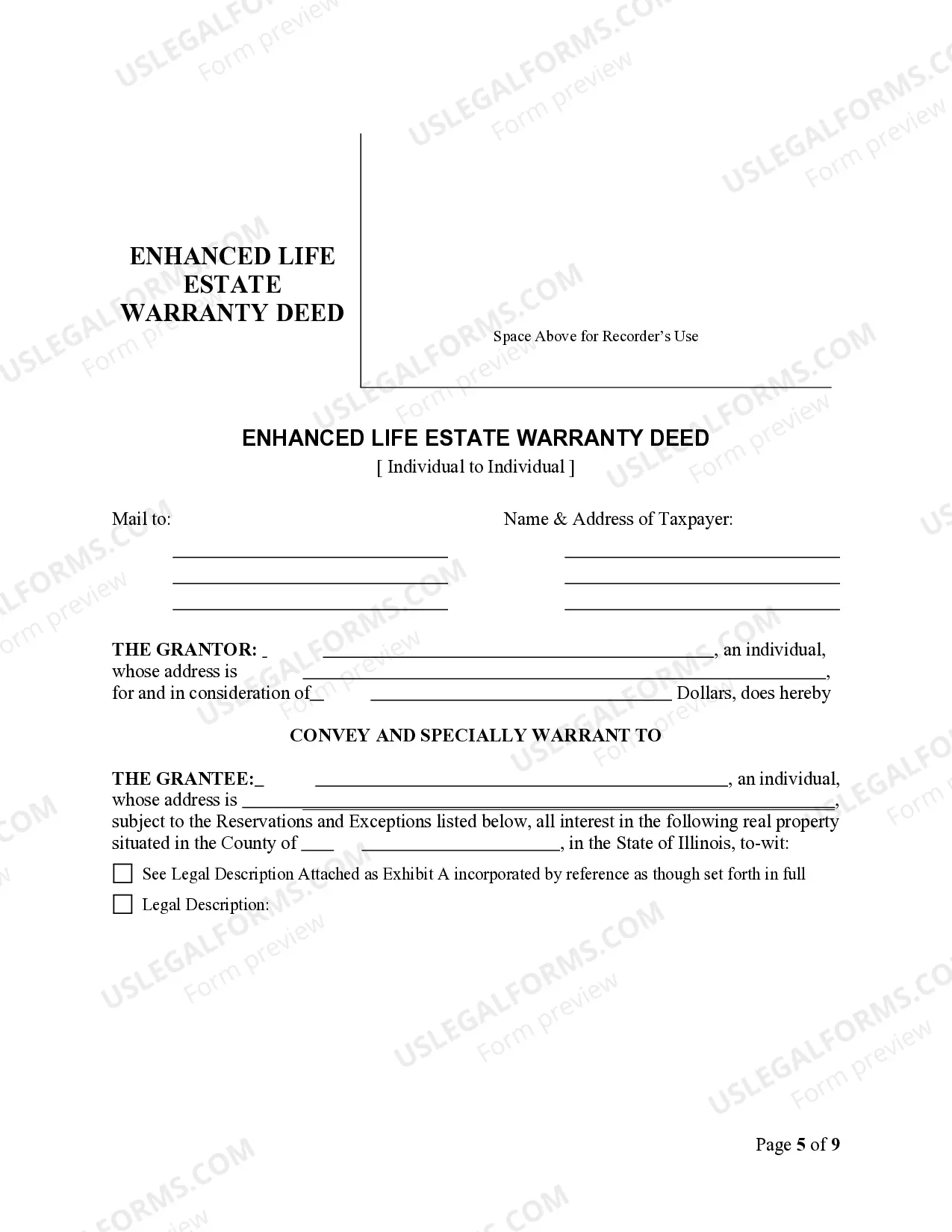

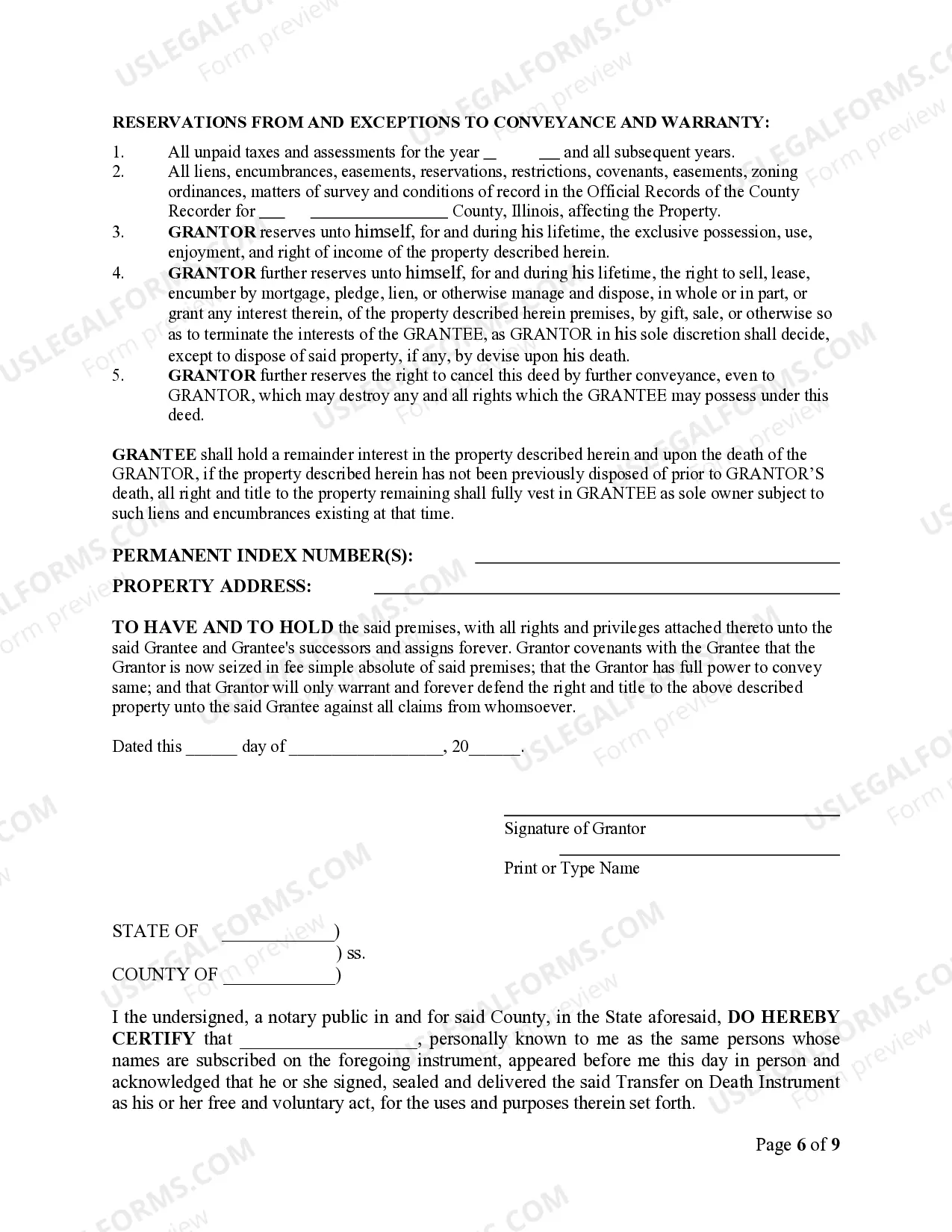

This form is a Warranty Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. This form is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Illinois Lady Bird or Enhanced Life Estate Deed - Individual to Individual

Description

Key Concepts & Definitions

A Lady Bird deed or enhanced life estate deed is a legal instrument used in estate planning to pass real estate property to heirs without the need for probate. It allows the original owner to retain control over the property during their lifetime, including the right to sell or mortgage the property, and automatically transfers ownership upon their death. This deed is recognized in select states within the United States, making it a strategic tool for financial planning particularly in managing potential Medicaid implications for long-term care such as in nursing homes.

