Illinois Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages

Description

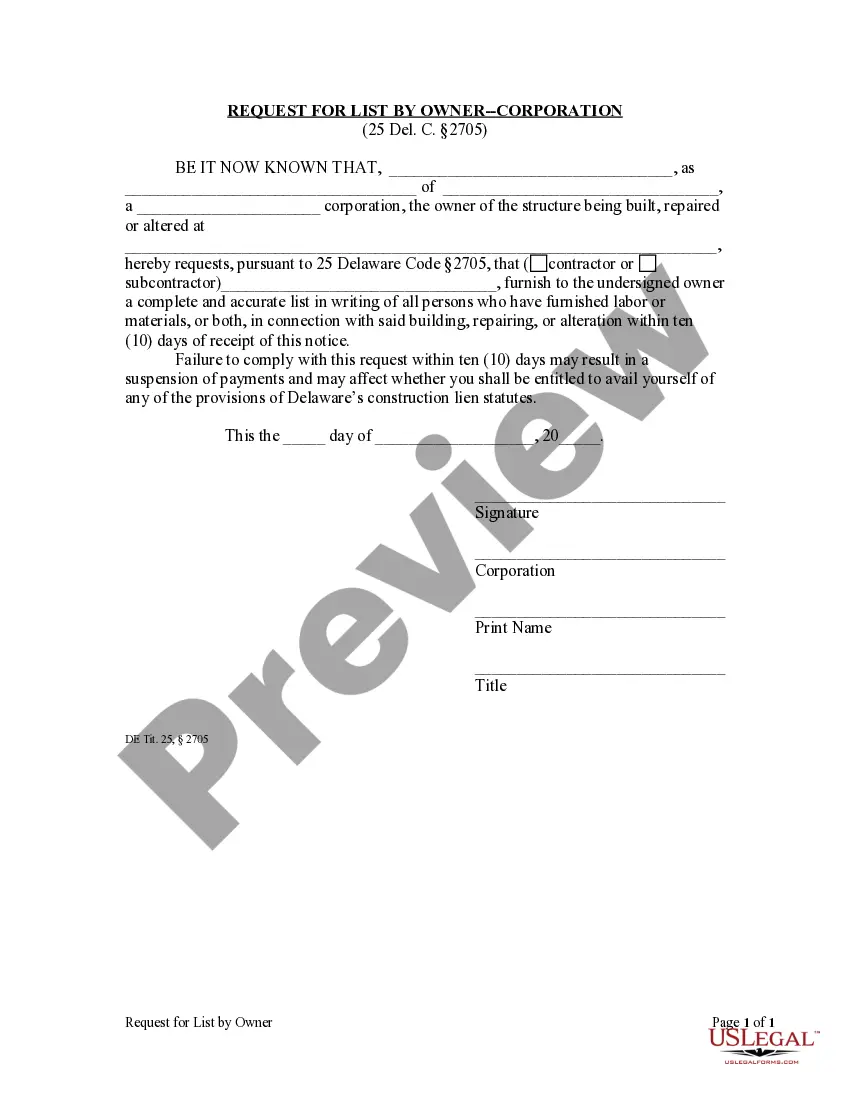

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

If you want to total, acquire, or printing legitimate document themes, use US Legal Forms, the biggest collection of legitimate types, that can be found online. Utilize the site`s basic and convenient look for to get the papers you require. A variety of themes for enterprise and person uses are categorized by categories and claims, or key phrases. Use US Legal Forms to get the Illinois Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages within a handful of clicks.

In case you are presently a US Legal Forms client, log in for your account and click the Acquire button to find the Illinois Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages. You can also accessibility types you in the past delivered electronically inside the My Forms tab of your respective account.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the form to the appropriate town/land.

- Step 2. Use the Review method to look through the form`s content. Never neglect to read through the information.

- Step 3. In case you are unhappy with the form, make use of the Lookup area towards the top of the monitor to discover other types from the legitimate form web template.

- Step 4. Upon having located the form you require, click the Buy now button. Select the prices strategy you like and include your qualifications to sign up for an account.

- Step 5. Approach the financial transaction. You can utilize your Мisa or Ьastercard or PayPal account to finish the financial transaction.

- Step 6. Select the file format from the legitimate form and acquire it in your gadget.

- Step 7. Complete, edit and printing or indicator the Illinois Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages.

Each legitimate document web template you purchase is your own forever. You have acces to every form you delivered electronically within your acccount. Go through the My Forms section and choose a form to printing or acquire yet again.

Be competitive and acquire, and printing the Illinois Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages with US Legal Forms. There are millions of professional and condition-distinct types you can use for the enterprise or person requires.

Form popularity

FAQ

Illinois Elective Share In Illinois, a surviving spouse can elect to renounce the decedent spouse's will and will then be entitled to, after all just claims are fully paid, the following: 1/3 of the estate if the decedent has descendants; or. 1/2 of the estate if the decedent has no descendants.

§ 510. Modification and termination of provisions for maintenance, support, educational expenses, and property disposition. (B) upon a showing of a need to provide for the health care needs of the child under the order through health insurance or other means.

In Illinois, if you are married and you die without a will, what your spouse gets depends on whether or not you have living descendants -- children, grandchildren, or great-grandchildren. If you don't, then your spouse inherits all of your intestate property.

In an Illinois divorce, all assets acquired during a marriage are subject to property division except ?property acquired by gift, legacy, or descent.? Inherited property and inheritance money usually fall into these categories as separate property, unless the court rules otherwise.

Sec. 513. Educational expenses for a non-minor child. (a) The court may award sums of money out of the property and income of either or both parties or the estate of a deceased parent, as equity may require, for the educational expenses of any child of the parties.

If the surviving spouse renounces the will, he or she will receive a ? share of the decedent's estate if the decedent has any surviving descendants and a ½ share of the estate if the decedent does not have surviving descendants.

In Illinois, inherited property is generally considered separate property and not subject to division in a divorce settlement.

What is a surviving spouse entitled to in Illinois? The surviving spouse is entitled to 20,000 dollars or enough money to sustain them for nine months. This comes after any funeral costs. The exact amounts will be decided based on the circumstances of your finances.