Illinois Certificate of Dissolution of Domestic Corporation

Description

Key Concepts & Definitions

Certificate of Dissolution of Domestic Corporation: A legal document that formally concludes the existence of a domestic corporation registered in the United States. This certificate is filed with the state government where the corporation was incorporated, indicating that the corporation has ceased its operations and is no longer subject to certain legal obligations.

Step-by-Step Guide

- Board Resolution: Hold a board meeting and pass a resolution to dissolve the corporation.

- Shareholder Approval: Obtain approval from the majority of shareholders, if required.

- Filing Required Documents: File the Certificate of Dissolution along with any other required forms with the state's business filing agency.

- Settling Debts: Pay off all debts and distribute remaining assets among shareholders.

- Final Tax Returns: File final tax returns and close all tax accounts.

- Notification: Inform all relevant parties, including creditors, employees, clients, and suppliers of the dissolution.

Risk Analysis

- Legal Risks: Non-compliance with state laws can result in fines or legal challenges.

- Financial Risks: Inadequate asset distribution can lead to disputes or additional financial liabilities.

- Reputation Risks: Poor handling of the dissolution process might damage relationships with business partners and the community.

Key Takeaways

- A Certificate of Dissolution formally ends a corporation's legal existence.

- Ensure compliance with state laws and guidelines during the dissolution process.

- Properly managing the dissolution can mitigate legal, financial, and reputational risks.

Best Practices

- Early Planning: Begin dissolution planning well in advance to ensure a smooth process.

- Legal Consultation: Consult with an attorney specialized in corporate law to navigate state-specific regulations.

- Transparent Communication: Keep open lines of communication with all stakeholders throughout the process.

Common Mistakes & How to Avoid Them

- Ignoring Tax Obligations: Ensure all tax liabilities are settled before filing for dissolution.

- Poor Documentation: Maintain detailed records throughout the dissolution process to avoid legal complications.

- Rushing the Process: Allocate sufficient time for each step to prevent oversights.

