This form is a Quitclaim Deed where the Grantor is an individual, acting through an attorney in fact authorized by a recorded power of attorney, and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Indiana Quitclaim Deed - Individual Grantor, by Attorney in Fact, to Individual

Description

How to fill out Indiana Quitclaim Deed - Individual Grantor, By Attorney In Fact, To Individual?

Seeking the Indiana Quitclaim Deed - Individual Grantor, by Attorney in Fact, to Individual forms and completing them may pose a difficulty.

To conserve a considerable amount of time, money, and effort, utilize US Legal Forms to locate the appropriate template specifically for your state in just a few clicks.

Our legal experts prepare every document, allowing you to simply fill them out. It's that straightforward.

Opt for your payment method with a credit card or via PayPal. Save the form in your preferred file format. You can print the Indiana Quitclaim Deed - Individual Grantor, by Attorney in Fact, to Individual template or complete it using any online editor. There's no need to worry about making mistakes since your template can be utilized, sent, and printed as often as desired. Explore US Legal Forms to gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the document.

- All your stored templates are preserved in My documents and are available at all times for future use.

- If you haven’t subscribed yet, you should sign up.

- To acquire a valid form, verify its acceptability for your state.

- Examine the sample using the Preview feature (if it’s offered).

- If there’s an explanation, read it to comprehend the specifics.

- Click Buy Now if you’ve found what you're looking for.

- Select your plan on the pricing page and create your account.

Form popularity

FAQ

A power of attorney enables an agent (also called the attorney-in-fact) to conduct transactions on another person's behalf.If so, a spouse, relative or friend with POA can sign a deed or other real estate documents.

A power of attorney enables an agent (also called the attorney-in-fact) to conduct transactions on another person's behalf.If so, a spouse, relative or friend with POA can sign a deed or other real estate documents.

Perhaps the most important duty you have as an attorney is the duty to act in the best interests of the donor. Therefore, any gifts or payments you make on the donor's behalf must be in line with their best interests.Attorneys can even make payments to themselves.

A power of attorney agent is not barred by law to sell the property unto himself by following proper procedures. He is selling the property on behalf of his principal in the capacity of his agent/representative and buying it as a buyer.In his absence or at his option, the POA can act.

