Illinois Estate Planning Questionnaire

What is this form?

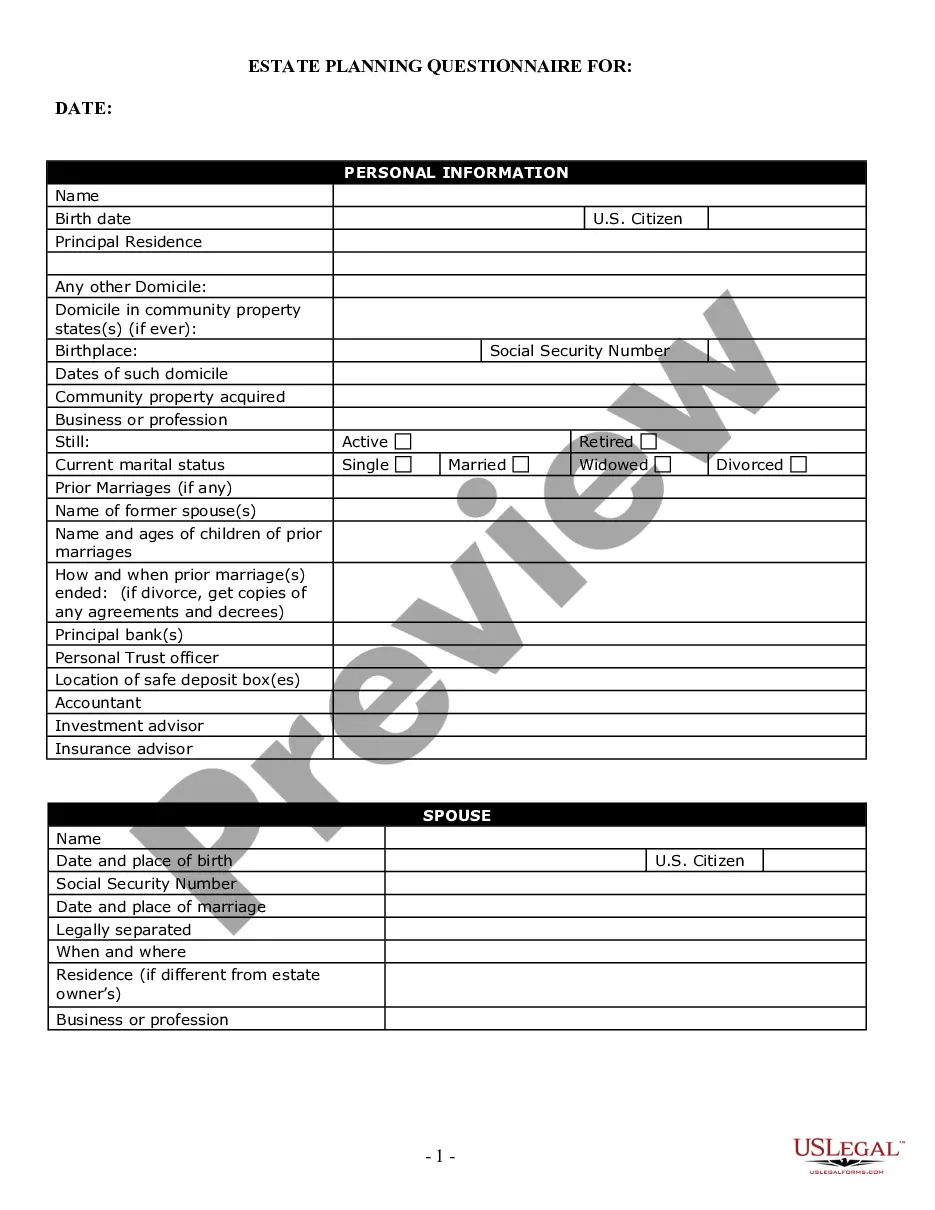

The Estate Planning Questionnaire is a comprehensive document designed to gather essential information necessary for creating a personalized estate plan. By completing this form, individuals provide their attorneys or estate planners with critical insights into their financial situation, family dynamics, and specific wishes for asset distribution after their passing. This form differs from other legal templates by focusing solely on gathering pertinent details, paving the way for customized estate planning advice.

