Illinois Small Business Accounting Package

About this form package

The Illinois Small Business Accounting Package is a comprehensive set of essential forms designed to help small business owners manage their accounting needs effectively. This package includes various accounting forms that are tailored to meet the requirements of small businesses in Illinois, setting it apart from general accounting form packages. With these forms, you can streamline your financial records, ensuring accuracy and compliance.

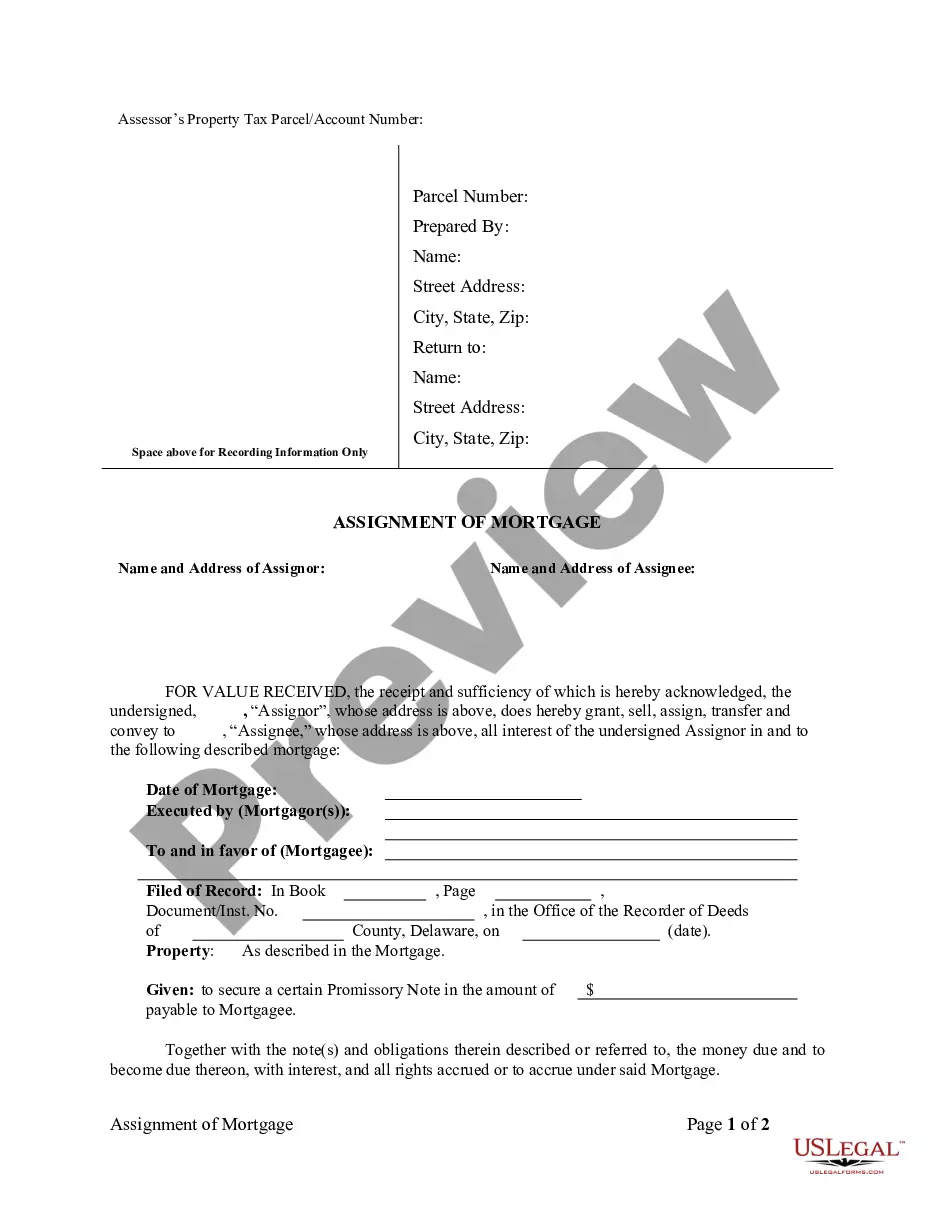

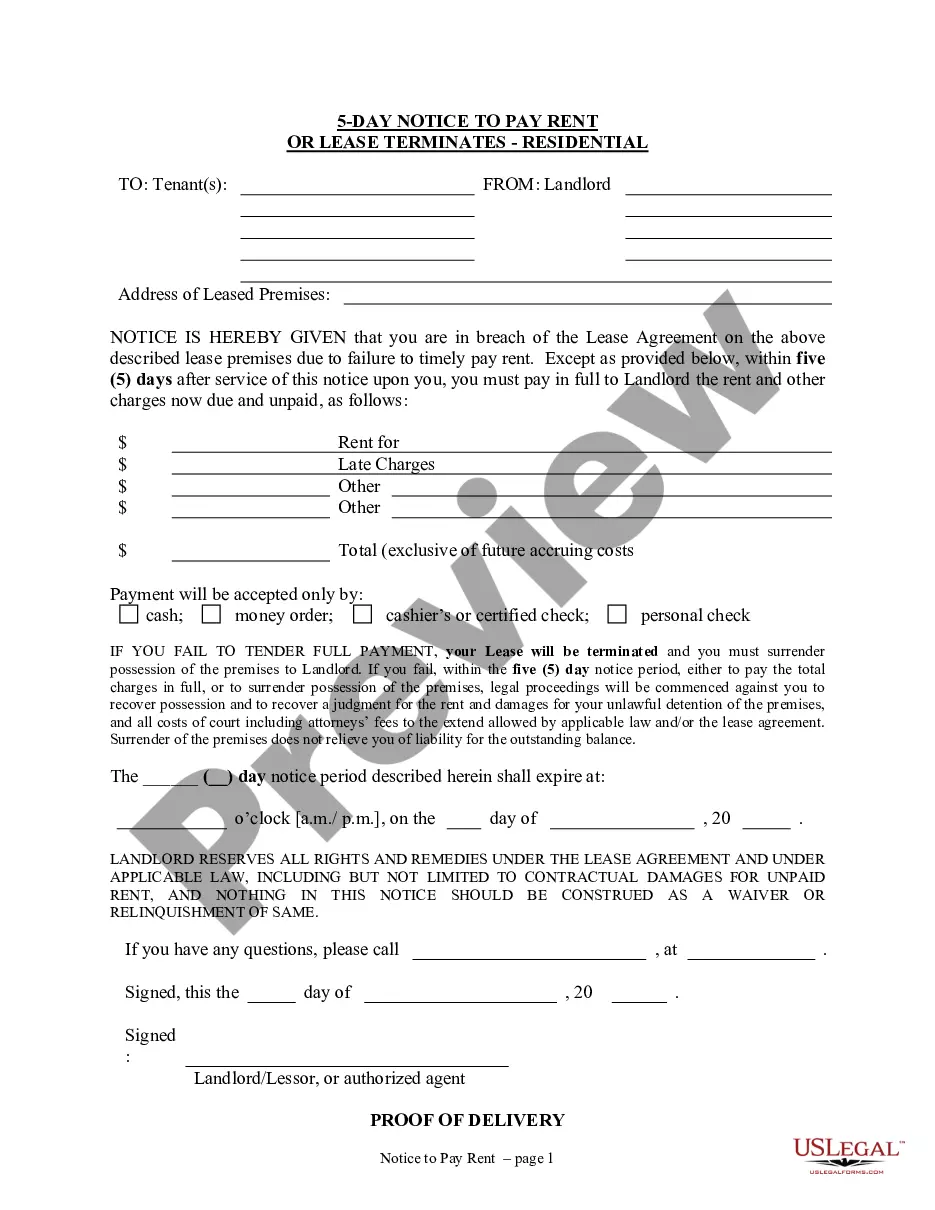

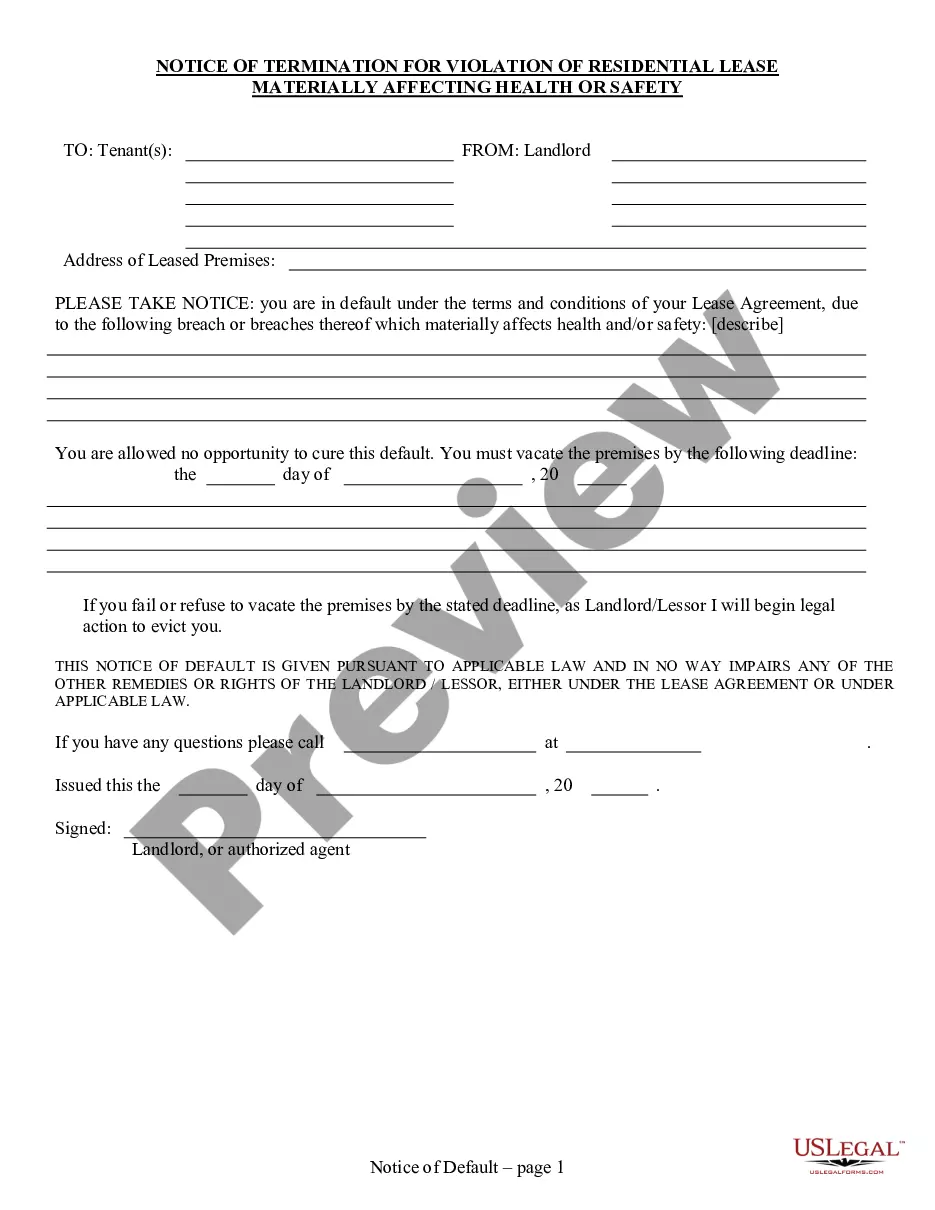

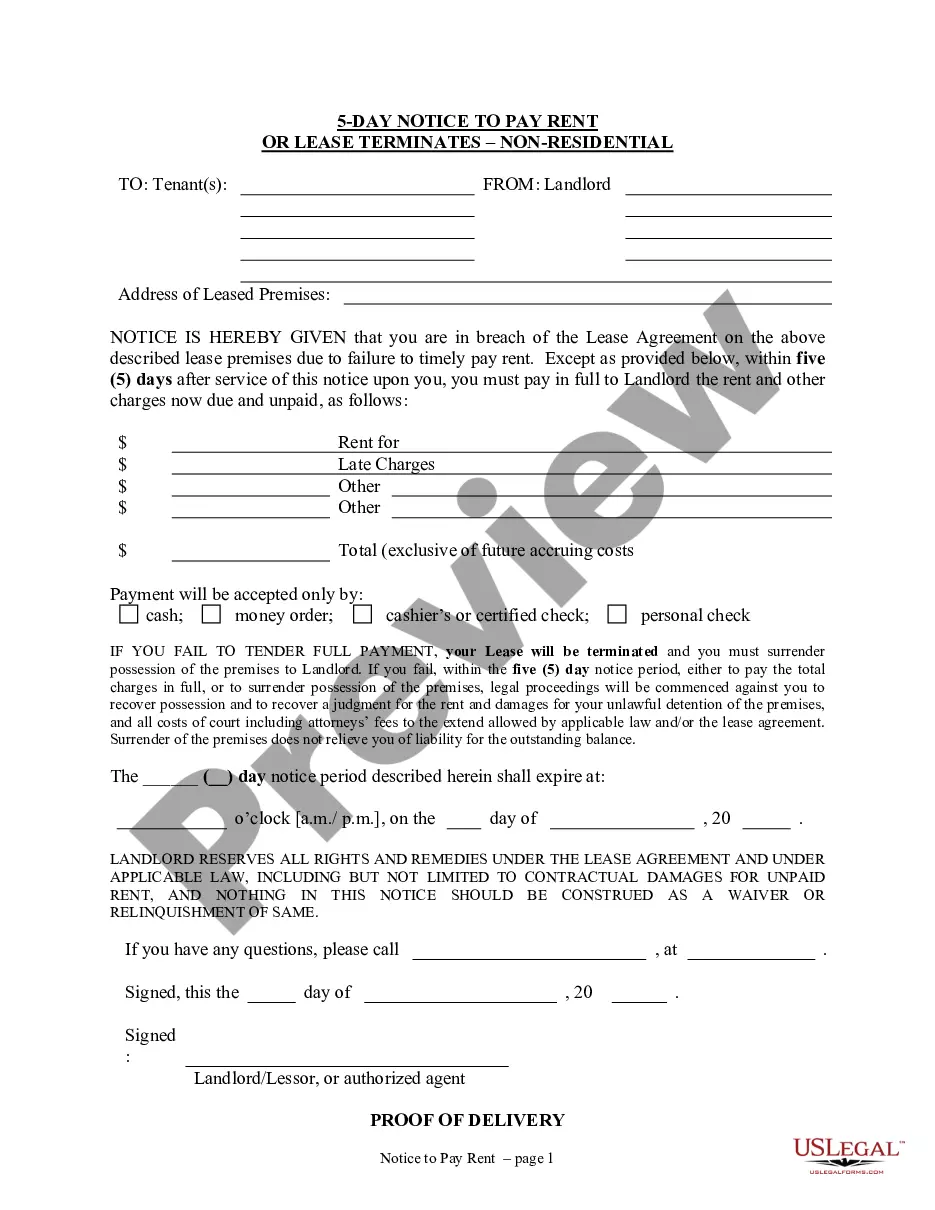

Documents contained in this package

When this form package is needed

This form package is valuable in several scenarios, including:

- Starting a new small business and needing to establish accounting practices.

- Regularly tracking income and expenses to maintain financial health.

- Preparing for tax filing by organizing financial data throughout the year.

- Managing cash flow and understanding accounts receivable and payable.

Who this form package is for

- Small business owners in Illinois

- Entrepreneurs looking to establish structured accounting practices

- Business managers responsible for overseeing financial operations

- Individuals with limited accounting experience who need user-friendly forms

