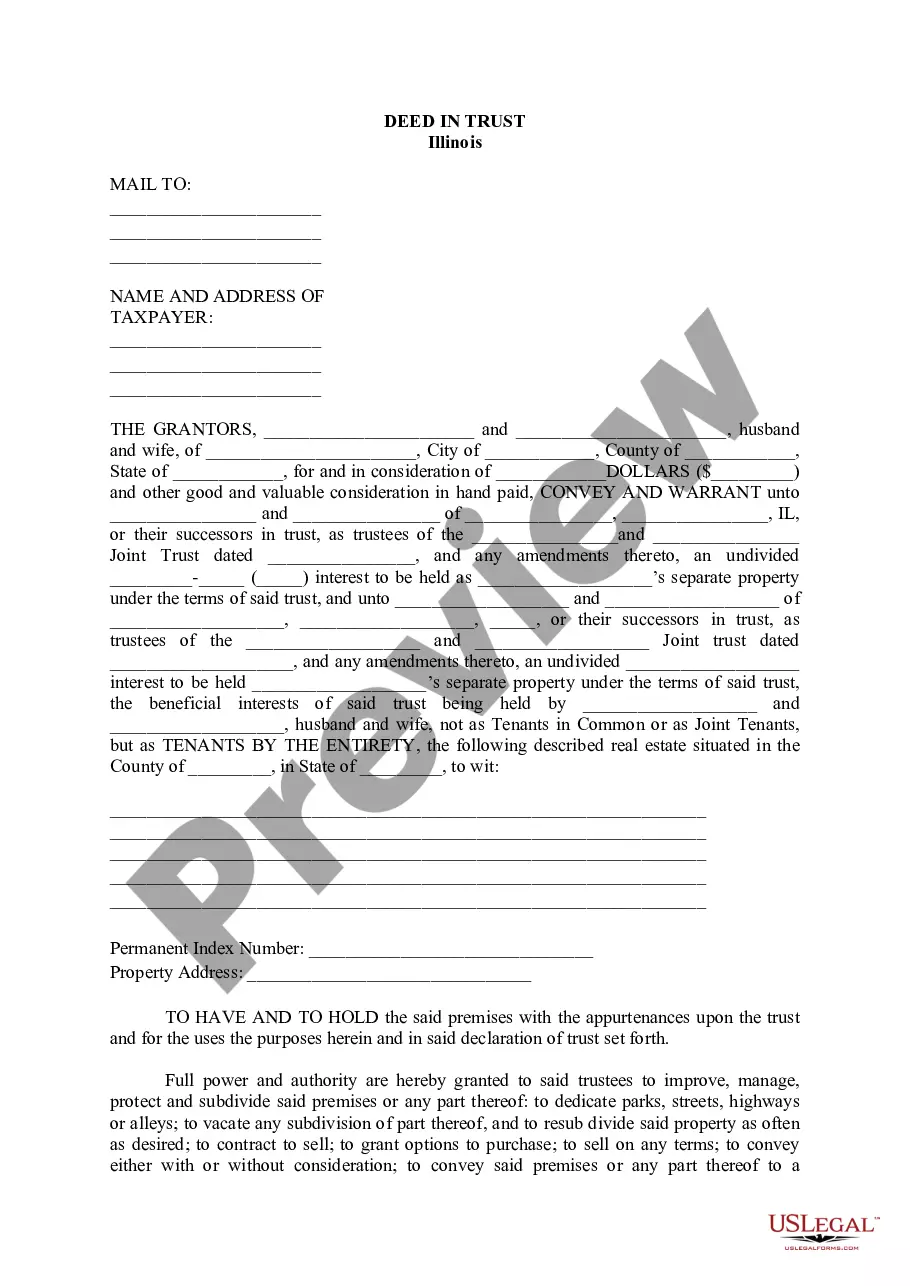

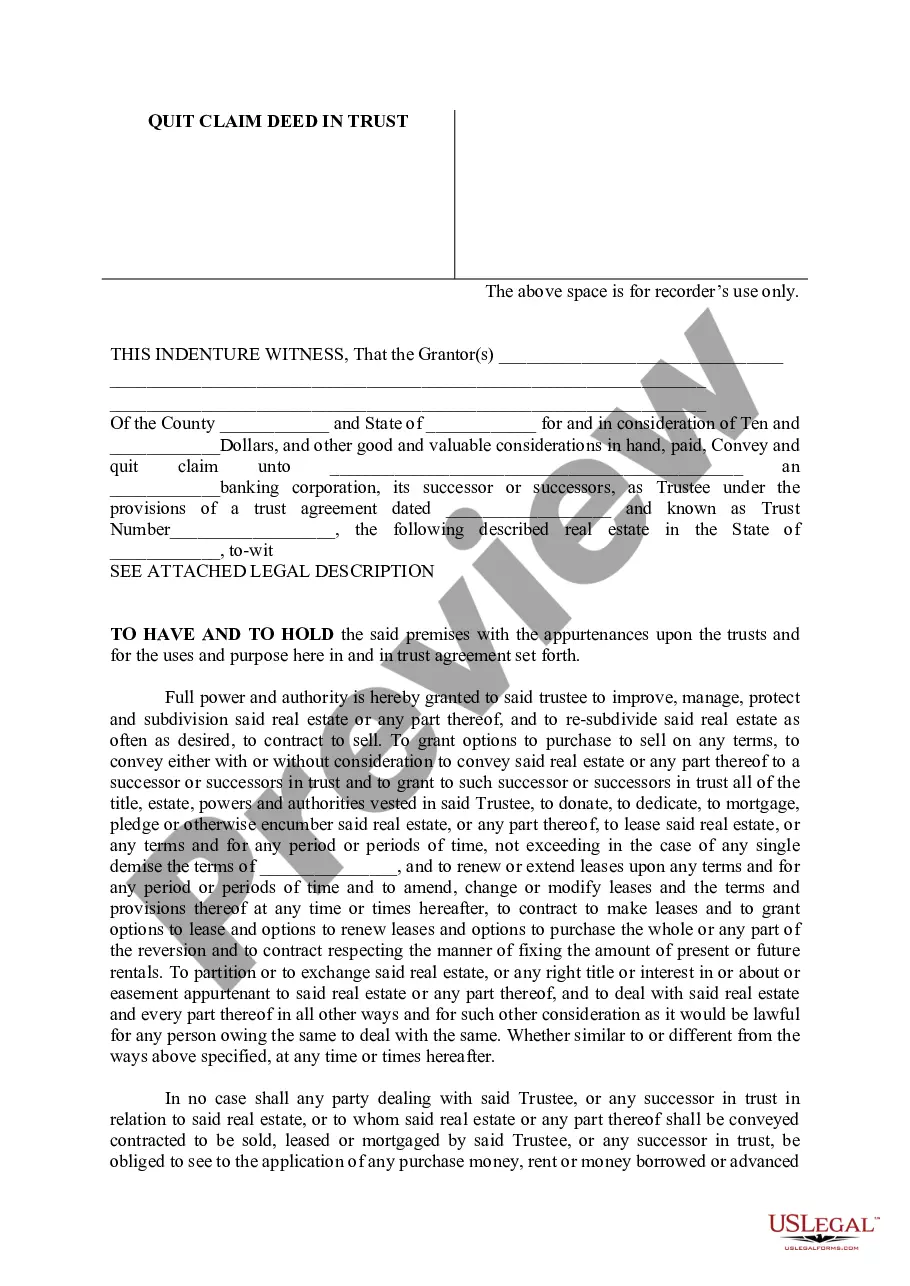

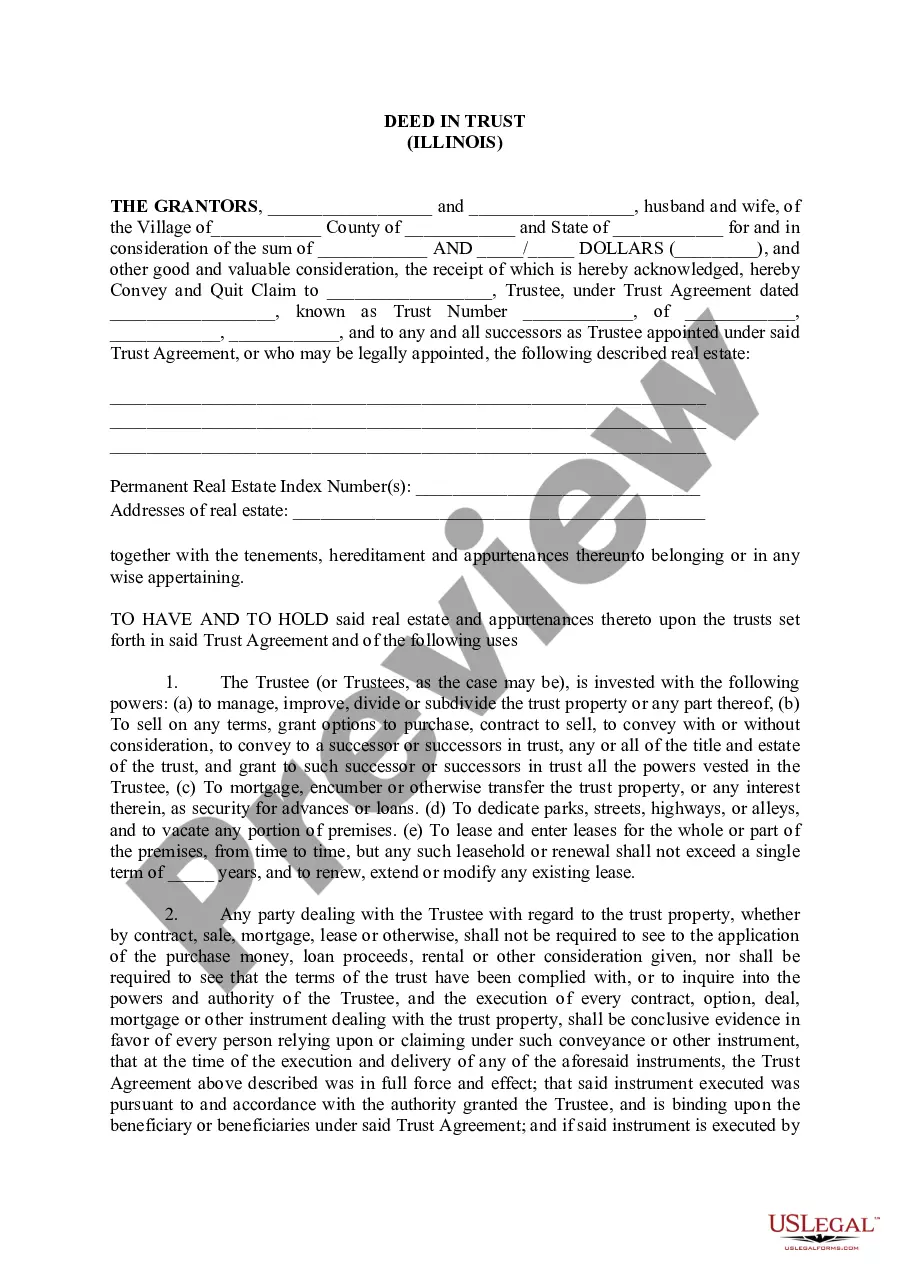

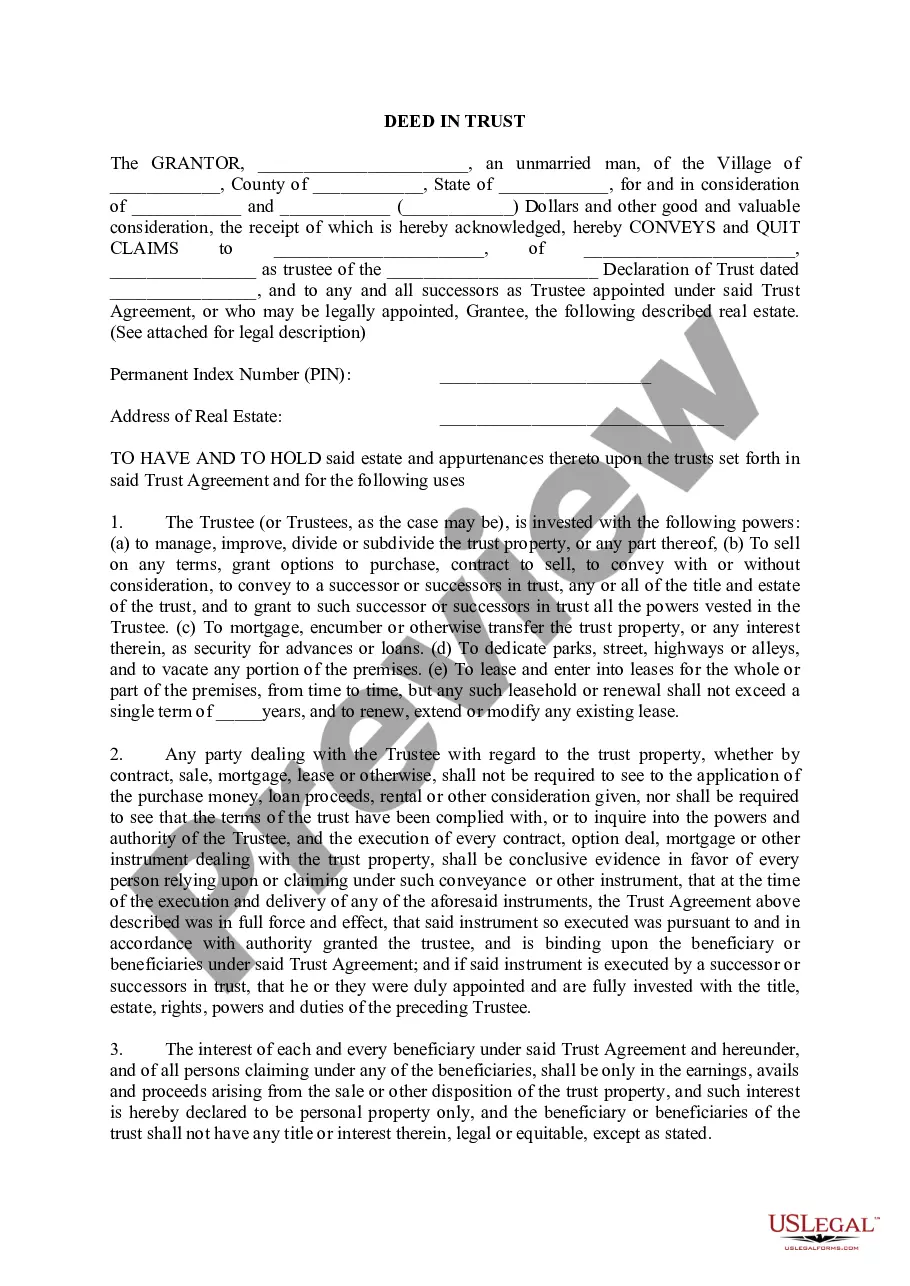

Illinois Deed In Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Deed In Trust?

Utilize US Legal Forms to obtain a printable Illinois Deed In Trust. Our court-recognized forms are crafted and frequently updated by qualified attorneys.

Ours is the most comprehensive collection of forms available online, providing economical and precise templates for consumers, legal professionals, and small to medium-sized businesses.

The templates are classified into state-specific categories, with a selection available for previewing before download.

Create your account and complete your payment via PayPal or credit card. Download the form to your device and feel free to reuse it multiple times. Use the Search bar if you require a different document template. US Legal Forms offers thousands of legal and tax templates and packages for both business and personal needs, including the Illinois Deed In Trust. More than three million users have successfully utilized our platform. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- To access samples, users must hold a subscription and Log In to their account.

- Click Download beside any form you wish to acquire and locate it in My documents.

- For users without a subscription, adhere to the following steps to efficiently find and download the Illinois Deed In Trust.

- Ensure that you select the correct template based on the state it is required for.

- Examine the document by reading the description and utilizing the Preview feature.

- Click Buy Now if it is the document you desire.