Key parts of this document

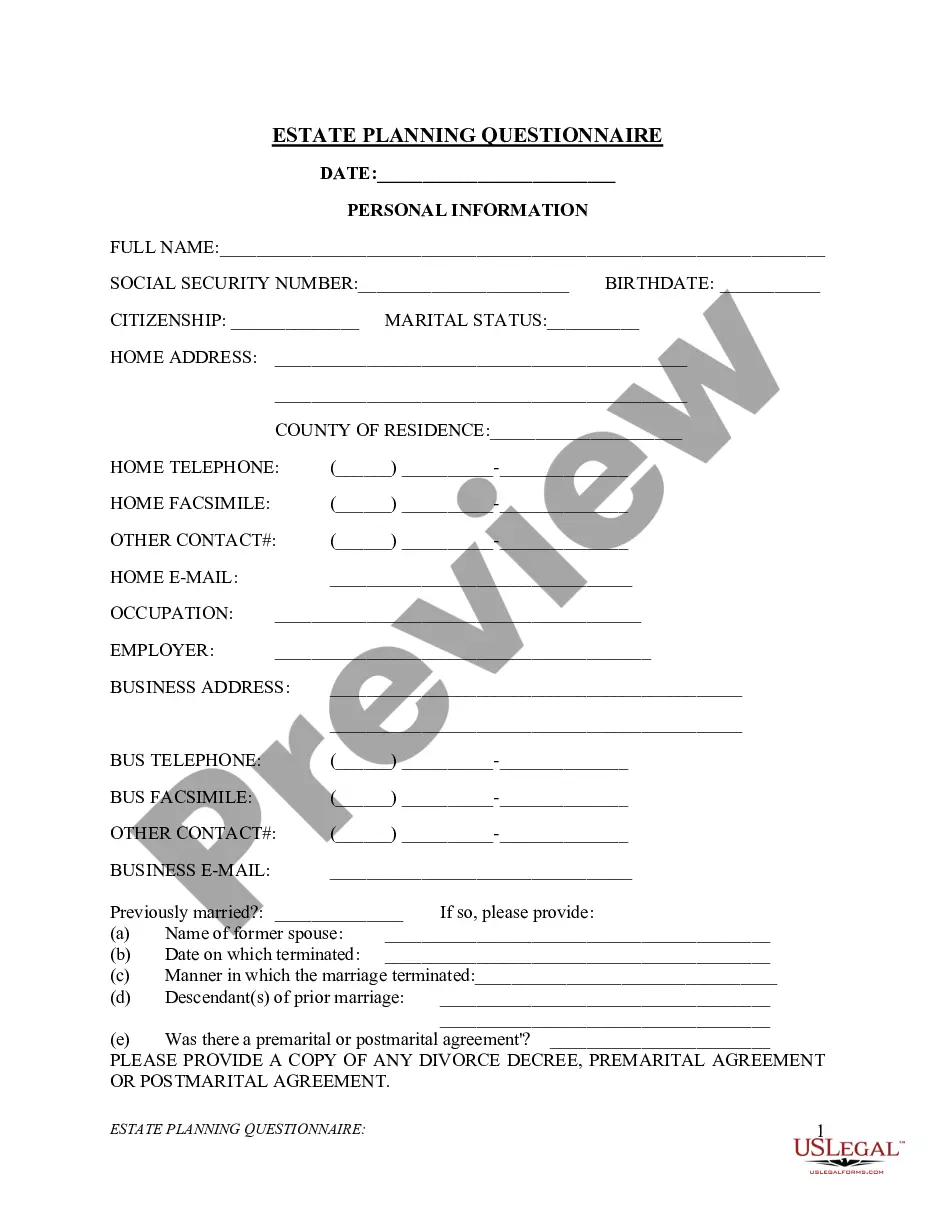

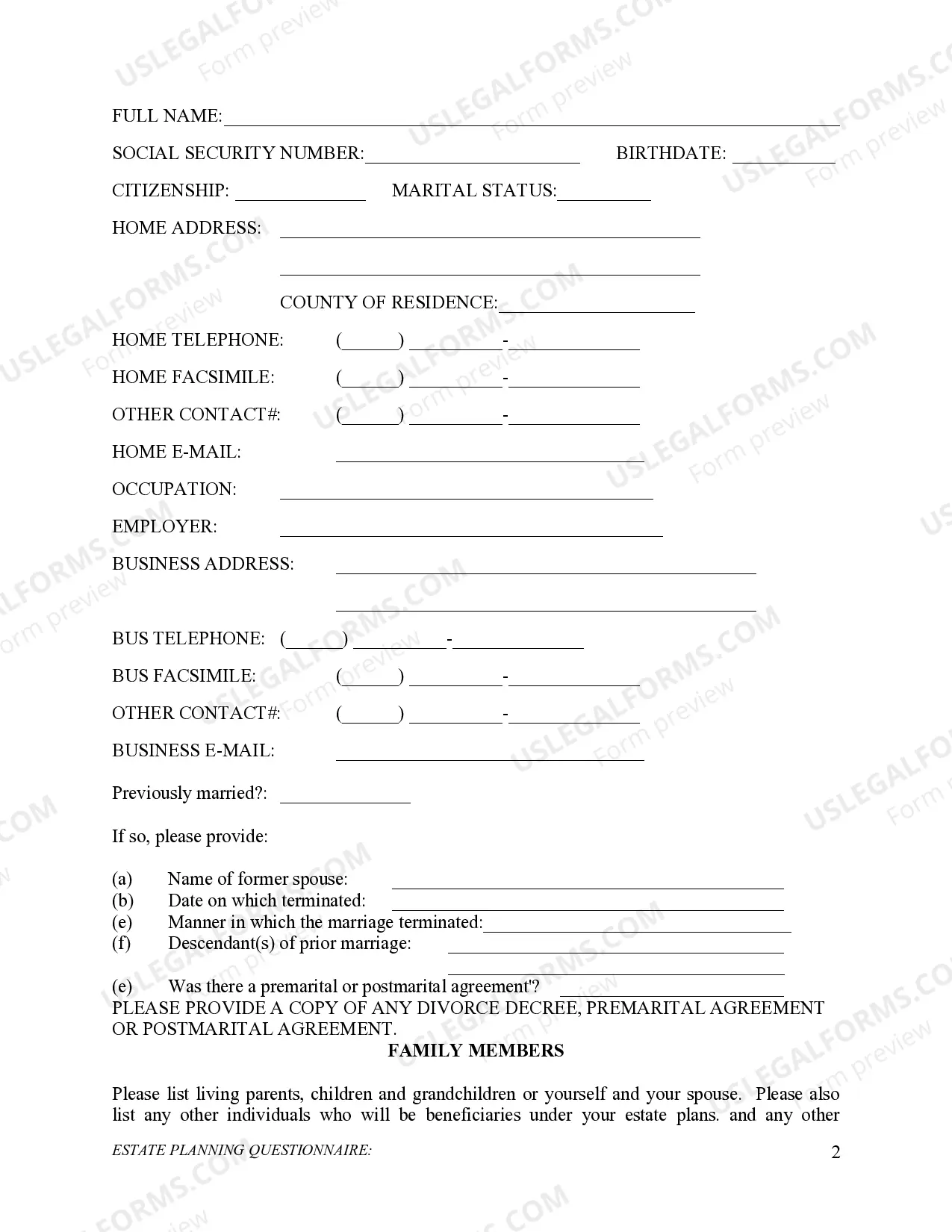

- Personal Information: Collects your full name, contact details, and occupational information.

- Marital History: Captures details about previous marriages and any related agreements.

