Illinois Estate Claim is a legal process available to beneficiaries of a deceased person's estate who may have been wrongfully denied their inheritance or have not received their inheritance in a timely manner. It is also available to creditors who have not been paid in a timely manner by a deceased's estate. There are two types of Illinois Estate Claims: Small Estate Claim and Contested Estate Claim. A Small Estate Claim is available when the value of the estate is less than $100,000 and no probate is required. A Contested Estate Claim is required when the value of the estate is greater than $100,000 or when a dispute exists between the beneficiaries of the estate. In a Contested Estate Claim, a court will decide how the estate's assets are to be distributed.

Illinois Estate Claim

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

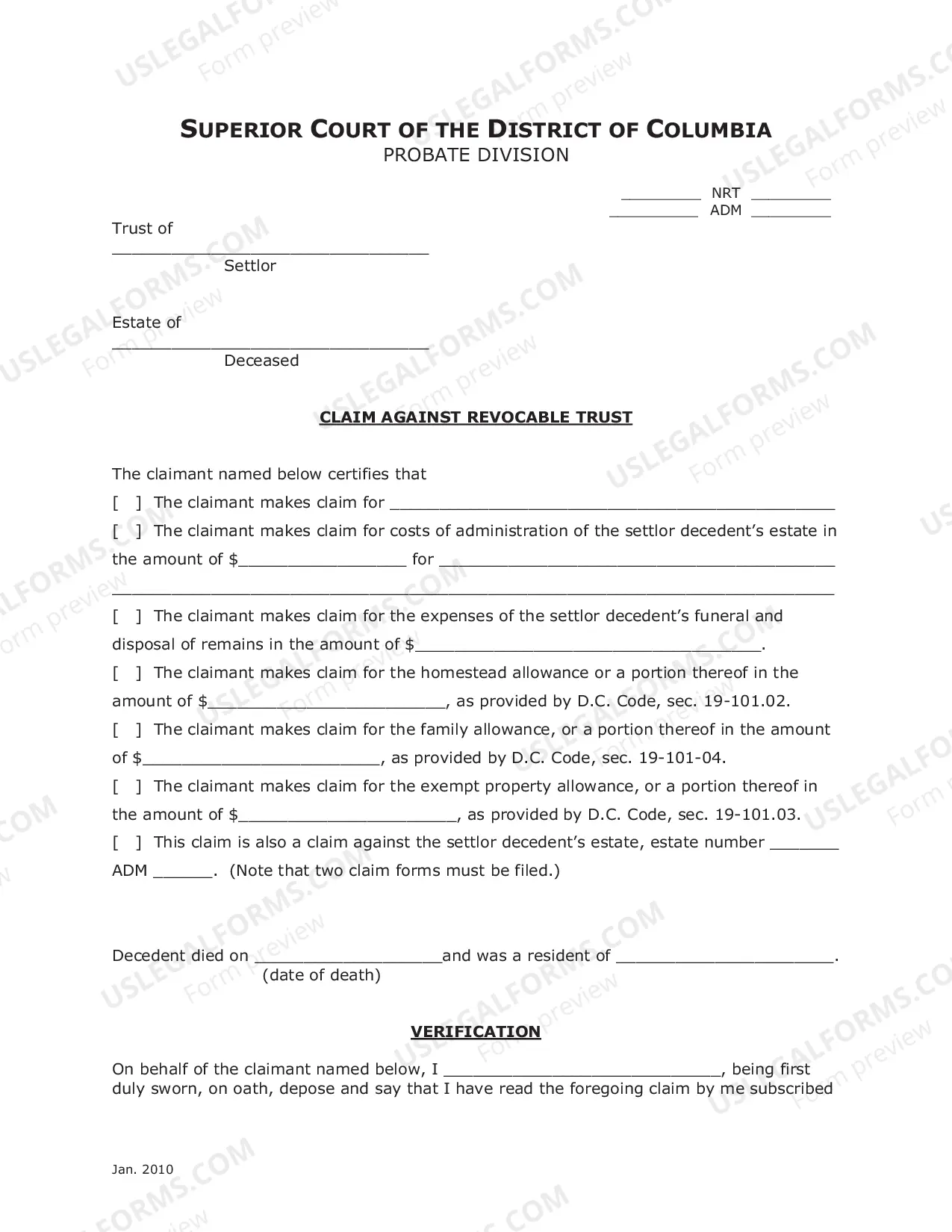

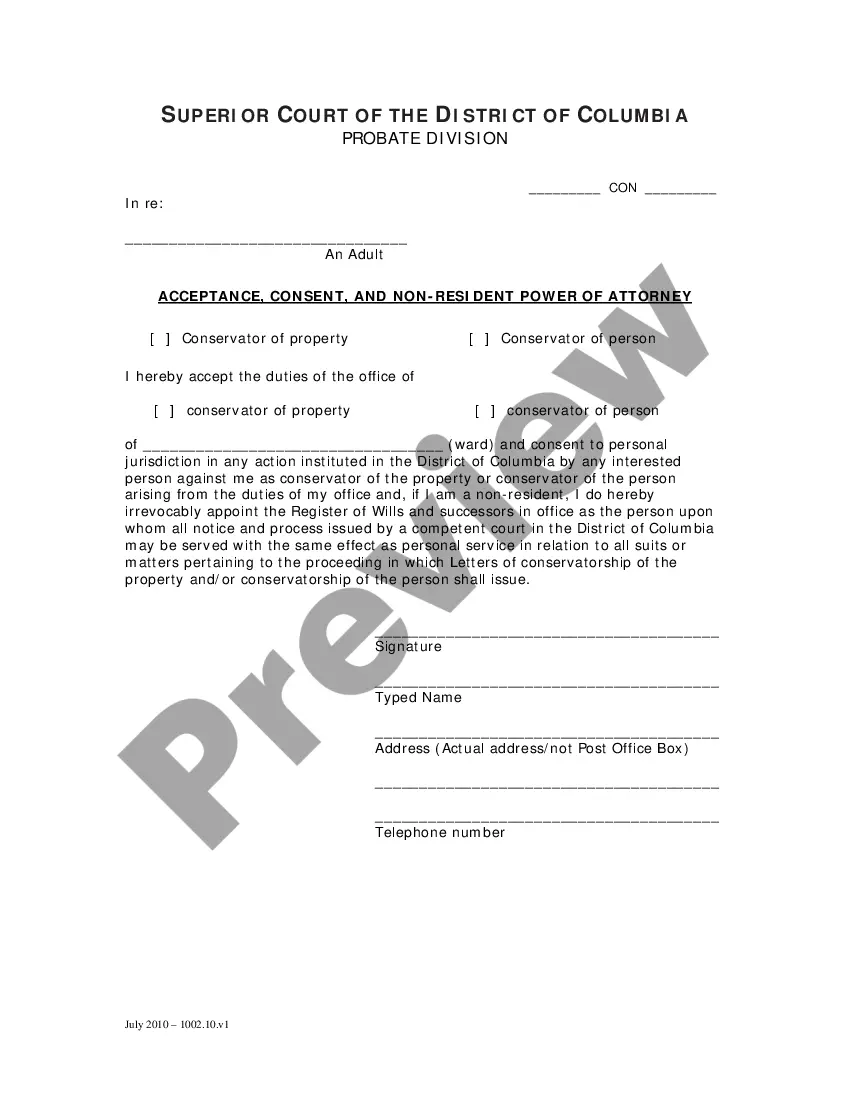

How to fill out Illinois Estate Claim?

US Legal Forms is the easiest and most economical method to find suitable official templates.

It is the largest online repository of business and personal legal documents created and verified by legal experts.

Here, you can access both printable and fillable templates that adhere to federal and local regulations - just like your Illinois Estate Claim.

Review the form description or view the document preview to confirm you’ve matched it to your requirements, or search for another one using the search tab above.

Click Buy now once you are confident of its suitability with all the criteria, and select the subscription plan that appeals to you the most.

- Acquiring your template involves just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the online service and download the form to their device.

- Later, they can find it in their profile under the My documents section.

- And here’s how to obtain a correctly crafted Illinois Estate Claim if you are using US Legal Forms for the first time.

Form popularity

FAQ

