Connecticut Reaffirmation Agreement

Description

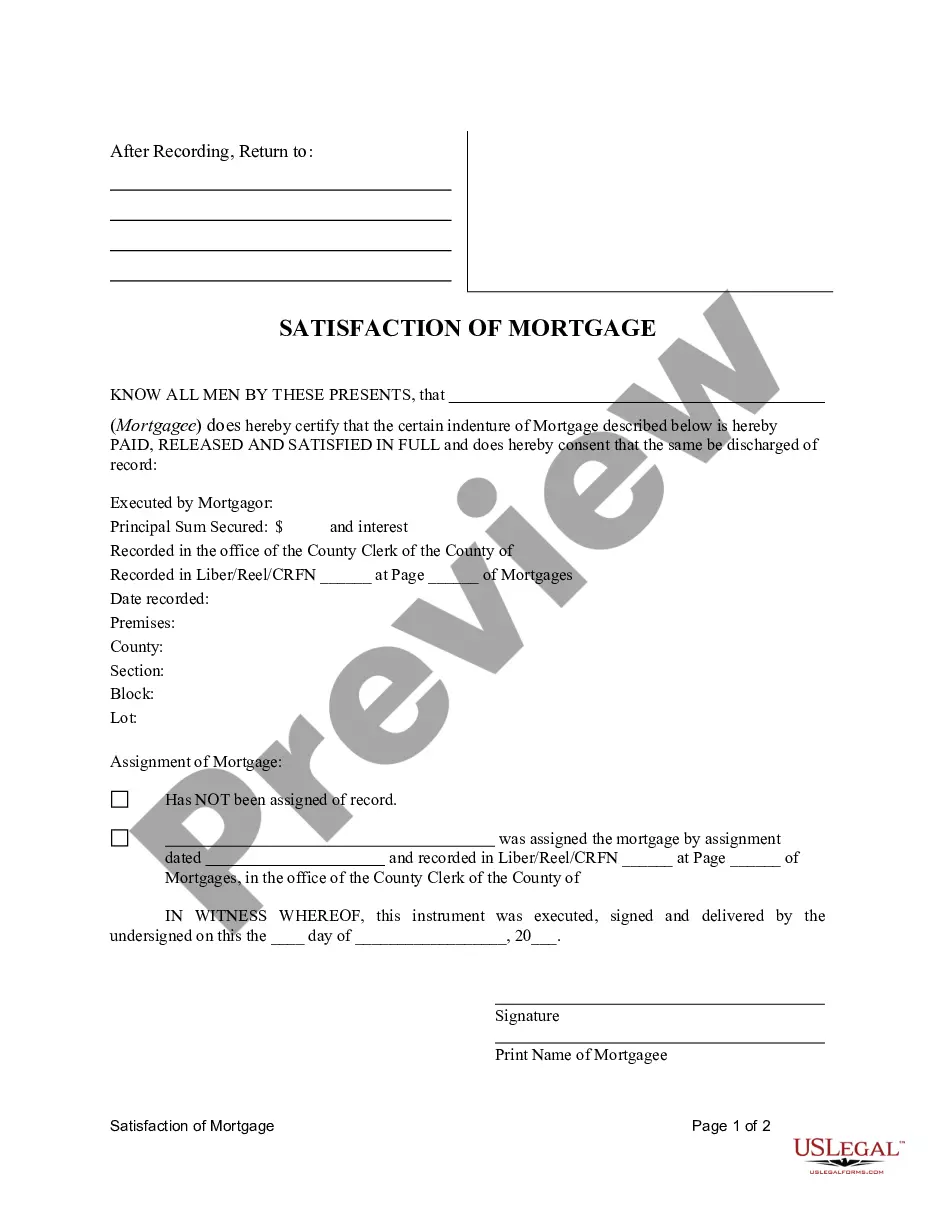

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

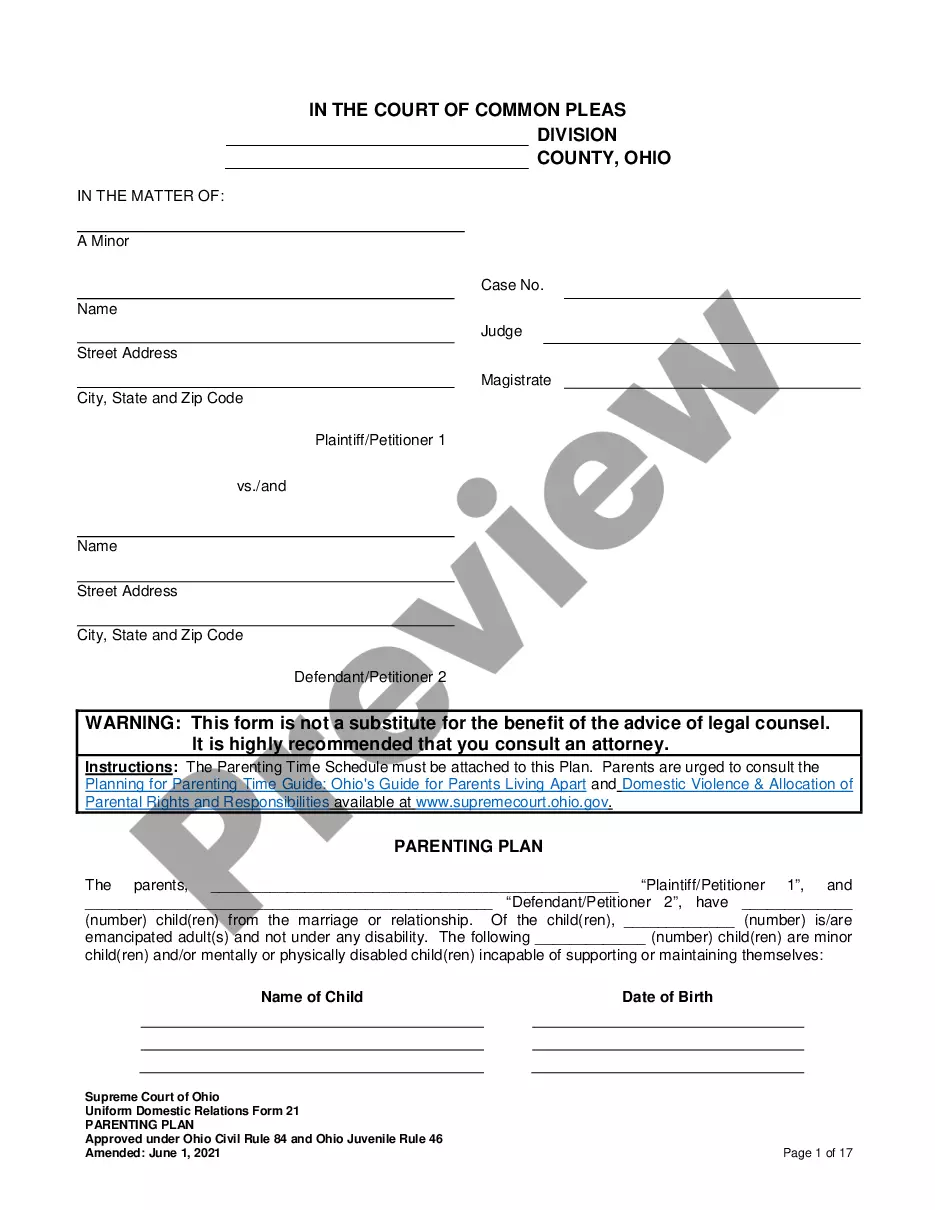

How to fill out Connecticut Reaffirmation Agreement?

The larger quantity of documents you need to produce - the more anxious you become.

You can discover a vast array of Connecticut Reaffirmation Agreement templates online; however, you’re uncertain which ones to trust.

Remove the difficulty and simplify finding samples with US Legal Forms. Obtain correctly formatted forms that comply with state regulations.

Enter the requested information to create your account and pay for the order using your PayPal or credit card. Choose a suitable document format and obtain your sample. Access any document you download in the My documents section. Just go there to prepare a new copy of your Connecticut Reaffirmation Agreement. Even when utilizing well-crafted templates, it is still crucial to consider consulting your local attorney to verify that your completed document is accurate. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, sign in to your account, and you will notice the Download option on the Connecticut Reaffirmation Agreement’s page.

- If this is your first time using our service, complete the registration procedure by following these instructions.

