Illinois Estate Claim is a legal process used to reclaim assets and possessions of a deceased person or estate from an executor or other party. It is often used to reclaim property that an owner had a legal interest in, but the executor or other party failed to properly distribute. There are two types of Illinois Estate Claim: Small Estate Claim and Formal Estate Claim. Small Estate Claim is used for estates that are worth less than $100,000 and do not involve probate proceedings. Formal Estate Claim is used when the estate is worth more than $100,000 or when the deceased had assets in more than one state. In both cases, the claimant must provide evidence of their legal interest in the estate, such as a will, trust document, or beneficiary designation form. The claimant must also provide proof of the executor or other party’s failure to properly distribute the assets or possessions.

Illinois Estate Claim

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Estate Claim?

If you’re seeking a method to properly finalize the Illinois Estate Claim without employing a legal advisor, then you’re precisely in the correct spot.

US Legal Forms has established itself as the most comprehensive and dependable collection of official templates for every personal and business situation. Every document you discover on our online platform is formulated in compliance with federal and state laws, so you can be assured that your paperwork is in order.

Another fantastic aspect of US Legal Forms is that you never misplace the paperwork you obtained - you can access any of your downloaded forms in the My documents tab of your profile whenever you require it.

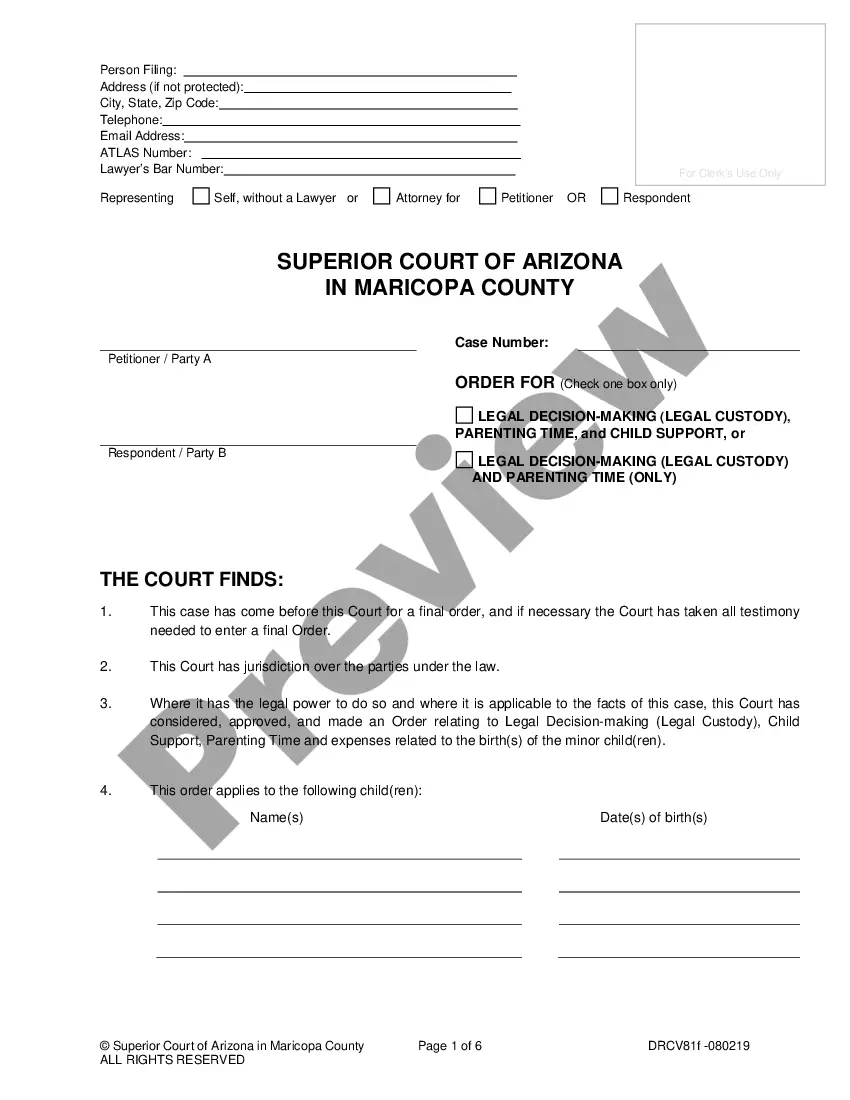

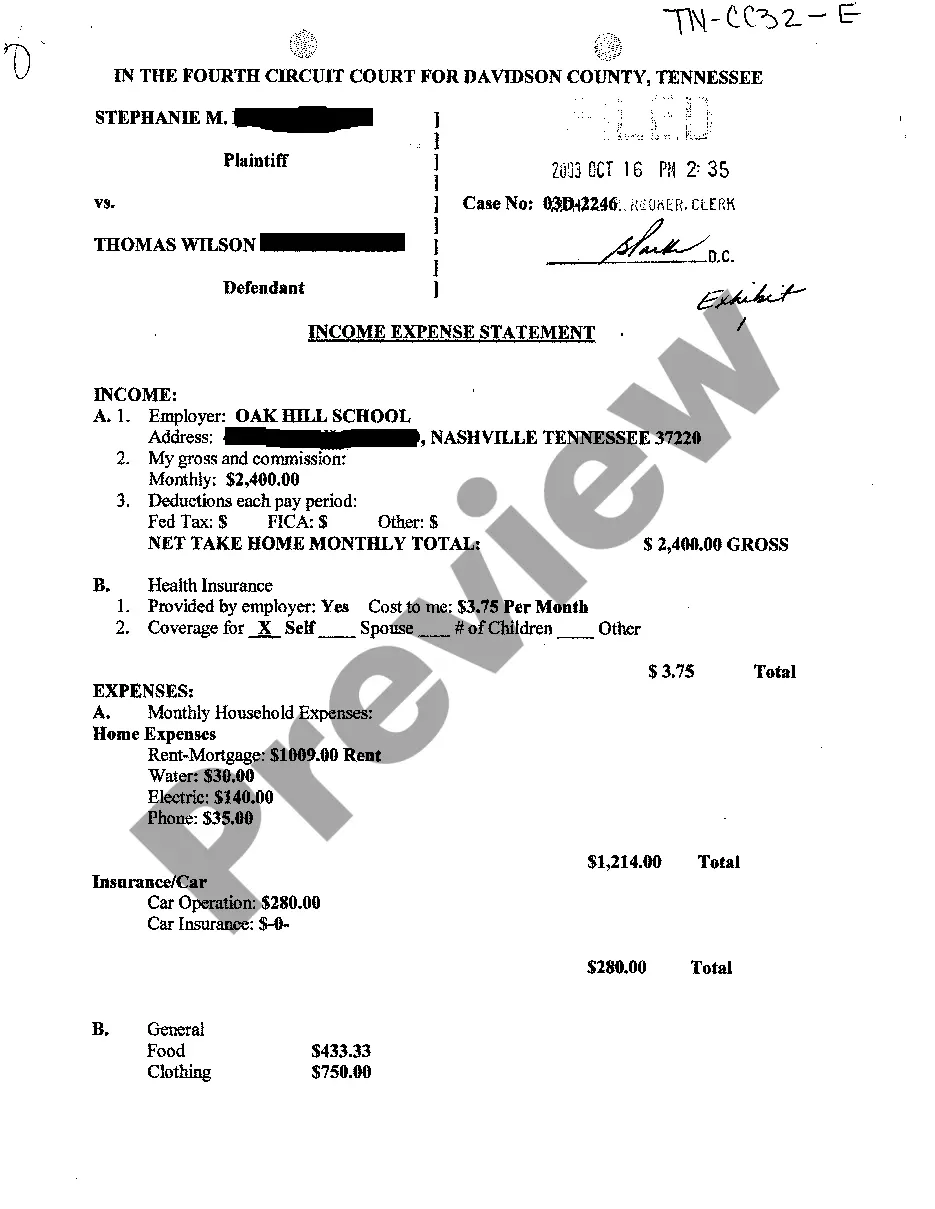

- Ensure the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its textual description or checking the Preview mode.

- Input the document title in the Search tab at the top of the page and choose your state from the dropdown to locate an alternative template if there are any discrepancies.

- Repeat the content verification process and click Buy now when you are certain about the paperwork's adherence to all the requirements.