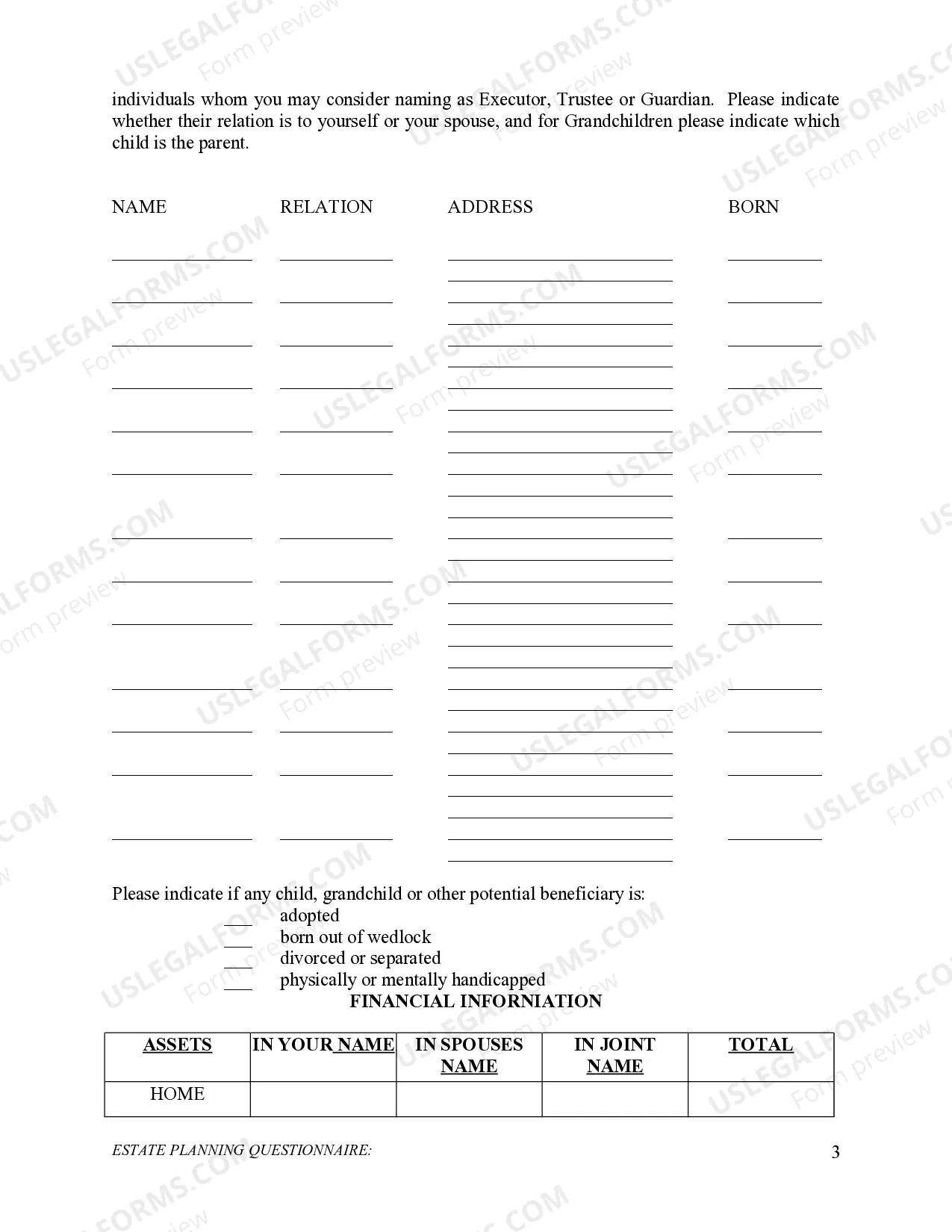

- Family Members: Lists relevant relatives and potential beneficiaries, including children and grandchildren.

