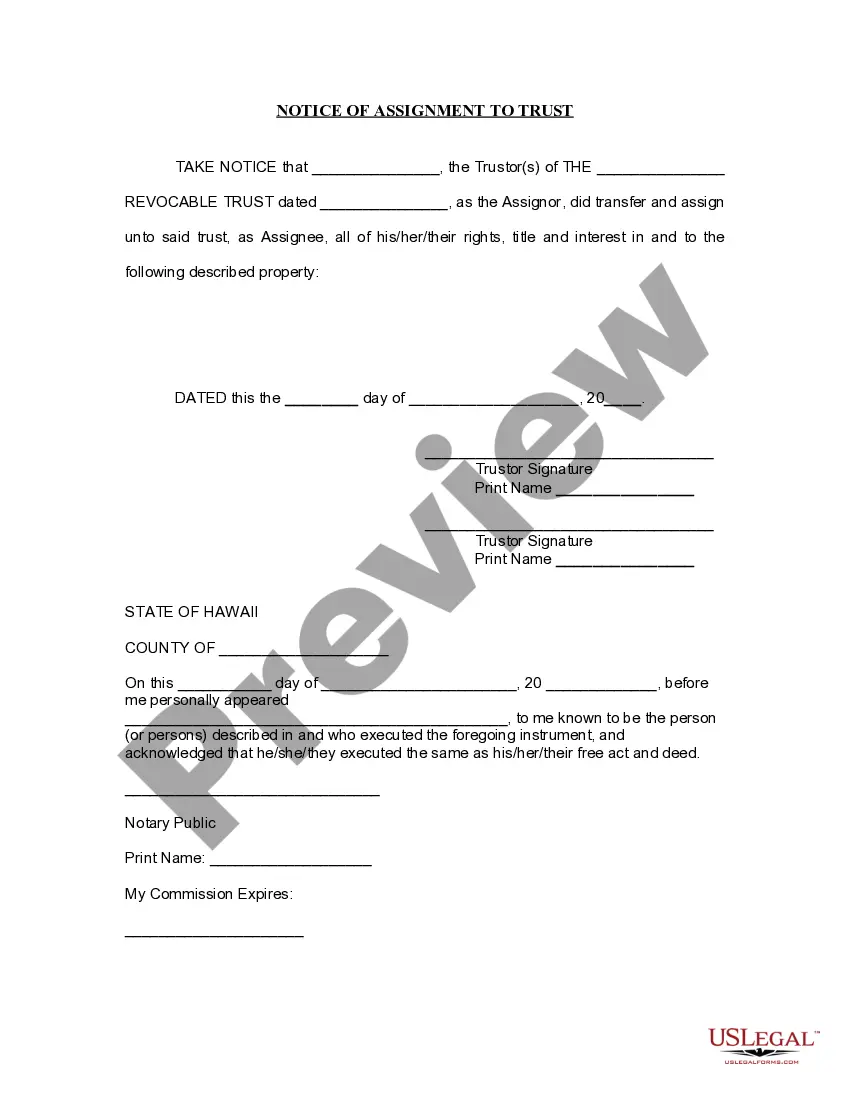

Hawaii Notice of Assignment to Living Trust

Description

How to fill out Hawaii Notice Of Assignment To Living Trust?

Access one of the most comprehensive libraries of legal templates.

US Legal Forms is actually a platform where you can discover any state-specific document in just a few clicks, including Hawaii Notice of Assignment to Living Trust samples.

No need to waste several hours of your time trying to locate a court-admissible form.

After selecting a pricing plan, register your account. Make payments via credit card or PayPal. Download the template to your computer by clicking the Download button. That's it! You need to complete the Hawaii Notice of Assignment to Living Trust template and validate it. To ensure that everything is accurate, consult your local legal advisor for assistance. Sign up and easily browse around 85,000 useful forms.

- To utilize the forms library, choose a subscription and create an account.

- If you’ve already done so, simply Log In and select Download.

- The Hawaii Notice of Assignment to Living Trust template will instantly be stored in the My documents tab (a section for all forms you save on US Legal Forms).

- To set up a new profile, follow the brief instructions provided below.

- If you intend to use a state-specific sample, ensure that you specify the correct state.

- If possible, review the description to understand all the details of the form.

- Use the Preview option if available to inspect the document's content.

- If everything is in order, click Buy Now.

Form popularity

FAQ

Creating an addendum to a living trust involves drafting a document that specifies changes or additions you want to make. Ensure that the addendum complies with state laws and is signed and dated to maintain its validity. Keep in mind the importance of the Hawaii Notice of Assignment to Living Trust when making changes, as it helps clarify any updates related to your assets.

To put your house in a trust in Hawaii, you first need to create a trust document that outlines your wishes. Next, execute a deed transferring the property into the trust, which is crucial for proper legal recognition. It's wise to follow the process closely, especially understanding the role of the Hawaii Notice of Assignment to Living Trust, to ensure smooth handling in the future.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly fund the trust with their assets. Without funding, the trust cannot operate as intended, leaving family members vulnerable to legal complications. Additionally, not considering the implications of the Hawaii Notice of Assignment to Living Trust can also lead to misunderstandings about how to handle the assets correctly.

An assignment to a trust involves transferring ownership of property into a trust for the benefit of specified beneficiaries. In the context of the Hawaii Notice of Assignment to Living Trust, this document acts as a formal notice that property has been assigned to a living trust. This assignment helps ensure a smooth transition of assets and can help avoid probate issues. Utilizing platforms like US Legal Forms can simplify the process, allowing you to create and manage your trust effectively.

Filling out a certification of trust form requires basic information about the trust, including the names of the trustees and key details of the trust document. It is essential to ensure accuracy to avoid legal issues later on. Resources on the Hawaii Notice of Assignment to Living Trust can guide you through this process effortlessly, ensuring you submit the form correctly.

Some negative aspects of trust funds include potential tax implications and administrative costs associated with managing them. Additionally, beneficiaries may feel constrained by the terms set by the trust, affecting their financial independence. Gaining insight into the Hawaii Notice of Assignment to Living Trust can help you navigate these complexities effectively.

Considering whether your parents should place their assets in a trust depends on their specific needs and goals. A trust can help avoid probate and manage assets efficiently after their passing. Discussing these options with them can clarify how the Hawaii Notice of Assignment to Living Trust fits into their estate plan and gives peace of mind.

A family trust can limit access to your assets if family members disagree on how to manage them. Disputes may arise concerning distributions and management, leading to family tension. It’s also essential to remain informed about the Hawaii Notice of Assignment to Living Trust to ensure smooth transitions and minimize conflict over time.