Connecticut Quitclaim Deed from Husband to Himself and Wife

Definition and meaning

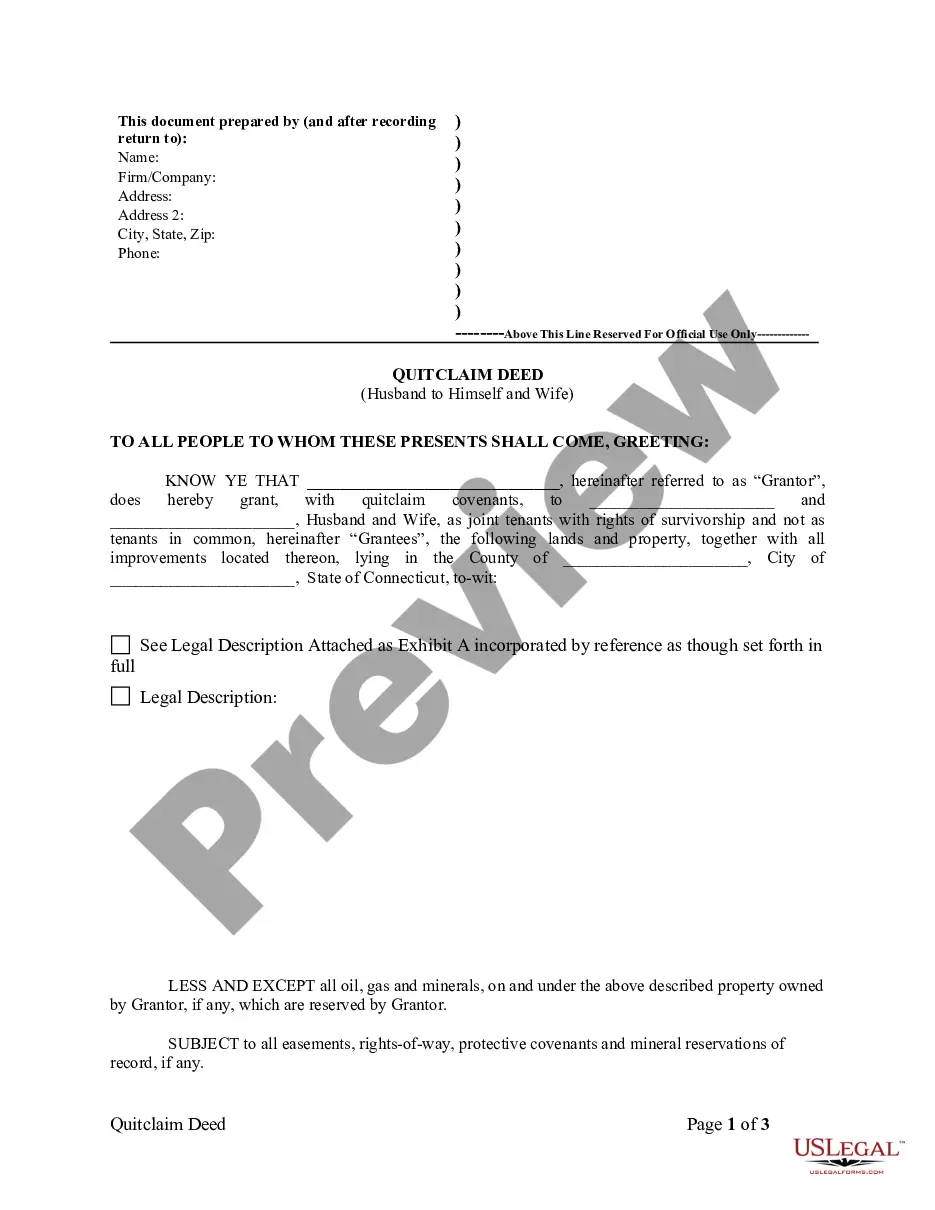

A Connecticut Quitclaim Deed from Husband to Himself and Wife is a legal document used to transfer property ownership from one individual (the Grantor) to two individuals (the Grantees) who are married. This form is specifically structured to clarify that the property is being held jointly between the husband and wife as joint tenants with rights of survivorship. This means that in the event of the death of one spouse, the surviving spouse automatically inherits the property without going through probate.

How to complete a form

Completing the Connecticut Quitclaim Deed requires attention to detail. Follow these steps:

- Enter Grantor Information: Fill in the name of the Grantor who is transferring the property.

- Enter Grantee Information: Provide the names of both Grantees (the husband and wife).

- Property Description: Include a legal description of the property. This can often be found in previous deed documents.

