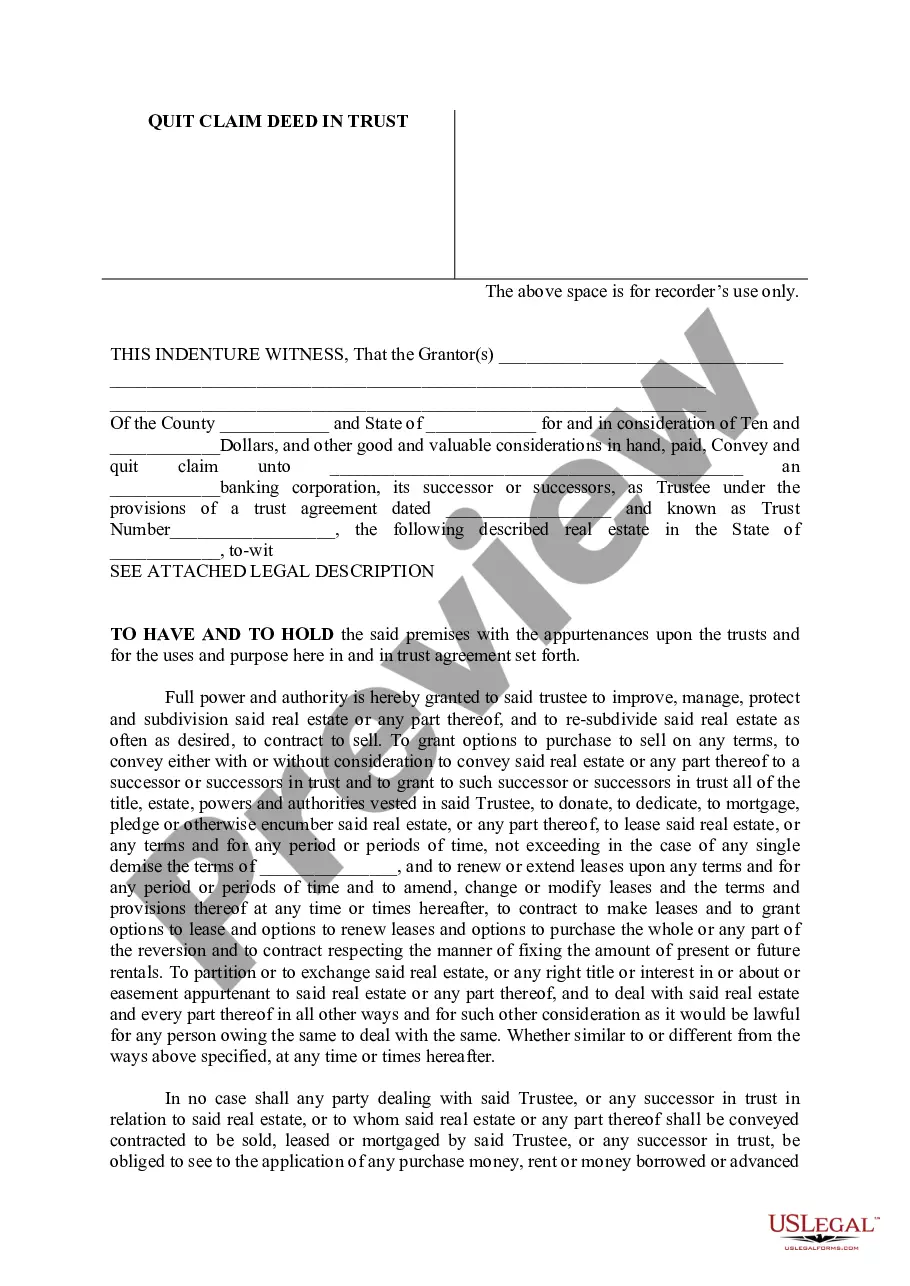

Illinois Quit Claim Deed in Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

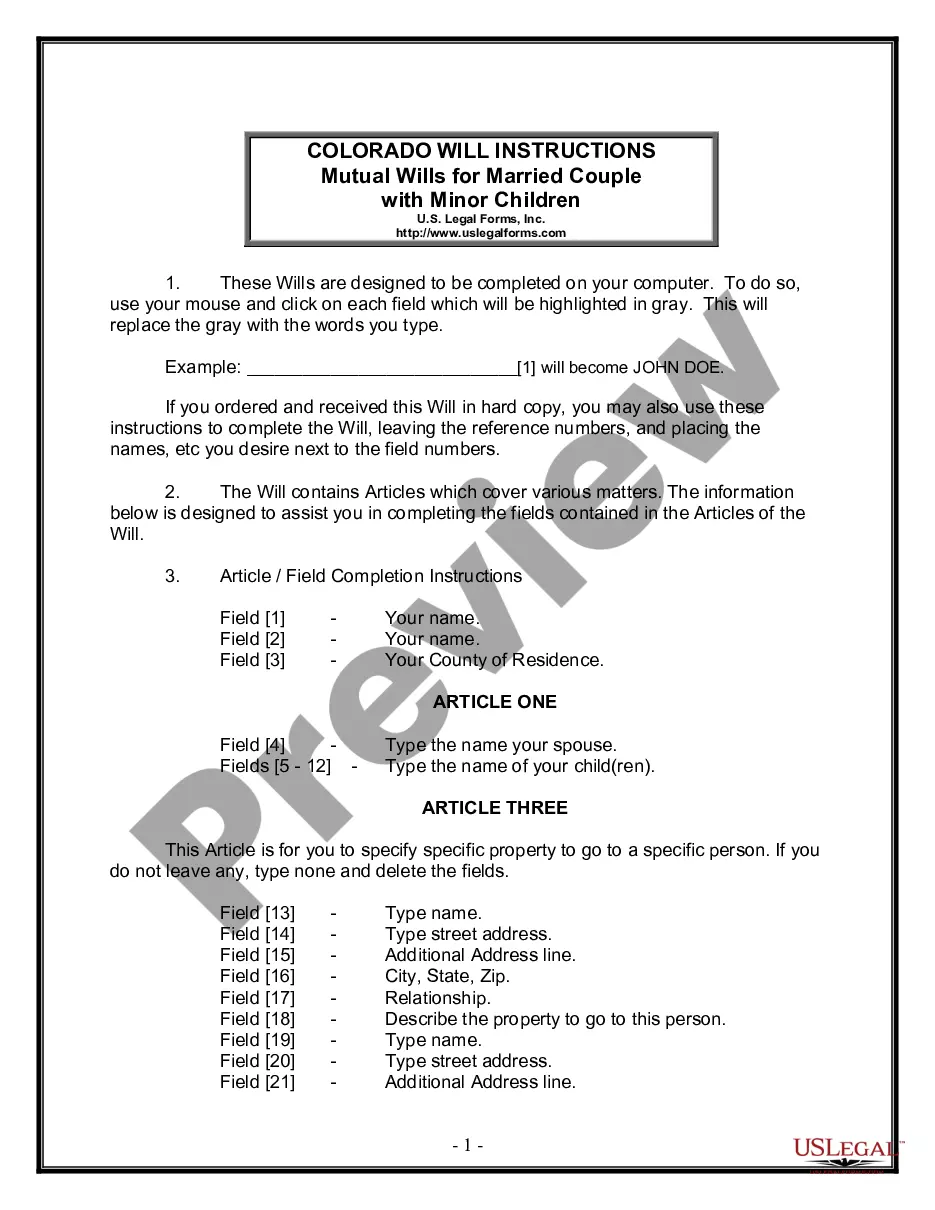

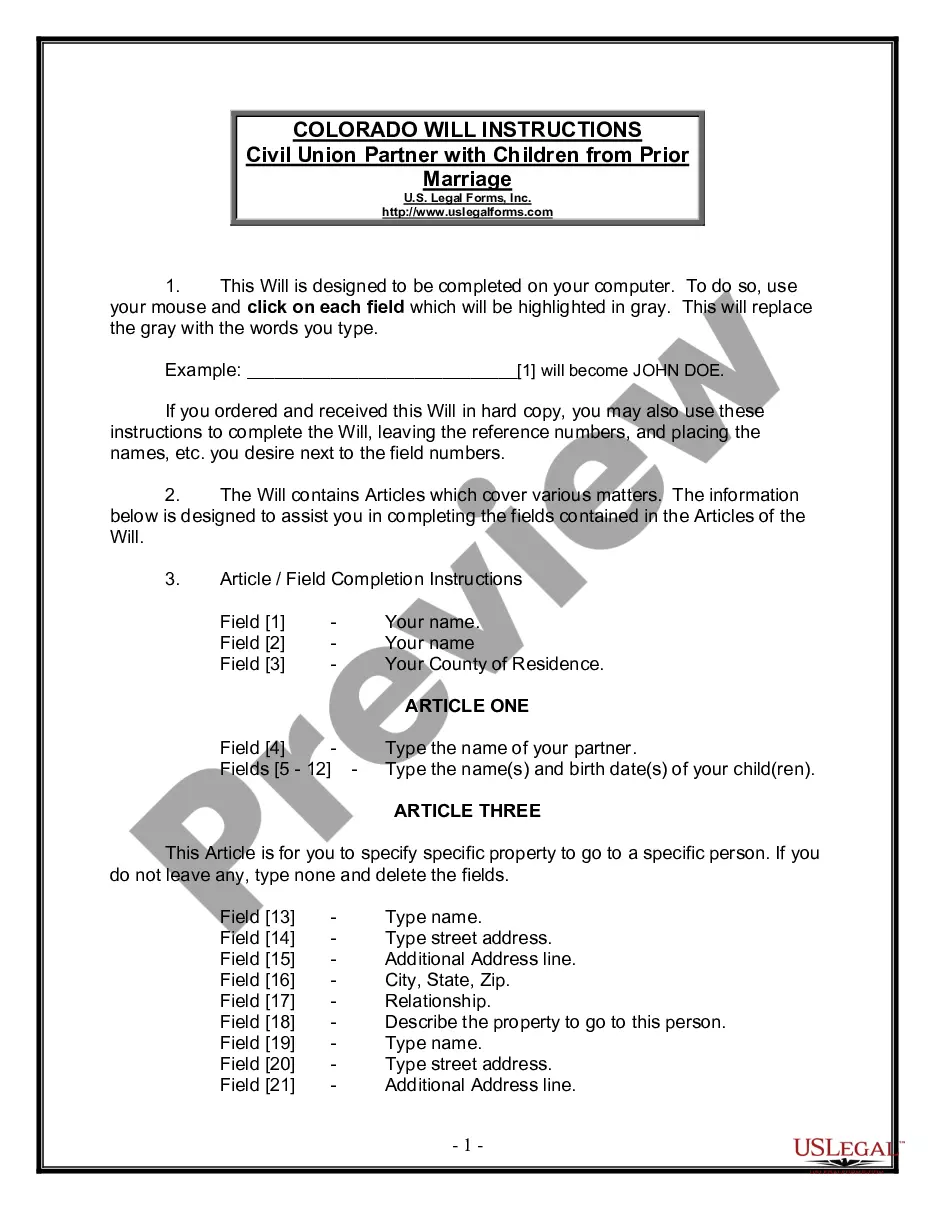

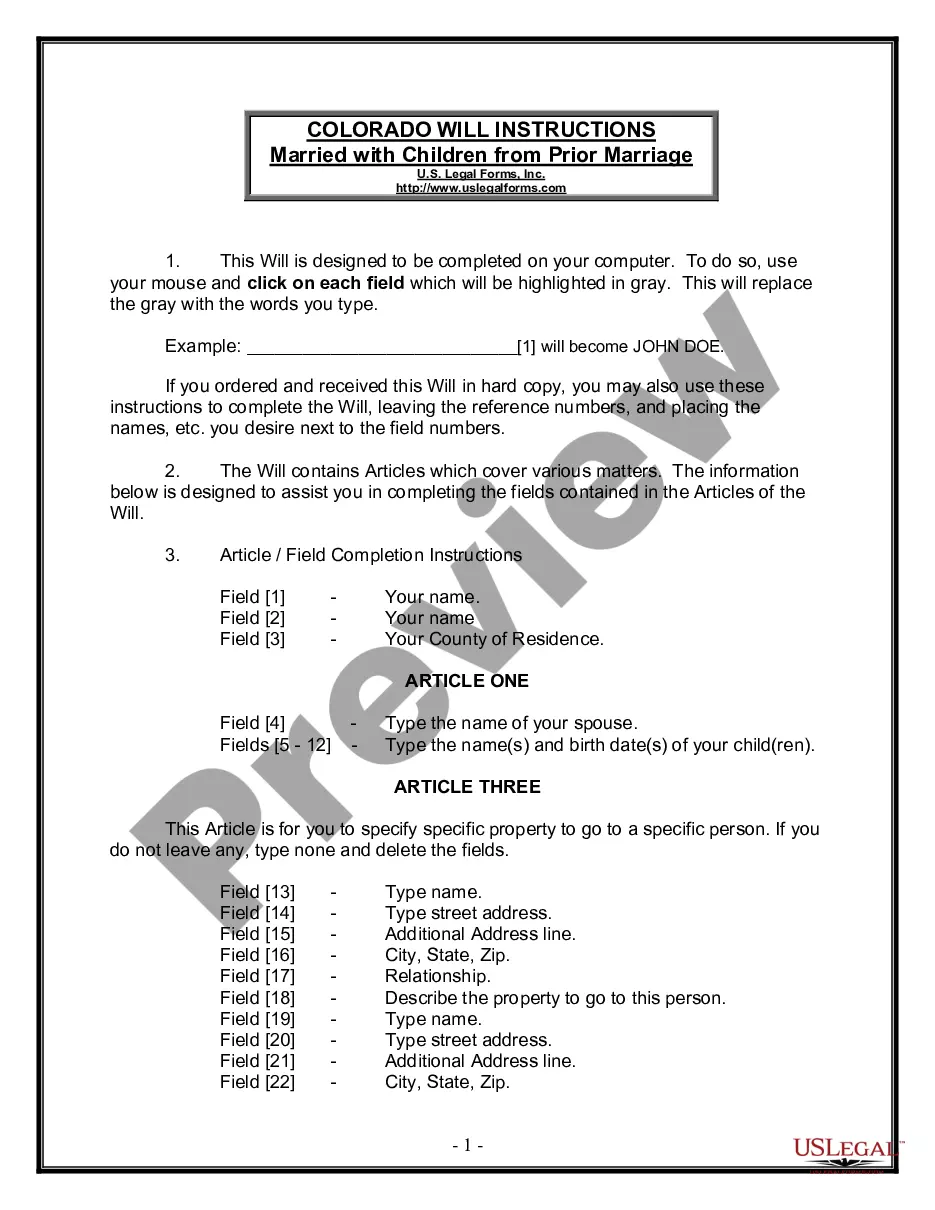

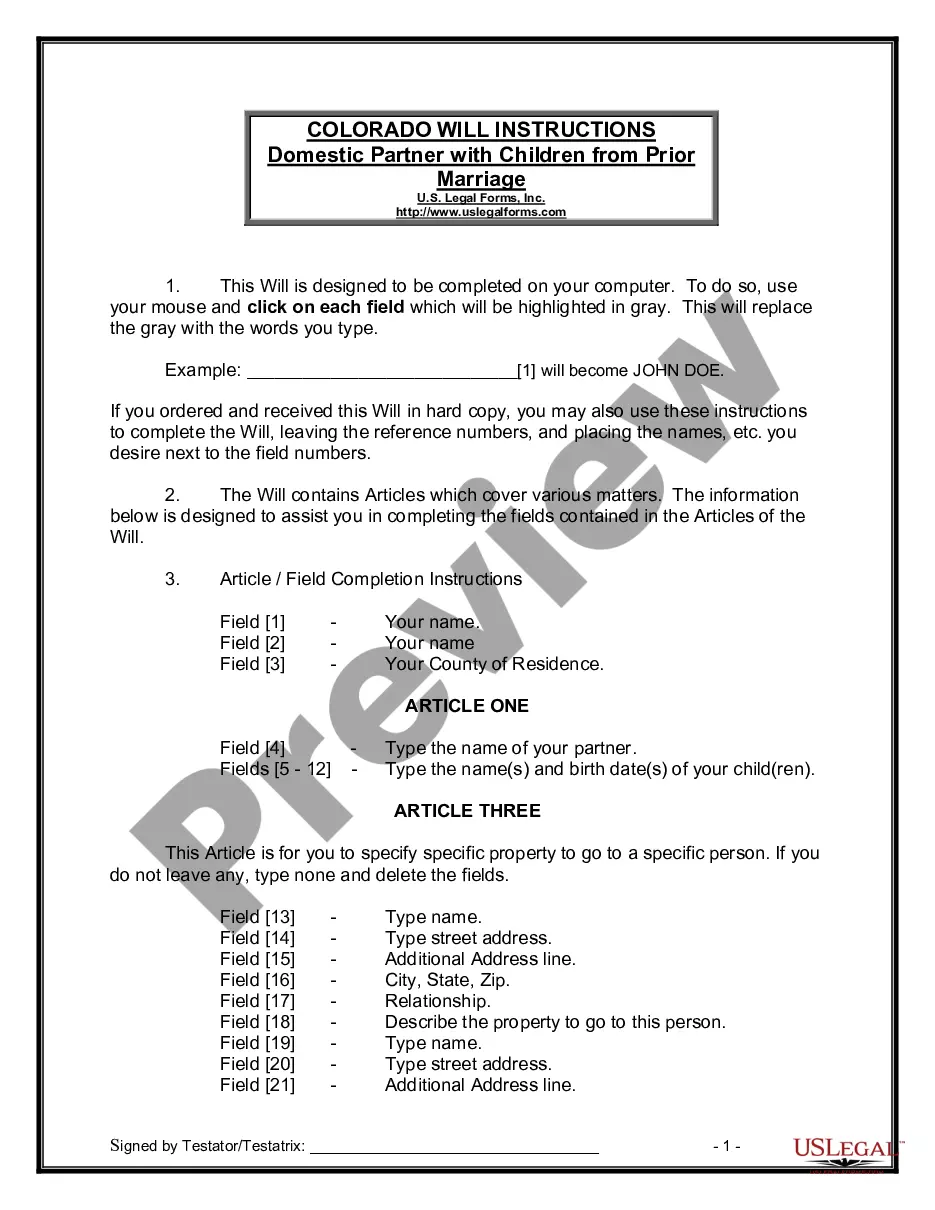

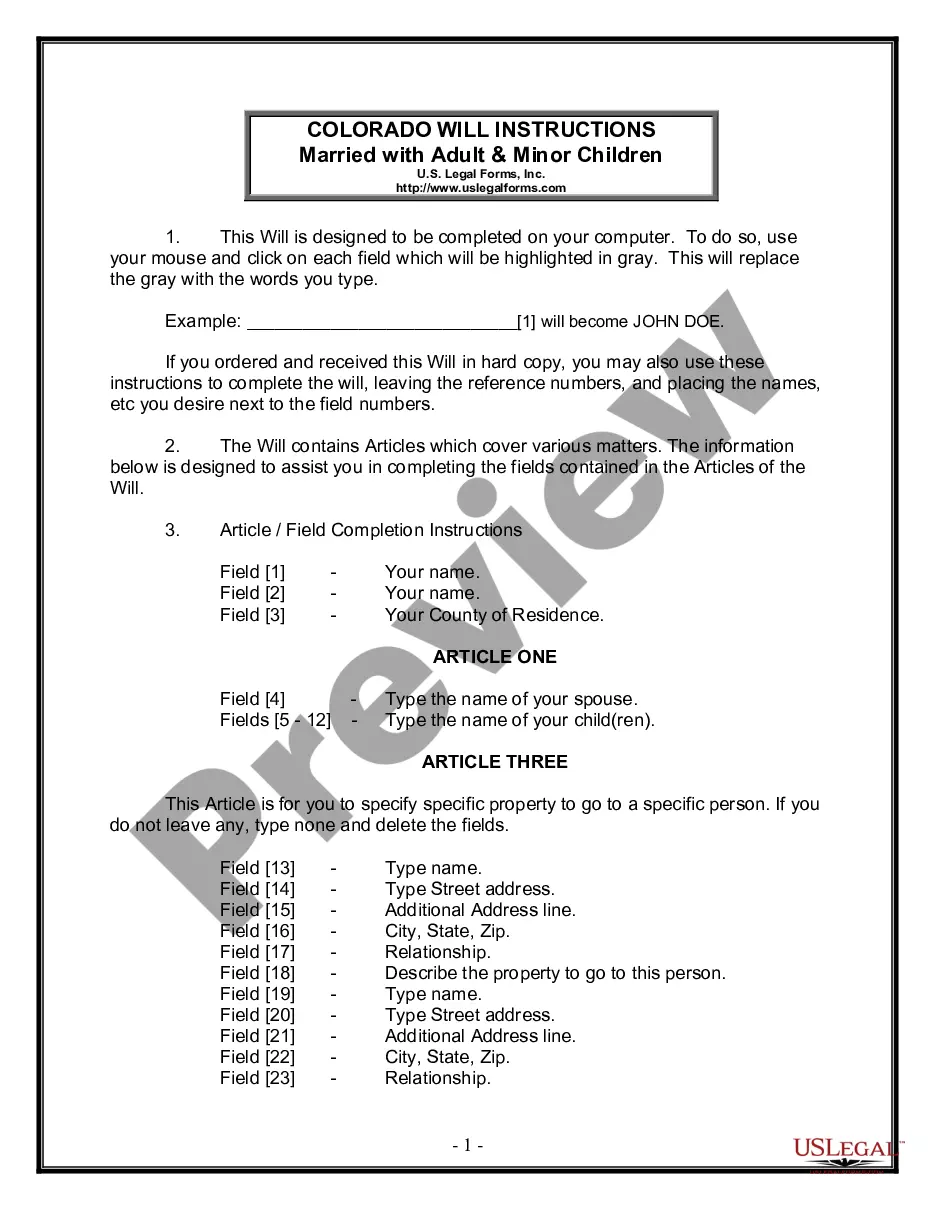

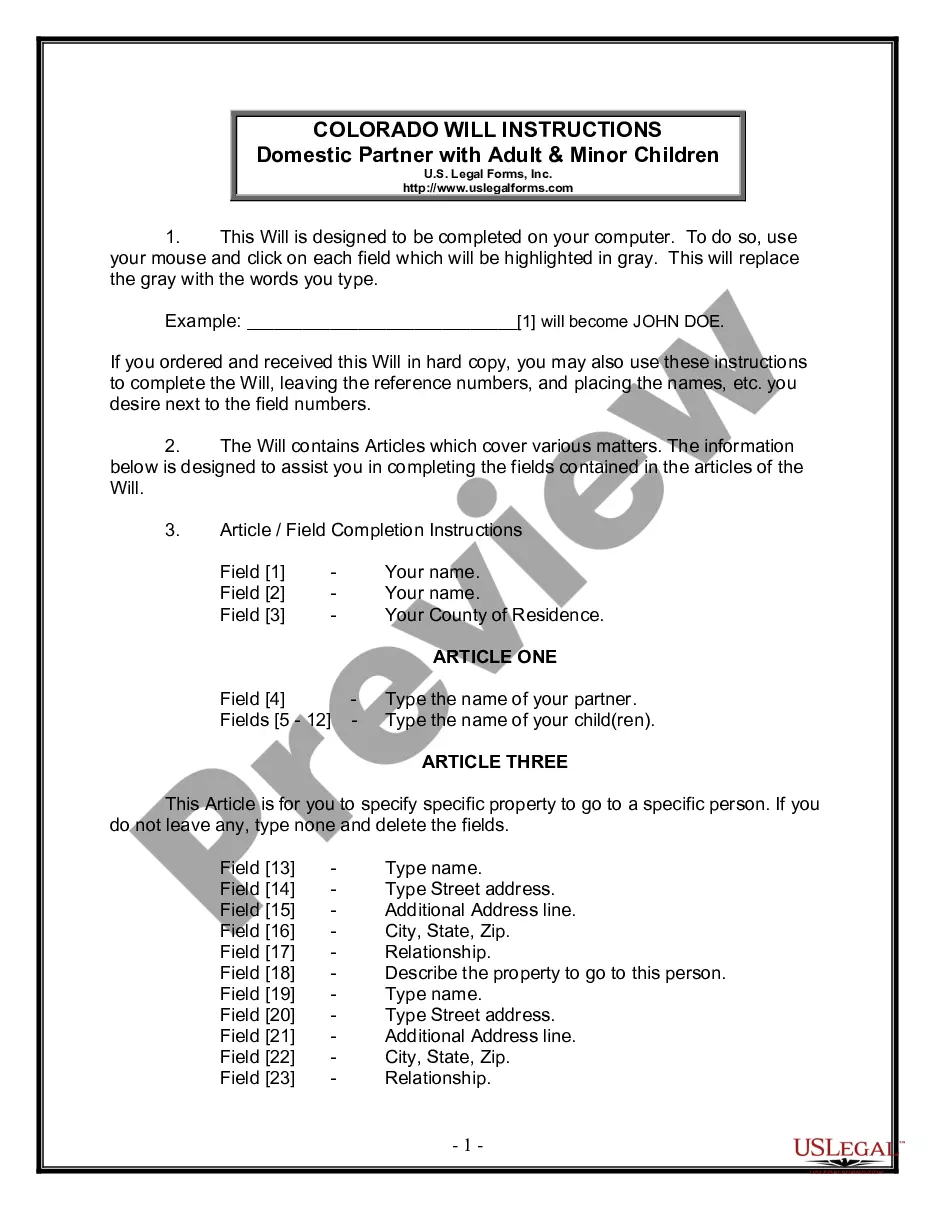

How to fill out Illinois Quit Claim Deed In Trust?

Utilize US Legal Forms to obtain a printable Illinois Quit Claim Deed in Trust.

Our court-acceptable forms are created and frequently revised by skilled attorneys.

We boast the most extensive collection of forms available online, providing economical and precise templates for individuals, legal professionals, and small to medium-sized businesses.

Click Buy Now if it's the template you seek. Establish your account and pay through PayPal or your credit card. Download the template to your device and you can reuse it repeatedly. Use the Search engine to find additional document templates. US Legal Forms provides a vast selection of legal and tax samples and packages for both business and personal use, including the Illinois Quit Claim Deed in Trust. More than three million users have successfully leveraged our service. Select your subscription plan and receive high-quality documents in just a few clicks.

- The documents are categorized by state and many can be previewed before downloading.

- To access samples, users must have a subscription and Log In to their account.

- Select Download next to any template you desire and locate it in My documents.

- For those without a subscription, follow the instructions below to efficiently find and download the Illinois Quit Claim Deed in Trust.

- Ensure you choose the correct form based on the required state.