- Verify that the Connecticut Reaffirmation Agreement is acceptable in your residing state.

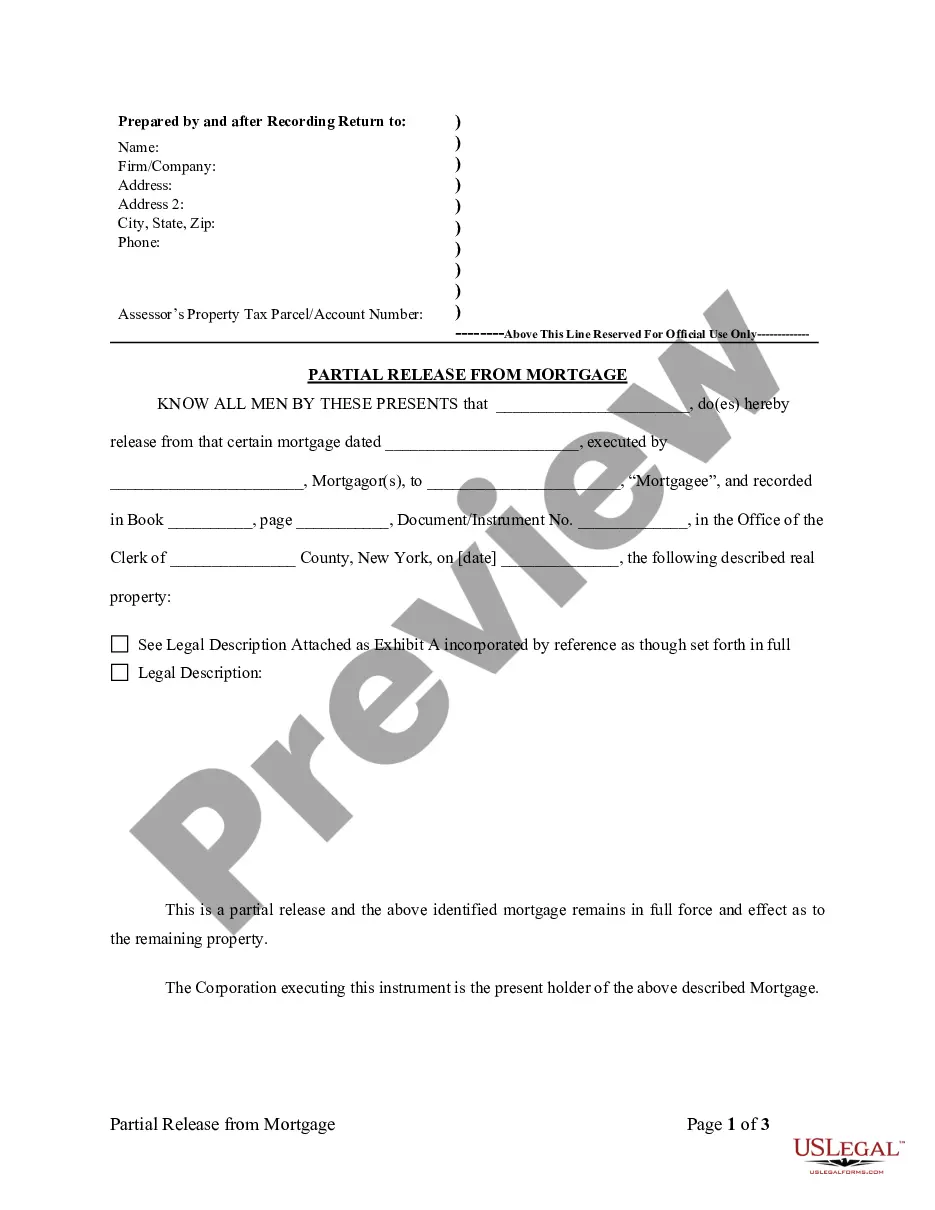