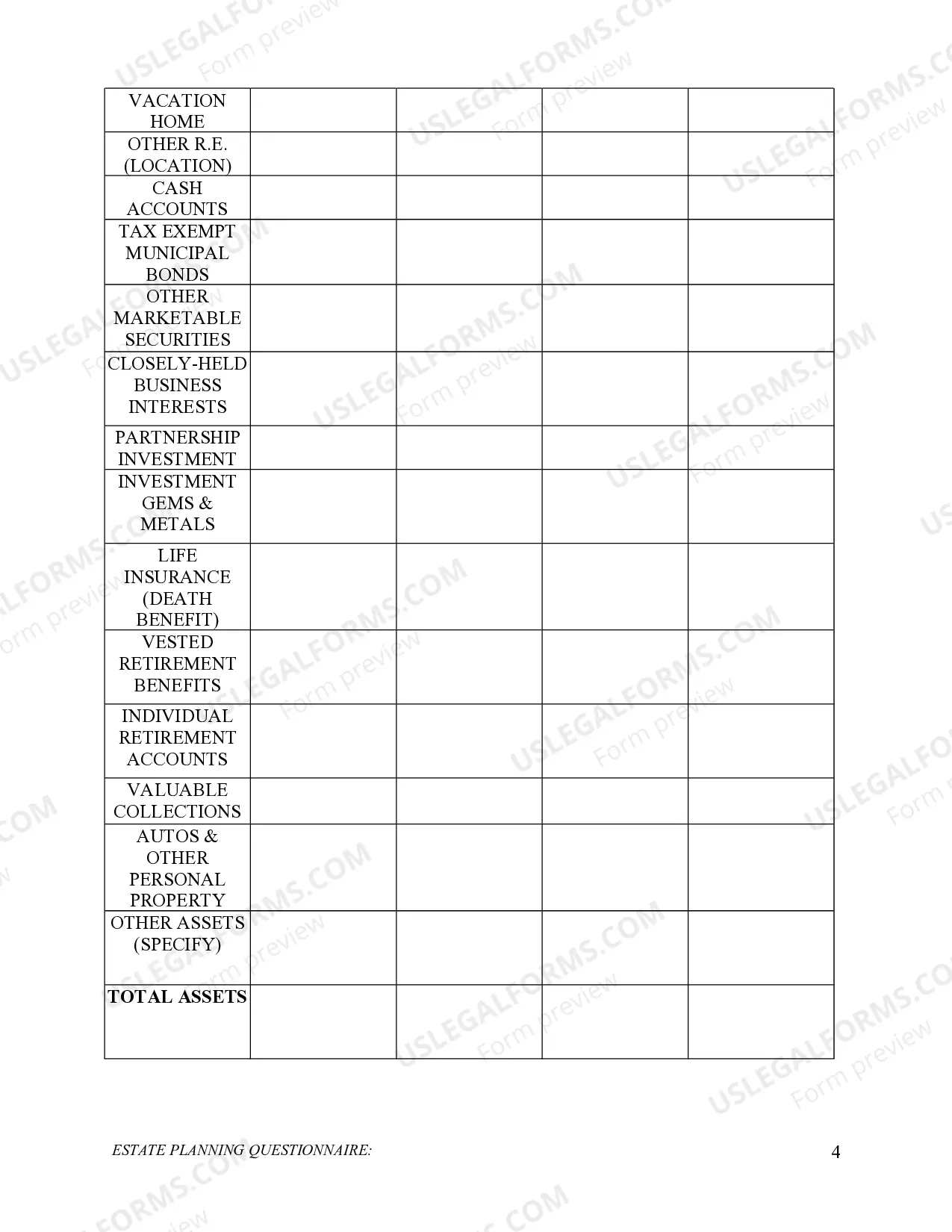

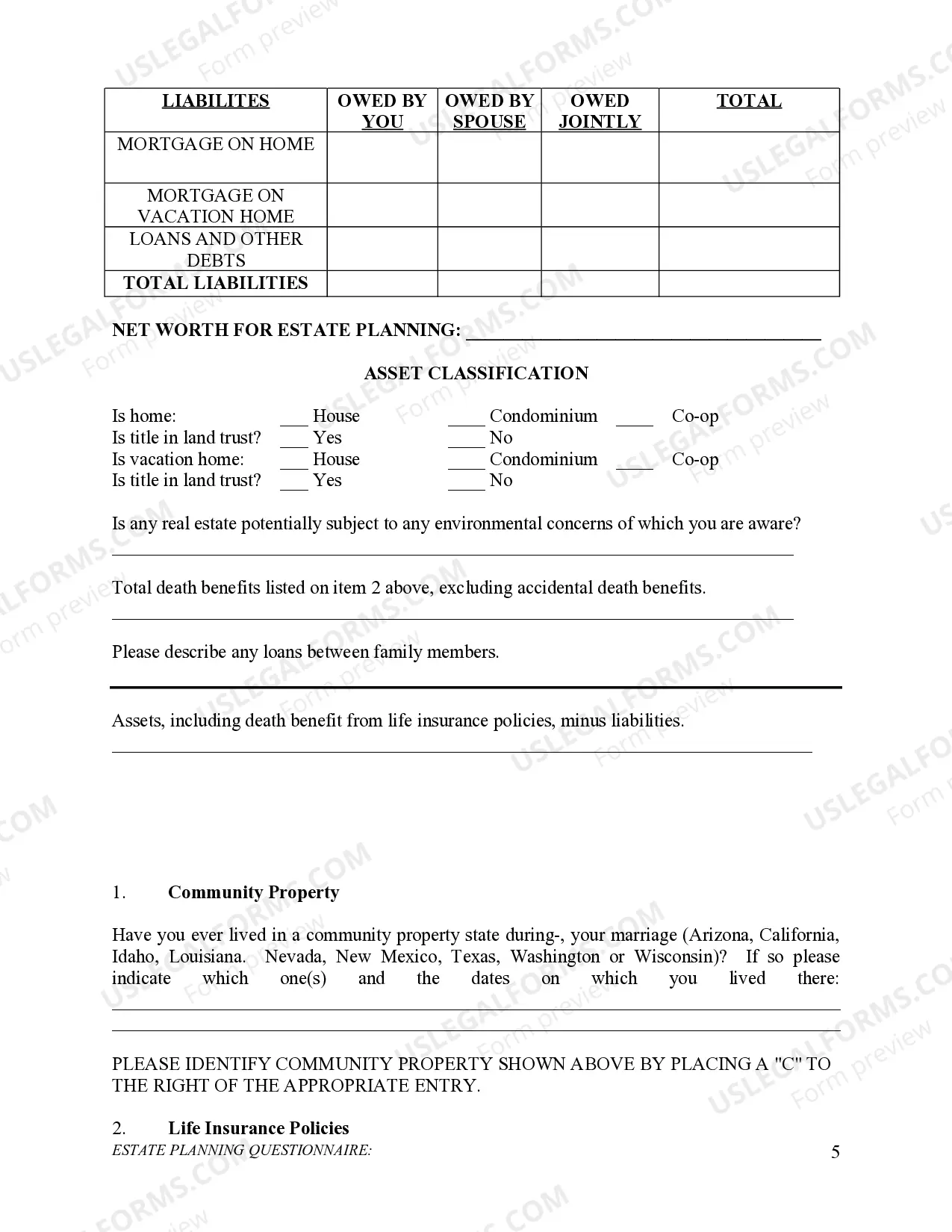

