Hawaii Letter to Lienholder to Notify of Trust

Description

Key Concepts & Definitions

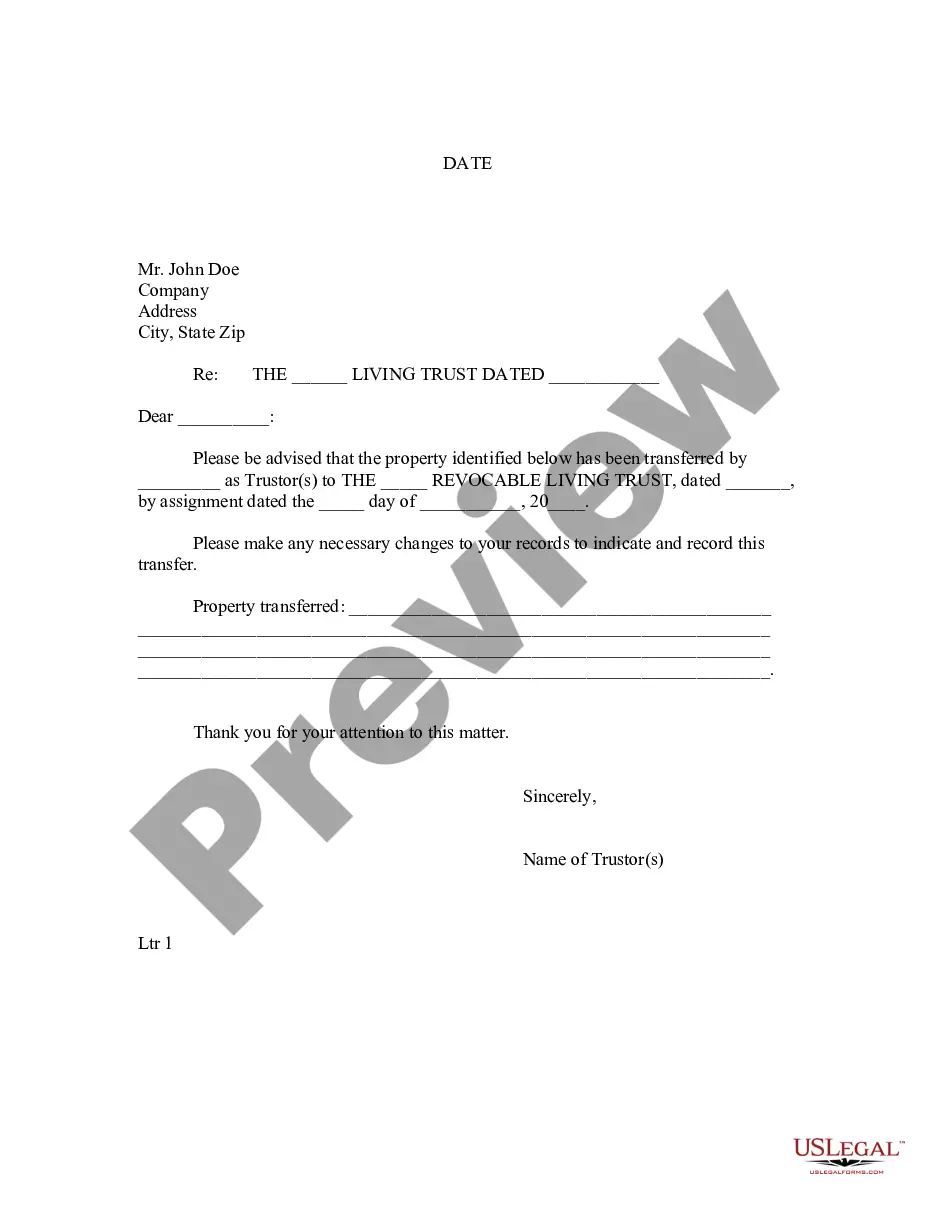

Letter to Lienholder to Notify of Trust: This is a document sent to a lienholder to inform them that a property has been transferred into a trust. The trust, such as a Trust California Form, is a legal arrangement where property is managed by a trustee for the benefit of the trust's beneficiaries. Lienholder notify trust involves communicating changes in property ownership which can affect the security interest of a lienholder.

Step-by-Step Guide

- Locate the appropriate form: Use legal forms online to find a 'letter to lienholder to notify of trust' template or a generalized notification form.

- Fill out the form: Using information about the trust, fill in the details in the form, ensuring accuracy to prevent future disputes.