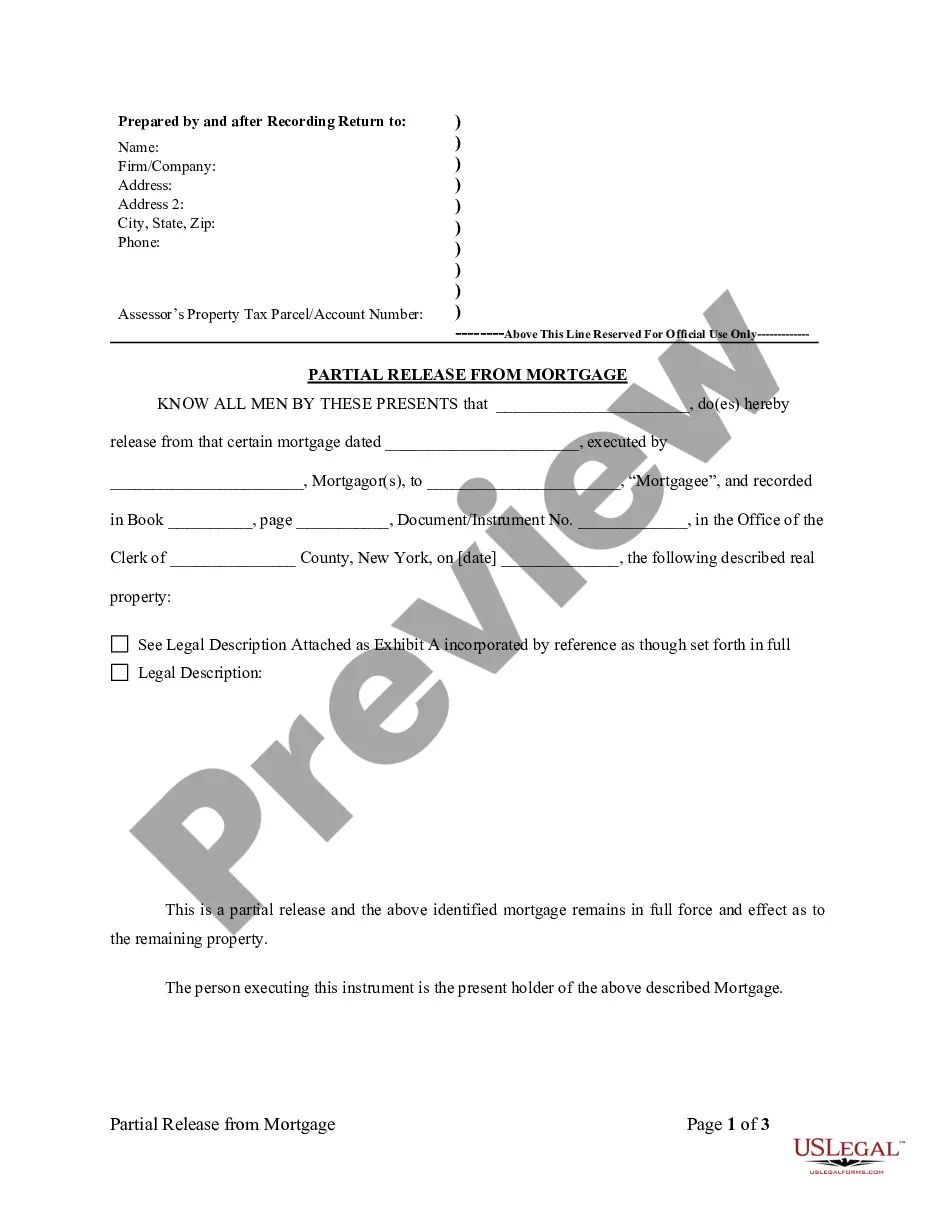

- Review your choice by reading the description or utilizing the Preview function, if available for the chosen document.

