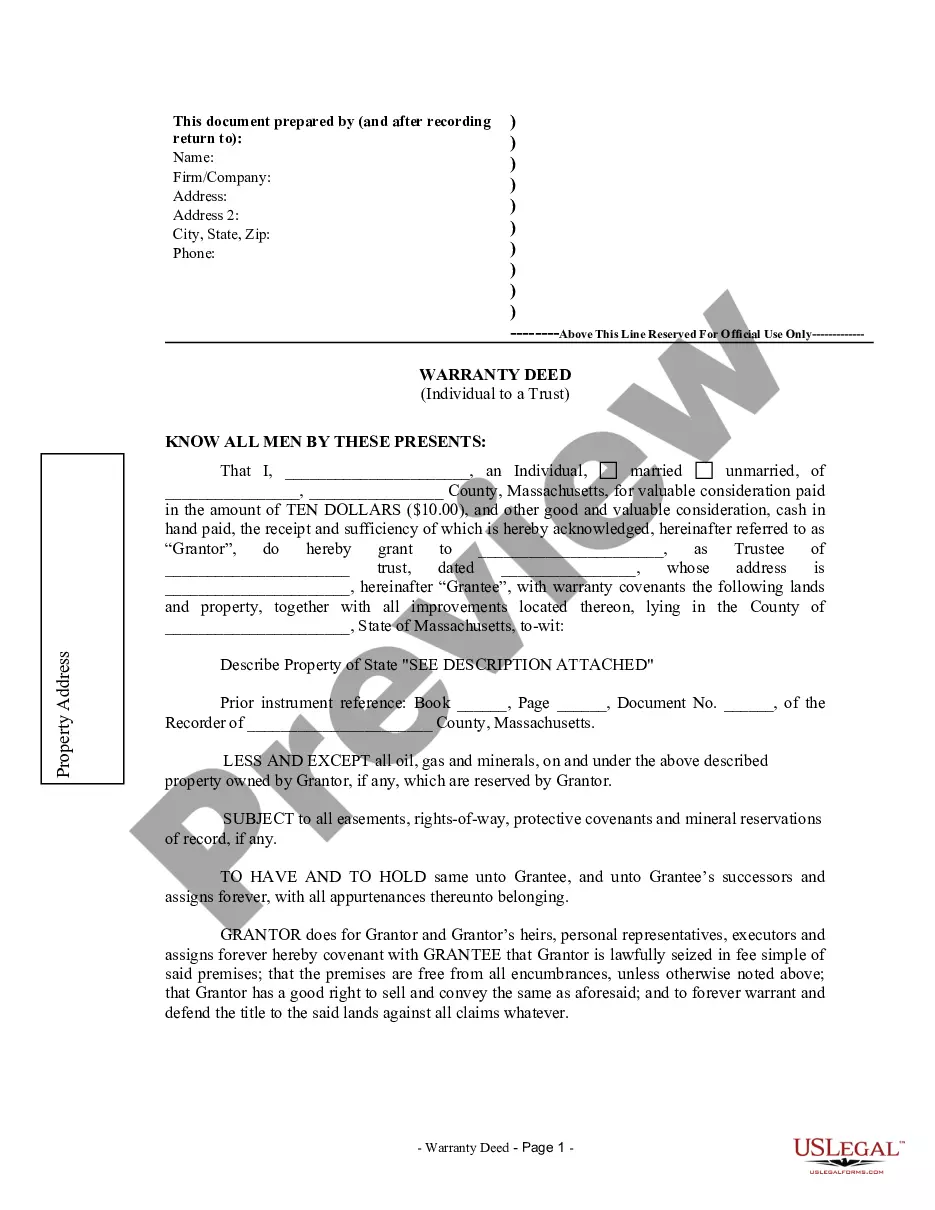

Massachusetts Warranty Deed from Individual to a Trust

Definition and meaning

A Massachusetts Warranty Deed from Individual to a Trust is a legal document used to transfer ownership of real property from an individual, referred to as the Grantor, to a trust, identified as the Grantee. This form ensures that the title of the property is passed securely, protecting the interests of the trust and its beneficiaries.

How to complete a form

Completing the Massachusetts Warranty Deed involves several steps:

- Identify the Grantor: Provide the full name of the individual transferring the property.

- Specify the Grantee: List the name of the trust and the trustee responsible for managing the trust.

- Property Description: Include a detailed description of the property being transferred.

- Consideration Amount: State the amount paid for the property, even if it is nominal.

- Sign and Notarize: The Grantor must sign the deed in the presence of a notary public.

Who should use this form

This form is intended for individuals who want to transfer real estate property into a trust for estate planning or asset protection purposes. It is especially useful for property owners looking to streamline the transfer of their assets to beneficiaries without going through probate.

Key components of the form

The essential elements of a Massachusetts Warranty Deed include:

- Grantor and Grantee Identification: The full names of the individual and the trust.

- Property Description: An accurate and complete description of the property, often referenced from a prior instrument.

- Consideration: The amount that the Grantor acknowledges receiving.

- Legal Covenants: Assurances regarding the title and ownership of the property.

- Notary Acknowledgment: A section where a notary public confirms the identity of the Grantor.

What to expect during notarization or witnessing

During the notarization process, the Grantor should present valid identification to the notary public. The notary will verify the identity of the Grantor and ensure that they understand the terms of the deed. The Grantor must sign the document in front of the notary, who will then complete their section, affirming that the document was executed properly. It's important that this process is conducted in a secure and private environment to protect the parties' interests.

Common mistakes to avoid when using this form

To ensure proper execution of the Massachusetts Warranty Deed, avoid the following errors:

- Failing to provide a complete property description.

- Not listing the correct names of the Grantor and Grantee.

- Neglecting to have the document notarized.

- Not specifying the correct consideration amount.

- Leaving out any legal covenants that may affect ownership.

Legal use and context

The Massachusetts Warranty Deed is primarily used in real estate transactions where individuals wish to transfer property into a trust. This legal instrument serves as proof of the transfer and protects the interests of the trustee and beneficiaries by ensuring that the Grantor has good title to the property. It is crucial in estate planning as it facilitates the smooth transfer of property outside the probate process.

Form popularity

FAQ

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

A trustee deed offers no such warranties about the title.