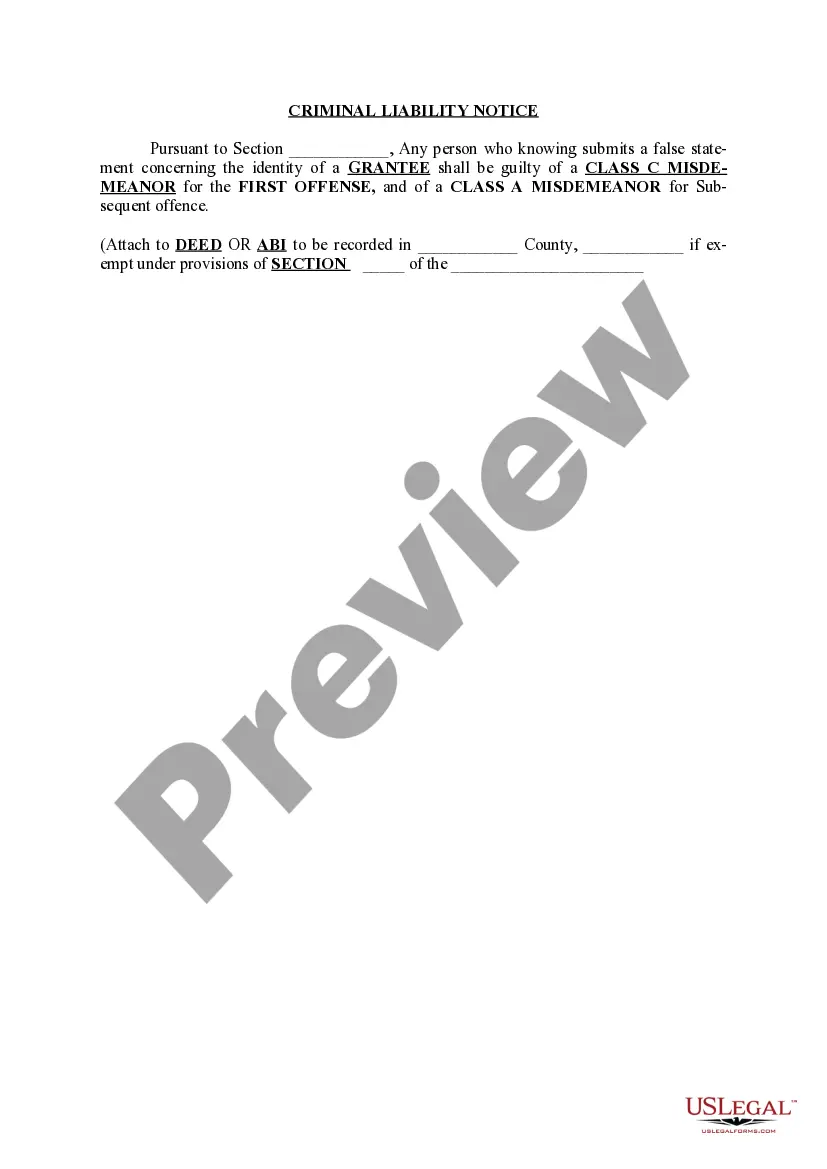

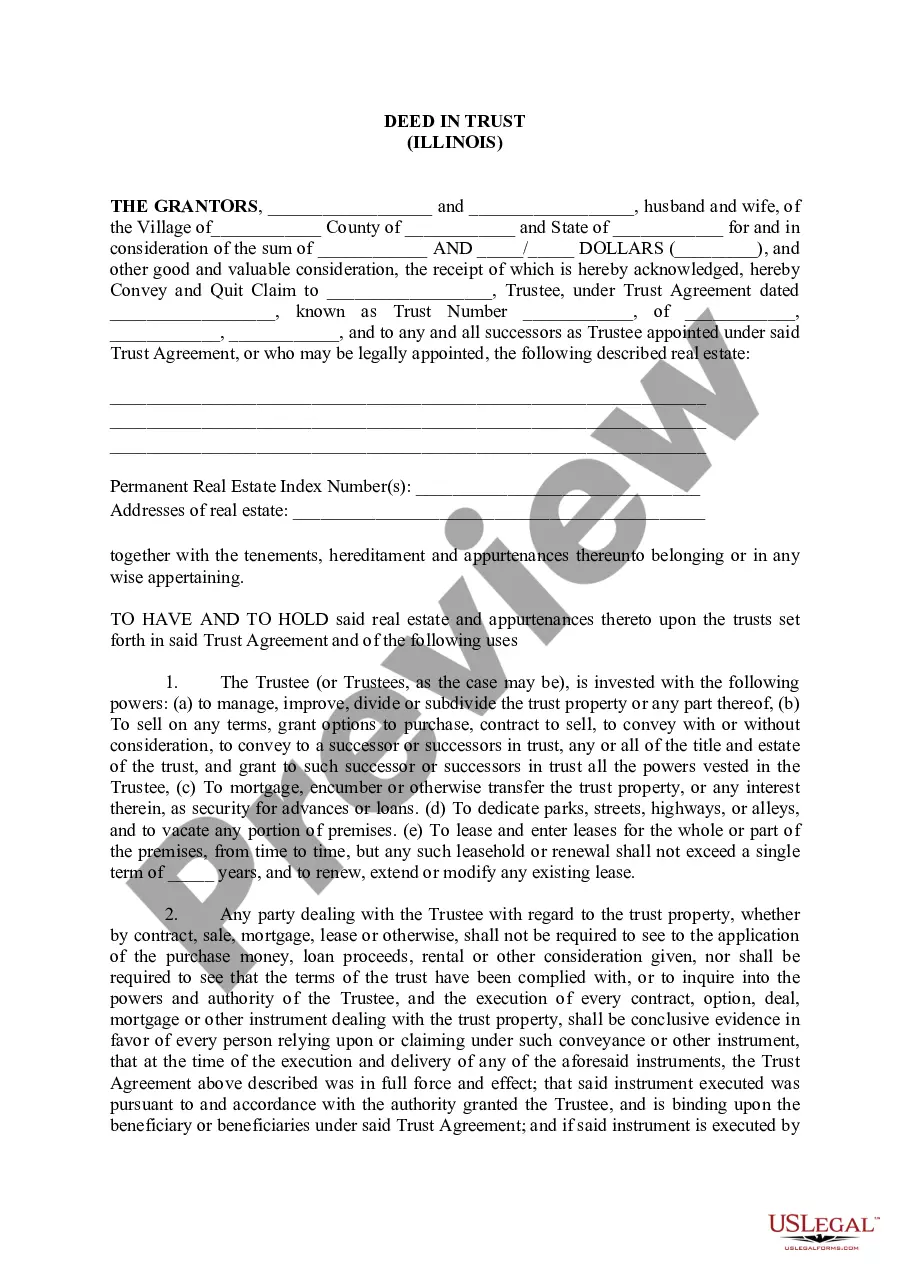

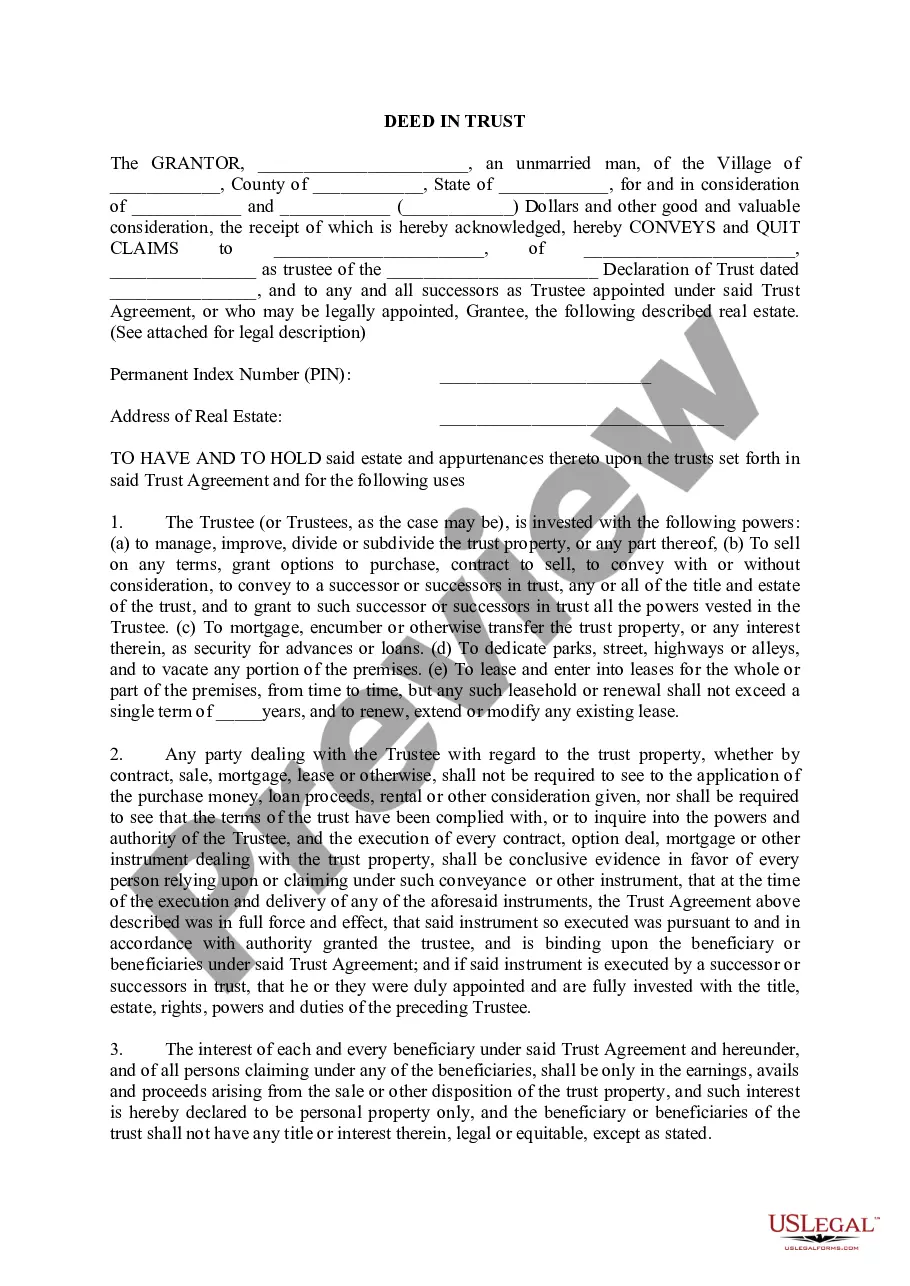

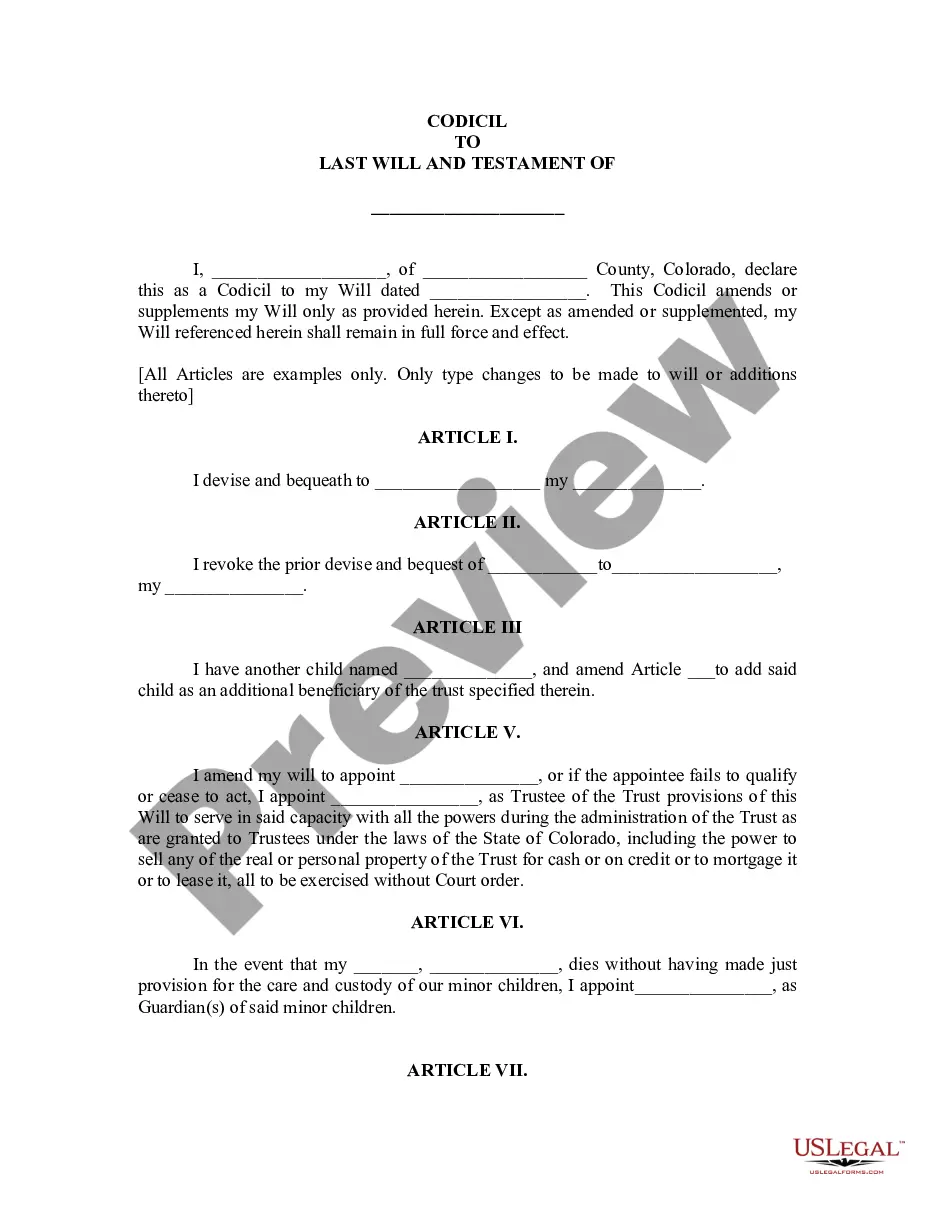

- Examine the form by reviewing the description and using the Preview feature.

Form popularity

FAQ

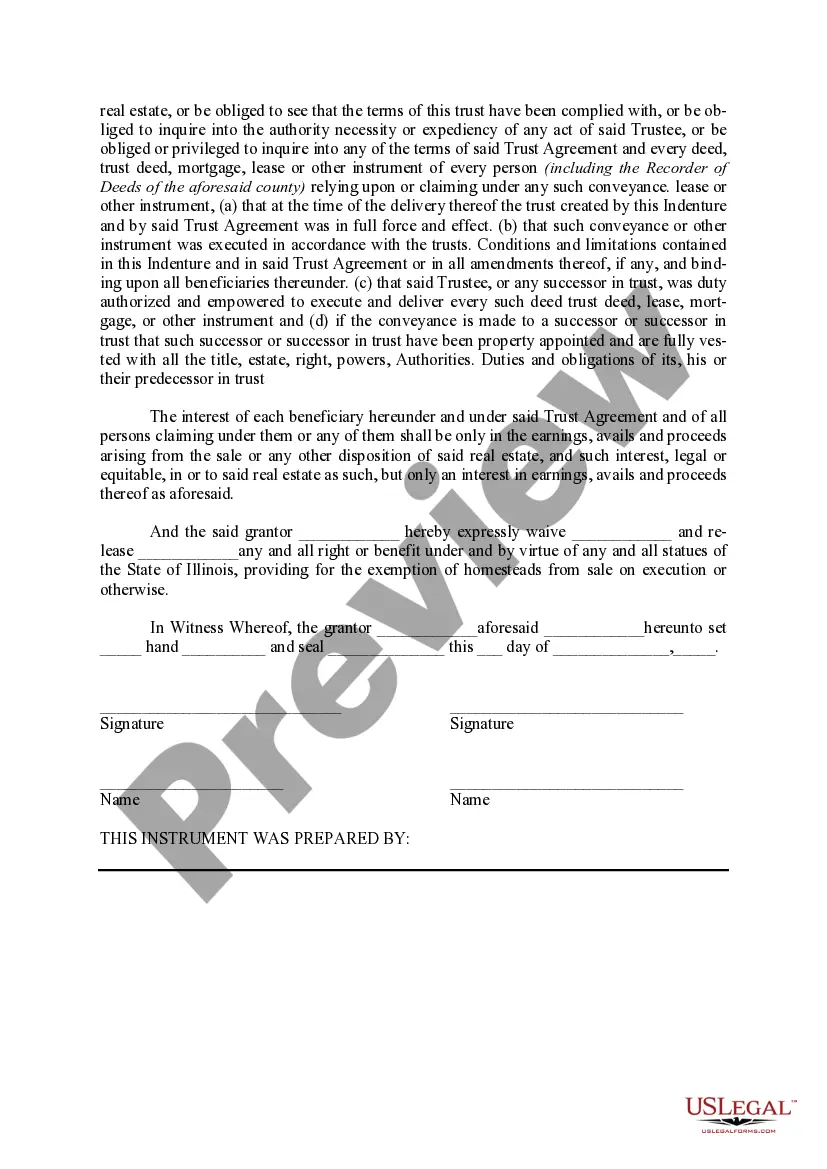

A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.A quitclaim deed requires trust on the part of the person receiving the deed, because the person transferring it, also known as the grantor, isn't guaranteeing they actually own the property.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

To preserve legal chain of title, real estate transfers in Illinois must be recorded with the appropriate county recorder of deeds office. Additionally, it is well-settled law that a transfer to a trust is valid without recording a deed if one later uses a pour-over will via probate.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.