Form popularity

FAQ

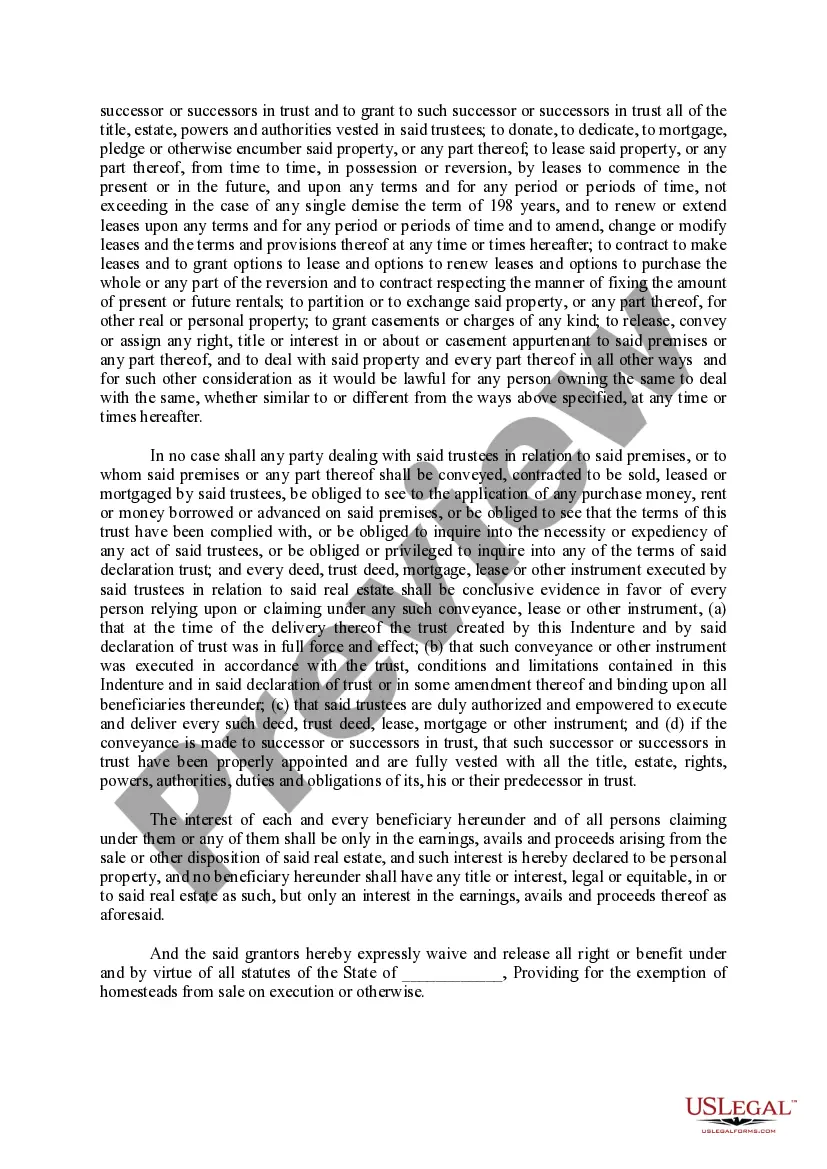

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.

Most states that use deeds of trust to secure home loans are title theory states.A few deed of trust states include West Virginia, Alaska, Virginia, Arizona, Texas, California, North Carolina, Colorado, New Mexico, Idaho, Montana, Illinois, Missouri and Mississippi.