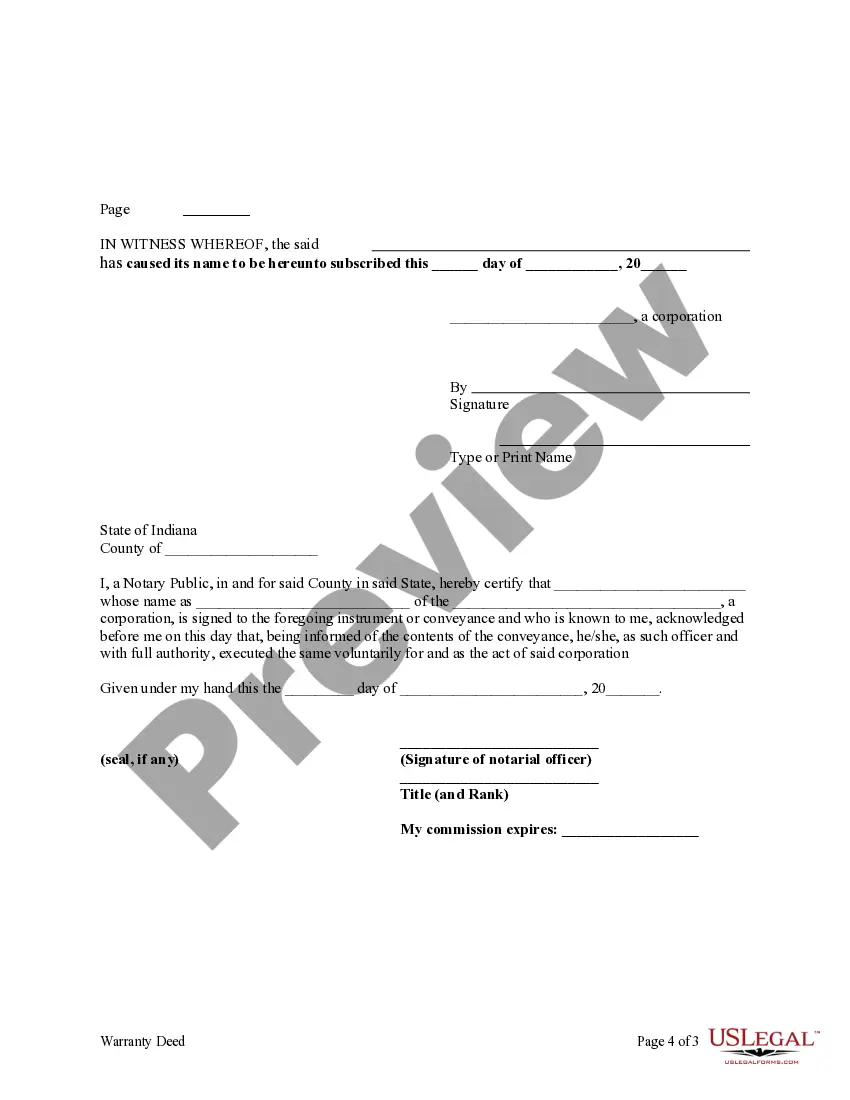

When the document goes into effect, you become that person's attorney in fact, which means you act as their agent. Generally, to sign documents in this capacity, you will sign the principal's name first, then your name with the designation "attorney in fact" or "power of attorney."

An agent cannot:Make decisions on behalf of the principal after their death.However, unless the principal named a co-agent or alternate agent in the same POA document or is still competent to appoint someone else to act on their behalf, an agent cannot choose who takes over their duties.

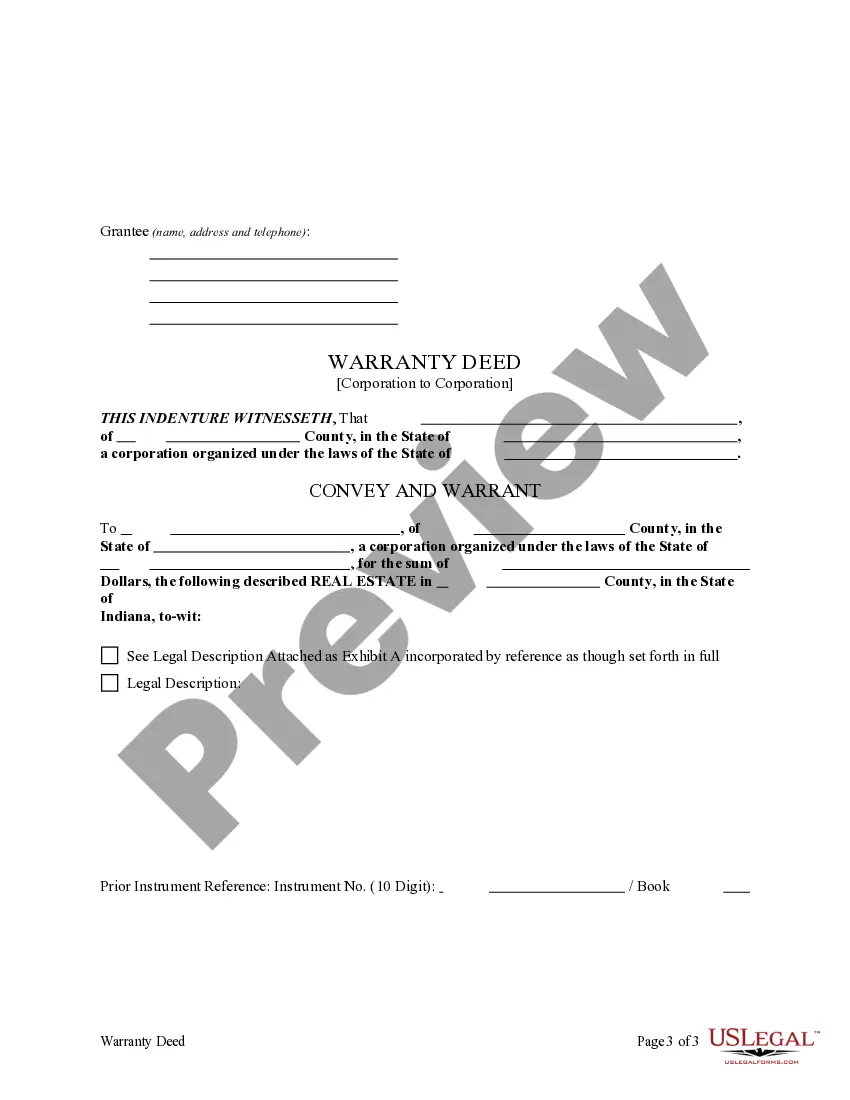

Step 1: Find your IN quitclaim deed form. Step 2: Gather the information you need. Step 3: Enter the information about the parties. Step 4: Enter the legal description of the property. Step 5: Have the grantor sign the document in the presence of a Notary Public.

The Power of Attorney is able to do anything which is authorized in the document. If there is language in the POA which allows the transfer of real property, the power of attorney is able to transfer the property to himself.