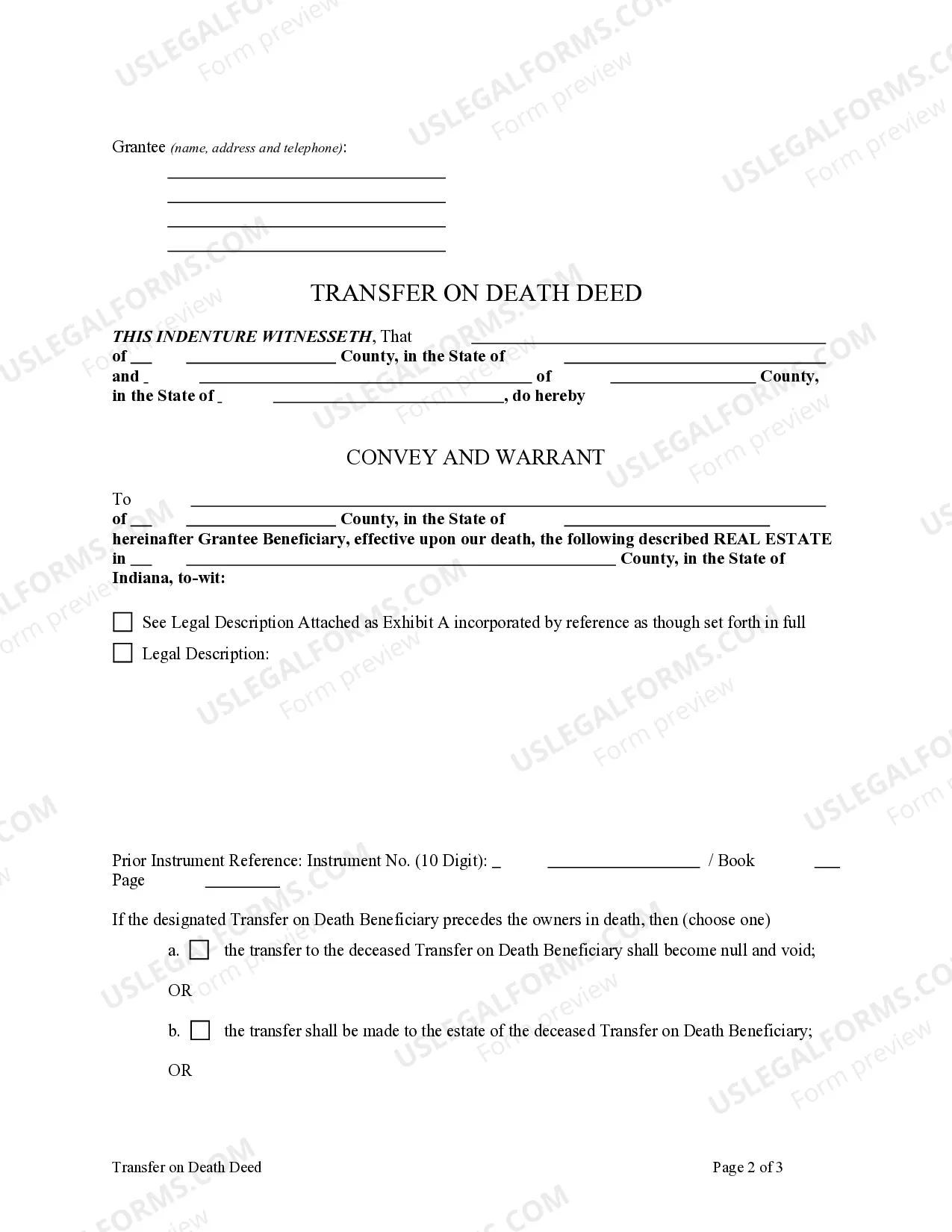

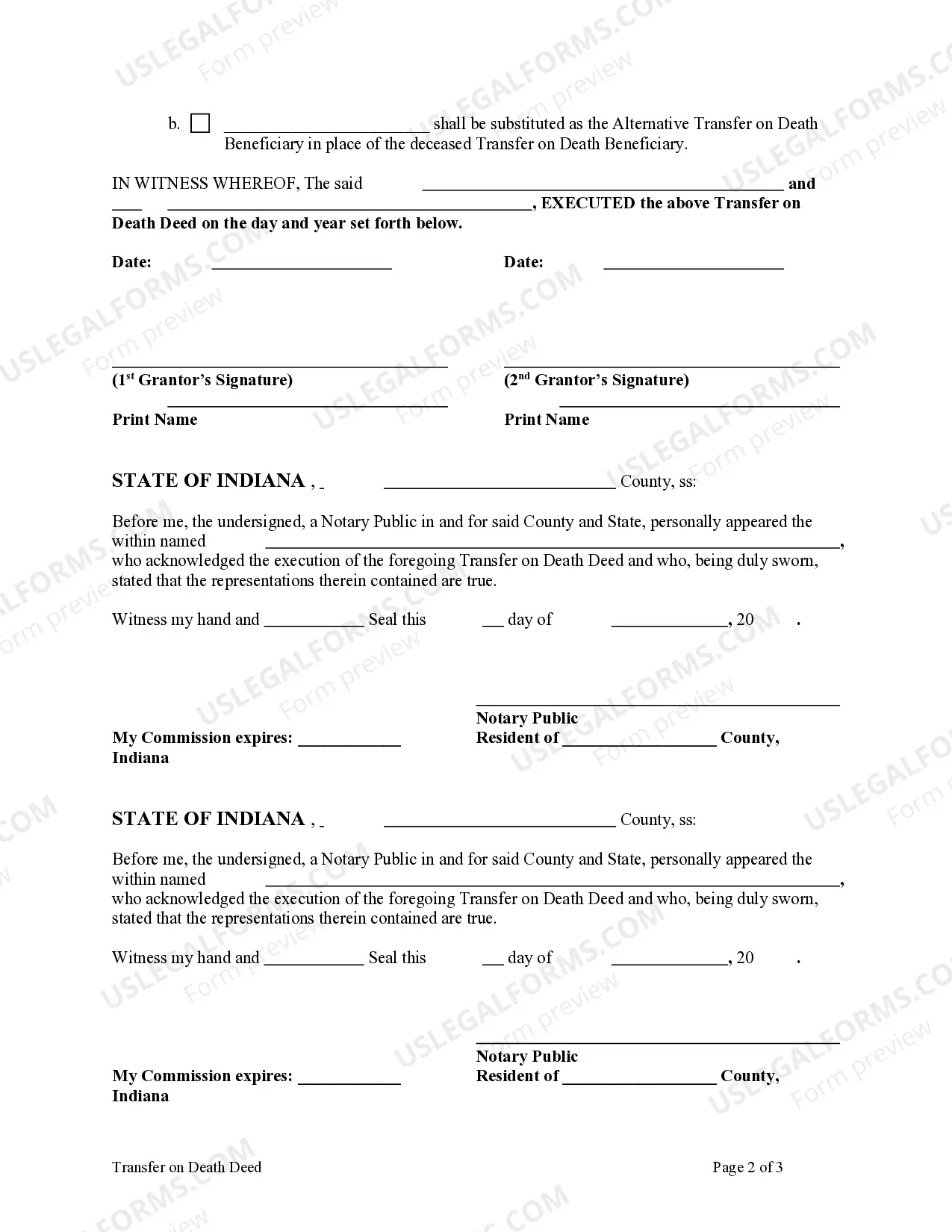

Transfer on Death Deed from Two Individuals to an Individual. This Deed is used to transfer the title of a parcel of land, upon the death of the Owner(s) to the designated Beneficiary. The form does include provision for an contingent beneficiary in the event the designated beneficiary predeceases the owners. The designation of the beneficiaries in an Transfer on Death Deed may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the affiant/owner of the interest by executing and recording a transfer on death deed conveying the owner's entire, separate interest in the real property to one or more persons, including the owner, with or without the designation of another transfer on death beneficiary.

An Indiana Transfer on Death Deed — TOD from Two Individuals / Husband and Wife, to an Individual refers to the transfer of real estate from two people (a husband and wife) to a single individual. This type of deed is often used to transfer residential property from two people to a single person, such as a family member or friend. There are two types of Transfer on Death Deed — TOD from Two Individuals / Husband and Wife, to an Individual: a Survivorship Deed and a Survivorship Joint Tenancy Deed. With a Survivorship Deed, the ownership of the property is transferred to the recipient upon the death of both individuals. With a Survivorship Joint Tenancy Deed, the ownership of the property is transferred to the recipient upon the death of only one of the individuals. Both types of deeds require that the two individuals be joint tenants in the property, and that the transfer be made without consideration.