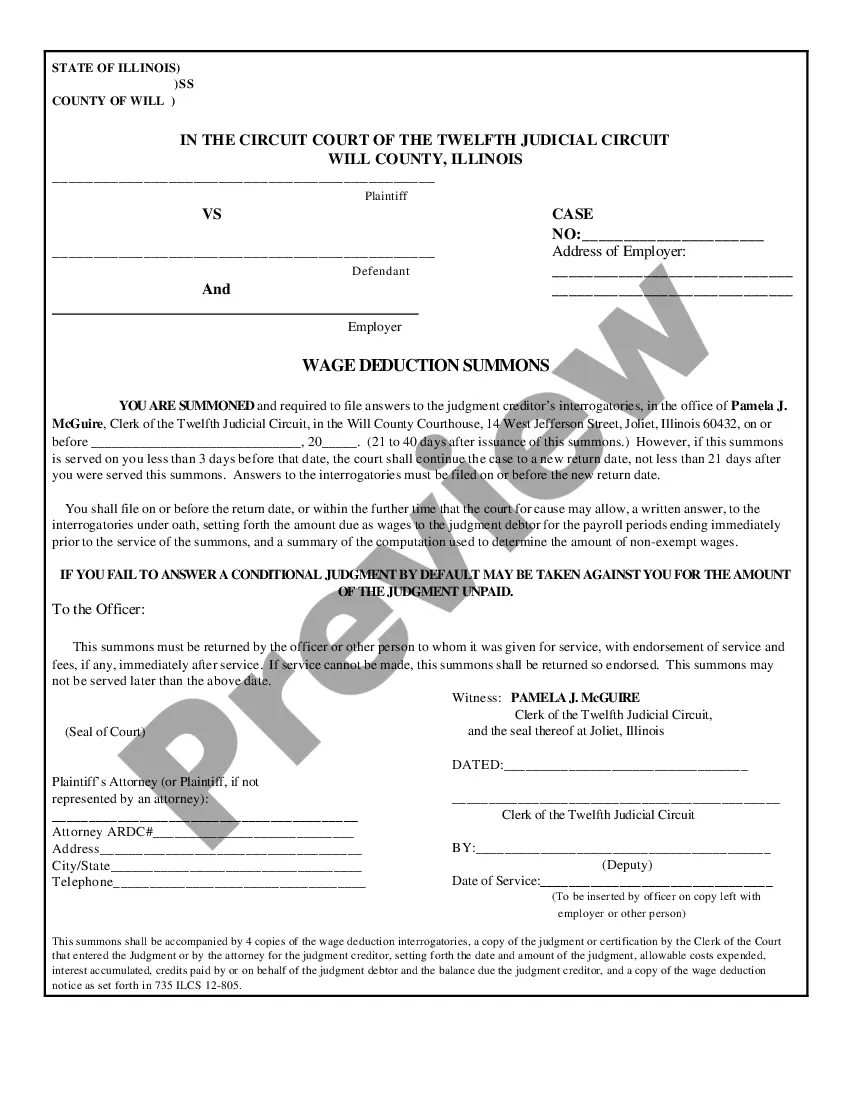

This Wage Deduction Order is an official form to be used in the Will County Circuit Court advising the employer to deduct wages from the employee and to transfer those wages to the plaintiff in the lawsuit. This form is for use in Will County, Illinois. If you plan to use this form in another Illinois county, please check with the Clerk's office to be certain that this form will suffice.

Illinois Wage Deduction Order

Description

How to fill out Illinois Wage Deduction Order?

Searching for Illinois Wage Deduction Order forms and filling them out can be difficult.

To save a significant amount of time, money, and effort, utilize US Legal Forms and select the appropriate template specifically for your state with just a few clicks.

Our attorneys prepare all documents, so you only need to complete them. It's really that straightforward.

You can print the Illinois Wage Deduction Order template or complete it using any online editor. There's no need to stress about errors since your template can be used, submitted, and printed as many times as you want. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the example.

- All your downloaded templates are stored in My documents and are always accessible for later use.

- If you haven't signed up yet, registration is required.

- Review our detailed instructions on how to obtain the Illinois Wage Deduction Order template in minutes.

- To acquire an applicable sample, verify its suitability for your state.

- View the example using the Preview option (if available).

- If there’s a description, read it to understand the specifics.

- Click Buy Now if you've found what you need.

Form popularity

FAQ

State and federal taxes, Social Security (FICA) contributions, Court ordered wage garnishments or income assignments like child support.

Get Debt Counseling A consumer credit counseling service (CCS) may be able to help you stop a garnishment. Not to be confused with debt repair companies, a CCS is a non-profit agency that can help you negotiate and reach an agreement with your creditors to pay them over time.

To get a wage garnishment , you need to file a Citation to Discover Assets to Debtor's Employer first. Use the collect a judgment from debtor's employer program to make the forms you need.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Generally, any creditor can garnish your wages.Specifically, most must file a lawsuit and obtain a money judgment and court order before garnishing your wages. However, not all creditors need a court order. It depends on the type of debt.

Include in your letter what steps you plan to take to address the default, such as making a reasonable effort at a payment plan. Mention any circumstances that have changed recently to make your ability to pay off the debt more likely. This conveys to the creditor your goodwill toward satisfying the debt.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

WAGE DEDUCTION SUMMONS To the employer:This proceeding applies to non-exempt wages due at the time you were served with this summons and to wages which become due thereafter until the balance due on the judgment is paid.