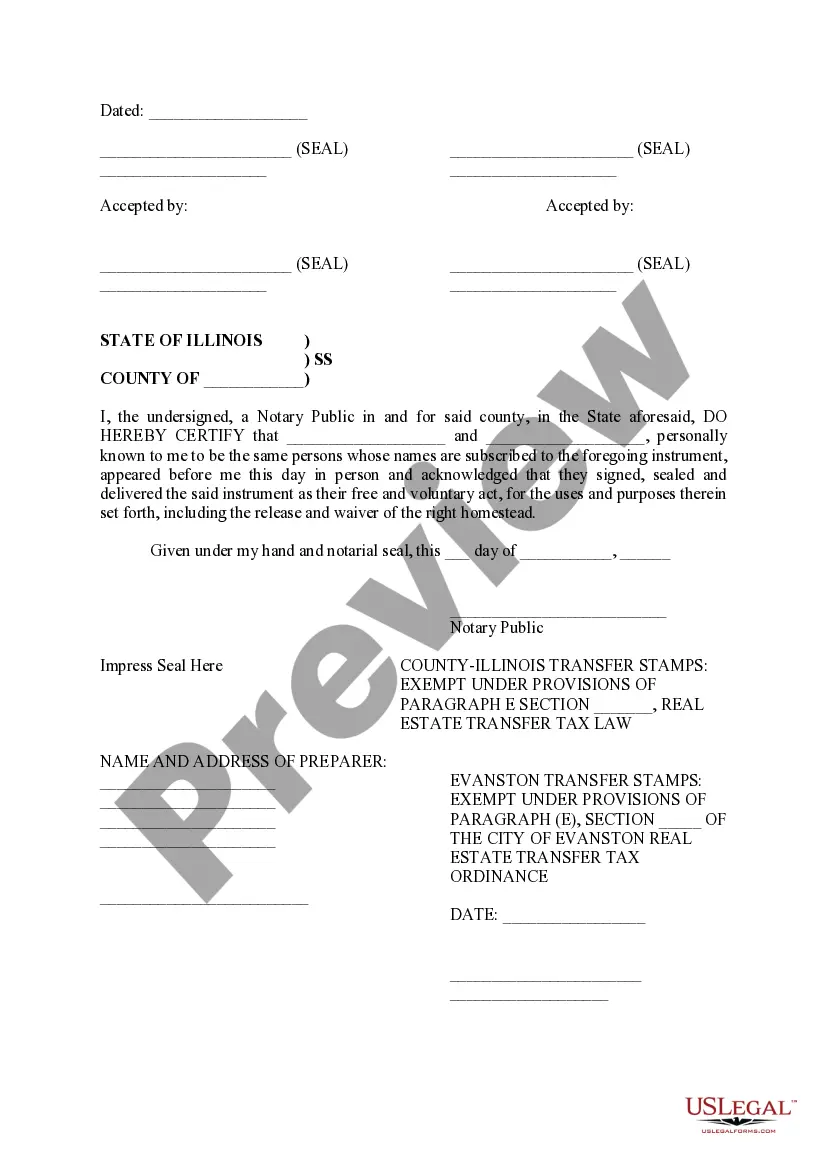

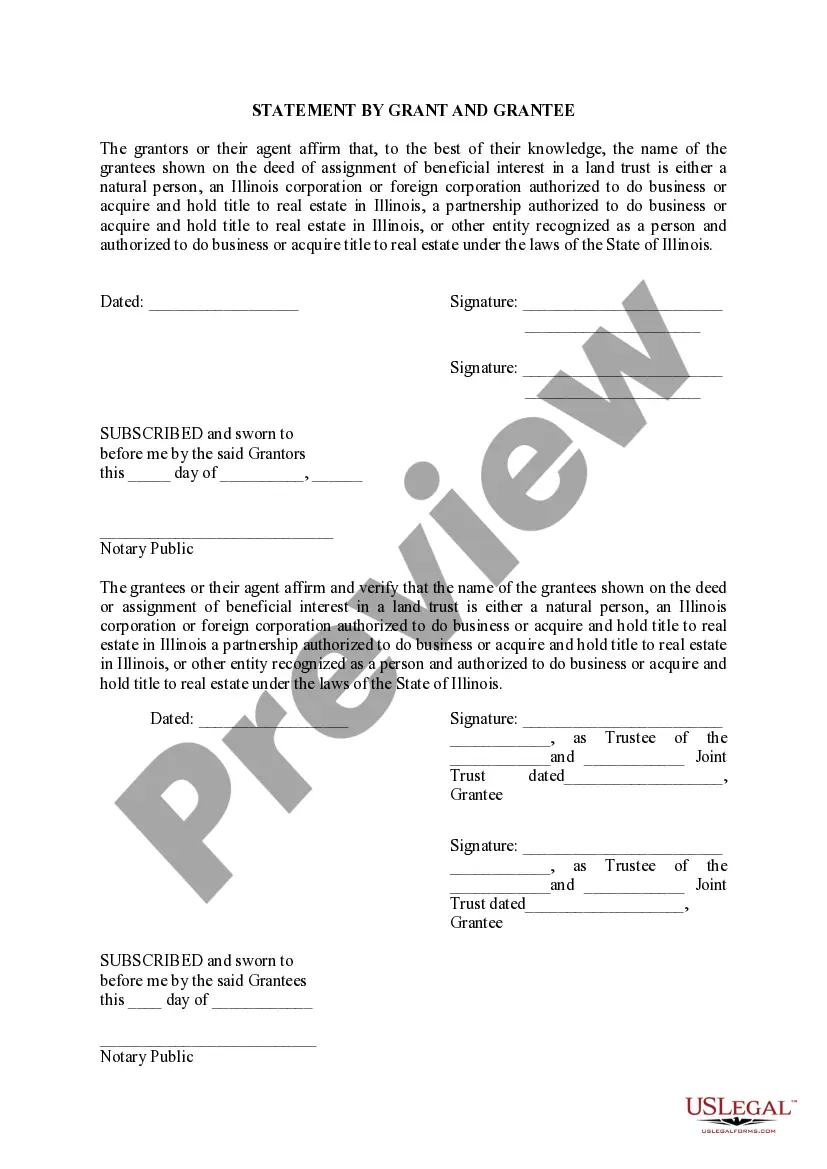

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

Unlike a will, the contents of a living trust are not a matter of public record. Like most court records, probate files are open to the public.