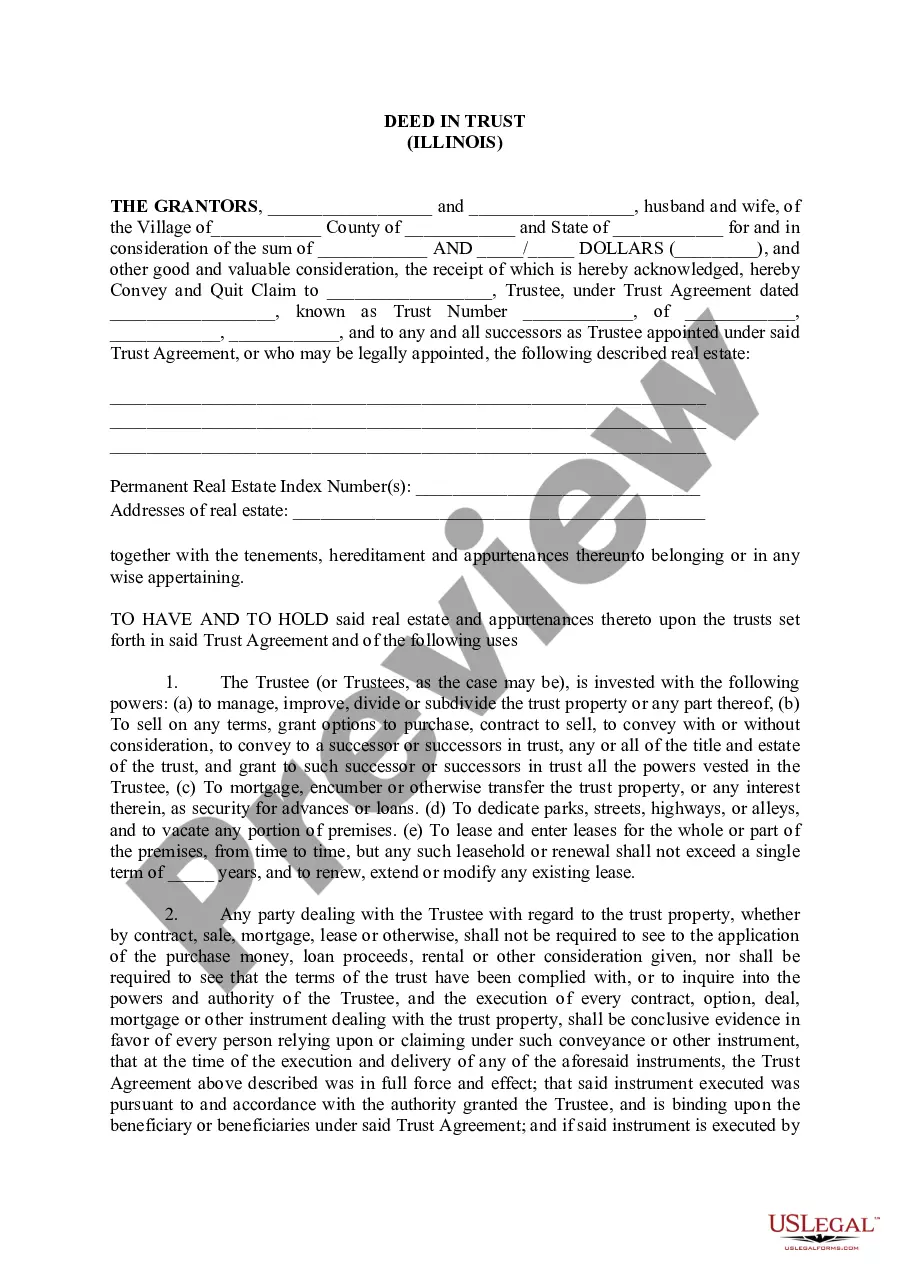

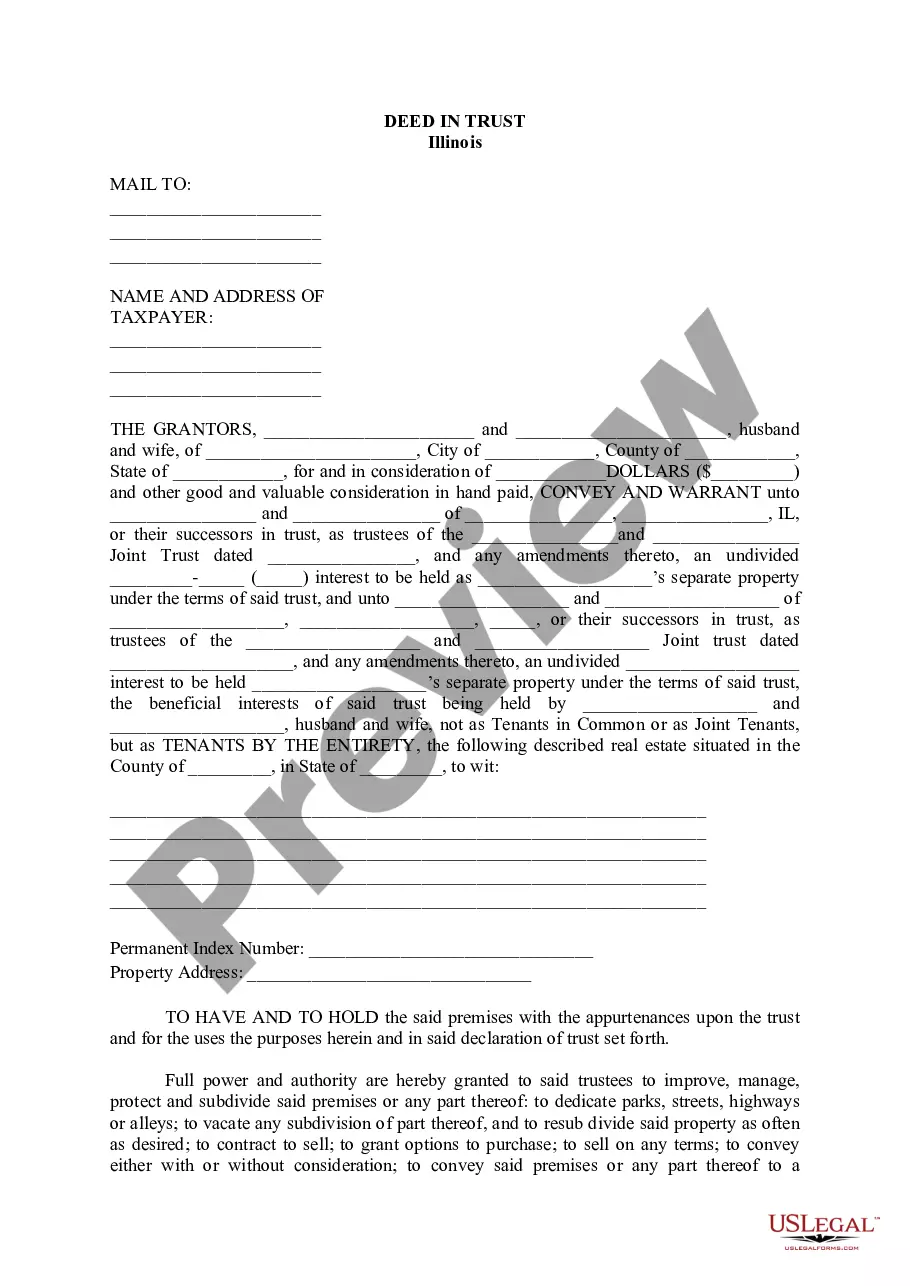

Illinois Deed In Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Deed In Trust?

Utilize US Legal Forms to secure a printable Illinois Deed In Trust.

Our court-acceptable documents are crafted and frequently revised by experienced attorneys.

Ours is the most comprehensive Forms collection available online and provides cost-effective and precise samples for individuals, legal professionals, and small to medium-sized businesses.

Press Buy Now if it is the document you want. Set up your account and pay through PayPal or with a credit card. Download the form to your device and feel free to use it repeatedly. Utilize the Search feature if you need to find another document template. US Legal Forms provides a vast array of legal and tax templates and bundles for both business and personal requirements, including the Illinois Deed In Trust. Over three million users have utilized our service with success. Select your subscription plan and access high-quality forms in just a few clicks.

- The templates are categorized based on state requirements, and some may be viewed prior to downloading.

- To access samples, users need a subscription and must Log In to their account.

- Click Download next to the desired form and locate it in My documents.

- For those without a subscription, follow the suggestions below to swiftly locate and download the Illinois Deed In Trust.

