Illinois Take Notice is an online service for small businesses and non-profits in the state of Illinois. It provides a centralized platform for filing annual reports, registering charitable organizations, and registering trade names. It also offers a secure portal to manage entity information, including addresses, contacts, and financial information. The service is free and designed to streamline the business operations of users. There are three types of Illinois Take Notice services available: Annual Report, Charitable Organization Registration, and Trade Name Registration. The Annual Report service allows users to submit their annual reports to the Secretary of State quickly and securely. The Charitable Organization Registration service enables non-profits to register with the state. And the Trade Name Registration service allows companies to register a business name with the state and protect their business name from being used by others.

Illinois Take Notice

Description

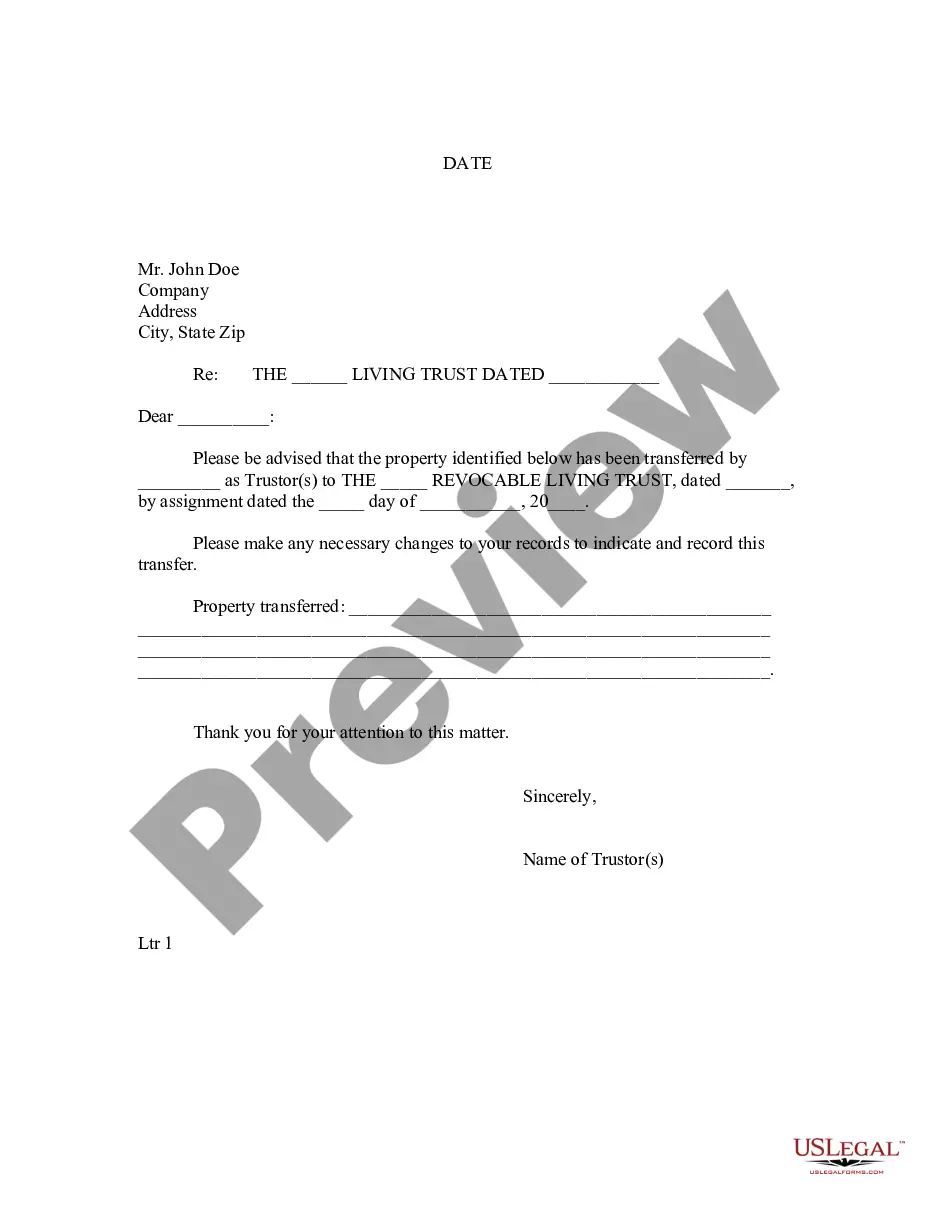

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Take Notice?

Managing legal documentation demands focus, accuracy, and utilizing well-prepared templates.

US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Illinois Take Notice template from our service, you can rest assured it adheres to federal and state regulations.

All documents are designed for multiple uses, like the Illinois Take Notice available on this page. If you require them in the future, you can complete them without additional payment - simply go to the My documents tab in your profile and finalize your document whenever necessary. Try US Legal Forms and complete your business and personal documentation quickly and fully compliant with legal standards!

- Ensure to meticulously review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Look for another official template if the previously accessed one does not suit your circumstances or state laws (the tab for that is located at the top page corner).

- Log in to your account and save the Illinois Take Notice in your preferred format. If it’s your first visit to our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the blank form or add it to a professional PDF editor for a paperless submission.

Form popularity

FAQ

When a property owner fails to pay property taxes, the county in which the property is located creates a lien on it for the amount owed. Tax liens are sold in order to recoup losses from unpaid taxes, and the buyers of those liens get the benefit of investing in a piece of real estate.

File a petition for a tax deed. If the redemption period expires and the owner has not paid the delinquent property taxes, start a lawsuit in the circuit court where the property is located. Ask the judge to order the county clerk to issue a tax deed in your name.

In Illinois, generally you have up to 2 years, or 24 months, to redeem taxes from the county clerk for commercial properties. However, sometimes this period can be as little as 6 months. You should contact your county clerk to find out. The county clerk's office can be reached by phone, email, or in person.

States can be generally divided between tax lien states or tax deed states. Illinois is a tax lien state. However, not every tax lien state operates the same. Illinois is particularly attractive to investors looking for a solid rate of return as the penalty interest amount can be as high as 36%.

The lien will remain for 20 years or until you pay it off, whichever comes first.

2-3 Years Following Tax Sale: Period of redemption: Following the tax sale, the property owner (or other financially vested party) has a period of time to redeem the taxes before they could lose ownership. For residential properties of 1-6 units, the minimum period of redemption is 2½ years.

?The State Tax Lien Registry was created in ance with Public Act 100-22 which created the State Tax Lien Registration Act. The State Tax Lien Registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the Illinois Department of Revenue (IDOR).

Interest accrues on the Subsequent Years Taxes on the purchase date and then annually from the purchase date (?Date? in the Subsequent Years Taxes section) at a rate of 12%.