Instructions for completing these forms

- Download the Illinois Small Business Accounting Package.

- Review the included forms to understand their purpose and importance.

- Gather relevant financial information to complete each form accurately.

- Fill out the forms using a computer or print them for manual entry.

- Save the completed forms for your records and future reference.

Do forms in this package need to be notarized?

Notarization is generally not required for forms in this package. However, specific circumstances or local laws may require it. You can complete notarization remotely through US Legal Forms, powered by Notarize, with 24/7 availability.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to keep accurate records throughout the year.

- Neglecting to review forms for completeness before submission.

- Using outdated versions of forms or incorrect templates.

- Overlooking state-specific requirements in form completion.

Why complete this package online

- Convenience of downloading forms from anywhere at any time.

- Editability allows customization to fit your specific business needs.

- Access to professionally drafted forms prepared by licensed attorneys.

- Cost-effective solution, saving you money compared to purchasing each form separately.

Looking for another form?

Form popularity

FAQ

The self-employed tax rate in Illinois includes both federal and state taxes, totaling approximately 15.3% for self-employment taxes at the federal level. Additionally, you'll need to account for state income tax based on your earnings. Using an Illinois Small Business Accounting Package can help you accurately calculate your liabilities and plan ahead for tax payments.

To fill out the Illinois withholding worksheet, you need to gather your income information, including paychecks and other sources of income. The worksheet guides you through calculating the number of allowances you may claim based on your tax situation. Completing this worksheet accurately helps ensure proper withholding from your paycheck, and integrating the Illinois Small Business Accounting Package can streamline this process significantly.

The typical accounting fees for small business fall between $1,000 to $5,000, according to the poll. If you're a new business owner, don't forget to factor accounting costs into your budget. If you're a veteran owner, it might be time to re-evaluate accounting costs.

Generally, a small business is not required to have a CPA or certified public accountant.Although most small businesses are not required to have a CPA involved, a small business may engage a CPA to review its internal controls, evaluate accounting software, obtain tax advice, and so on.