- Ensure you have the correct template corresponding to the necessary state.

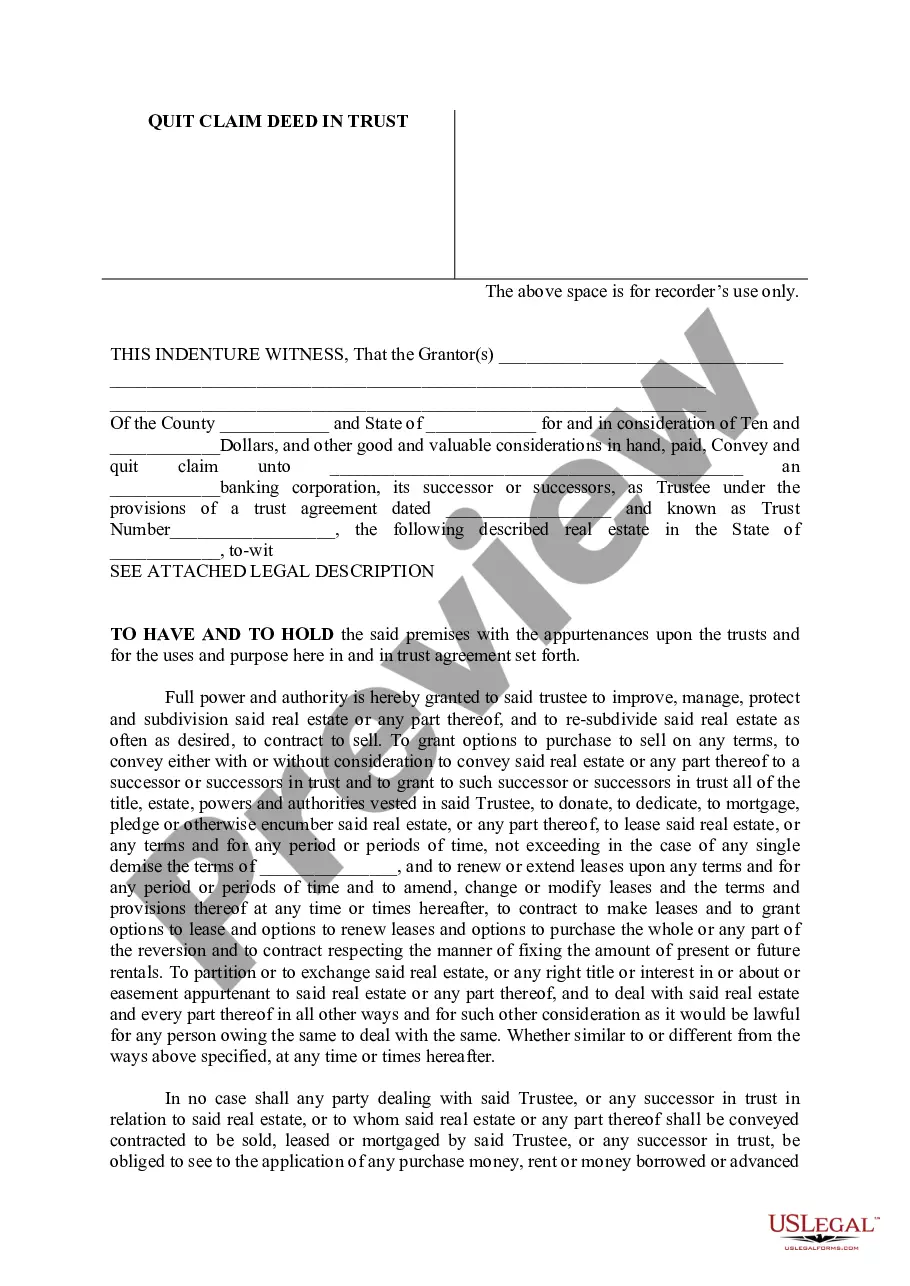

- Examine the document by reviewing the description and utilizing the Preview function.

Form popularity

FAQ

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.

Most states that use deeds of trust to secure home loans are title theory states.A few deed of trust states include West Virginia, Alaska, Virginia, Arizona, Texas, California, North Carolina, Colorado, New Mexico, Idaho, Montana, Illinois, Missouri and Mississippi.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

Unlike a will, the contents of a living trust are not a matter of public record. Like most court records, probate files are open to the public.