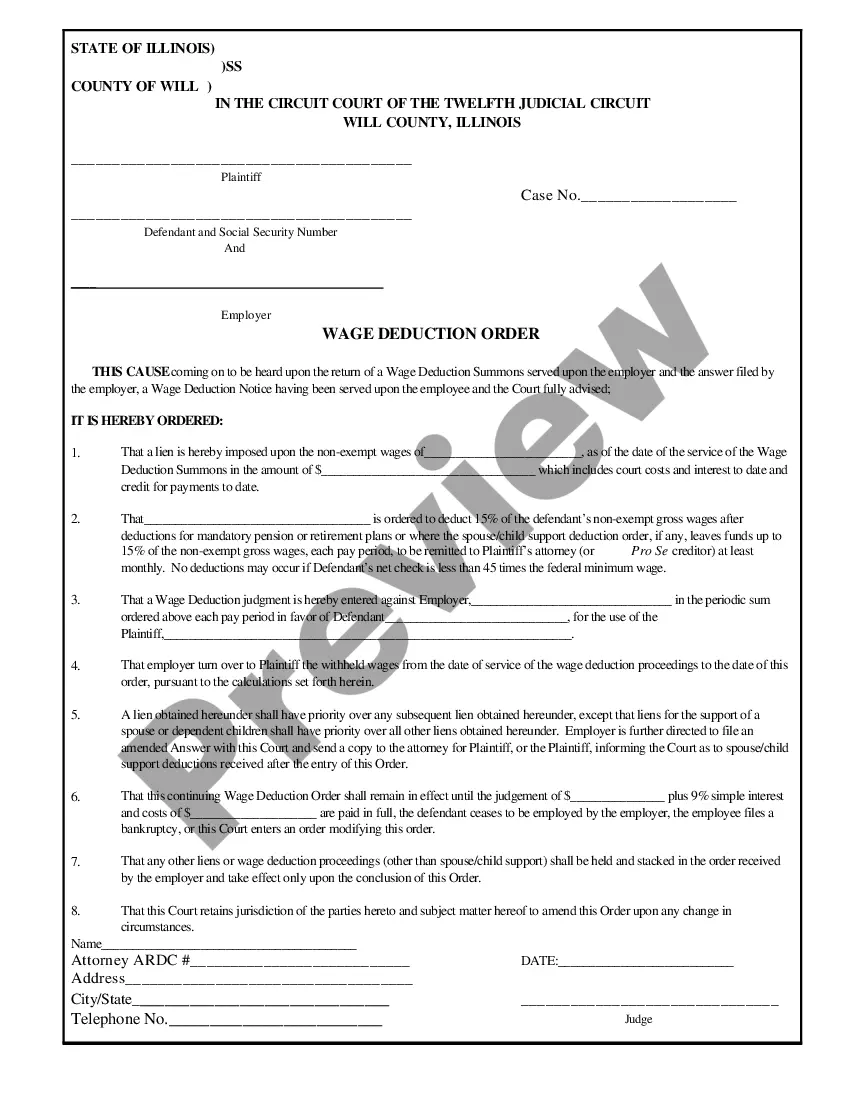

This official form from Will County, Illinois, is a summons to an employer to answer a judgment creditor's interrogatories regarding the deduction of wages for a judgment debtor. This form is for use in Will County, Illinois. If you plan to use this form in another Illinois county, please check with the Clerk's office to be certain that this form will suffice.

Illinois Wage Deduction Summons

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Wage Deduction Summons?

Locating Illinois Wage Deduction Summons documents and completing them can be a hassle.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our legal experts prepare all paperwork, so you merely need to fill them in. It’s genuinely that easy.

Choose your plan on the pricing page and create an account. Decide if you want to pay by card or using PayPal. Download the document in your preferred format. You can now print the Illinois Wage Deduction Summons form or complete it using any online editor. Don’t worry about making mistakes since your form can be used, submitted, and printed as many times as desired. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the template.

- All of your saved templates are stored in My documents and are available at any time for future use.

- If you haven’t registered yet, you will need to create an account.

- Follow our comprehensive instructions on how to obtain your Illinois Wage Deduction Summons template in a few minutes.

- To acquire a valid form, verify its eligibility for your state.

- Review the sample using the Preview option (if available).

- If there’s a description, read it to understand the specifics.

- Click on the Buy Now button if you find what you're looking for.

Form popularity

FAQ

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

Generally, any creditor can garnish your wages.Specifically, most must file a lawsuit and obtain a money judgment and court order before garnishing your wages. However, not all creditors need a court order. It depends on the type of debt.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

WAGE DEDUCTION SUMMONS To the employer:This proceeding applies to non-exempt wages due at the time you were served with this summons and to wages which become due thereafter until the balance due on the judgment is paid.

To get a wage garnishment , you need to file a Citation to Discover Assets to Debtor's Employer first. Use the collect a judgment from debtor's employer program to make the forms you need.