Step-by-Step Guide

- Determine Eligibility: Confirm if your state recognizes Lady Bird deeds as valid legal instruments for estate planning.

- Consult an Estate Planner: Work with a knowledgeable estate planner or attorney to ensure all legal nuances, including impacts on Medicaid eligibility and tax implications, are properly addressed.

- Prepare the Deed: The deed must include specific language to establish an enhanced life estate, naming beneficiaries clearly.

- Execute the Deed: Sign the deed in the presence of a notary to ensure its legality and enforceability.

- Record the Deed: File the deed with the local county office to record the document officially, which is crucial for the transfer mechanism to work upon the grantor's death.

Risk Analysis

- Medicaid Eligibility: Although a Lady Bird deed can help avoid probate, improper structuring may affect Medicaid eligibility. It's crucial to use a Medicaid trust or other mechanisms advised by a financial planner specializing in elder care.

- Property Control Risks: The granter retains control over the property, which could lead to financial decisions that might not align with the future beneficiaries' best interests.

- Legal Changes: Law changes can affect the validity of a Lady Bird deed, possibly impacting the intended estate planning.

Pros & Cons

- Pros:

- Avoids probate thus saving time and money.

- Retains control over the property throughout the owner's lifetime.

- Can be easily revoked or modified by the owner.

- Cons:

- Not available in all states, limiting its applicability.

- Might complicate signing up for Medicaid if not properly structured.

- Potential for misuse by the owner since control is retained.

Best Practices

When using a Lady Bird or enhanced life estate deed:

- Always consult with a real estate or estate planning attorney to tailor the deed to your specific situation.

- Consider the impact of the deed on financial planning elements such as credit cards, online loans, and tax calculations.

- Annually review the deed and overall estate plan with your attorney to adapt to any changes in laws or financial circumstances.