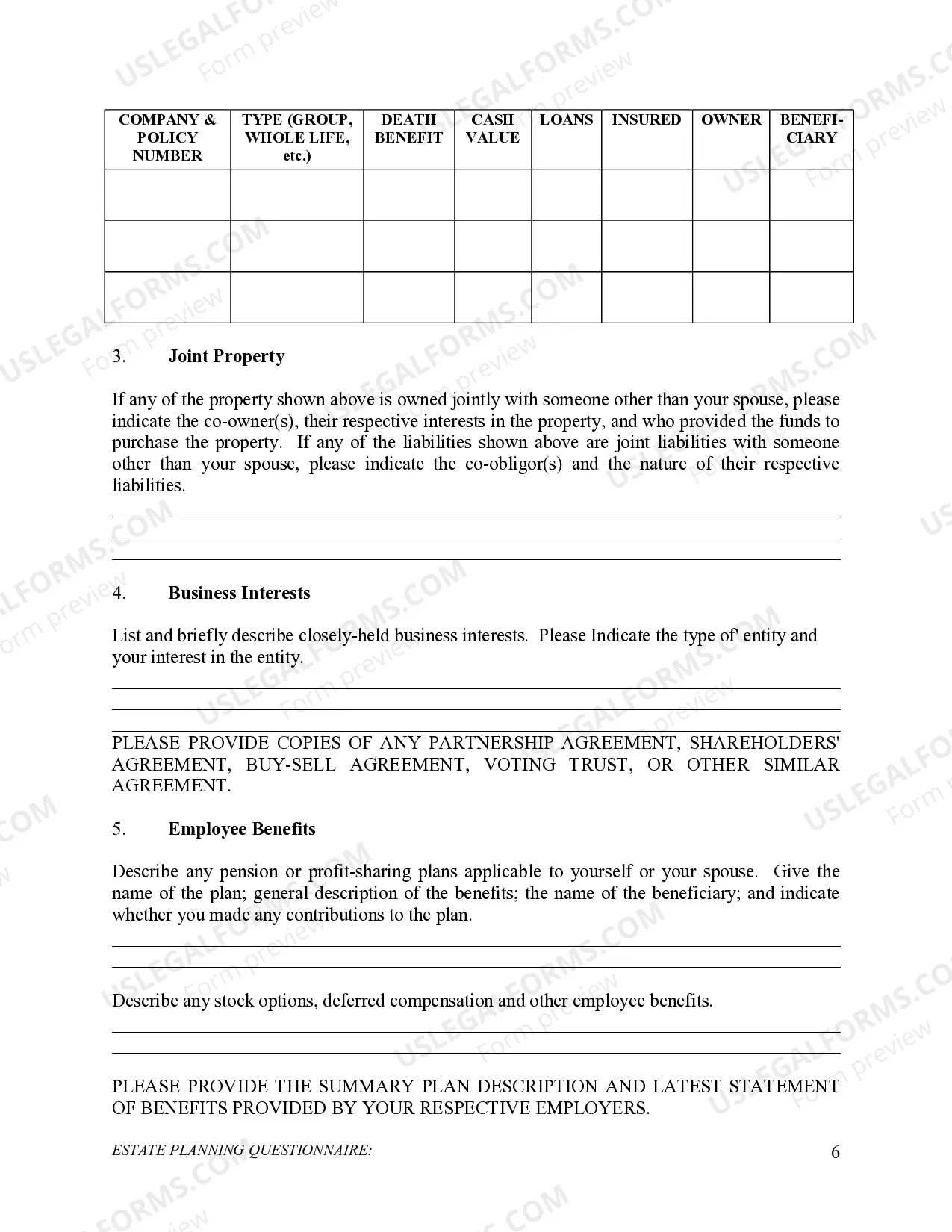

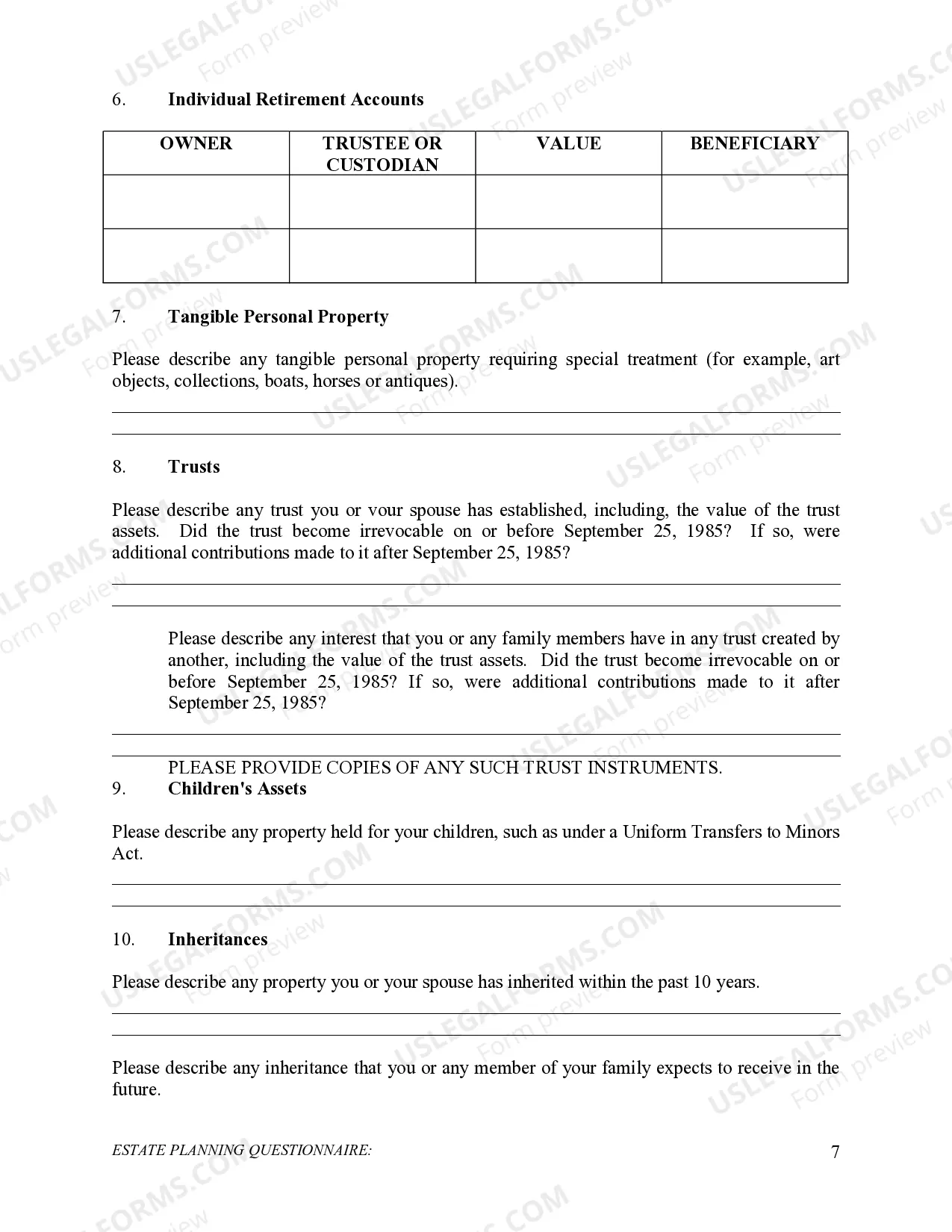

- Financial Information: Gathers data about assets and liabilities to evaluate net worth.

