Illinois Assignment of Interest in Trust

Description

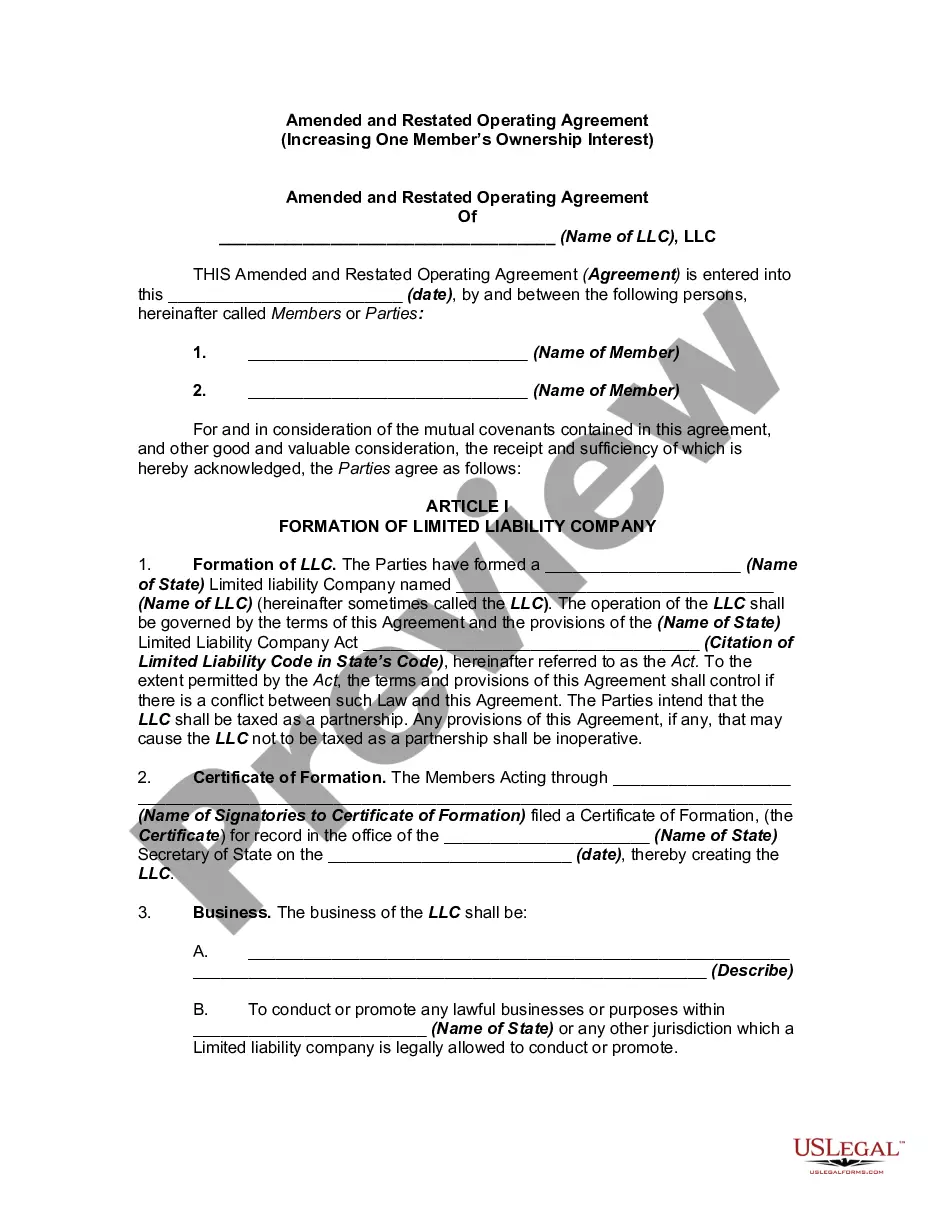

How to fill out Assignment Of Interest In Trust?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a range of legal document formats that you can download or print.

By using the website, you can access a vast number of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of documents like the Illinois Assignment of Interest in Trust in just a few minutes.

If you already have an account, Log In to download the Illinois Assignment of Interest in Trust from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the payment.

Select the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Illinois Assignment of Interest in Trust. Every template you add to your account has no expiration time and is yours indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Illinois Assignment of Interest in Trust with US Legal Forms, the most extensive collection of legal document formats. Utilize a vast array of professional and state-specific templates that fulfill your business or personal requirements.

- If this is your first time using US Legal Forms, here are simple steps to get started.

- Make sure you have selected the correct form for your state/region.

- Click on the Preview button to review the content of the form.

- Check the form description to confirm that you have chosen the correct document.

- If the form doesn't meet your needs, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Purchase now button.

- Next, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Trust Interest means an account owner's interest in the trust created by a participating trust agreement and held for the benefit of a designated beneficiary.

A trustee does not need beneficiary approval to sell trust property. However, a trustee who wants to avoid litigation would be wise to at least seek approval of the trust beneficiaries, and, at a minimum, be able to substantiate why the property was sold and how that sale benefited the trust beneficiaries.

The Role of a Trustee When it comes to the beneficial interest of a trust, your trustee will need to accept the transfer. If you have an entity that is named as the land trust beneficiary, the beneficial interests can be transferred without needing a change in the beneficiary designation.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

The rule against perpetuities is a legal rule in the Anglo-American common law that prevents people from using legal instruments (usually a deed or a will) to exert control over the ownership of private property for a time long beyond the lives of people living at the time the instrument was written.

The common law Rule against Perpetuities is English in origin and was first promulgated centuries ago. The modern version of the Rule has been altered in California by statute. California has enacted the Uniform Statutory Rule Against Perpetuities, which supersedes the old common law rule.

Illinois courts have adopted the classical definition of the common law rule against perpetuities which generally provides that No interest is good unless it must vest, if at all, not later than twenty-one years after some life in being at the creation of the interest.5 A corollary is that where an appointment is

As a general rule, trust property cannot be sold outright by a beneficiary; the property must be first transferred to the beneficiary and placed in his name.

When it comes to limited partnerships and LLCs, or limited liability companies, the business interest of the company is only partly yours. However, you can transfer your portion of the business interest to a Trust as long as you secure a document of transfer, sometimes called an Assignment of Interest.

Illinois Trust Code and Uniform Trust Code With the adoption of the ITC, Illinois becomes the 34th state to adopt a version of the UTC, leaving Iowa, Indiana, Oklahoma and South Dakota as the only Midwestern states that have not adopted a version of the UTC.