Connecticut Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Chapter 13 Plan?

The greater the number of documents you must prepare, the more anxious you feel.

You can find numerous Connecticut Chapter 13 Plan templates online; however, you are unsure which ones to trust.

Eliminate the frustration and simplify the process of finding samples with US Legal Forms. Obtain properly composed forms that comply with the state standards.

Submit the required information to create your account and complete the payment for the order using your PayPal or credit card. Choose a convenient file format and acquire your template. Access every template you obtain in the My documents section. Simply navigate there to generate a new copy of the Connecticut Chapter 13 Plan. Even with correctly created templates, it’s still essential to consider consulting your local attorney to verify that your document is filled out correctly. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, Log In to your account to discover the Download option on the Connecticut Chapter 13 Plan webpage.

- If you haven't used our platform before, follow the registration steps below.

- Verify that the Connecticut Chapter 13 Plan is applicable in your state.

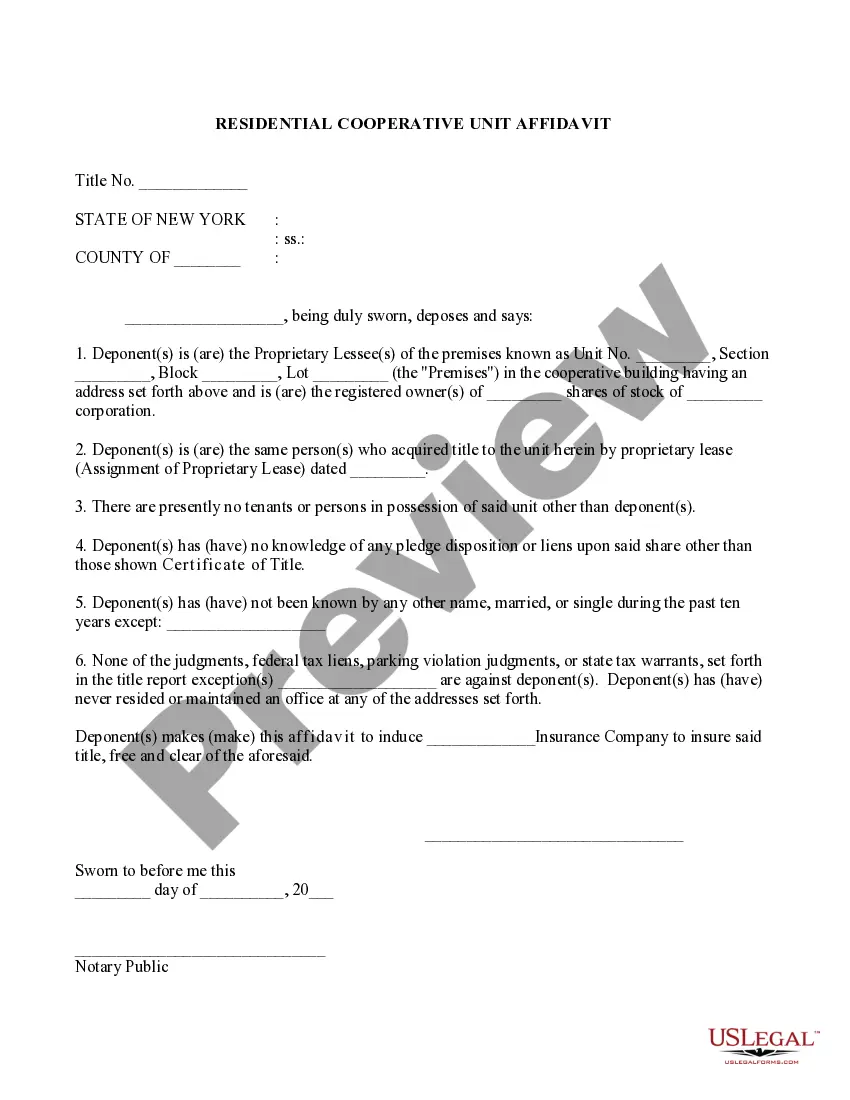

- Confirm your selection by reviewing the description or utilizing the Preview mode if it is available for the selected document.

- Click on Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

To start filing for a Connecticut Chapter 13 Plan, first gather your financial documents, including income statements and an inventory of your debts. Next, consider consulting with a bankruptcy attorney or using platforms like uslegalforms to help guide you through the filing process. Completing the necessary paperwork accurately is essential to ensure your case proceeds smoothly.

Yes, it is possible to be denied a Connecticut Chapter 13 Plan. Reasons for denial often include failing to meet eligibility requirements or providing incomplete or inaccurate information. To increase your chances of approval, ensure your application is thorough and accurate, and consider using uslegalforms for assistance in preparing your documents.

Under current guidelines for a Connecticut Chapter 13 Plan, your unsecured debt must be less than $394,725. Additionally, your secured debts should be under $1,184,200. Keeping these limits in mind as you evaluate your financial status can help you effectively plan your next steps toward filing.

To file for a Connecticut Chapter 13 Plan, you must have a regular income and unsecured debts under $394,725, and secured debts under $1,184,200. These limits can change, so it's wise to check for the latest figures to ensure you qualify. Understanding your total debt helps you make informed decisions about your financial future.

While it is possible to file for a Connecticut Chapter 13 Plan without an attorney, it's generally not recommended. The process can be complex, and errors in paperwork could lead to your case being dismissed. By using services like uslegalforms, you can navigate the process more smoothly and ensure all necessary documents are completed correctly.

The average monthly payment for a Connecticut Chapter 13 Plan varies based on individual circumstances, including income, expenses, and the amount of debt. Generally, it can range between $200 to $1,500, depending on your financial situation. A qualified attorney can help you determine a realistic payment plan that meets your needs and adheres to the requirements of the court.

You may become ineligible for a Connecticut Chapter 13 Plan for various reasons. If your secured and unsecured debts exceed the federal limits, or if you fail to make required payments in a previous bankruptcy case, you won't qualify. Furthermore, having a recent bankruptcy discharge can also impact your eligibility.

To file a Connecticut Chapter 13 Plan, you first need to complete a credit counseling course. After that, you gather your financial documents and file a petition with the bankruptcy court. It's advisable to consult legal resources or platforms like uslegalforms to ensure you follow the correct procedures and maximize the benefits of your plan.

Several factors can disqualify you from filing a Connecticut Chapter 13 Plan. If you have previously filed for Chapter 13 and failed to complete the plan, or have received a discharge under this chapter within the last two years, you may be ineligible. Additionally, failing to meet income or debt limits can also disqualify you.

Yes, a Connecticut Chapter 13 Plan can be denied under specific circumstances. If the plan does not meet legal requirements or if you fail to propose a feasible repayment plan, the court may reject it. It's crucial to ensure your plan is well-structured and in compliance to improve your chances of approval.