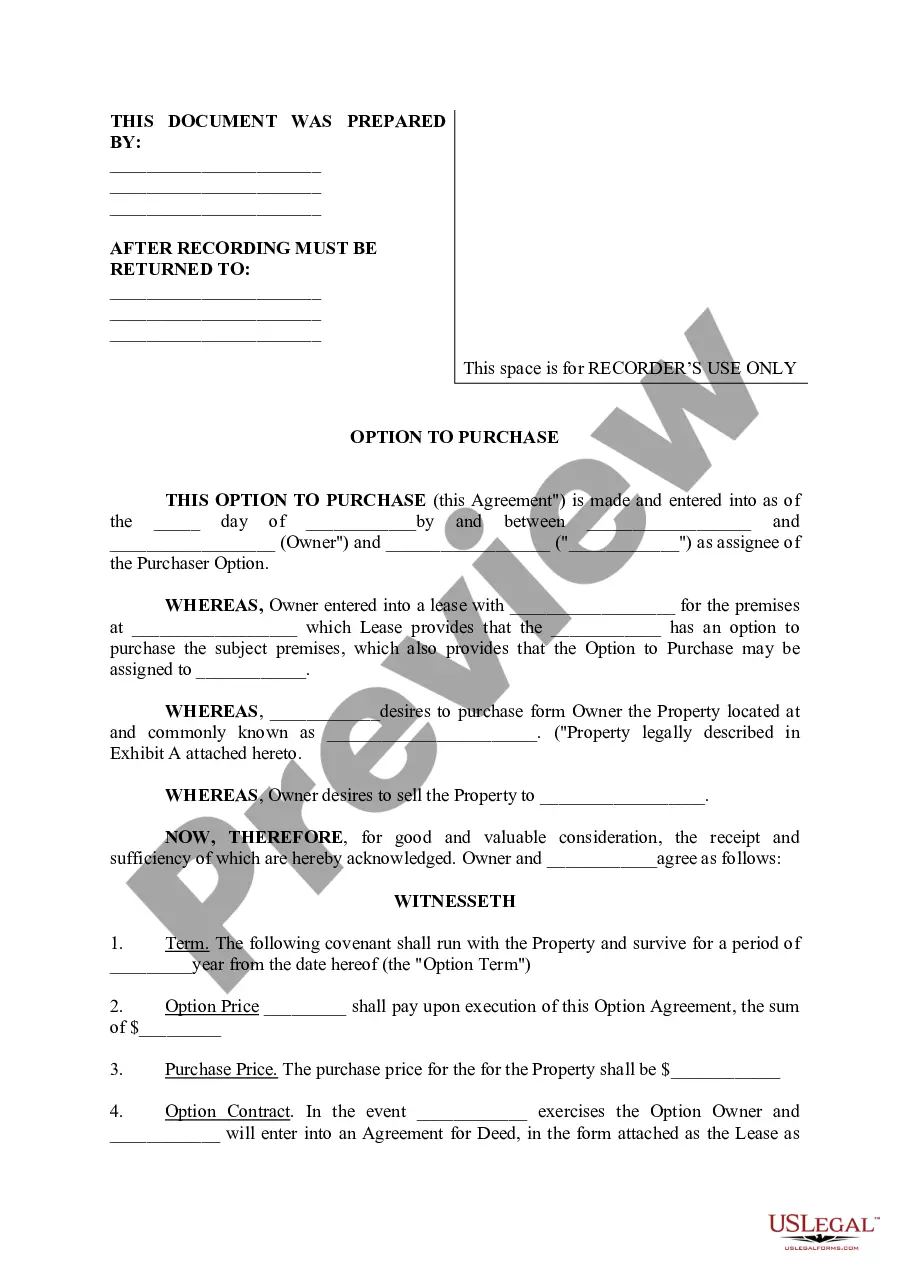

Illinois Option to Purchase

Description

How to fill out Illinois Option To Purchase?

Utilize US Legal Forms to acquire a printable Illinois Option to Purchase.

Our court-acceptable forms are created and routinely refreshed by experienced attorneys.