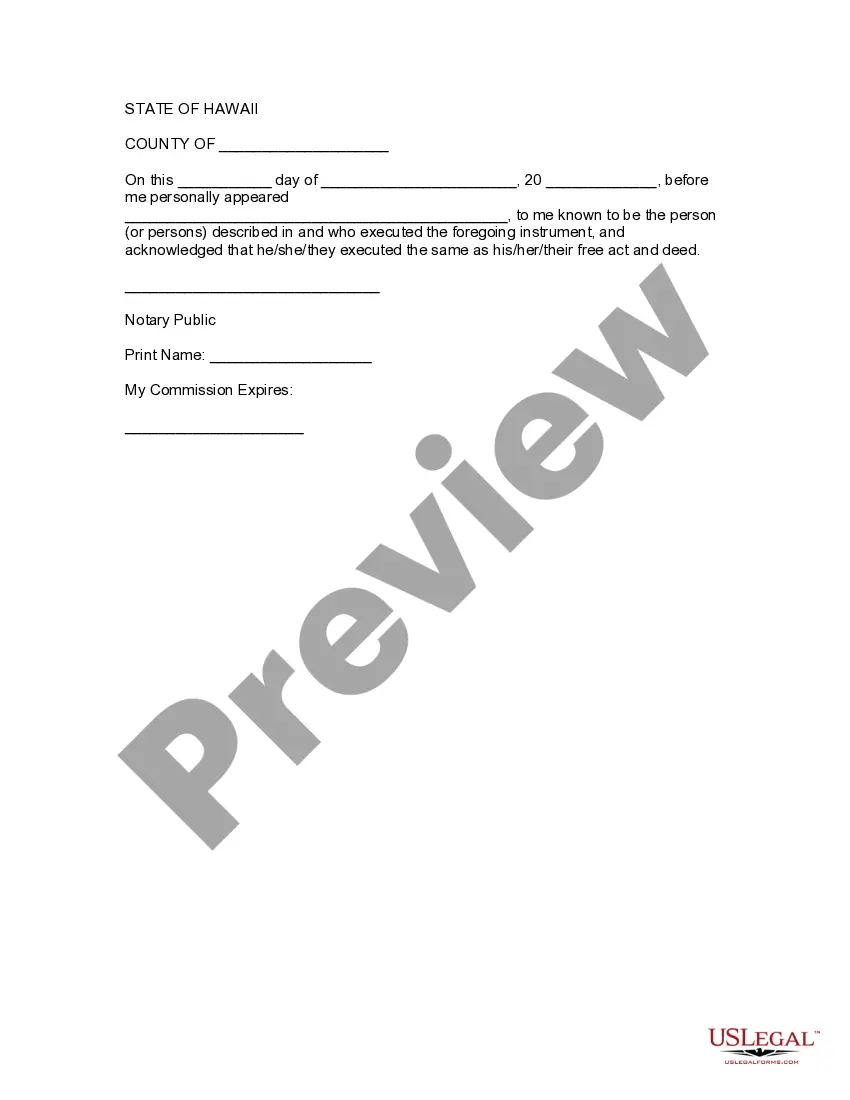

- Sign the document: Create an eSignature with tools like airslate signnow to legally sign the document.

- Send the document securely: Use secure document share services to send the completed form to the lienholder.

- Keep records: Maintain copies of sent documents for future reference or legal needs.

Risk Analysis

Sending a letter to lienholder without properly updating or accurately filling out the form can lead to legal complications, such as claims disputes or delays in real estate transactions. Its crucial to ensure that all real estate documents reflect current legal realities and property ownership to avoid potential financial and legal risks.

Best Practices

- Ensure accuracy: Double-check information in the document to prevent errors.

- Use professional services: Consider consulting with legal experts when dealing with sensitive documents.

- Utilize online tools: Tools like edit pdf online can be useful for making quick corrections to documents.

- Timely notification: Notify lienholders as soon as possible to maintain trust and compliance.

Common Mistakes & How to Avoid Them

- Not notifying all parties: Ensure all relevant parties are informed to avoid legal complications.

- Using outdated forms: Always use the most current form, like the trust california form for individuals establishing trusts within California.

FAQ

- What is a lienholder? A lienholder is a party that has a legal interest in a property until a debt obligation is fulfilled.

- Why notify a lienholder about a trust? Notification is required as the ownership status of the collateral—that is, the property—changes.

How to fill out Hawaii Letter To Lienholder To Notify Of Trust?

Obtain entry to the largest collection of legal documents.