- Log in to your account and click Download. Register for the service and pick a subscription plan if you haven’t done so already.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The blank will be ready for download immediately after.

- Select the format in which you wish to save your Illinois Estate Claim and download it by pressing the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your physical copy manually.

Form popularity

FAQ

The executor immediately must publish a written notice in a newspaper within the county of the Probate Court to notify potential creditors of the existence of the estate and the necessity for their filing of written claims against the estate. The law in Illinois provides such creditors six months to file those claims.

California law does allow creditors to pursue a decedent's potentially inheritable assets. In the event an estate does not possess or contain adequate assets to fulfill a valid creditor claim, creditors can look to assets in which heirs might possess interest, if: The assets are joint accounts.

The statute of limitations for probate claims in Illinois provides that creditors have two years from the decedent's death to file a claim against the estate. However, the representative can shorten this period by providing notice to known and unknown creditors.

When is the Deadline to File a Probate Claim in Illinois? The statute of limitations for probate claims in Illinois provides that creditors have two years from the decedent's death to file a claim against the estate.

Things that aren't part of the deceased person's estate don't have to be handled in settling their estate. Probate is just one way to settle an estate when someone dies. And it's not always required. Illinois law allows a different and simplified procedure for handling small estates.

Generally, the statute of limitations for probate claims in Illinois provides that a collector has up to two years following the death of the person in question to file a claim against the estate.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

A claim against the probate estate can either be filed with the court or mailed to the representative of the estate. Once the representative receives notice of the claim, he or she can either allow the claim or send a notice to the claimant informing them that they are ?disallowing? the claim.