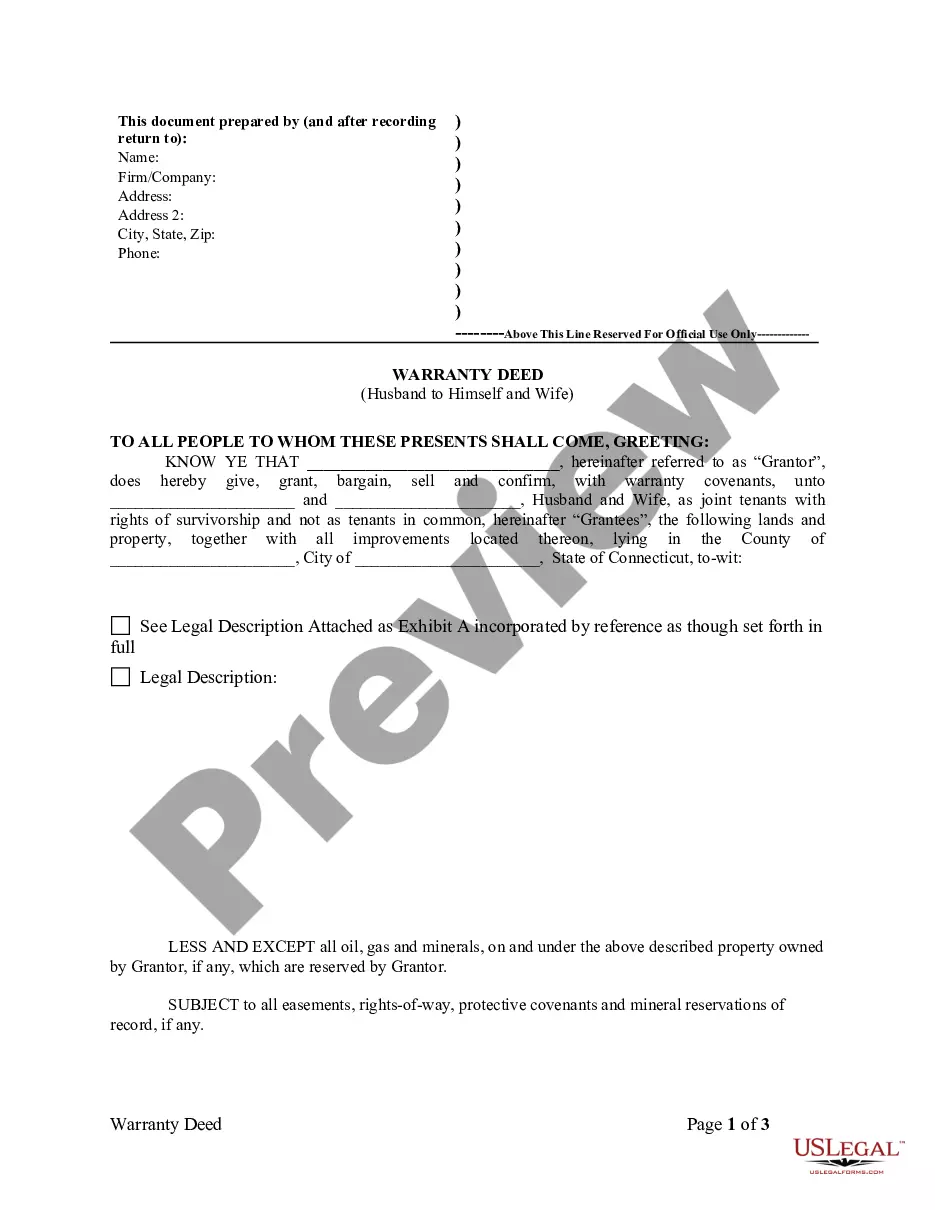

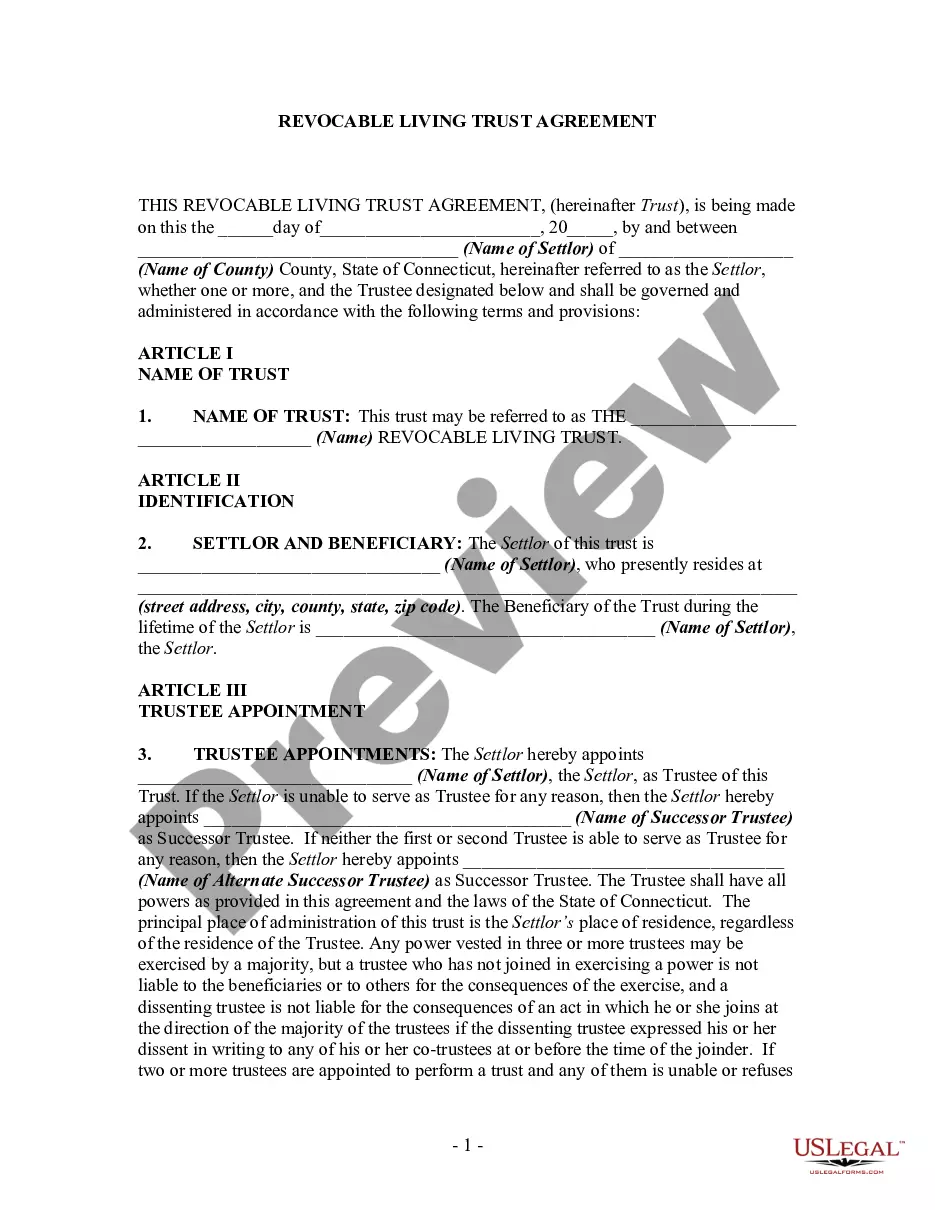

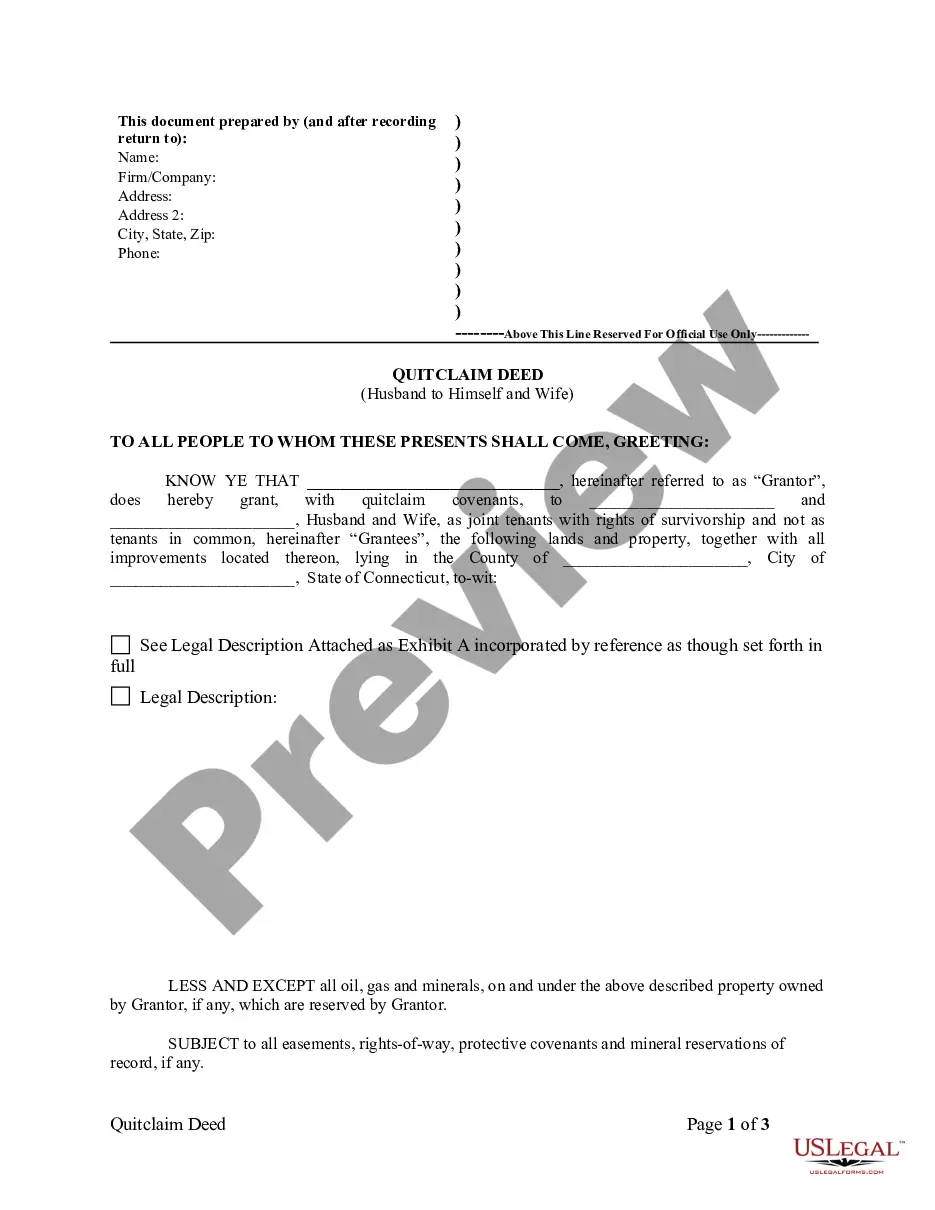

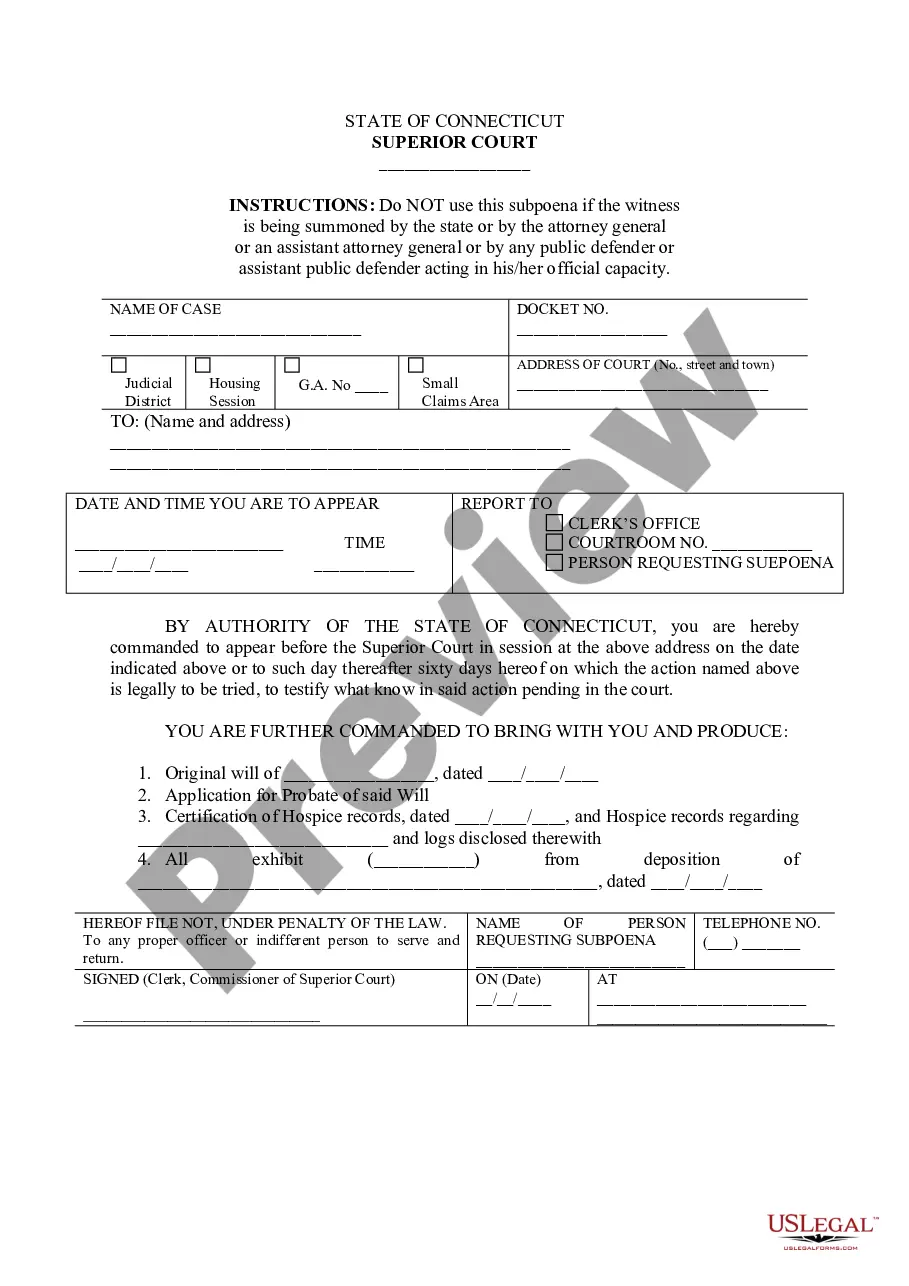

How to fill out Illinois Certificate Of Dissolution Of Domestic Corporation?

Utilize US Legal Forms to obtain a printable Illinois Certificate of Termination of Domestic Corporation.

Our court-acceptable forms are crafted and frequently revised by qualified attorneys.

Ours is the most comprehensive Forms catalog available online and provides affordable and precise samples for consumers, legal practitioners, and small to medium-sized businesses.

Examine the form by reviewing the details and utilizing the Preview function. Click Buy Now if it is the required template. Establish your account and transact via PayPal or debit|credit card. Download the document to your device and feel free to reuse it multiple times. Use the search engine if you wish to