US Legal Forms is fundamentally a platform where you can locate any state-specific paperwork in just a few clicks, such as the Hawaii Letter to Lienholder to Notify of Trust samples.

There's no necessity to invest multiple hours searching for a court-acceptable template.

If everything appears accurate, click on the Buy Now button. After choosing a pricing plan, create an account. Make a payment via credit card or PayPal. Download the document to your computer by pressing the Download button. That's it! You should complete the Hawaii Letter to Lienholder to Notify of Trust form and verify it. To ensure everything is precise, consult with your local legal advisor for assistance. Sign up and conveniently browse over 85,000 useful samples.

- To utilize the documents library, select a subscription and create an account.

- If you've completed this step, simply Log In and click on Download.

- The Hawaii Letter to Lienholder to Notify of Trust template will be immediately saved under the My documents section (a category for every form you accumulate on US Legal Forms).

- To register a new account, refer to the brief instructions below.

- If you need to use state-specific forms, ensure you specify the correct state.

- If possible, review the description to grasp all the details of the document.

- Take advantage of the Preview feature if available to examine the document's content.

Form popularity

FAQ

To file a lien in Hawaii, you must first gather the necessary information, including details of the property and the amounts owed. Then, prepare a Hawaii Letter to Lienholder to Notify of Trust, which notifies the lienholder of your intention to file. After completing the letter and any required forms, submit your documents to the appropriate county office. It's essential to follow local regulations, and using a reliable service like US Legal Forms can help streamline the process.

To file a lien on property in Hawaii, you must complete a Hawaii Letter to Lienholder to Notify of Trust. This document alerts interested parties about the trust involved in the property. First, gather the necessary information, including the property details and the lienholder information. Then, submit the completed letter to the appropriate county office and ensure you follow up to confirm the filing.

Recording a trust itself is not typically required in Hawaii; however, you do need to record a deed if property is transferred into the trust. This deed will reflect the trust ownership, and you will include information such as the trust name and trustee details. When dealing with lienholders, sending a Hawaii Letter to Lienholder to Notify of Trust can ensure all parties are informed. Consider using uslegalforms for this documentation.

Filing a lien on a property in Hawaii requires completing the necessary forms and submitting them to the Bureau of Conveyances. Make sure to include specific details about the property and the debt owed. After filing, you may want to send a Hawaii Letter to Lienholder to Notify of Trust if the property is held in trust. Utilizing services like uslegalforms can help streamline this process.

To check for a lien on a property in Hawaii, you can perform a title search through the Bureau of Conveyances or hire a title company to assist. By examining public records for any recorded liens against the property, you will gain clarity on any financial claims. If you are dealing with a trust, consider sending a Hawaii Letter to Lienholder to Notify of Trust for proper communication with lienholders. This process can be simplified using uslegalforms.

A trust does not need to be recorded in Hawaii unless you intend to transfer property into the trust. However, recording the property deed when it is transferred is necessary. For any properties affected by liens, it's wise to use a Hawaii Letter to Lienholder to Notify of Trust to keep lienholders informed. Resources like uslegalforms can help streamline this process.

A certificate of trust typically does not require recording in Hawaii, as it serves as a summary of key elements of the trust rather than a full disclosure. However, it can be submitted if needed for specific transactions or to prove the trust exists. Although it is not mandatory, using a Hawaii Letter to Lienholder to Notify of Trust can facilitate communication regarding trust assets. Consider leveraging platforms like uslegalforms for additional guidance.

In Hawaii, registering a trust is generally not required; however, it can be beneficial to establish one formally. You may want to document the trust through a certification that you can present to financial institutions or other relevant parties. While not mandatory, using a Hawaii Letter to Lienholder to Notify of Trust can help ensure proper communication with lienholders regarding the trust's assets. Legal services like uslegalforms can assist with this process.

Documenting a trust involves creating a trust agreement that outlines the terms, conditions, and responsibilities of the trustee. This document should specify the assets in the trust, the beneficiaries’ names, and the distribution plan. Many people find it helpful to work with a qualified attorney or a service like uslegalforms to ensure everything is correctly prepared. Be sure to reference a Hawaii Letter to Lienholder to Notify of Trust when dealing with lienholders.

To transfer ownership of a property in Hawaii, you need to prepare a new deed, typically a warranty deed or quitclaim deed. This deed should include essential details such as the names of the grantor and grantee, the property description, and the date of transfer. After preparing the deed, you must sign it in the presence of a notary public and then record it with the Bureau of Conveyances to update the ownership records. Consider utilizing a Hawaii Letter to Lienholder to Notify of Trust if the property is held in trust.