The minimum income required to file an estate tax return in Illinois does not have a strict income threshold but is influenced by the estate's total value and structure. Generally, if the estate exceeds the estate tax exemption limits, a return must be filed, regardless of income. This requirement ensures proper tax calculation and compliance. For more clarity and tools, US Legal Forms provides resources to assist in understanding these obligations.

Things that aren't part of the deceased person's estate don't have to be handled in settling their estate. Probate is just one way to settle an estate when someone dies. And it's not always required. Illinois law allows a different and simplified procedure for handling small estates.

Generally, the statute of limitations for probate claims in Illinois provides that a collector has up to two years following the death of the person in question to file a claim against the estate.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

When is the Deadline to File a Probate Claim in Illinois? The statute of limitations for probate claims in Illinois provides that creditors have two years from the decedent's death to file a claim against the estate.

A claim against the probate estate can either be filed with the court or mailed to the representative of the estate. Once the representative receives notice of the claim, he or she can either allow the claim or send a notice to the claimant informing them that they are ?disallowing? the claim.

California law does allow creditors to pursue a decedent's potentially inheritable assets. In the event an estate does not possess or contain adequate assets to fulfill a valid creditor claim, creditors can look to assets in which heirs might possess interest, if: The assets are joint accounts.

The executor immediately must publish a written notice in a newspaper within the county of the Probate Court to notify potential creditors of the existence of the estate and the necessity for their filing of written claims against the estate. The law in Illinois provides such creditors six months to file those claims.

The statute of limitations for probate claims in Illinois provides that creditors have two years from the decedent's death to file a claim against the estate. However, the representative can shorten this period by providing notice to known and unknown creditors.