US Legal Forms - among the most significant libraries of legal varieties in the United States - offers a variety of legal record web templates you are able to download or produce. Making use of the site, you can find thousands of varieties for company and personal uses, sorted by groups, claims, or keywords.You will discover the latest models of varieties like the Illinois Agreement Between Widow and Heirs as to Division of Estate in seconds.

If you have a subscription, log in and download Illinois Agreement Between Widow and Heirs as to Division of Estate from the US Legal Forms library. The Obtain key can look on each develop you view. You get access to all in the past saved varieties in the My Forms tab of your account.

In order to use US Legal Forms the very first time, listed here are simple recommendations to help you started:

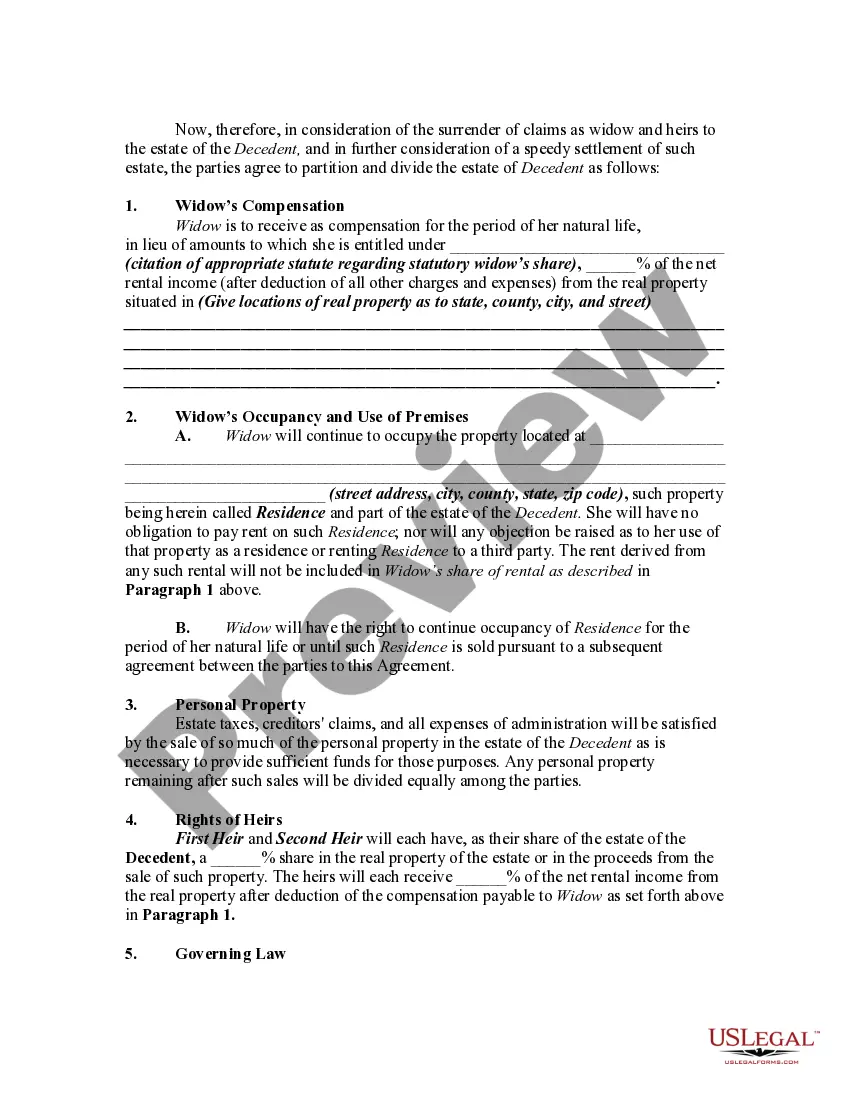

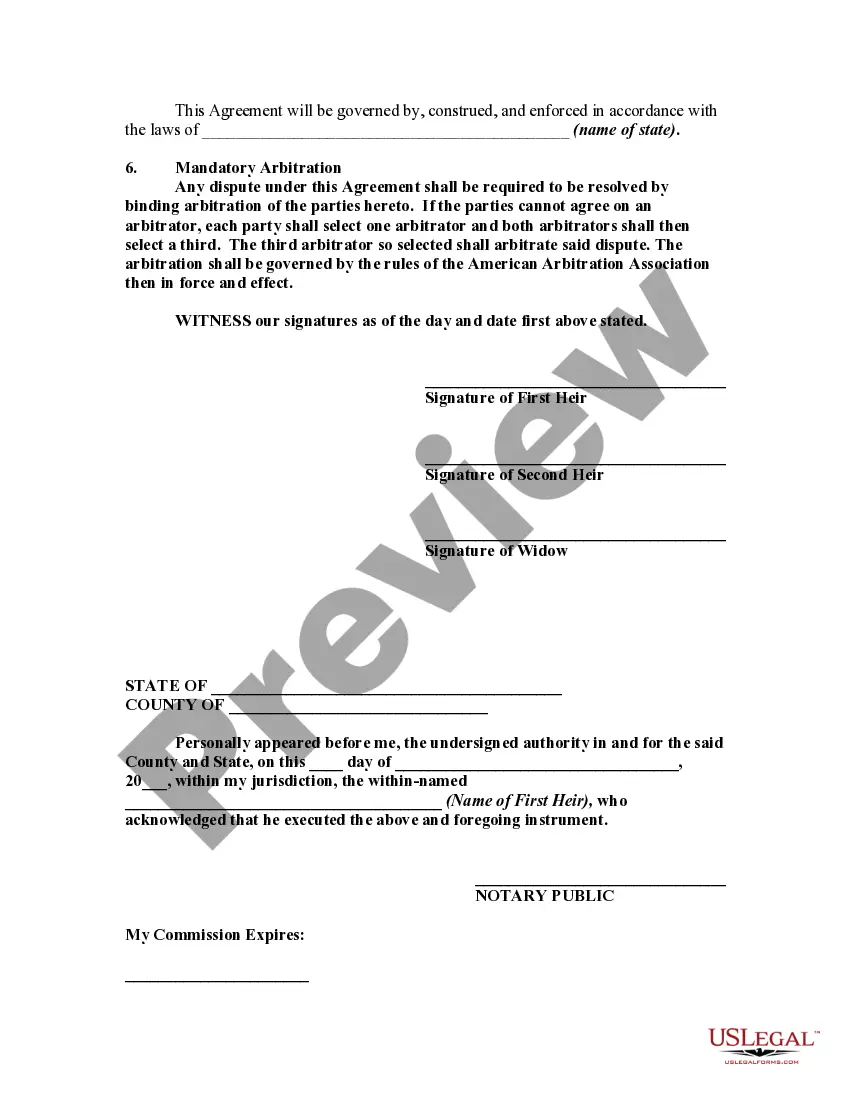

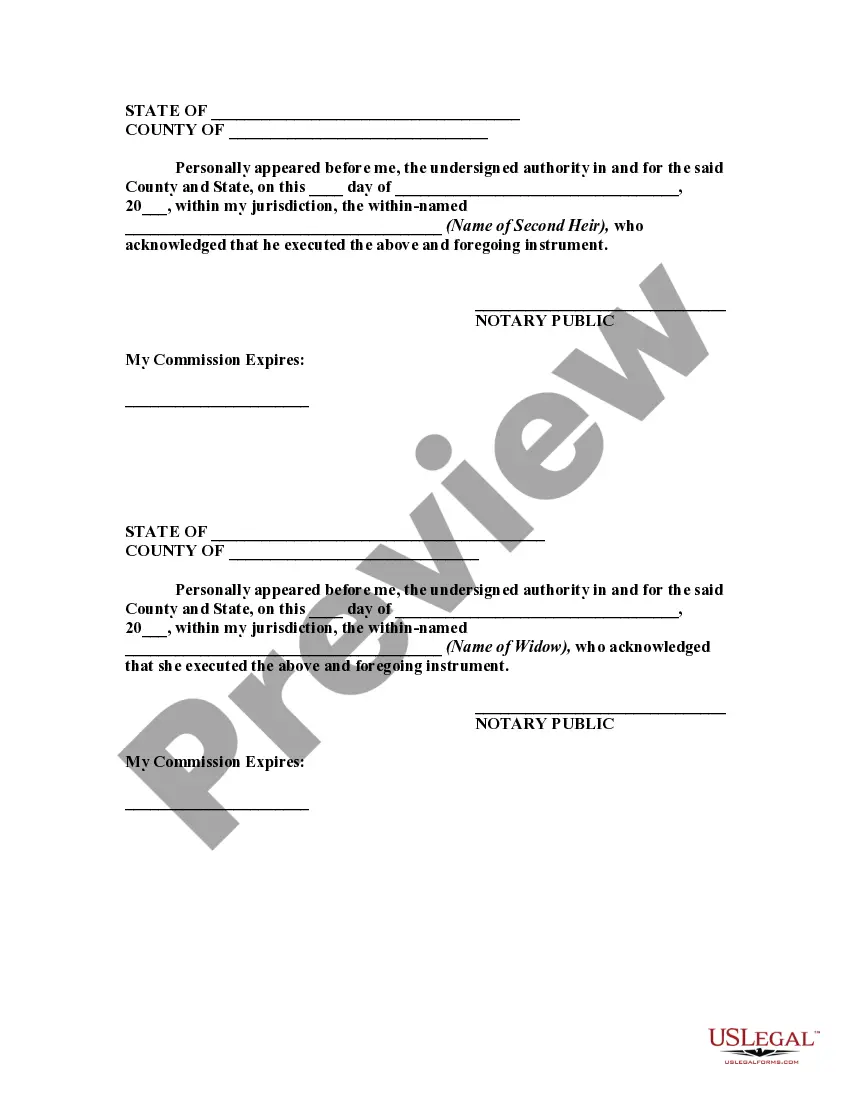

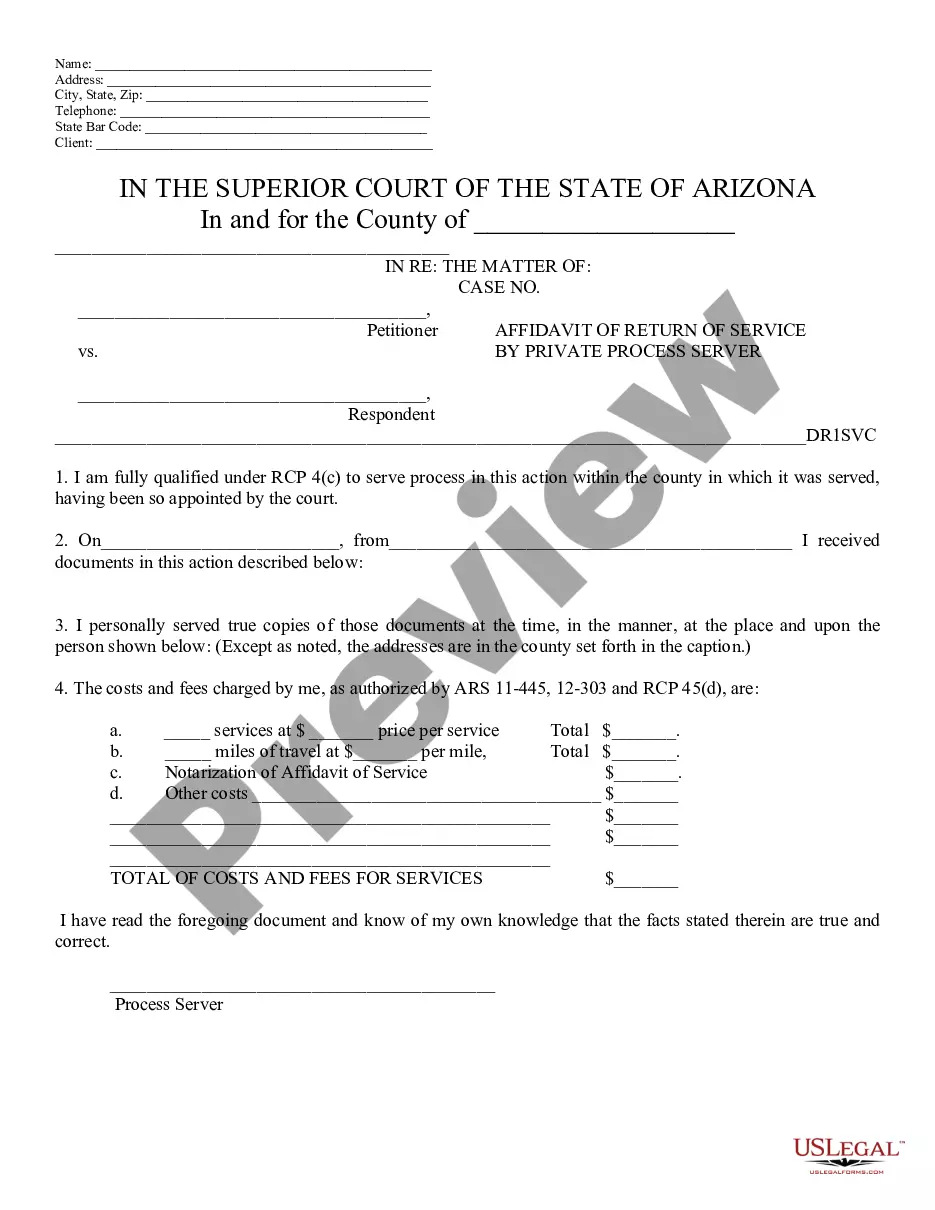

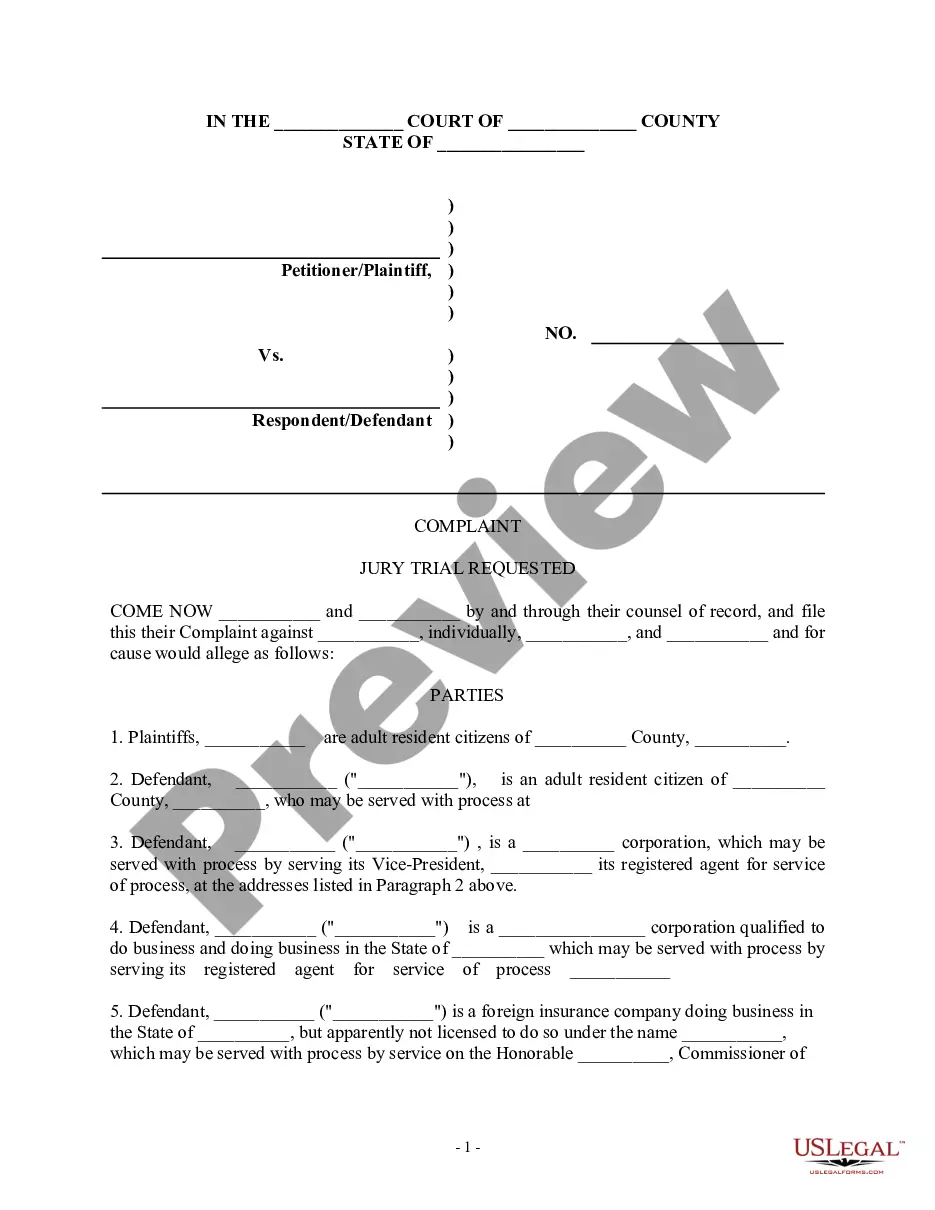

- Be sure to have chosen the right develop for your personal metropolis/area. Click on the Review key to examine the form`s content. Read the develop explanation to ensure that you have chosen the appropriate develop.

- When the develop does not suit your needs, use the Research area towards the top of the display screen to discover the one who does.

- In case you are pleased with the form, verify your option by visiting the Get now key. Then, select the pricing strategy you prefer and offer your accreditations to sign up on an account.

- Method the deal. Use your Visa or Mastercard or PayPal account to finish the deal.

- Choose the file format and download the form on the device.

- Make changes. Fill up, modify and produce and signal the saved Illinois Agreement Between Widow and Heirs as to Division of Estate.

Every web template you included with your bank account lacks an expiration date and is also your own property for a long time. So, in order to download or produce another backup, just go to the My Forms area and click about the develop you need.

Obtain access to the Illinois Agreement Between Widow and Heirs as to Division of Estate with US Legal Forms, one of the most considerable library of legal record web templates. Use thousands of expert and state-distinct web templates that fulfill your organization or personal needs and needs.