Idaho How to Request a Home Affordable Modification Guide

Description

How to fill out How To Request A Home Affordable Modification Guide?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Idaho How to Request a Home Affordable Modification Guide in moments.

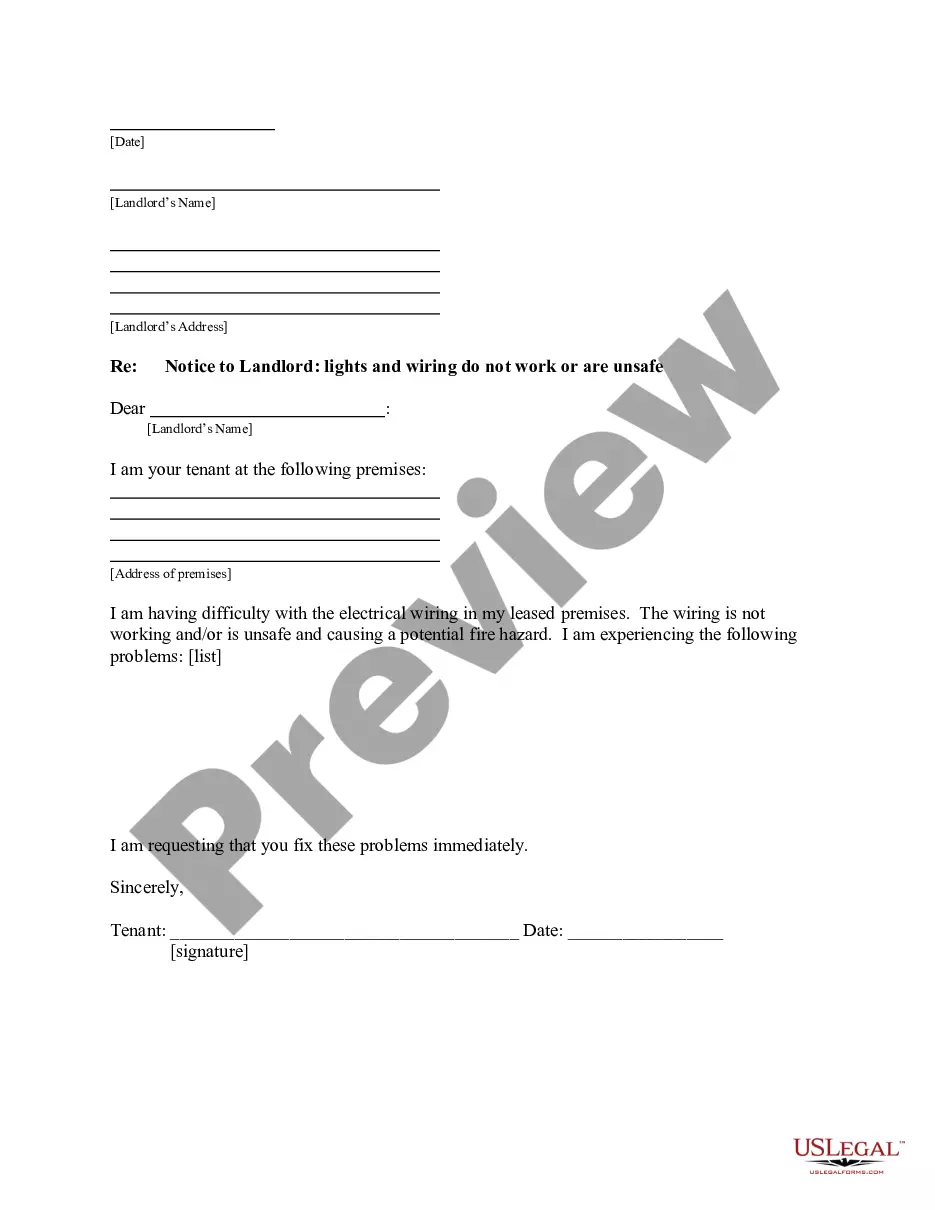

Click the Preview button to review the form's content. Read the form description to confirm you have chosen the correct one.

If the form does not meet your needs, utilize the Search area at the top of the screen to find one that does.

- If you already hold a subscription, Log In to access the Idaho How to Request a Home Affordable Modification Guide from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can find all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are easy steps to get started.

- Ensure you have selected the appropriate form for your locality.

Form popularity

FAQ

The Virginia Mortgage Relief Program is designed for homeowners facing financial difficulties due to circumstances like job loss or medical expenses. To qualify, applicants must meet specific income requirements and demonstrate a need for assistance. While this program specifically addresses Virginia, our Idaho How to Request a Home Affordable Modification Guide can help you identify similar options in your state, ensuring you find the right support tailored to your needs.

The Home Affordable Modification Program, often referred to as HAMP, aims to assist homeowners in reducing their mortgage payments to avoid foreclosure. This program provides options to modify loans, making them more affordable based on your current financial situation. By using our Idaho How to Request a Home Affordable Modification Guide, you can easily navigate the process and understand how to apply for benefits that may help you maintain your home.

The HAF program, or Homeowner Assistance Fund, is a resource designed to support homeowners in Idaho who are struggling with their mortgage payments. This program provides financial assistance to help homeowners avoid foreclosure. For detailed information on applying for help, refer to the Idaho How to Request a Home Affordable Modification Guide, which offers insights about available resources like HAF.

Securing a mortgage modification can present some challenges but is generally feasible for qualified homeowners. It often depends on your lender's policies and your ability to provide required documentation. By using the Idaho How to Request a Home Affordable Modification Guide, you can increase your chances of success and navigate the process with greater ease.

Applying for a mortgage modification involves several steps, starting with gathering your financial documents. You'll need to fill out the necessary forms, which can often be found on the lender's website or through platforms like UsLegalForms. Follow the processes detailed in the Idaho How to Request a Home Affordable Modification Guide for a smoother application experience.

The Home Affordable Modification Program is a government initiative that assists homeowners in modifying their mortgage terms. This program aims to lower monthly payments and make homeownership more sustainable. By understanding this program, you can better navigate the process outlined in the Idaho How to Request a Home Affordable Modification Guide. It serves as a lifeline for many struggling homeowners.

HAMP stands for the Home Affordable Modification Program. It was designed to help homeowners facing financial difficulties by modifying their mortgage loans to make them more affordable. The program aimed to prevent foreclosure while allowing homeowners to remain in their homes. Understanding HAMP is essential when you explore the Idaho How to Request a Home Affordable Modification Guide.