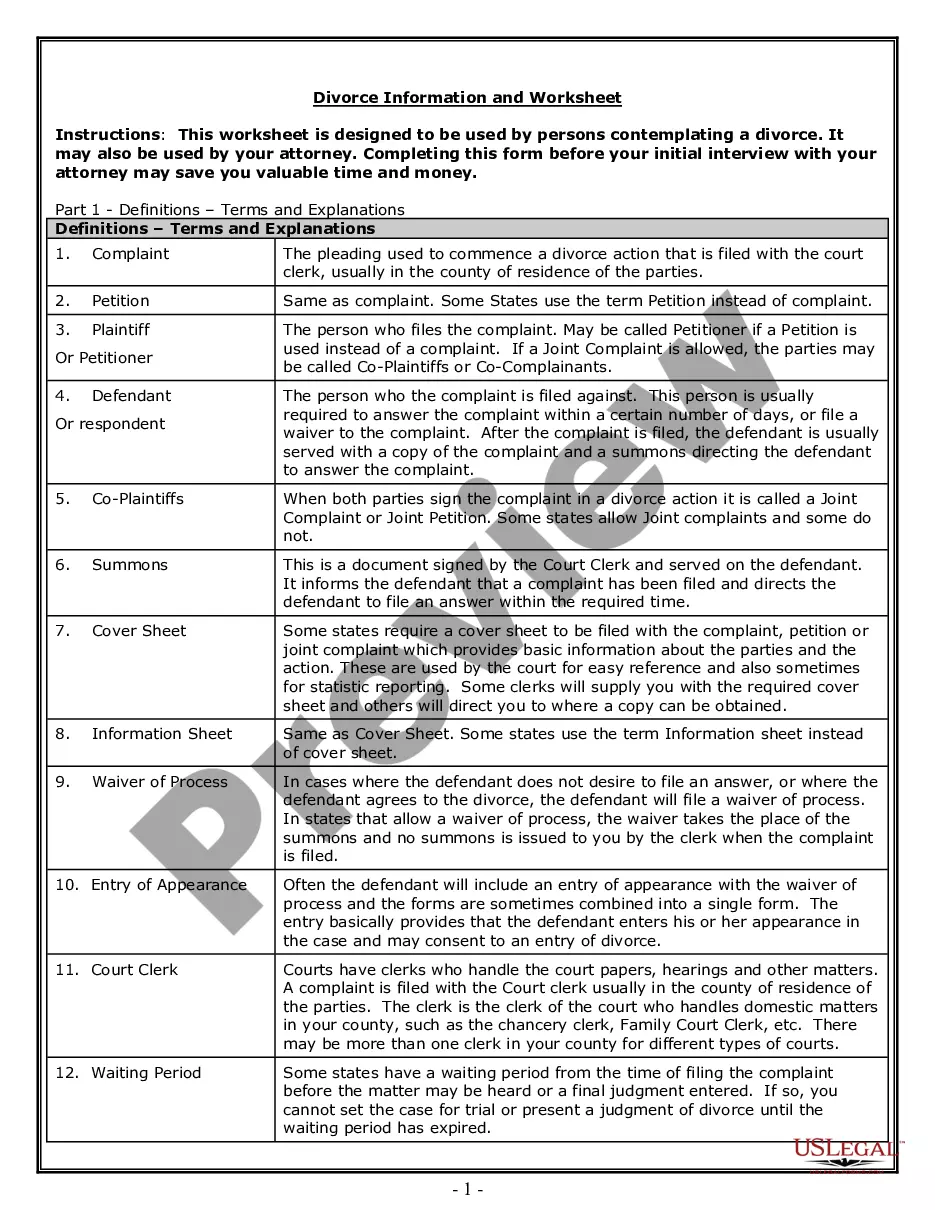

The Illinois Supervisor of Assessments Map is an online tool that provides a comprehensive view of current property assessment data across the state. The map includes detailed parcel information such as market value, owner information, and local tax assessment information. It also allows users to compare data between different counties and municipalities. The map is available for both residential and commercial properties. There are three types of maps available: the Assessment Map, the Assessment Search Map, and the Tax Rate Map. The Assessment Map allows users to search for properties by address, parcel number, or owner name. The Assessment Search Map allows users to search for properties by school district, municipality, or street address. The Tax Rate Map displays the local property tax rates for all counties and municipalities in the state.

Illinois Supervisor of assessments Map

Description

How to fill out Illinois Supervisor Of Assessments Map?

If you are searching for a method to effectively finalize the Illinois Supervisor of Assessments Map without employing an attorney, then you are in the perfect place.

US Legal Forms has established itself as the most comprehensive and reliable repository of official templates for every personal and corporate situation.

Another excellent benefit of US Legal Forms is that you never misplace the documents you have obtained - you can access any of your downloaded forms in the My documents tab of your profile whenever you need them.

- Verify that the document you view on the page aligns with your legal circumstances and state regulations by reviewing its textual description or browsing through the Preview mode.

- Enter the form title in the Search tab at the top of the page and select your state from the dropdown to find an alternate template if there are any discrepancies.

- Repeat the content validation process and click Buy now when you are assured of the document's compliance with all requirements.

- Log in to your account and click Download. If you don’t already have one, register for the service and select a subscription plan.

- Utilize your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be ready for download immediately after.

- Select the format in which you wish to save your Illinois Supervisor of Assessments Map and download it by clicking the relevant button.

- Incorporate your template into an online editor for quick completion and signing, or print it out to prepare a physical copy manually.

Form popularity

FAQ

This annual exemption is available for property that is occupied as a residence by a person 65 years of age or older who is liable for paying real estate taxes on the property and is an owner of record of the property or has a legal or equitable interest therein as evidenced by a written instrument, except for a

You can get your property taxes lowered by proving that your house is worth less than the assessor says it is. To do this, you have to appeal to your local board of review. You can find contact information for your local board of review on the Illinois Property Tax Appeal Board website.

Lake County had the highest median property taxes paid in Illinois at $7,724.

The program requirements include: The property must have been your primary residence for at least 3 years, You must have property insurance, Taxes cannot be delinquent, If there is a mortgage on the property, the lender must approve the tax loan, Multiple annual loans are permitted,

The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax years beginning January 1, 2022, it is $2,425 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,425 or less, your exemption allowance is $2,425.

Green Oaks, Greenwood, Gurnee, Harristown, Homer Glen, Indian Creek, Kaneville, Kaskaskia, Lily Lake, Long Creek, Long Grove, Loves Park, Lynnville, Machesney Park, Media, Menominee and Millbrook.

Senior Citizens Real Estate Tax Deferral Program allows persons 65 years of age and older, who have a total household income of less than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments on their principal residences.

Taxpayers whose primary residence is a single-family home, townhouse, condominium, co-op or apartment building (up to six units) are eligible. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question.