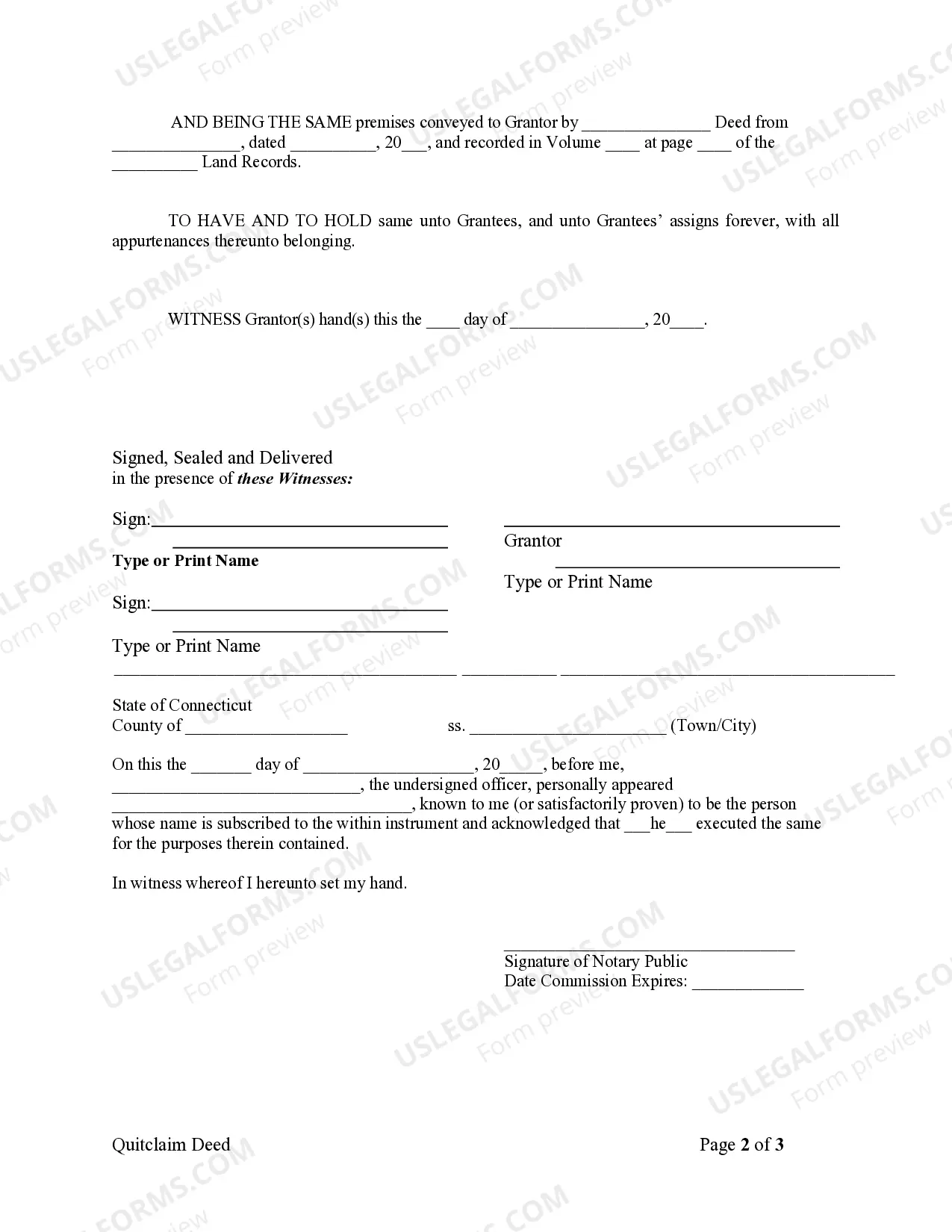

- Signature: The Grantor must sign the document in the presence of a notary public, who will also sign and stamp the form.

- Witnesses: Include signatures from witnesses, if required by state law.

Make sure all information is accurate to ensure the validity of the deed.

Who should use this form

This form is ideal for married couples who wish to formalize ownership of a property they jointly hold. It is particularly useful for couples who are merging assets and want to ensure both partners have equal ownership rights. The Quitclaim Deed is best suited for properties that are already owned by the husband and now need to be added to the ownership of both partners. It's also suitable for individuals who wish to simplify property transfer between spouses without the complexities of a traditional sale.

Key components of the form

The Connecticut Quitclaim Deed includes several essential components:

- Grantor and Grantee Details: Full names and addresses of the individuals involved.