Because LLCs both make your accounting easier and provide you with some wonderful tax planning opportunities.If you've elected to have an LLC treated as an S corporation or as a C corporation, you probably should have a knowledgeable tax practitioner (a CPA, an enrolled agent or an attorney) prepare your tax return.

Every business, no matter how small, needs a financial and tax advisor. But your business needs a Certified Public Accountant (CPA), not just an accountant or enrolled agent.

The typical accounting fees for small business fall between $1,000 to $5,000, according to the poll. If you're a new business owner, don't forget to factor accounting costs into your budget. If you're a veteran owner, it might be time to re-evaluate accounting costs.

Business Bank Reconciliations. Credit Card Management. Accounts Receivable. Accounts Payable. Sales Tax. Payroll.

Choose Cash or Accrual Accounting. Set Up a Business Bank Account. Pick a Bookkeeping Software Package for Small Businesses. Create a Chart of Accounts. Set Up an Expense Tracking System. Prepare Your Bank Reconciliation Process. Set Up Your Reporting System. Getting help.

Create a New Business Account. Set Budget Aside for Tax Purposes. Always Keep Your Records Organised. Track Your Expenses. Maintain Daily Records. Leave an Audit Trail. Stay on Top of Your Accounts Receivable. Keep Tax Deadlines in Mind.