Are you inside a place where you will need paperwork for either company or specific purposes virtually every working day? There are plenty of lawful document templates available online, but discovering ones you can trust isn`t simple. US Legal Forms gives a huge number of kind templates, such as the Illinois Agreement By Heirs to Substitute New Note for Note of Decedent, that happen to be composed to satisfy state and federal specifications.

When you are previously familiar with US Legal Forms web site and get a merchant account, merely log in. Following that, you can acquire the Illinois Agreement By Heirs to Substitute New Note for Note of Decedent web template.

If you do not come with an accounts and wish to begin to use US Legal Forms, follow these steps:

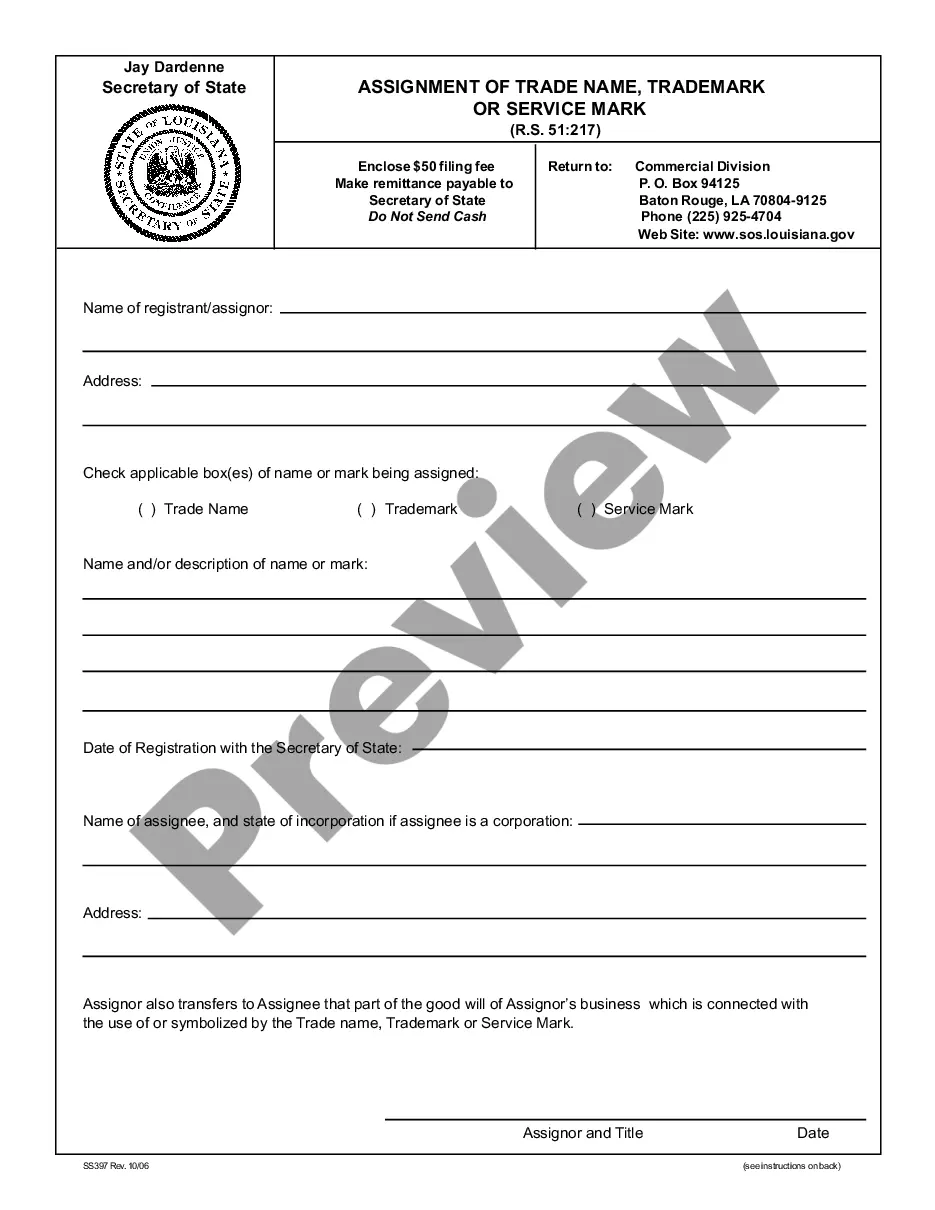

- Find the kind you will need and ensure it is for the right city/area.

- Make use of the Review button to examine the shape.

- Look at the outline to actually have selected the right kind.

- In case the kind isn`t what you are searching for, use the Look for field to get the kind that meets your requirements and specifications.

- Once you find the right kind, just click Get now.

- Pick the pricing program you need, fill in the required details to produce your money, and pay money for your order utilizing your PayPal or credit card.

- Choose a practical data file formatting and acquire your copy.

Get each of the document templates you possess purchased in the My Forms food list. You can obtain a further copy of Illinois Agreement By Heirs to Substitute New Note for Note of Decedent whenever, if possible. Just click on the required kind to acquire or print the document web template.

Use US Legal Forms, one of the most comprehensive assortment of lawful forms, to save lots of efforts and avoid faults. The support gives professionally made lawful document templates that you can use for a selection of purposes. Generate a merchant account on US Legal Forms and initiate making your life easier.