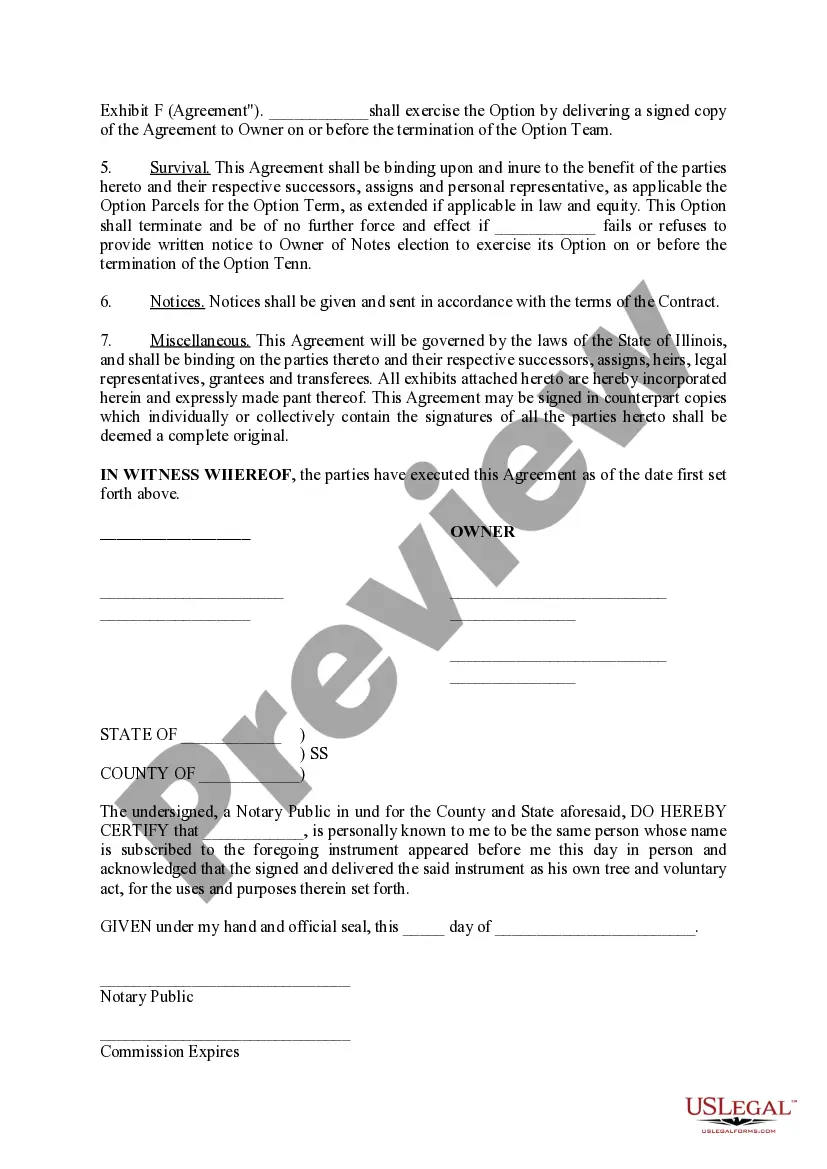

Ours is the largest collection of forms available online, providing reasonably priced and precise samples for customers, attorneys, and small to medium-sized businesses.

- The templates are categorized by state-based sections.

- Many templates can be previewed before downloading them.

- To download samples, users need a subscription and must Log In to their account.

- Click Download next to any template you require and find it in My documents.

- For users without a subscription, follow these steps to find and download the Illinois Option to Purchase.