- Simply click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

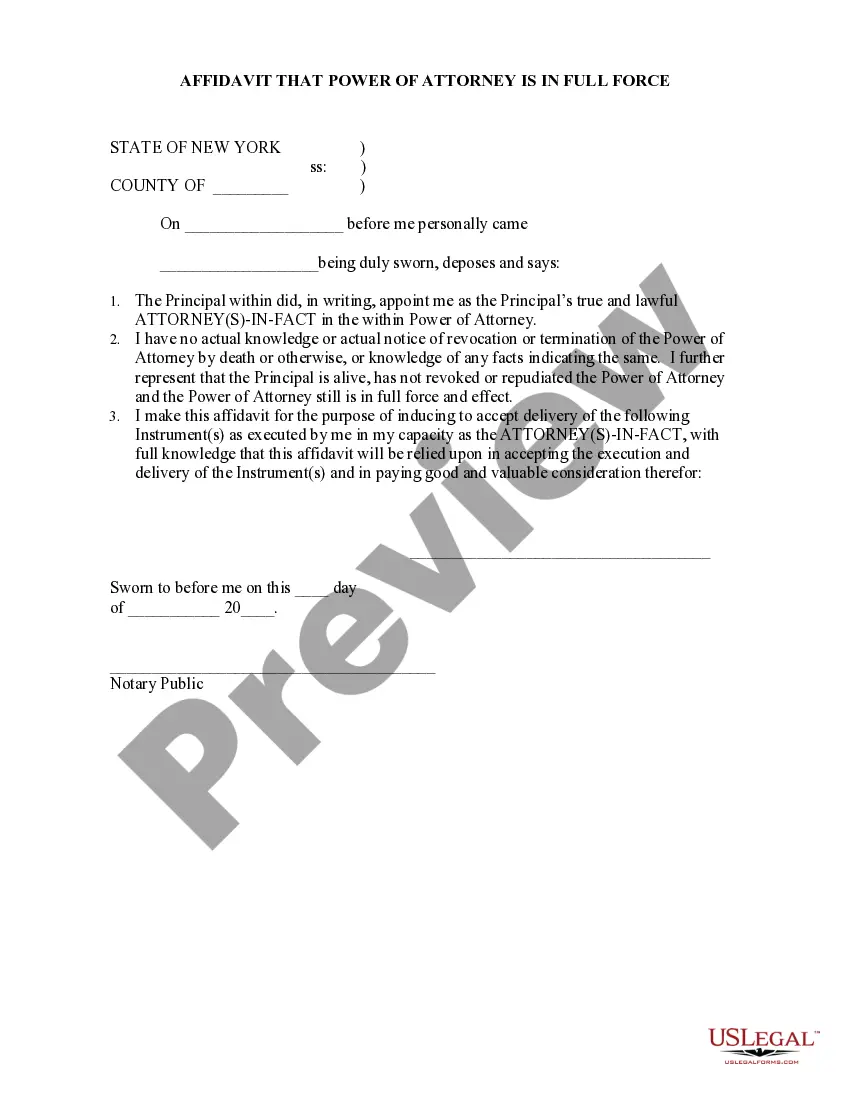

Reaffirming your car in Chapter 7 is not mandatory, but it can be beneficial. When you sign a Connecticut Reaffirmation Agreement, you commit to keeping your vehicle and continuing payments. If you choose not to reaffirm, the lender may repossess your car after your discharge. It's essential to weigh your options and consider your financial situation.

To obtain a Connecticut Reaffirmation Agreement, start by consulting with your bankruptcy attorney to ensure that this option is right for you. Your attorney will help you prepare the necessary documentation, which must clearly outline your intention to reaffirm the debt. Once you've completed the paperwork, you file it with the court as part of your bankruptcy case. Using US Legal Forms can simplify this process by providing you with customizable templates and guidance tailored to Connecticut's legal requirements.

If a Connecticut Reaffirmation Agreement is denied, the debtor loses the option to reaffirm the debt. This means the lender cannot seek payment for the debt through collection actions, but the debtor also cannot keep the associated collateral, such as a home or car. Denial often leads to the property being sold if it was tied to the reaffirmation agreement. To navigate these complexities, consider using USLegalForms to find the guidance you need.