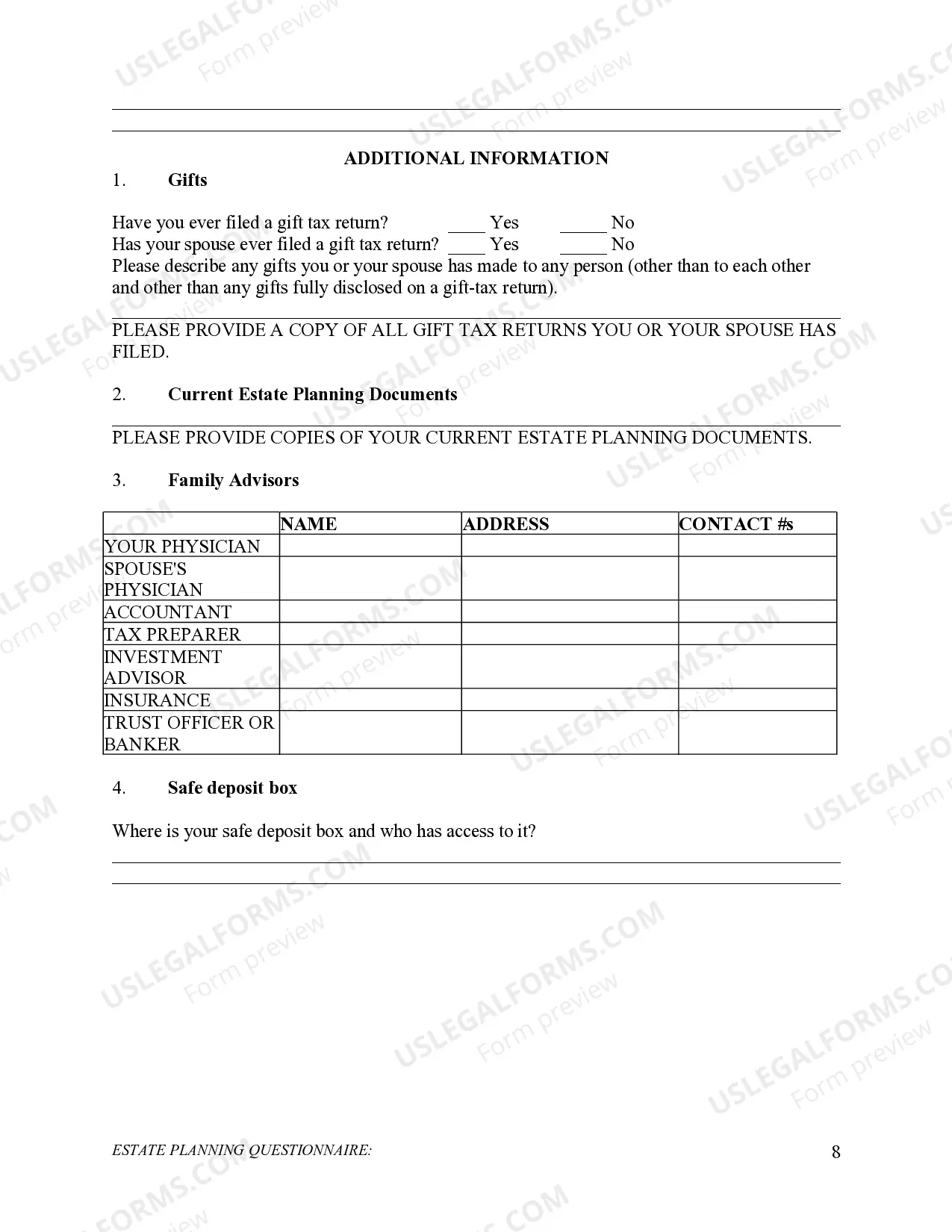

- Estate Planning Documents: Requests existing estate plans for review.

When to use this document

This form is ideal to complete prior to your meeting with an attorney or estate planner. It helps you organize your personal and financial information efficiently, ensuring that you can provide a clear picture of your estate planning needs. Using the questionnaire ultimately facilitates a more productive consultation by allowing professionals to tailor advice based on comprehensive information.

Who can use this document

- Individuals seeking to establish or update their estate plan.

- Married couples considering joint or separate estate planning.

- Parents wanting to outline plans for their children and beneficiaries.

- Any person needing clarity regarding their assets and liabilities in relation to estate planning.

Instructions for completing this form

- Begin by entering the date at the top of the form.

- Fill in your personal information, including full name, contact details, and occupation.

- Provide details about your marital history and any previous spouses.

- List all family members and potential beneficiaries with their respective relationships to you.

- Detail your assets and liabilities in the sections provided to assess your complete financial picture.

- Include any existing estate planning documents for review, if applicable.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Leaving sections incomplete, which may lead to delays in the planning process.

- Providing incorrect or outdated financial information.

- Overlooking to mention prior marriages or relevant agreements.

- Failing to include all beneficiaries, which can result in unintended exclusions.

Advantages of online completion

- Convenience of filling out the form at your own pace from anywhere.

- Editability to easily make adjustments as your personal situation changes.

- Reliable templates drafted by licensed attorneys ensure the legality and accuracy of the information being collected.

Looking for another form?

Form popularity

FAQ

Ways to Reduce or Eliminate the Illinois estate tax: Use advanced gift and estate planning techniques. Life insurance planning. Assets left to a surviving spouse or civil union partner are exempt from the Illinois estate tax. Assets left to charity are exempt from the Illinois estate tax.

Illinois is one of only 12 states to still impose an estate tax. Six other states impose an inheritance tax on assets transferred from a deceased person's estate.

Estate taxes should be paid within nine months after the death of the loved one. What about Illinois Estate Tax? Estates valued under $4 million do not need to file estate taxes in Illinois. For estates over $4 million, the tax rate is graduated with the upper level ($10.04 million and up) at 16 percent.

If a person dies without a will, the person died intestate. The person who died is called the decedent. The decedent's property is given to the decedent's heirs during a probate court case.If the person had no spouse or children, then their property goes to their next closest surviving relatives.

Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing.If there are no children, the surviving spouse often receives all the property.

The Illinois estate tax rate is graduated and goes up to 16%. It is applied on estates worth more than $4 million.

An inheritance tax is imposed on someone who actually receives an inheritance. But there's no federal or Illinois tax on inheritances. Some states do have inheritance taxes, but not Illinois. Illinoisans who inherit money or property, or receive it as a gift, are not taxed.

But there's no federal or Illinois tax on inheritances.Illinoisans who inherit money or property, or receive it as a gift, are not taxed.

Illinois Estate Tax Exemptions and RatesIllinois' estate tax exemption will remain at $4,000,000 in 2021 with no adjustments for inflation. Like many states, their highest maximum estate tax is 16% and they do not offer portability for spouses.