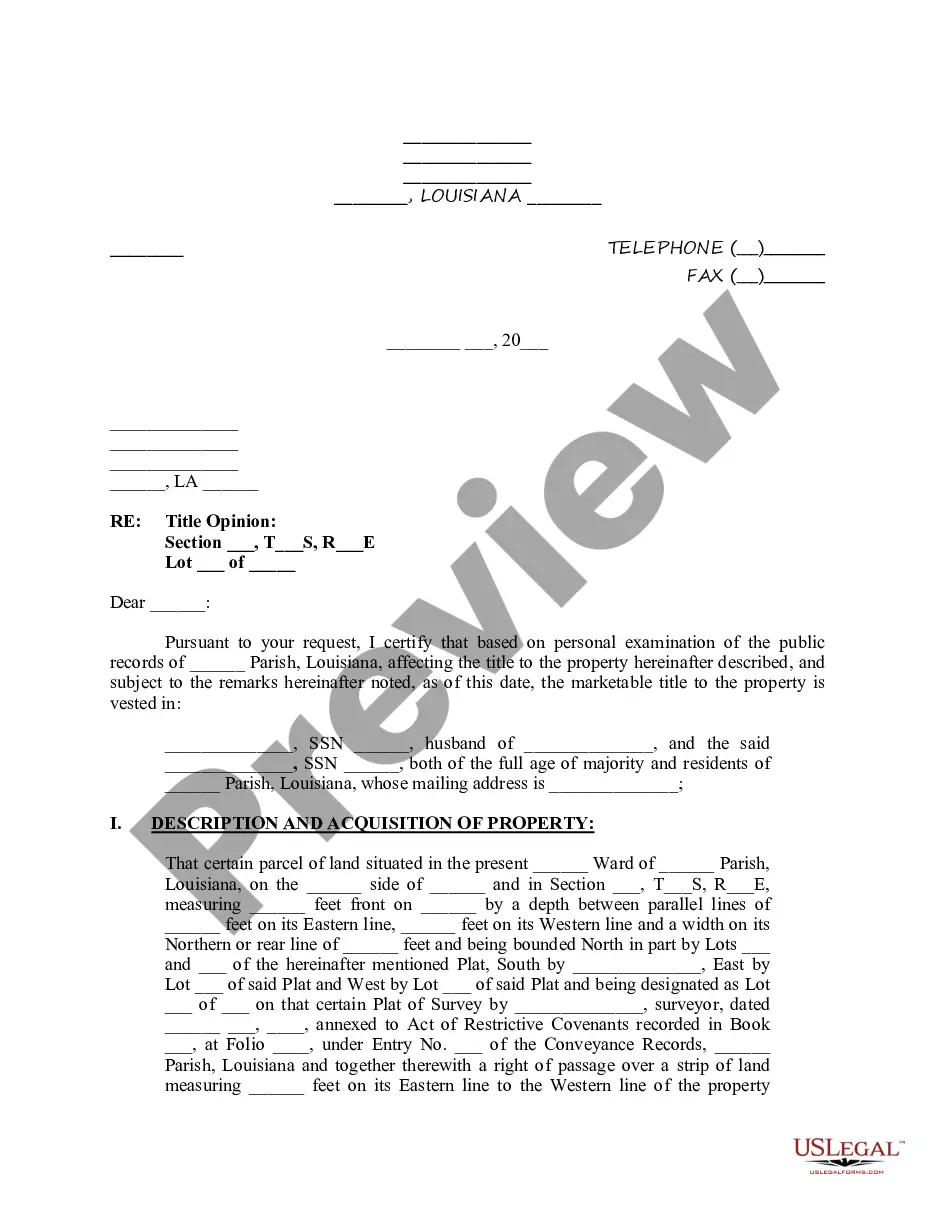

- Ensure that you select the correct form pertaining to the state where it is required.

Form popularity

FAQ

A lease-option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.

Rent-to-own programs can be attractive to buyers, especially those who expect to be in a stronger financial position within a few years. Some of the benefits include: Buy with bad credit: Buyers who cannot qualify for a home loan can start buying a house with a rent-to-own agreement.

Sell one out-of-the-money put option for every 100 shares of stock you'd like to own. Wait for the stock price to decrease to the put options' strike price. If the options are assigned by the options exchange, buy the underlying shares at the strike price.

Typically, the seller grants the buyer an option to purchase the property based on the terms and conditions in the Option to Purchase, in return of a sum of money from the buyer called the Option Fee. The Option Fee is typically 1% of the sale price of the property, but is negotiable between parties.

An option to purchase agreement therefore gives the buyer rights over the land, and will also bind a future owner of the land too.Pre-emption rights in regard to registered land take effect at the time of their creation however, and can therefore be binding on subsequent owners.

The primary difference is that an option contract entitles the buyer to the option to purchase the items at a later time, whereas a firm offer gives the buyer the right to buy the items outright at any time.

A rent-to-own agreement is a deal in which you commit to renting a property for a specific period of time, with the option of buying it before the lease runs out.You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

The strike price of $70 means that the stock price must rise above $70 before the call option is worth anything; furthermore, because the contract is $3.15 per share, the break-even price would be $73.15.

How long does an option last? An option typically lasts 24 months but the timeframe to exercise is completely negotiable at the agreement stage.