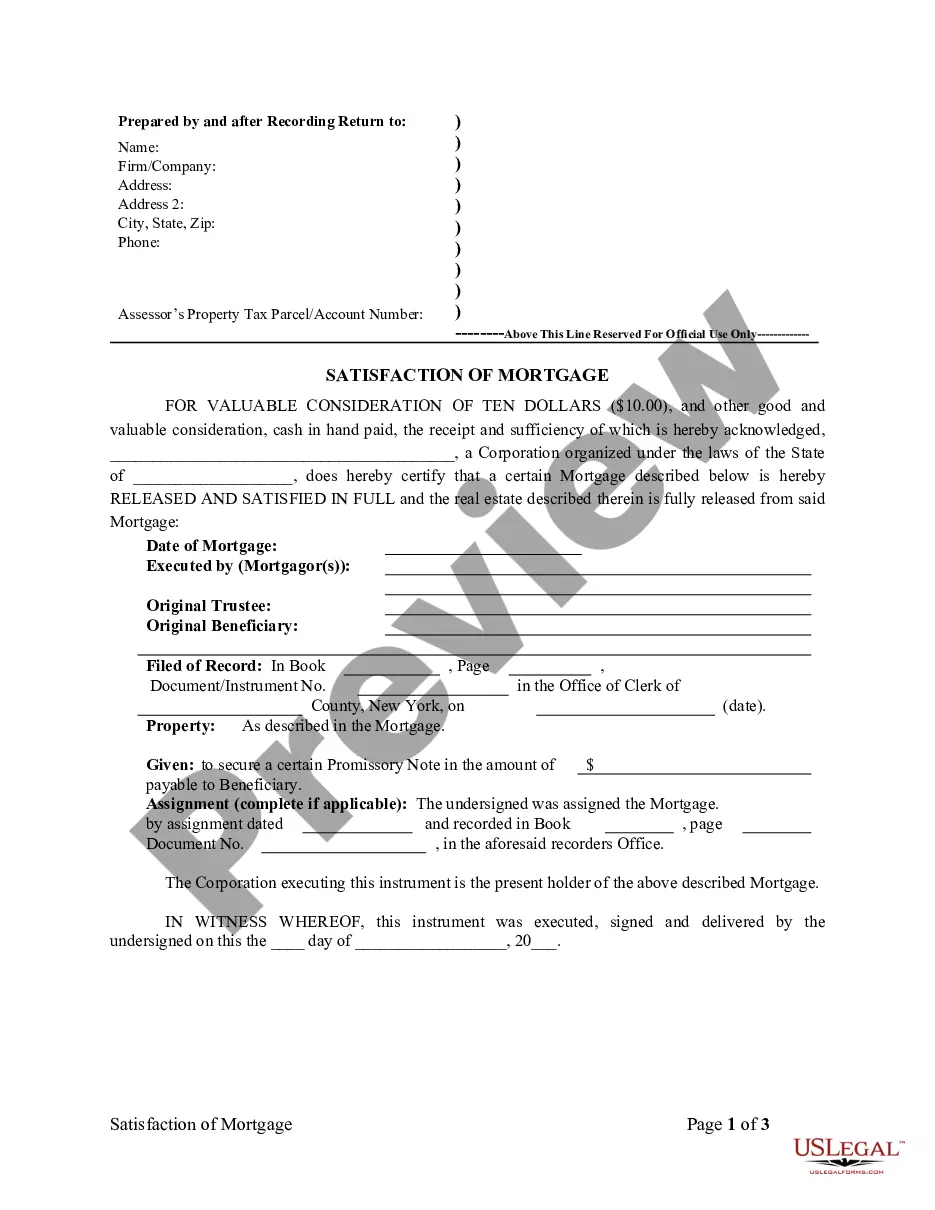

There is no specific minimum amount of debt required to file Chapter 7. However, filing is often more beneficial when your debts are significant relative to your income. It’s wise to consider a Connecticut Reaffirmation Agreement as part of your strategy to manage debts. Reviewing your financial situation can help determine if you meet the requirements to file.

Several factors can disqualify you from filing Chapter 7. If you have filed for bankruptcy in the past eight years, you may be ineligible again. Additionally, if you earn too much income or have assets that exceed Connecticut's exemption limits, you might not qualify. Understanding the Connecticut Reaffirmation Agreement can help navigate these disqualifications effectively.

Filing Chapter 7 in Connecticut without a lawyer is possible, but it requires careful preparation. You must complete the necessary paperwork, such as the bankruptcy petition and schedules, accurately. Consider using tools on the USLegalForms platform, which can simplify the process and ensure you understand the Connecticut Reaffirmation Agreement and other important details.

In Chapter 7 bankruptcy, you may lose non-exempt assets. Common assets at risk include luxury items, second homes, and certain savings. However, many personal possessions, like your primary residence or vehicle, may be protected under a Connecticut Reaffirmation Agreement. This agreement allows you to keep certain assets while addressing your debt.