- Property Description: An accurate legal description of the property being conveyed, which should be attached as an exhibit.

- Signature Lines: Spaces for the Grantor, witnesses, and notary public to sign, confirming the document's legality.

- Recording Information: Details on where the deed will be recorded in local land records.

These elements ensure that the document fulfills legal requirements and protects the interests of the parties involved.

What to expect during notarization or witnessing

When notarizing the Connecticut Quitclaim Deed, it's important to prepare for the following:

- Identification: The Grantor must present valid identification to the notary public.

- Signature: The Grantor needs to sign the document in the presence of the notary, who will then complete their notary section.

- Witness Requirements: Some states require a witness to sign the deed as well, depending on local laws.

Ensure all parties arrive prepared with the necessary identification and that the document is filled out completely before the meeting.

Common mistakes to avoid when using this form

While completing the Connecticut Quitclaim Deed, it is crucial to avoid these common errors:

- Incomplete Information: Failing to include full names and addresses for both Grantor and Grantees can render the form invalid.

- Incorrect Property Description: An inaccurate or vague property description may lead to legal disputes later.

- Missing Signatures: Ensure that all necessary signatures, including those of witnesses and notary, are obtained before submitting.

Being vigilant about these details can prevent delays in processing and potential legal issues.

Form popularity

FAQ

Yes, you can fill out a Connecticut Quitclaim Deed from Husband to Himself and Wife yourself, but it's important to ensure that you understand the basic requirements. This deed transfers property ownership, so accuracy is crucial. You can find templates and guidance online, including resources on platforms like uslegalforms, which can simplify the process. However, consulting with a legal expert may help you avoid potential pitfalls and ensure everything is completed correctly.

The primary beneficiaries of a Connecticut Quitclaim Deed from Husband to Himself and Wife are typically family members, especially spouses. This deed allows them to simplify the transfer of ownership without the complexities of a traditional sale. It serves as a handy tool for estate planning, helping families maintain property within the family unit. Moreover, it can facilitate smoother transactions during divorce or inheritance situations.

While a Connecticut Quitclaim Deed from Husband to Himself and Wife is generally straightforward, it may carry some risks. One significant concern is that it does not guarantee clear title or protect against claims against the property. This means that if there are unknown liens or issues, the new owner may face complications. Therefore, it’s advisable to have a title search conducted to mitigate any potential problems.

People typically use a Connecticut Quitclaim Deed from Husband to Himself and Wife to transfer property ownership easily and quickly. This type of deed is often used in family situations, such as marriage or divorce, where one spouse wants to give property to the other. Furthermore, it can help simplify the process of updating property titles without the need for extended legal procedures. Overall, it serves as a straightforward method to adjust ownership stakes.

Yes, you can create a Connecticut Quitclaim Deed from Husband to Himself and Wife by yourself. However, it's essential to ensure that you follow the legal requirements for your state, including proper formatting and notarization. If you're unsure about the process, consider using online resources or platforms like USLegalForms to guide you. This can help you avoid mistakes and ensure your deed is valid.

To successfully execute a Connecticut Quitclaim Deed from Husband to Himself and Wife, specific requirements must be met. The deed must include the names of the grantor and grantee, a legal description of the property, and must be signed by the grantor. Additionally, it's important that the deed is notarized and filed with the local land records office for public access.

Yes, you can create a Connecticut Quitclaim Deed from Husband to Himself and Wife on your own if you feel comfortable with the process. However, it's essential to understand all legal requirements to avoid mistakes. If you're unsure, using platforms like USLegalForms can provide templates and guidance to ensure your document is correct and satisfies state laws.

The process for a Connecticut Quitclaim Deed from Husband to Himself and Wife involves several steps. First, you must fill out the quitclaim deed form with accurate information. Next, the document needs to be signed in the presence of a notary. After notarization, you should file the deed with the local land records office to ensure it is legally recognized.

People often view quitclaim deeds with skepticism because they offer limited protection to buyers. Unlike warranty deeds, a Connecticut Quitclaim Deed from Husband to Himself and Wife does not guarantee the absence of liens or claims against the property. This lack of guarantees can lead to potential disputes in the future. Therefore, it is crucial to conduct thorough research before proceeding with such a deed.

In New York, both parties generally need to be present to complete the transfer of a title using a quitclaim deed. However, exceptions can occur if one party provides a power of attorney. For a seamless process, utilizing a Connecticut Quitclaim Deed from Husband to Himself and Wife ensures clarity and legality, making it easier for couples to navigate this transfer. The US Legal Forms platform offers resources and templates to facilitate this deed efficiently.