discover another document template. US Legal Forms provides an extensive array of legal and tax documents and packages for business and personal requirements, including the Illinois Certificate of Termination of Domestic Corporation. Over three million users have already successfully relied on our service. Choose your subscription option and obtain high-quality documents with just a few clicks.

- The templates are organized into state-specific categories.

- Many can be previewed prior to downloading.

- To access samples, clients are required to have a subscription and to Log In to their profile.

- Click Download next to any document you desire and locate it in My documents.

- For users without a subscription, adhere to the following instructions to easily locate and download the Illinois Certificate of Termination of Domestic Corporation.

- Ensure you select the correct template for the applicable state.

Form popularity

FAQ

Call a Board Meeting. File a Certificate of Dissolution With the Secretary of State. Notify the Internal Revenue Service (IRS) Close Accounts and Credit Lines, Cancel Licenses, Etc.

When an LLC is subjected to automatic dissolution, the business is, in fact, dissolved. Automatic dissolution requires the LLC to stop doing business, fulfill outstanding obligations and divide assets among members.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Reinstating a domestic LLC in Illinois begins with completing and filing the Reinstatement Following Administrative Dissolution form, which is also called the LLC-35.40. The LLC-35.40 form must be filed in duplicate by mail, or you can deliver it in person to the office of the Illinois Secretary of State.

Involuntary Dissolution. Illinois corporations may be dissolved involuntarily by a court order as a result of a lawsuit by creditors, or by the Illinois Secretary of State for failure to file an annual report or pay annual fees. Alternatively, corporations may be dissolved voluntarily by shareholder consent.

To reinstate a corporation, you must file BCA 12.45, Application for Reinstatement, in duplicate with the Secretary of State's office. You also must file Annual Reports for the years that were not filed. For more information, please call 217-785-5782.

Hold a board of directors meeting and formally move to dissolve your corporation. File the Articles of Dissolution with the Illinois Secretary of State. Fulfill all tax obligations with the state of Illinois, as well as with the IRS.

If a Corporation or LLC fails to fulfill any of its required business obligations the state will send a deficiency notice to the business.When a company has been Involuntary Dissolved by the state that company cannot legally conduct business and may be breaking the law if it does conduct business.