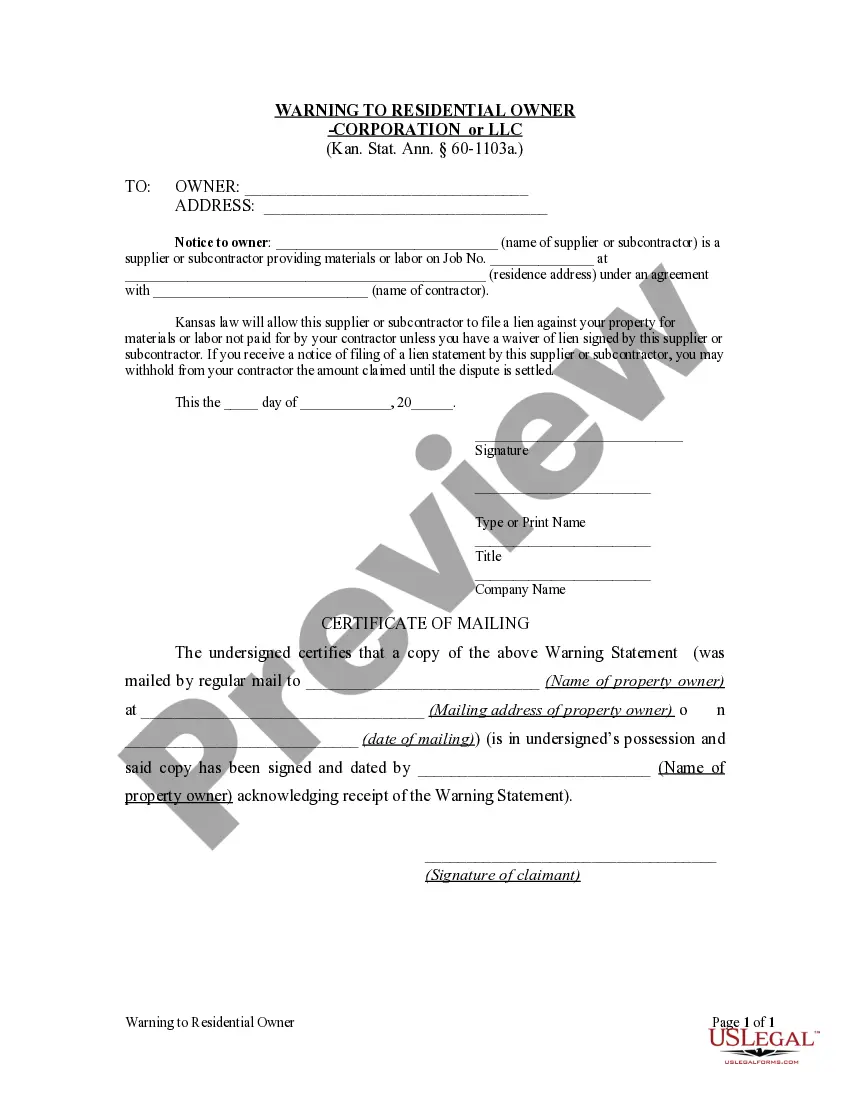

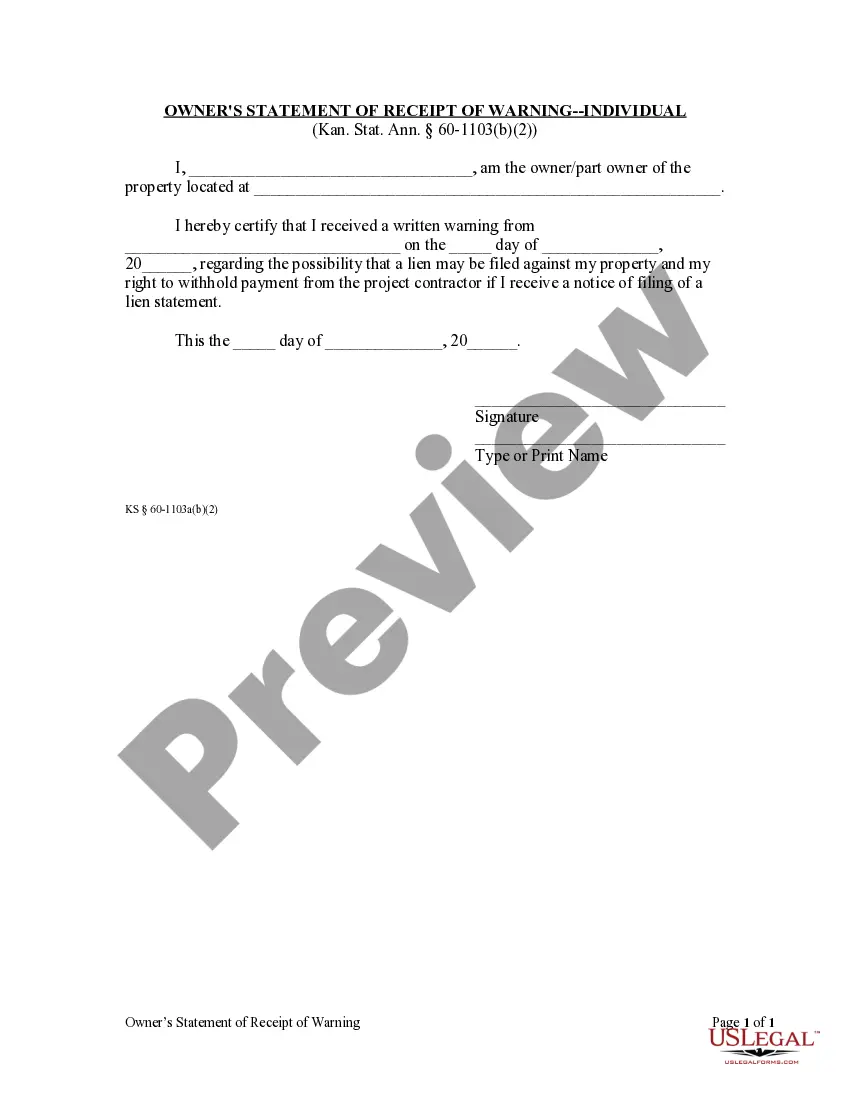

- Examine the form using the Preview feature (if it’s available).

- If there's a description, read it to understand the key details.

- Click on the Buy Now button if you’ve found what you're searching for.

Form popularity

FAQ

The name and address of the business or individual receiving the payment. The name and address of the person making the payment. The date the payment was made. A receipt number. The amount paid. The reason for the payment. How the payment was made (credit card, cash, etc)

The word receipt should, of course, be at the very top, followed by the seller's information such as name and/or company's name, contact information, and any other relevant details. Similarly, you also need to indicate all of the relevant information about the buyer.

Write a receipt and make two copies one for you and one for your buyer. It should include the date, price, registration number, make and model, plus you and your buyer's names and addresses.

A blank receipt template can be used by any business to create their own receipt. It includes the same basic components of identifying the parties, the amount paid, how it's paid, and what the money is for, but a blank template can be customized to include other information the parties consider important.

Your company/trading name, VAT number (if applicable), address and contact info. Your customer's company/trading name, address and contact info. A unique invoice number. The date of the invoice. A description of what you are charging for.

You can still claim deductions on your taxes without receipts for every transaction. Keep in mind that you don't have to send your shoe box full of receipts to the IRS to prove you're being honest. You'll only need them if you're audited (which can happen up to seven years after filing your taxes).

Write the name of the item on the left side of the receipt and write the cost of each item on the right side of the receipt. If you sold more than one item, list the items and their prices in a row. Write the subtotal below all of the items. The subtotal is the cost of all the items before taxes and additional fees.

The date the payment was received. The tenant's full name. The full name of anyone else who made the payment on behalf of the tenant. The name of the landlord or property manager receiving the payment. The rental property address and unit number.

Select the word processor to be used in creating the receipt. Create the receipt's header, which should include the business's name, its contact details, and the date/time of the transaction in question.