Common Mistakes & How to Avoid Them

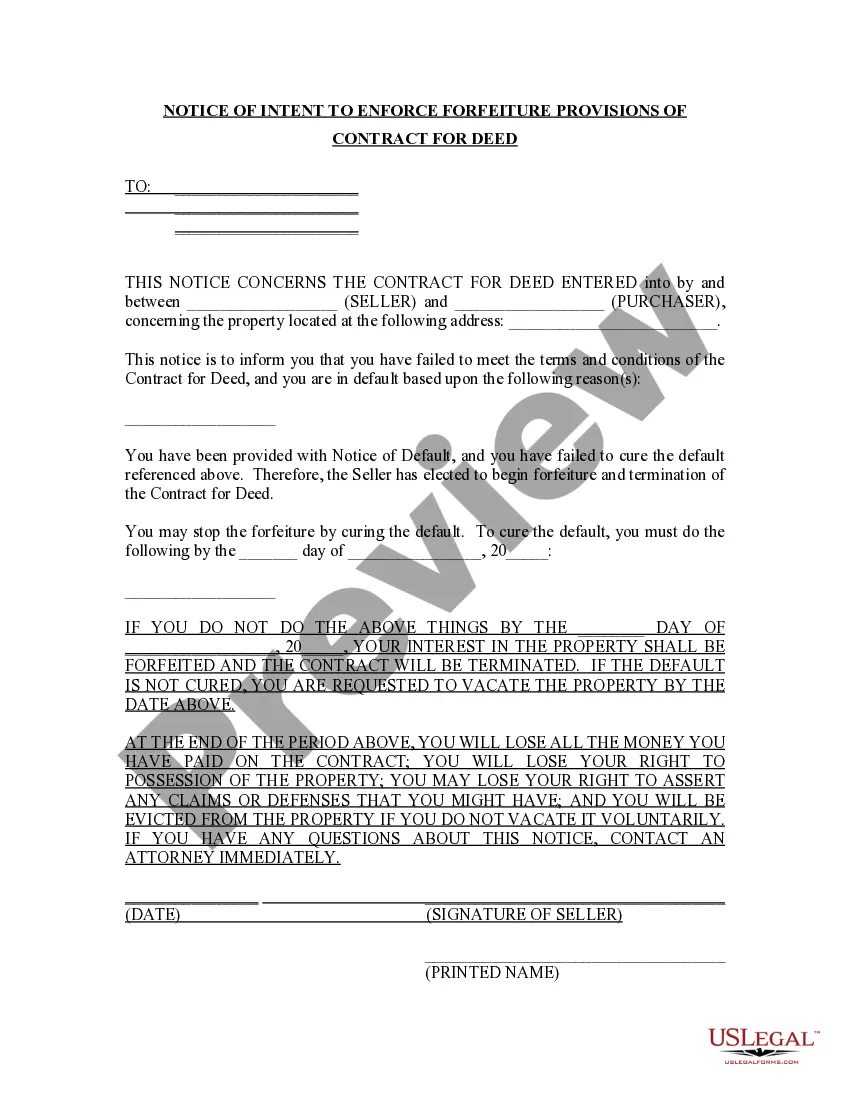

- Failing to Record the Deed: To ensure the deed is effective, it must be properly recorded with the appropriate government body. Not recording can result in legal complications after the grantor's death.

- Ignoring Tax Implications: Consult with a tax advisor to understand potential liabilities involving estate and gift taxes, even with an enhanced life estate deed in place.

- Lack of Regular Reviews: Laws and personal circumstances change; hence, reviewing the deed and broader estate strategy periodically is crucial.

How to fill out Illinois Lady Bird Or Enhanced Life Estate Deed - Individual To Individual?

Looking for Illinois Lady Bird or Enhanced Life Estate Deed - Individual to Individual templates and completing them could be a hurdle.

To conserve significant time, expenses, and effort, utilize US Legal Forms and select the appropriate example specifically for your state within just a few clicks.

Our attorneys prepare all documents, so you merely have to fill them out. It really is that straightforward.

Select your plan on the pricing page and create an account. Decide whether to pay by card or PayPal. Save the document in your preferred file type. You can print the Illinois Lady Bird or Enhanced Life Estate Deed - Individual to Individual form or fill it out using any online editor. There’s no need to worry about typographical errors because your template can be used, submitted, and printed as many times as you desire. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and revisit the form's page to download the template.

- All your stored templates are located in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you will need to sign up.

- Review our comprehensive instructions on how to obtain your Illinois Lady Bird or Enhanced Life Estate Deed - Individual to Individual form quickly.

- To get an authorized template, verify its applicability for your state.

- Examine the example using the Preview feature (if available).

- If there's a description, read through it to understand the key details.

- Click Buy Now if you have found what you are seeking.

Form popularity

FAQ

The answer is yes. Parties to a transaction are always free to prepare their own deeds. If you do so, be sure your deed measures up to your state's legal regulations, to help avert any legal challenge to the deed later. Some deeds require more expertise than others.

The date the deed was made; The name of the party granting the life estate and their address; The name of the grantee and their address; The address and a legal description of the property that is subject to the life estate;

Avoid probate of the property. keep the right to use and profit from the property for your lifetime. keep the right to sell the property at any time. avoid making a gift that might be subject to federal gift tax. avoid jeopardizing your eligibility for Medicaid.

This right to rescind is what distinguishes a Lady Bird Deed from a standard Life Estate Deed.A properly written, signed and filed Enhanced Life Estate Deed does supersede the terms of the owner's Will, so long as the grantor has not exercised the retained right to reclaim ownership while living.

It only applies to residential properties and must be promptly recorded after it is notarized. This document is exempt from documentary transfer tax under Rev. & Tax. Code §11930.

While you can draft a Ladybird Deed on your own, it is always best to have something like this done by an experienced attorney. These are documents that need to be done correctly, or it can create additional issues for your loved ones.

A Lady Bird deed avoids probate, so the home is not part of the probate estate and Medicaid cannot go after it.