As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Report of Independent Accountants after Audit of Financial Statements

Description

How to fill out Report Of Independent Accountants After Audit Of Financial Statements?

Aren't you tired of choosing from hundreds of templates each time you require to create a Report of Independent Accountants after Audit of Financial Statements? US Legal Forms eliminates the wasted time numerous American people spend searching the internet for ideal tax and legal forms. Our skilled crew of lawyers is constantly changing the state-specific Samples catalogue, so it always offers the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

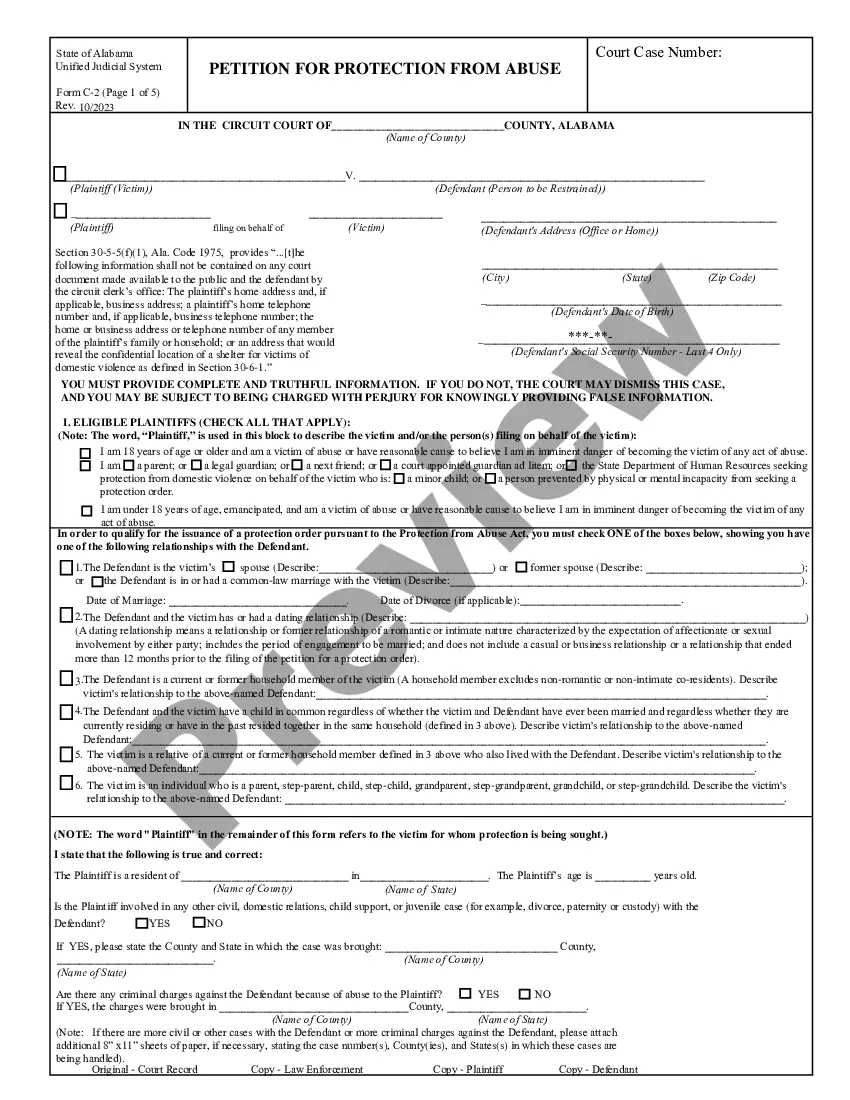

Visitors who don't have a subscription should complete a few simple steps before being able to get access to their Report of Independent Accountants after Audit of Financial Statements:

- Utilize the Preview function and read the form description (if available) to make sure that it’s the right document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct sample for your state and situation.

- Utilize the Search field on top of the web page if you need to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your document in a needed format to complete, print, and sign the document.

When you have followed the step-by-step instructions above, you'll always have the ability to sign in and download whatever file you require for whatever state you want it in. With US Legal Forms, finishing Report of Independent Accountants after Audit of Financial Statements samples or other official documents is not hard. Get started now, and don't forget to look at the samples with certified lawyers!

Form popularity

FAQ

Answer C. To reissue the 20X1 auditor's report on financial statements that have been neither restated nor revised, the auditor should use the original report date on the reissued report. Dual dating is used when a subsequent event occurs after the date of the report, but the report has not been issued.

A conclusion that speaks to your audit objective. The summary of two or three of the most important issues and recommendations. A description of the significance of the issues and of the report itself. A summary of the client's response to the recommendations.

Use pre-made financial audit report templates. Visualize your data. Add your business or organization branding designs. Use simple language. Edit. Fact-check all information presented.

Review the information systems. Look at record-keeping policies. Review the accounting system. Review internal controls policies. Compare the internal records. Review the tax returns. Perform tests of controls and the substantive test.

Be positive. Be specific. Identify who should act. Keep recommendations brief.

Conclude your audit by entering concluding remarks, forming an overall opinion/rating, and including recommendations based on your findings. Create a final report. Create a custom report for all issues related to health and safety.

Auditors generally assign findings as major, moderate, and minor to observations; some companies only assign levels of major or minor. Depending on the type of audit being performed, auditors can also assign audit findings as opportunities for improvement (OFI) or recommendations.

A financial statement audit is the examination of an entity's financial statements and accompanying disclosures by an independent auditor.The purpose of a financial statement audit is to add credibility to the reported financial position and performance of a business.

To highlight the results of the audit and allow the reader to cut to the chase, use an executive summary. This opening section of the report should highlight the scope and objectives of the audit, provide a summarization of critical findings, key management actions and overall evaluation statement.