Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

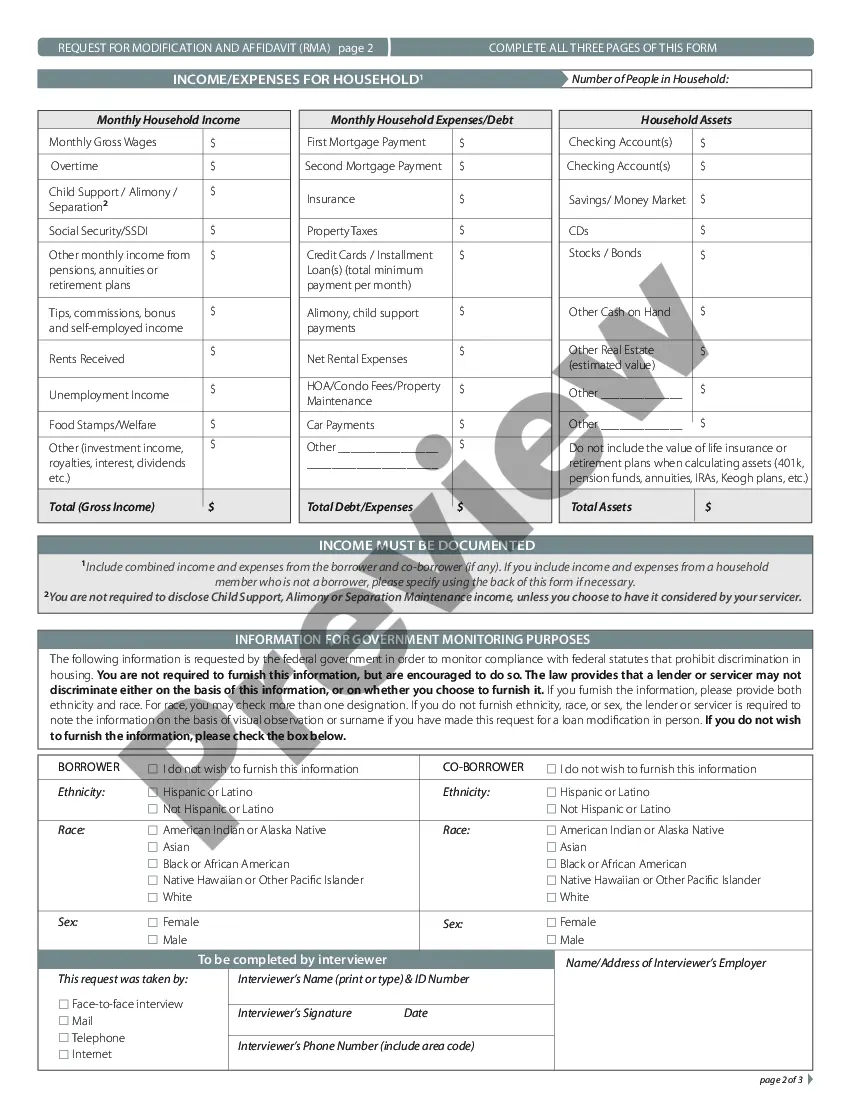

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

Selecting the appropriate genuine document template can be quite challenging.

Of course, there are numerous templates accessible online, but how do you find the authentic form you require.

Utilize the US Legal Forms site. This service provides thousands of templates, including the Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, which can be used for both business and personal purposes.

You can preview the form using the Preview button and review the form details to confirm it is the right one for you.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to get the Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- Use your account to search for the legitimate forms you may have purchased previously.

- Visit the My documents tab of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your area/state.

Form popularity

FAQ

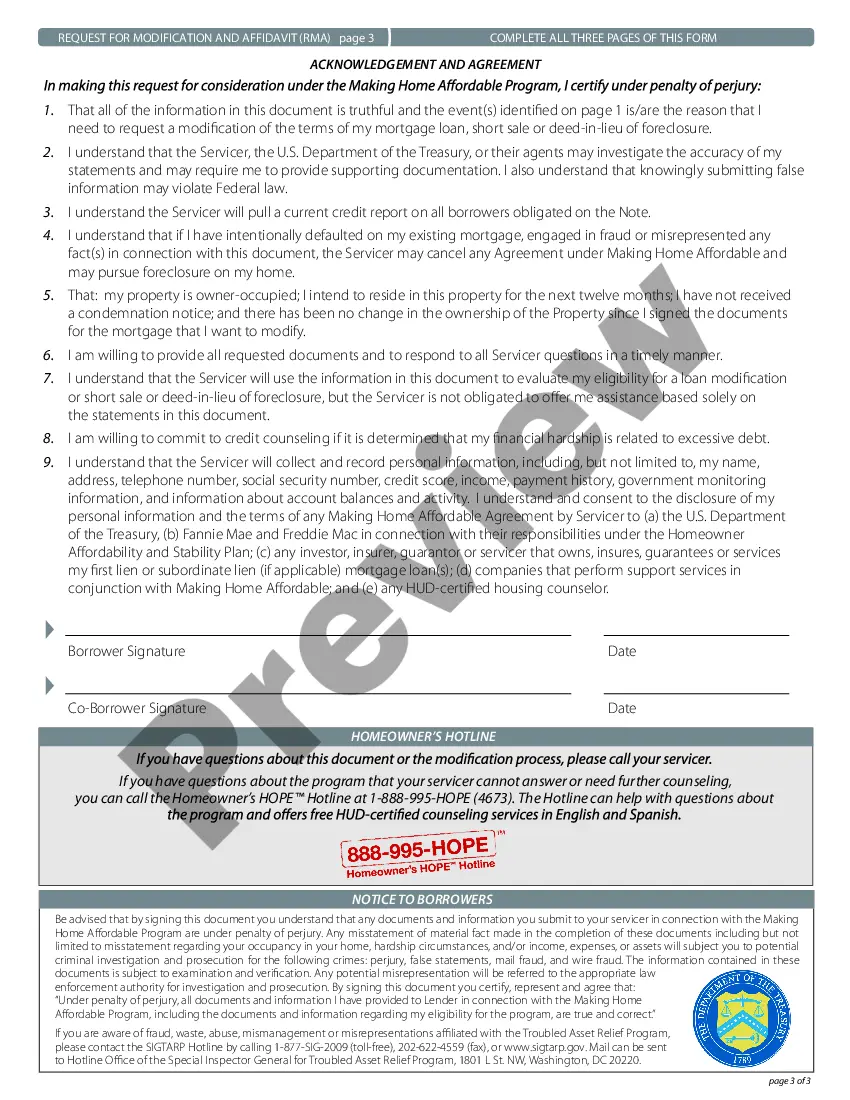

A loan modification request is a formal application a borrower submits to their lender, seeking changes to the terms of their existing mortgage. In the context of the Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, this request typically aims to make mortgage payments more affordable for homeowners facing financial hardship. By modifying loan terms like interest rates or repayment periods, borrowers can potentially avoid foreclosure and keep their homes. Utilizing platforms like UsLegalForms can streamline the process, guiding you through the necessary documentation and requirements for a successful loan modification.

Yes, HAMP modifications are still available for eligible homeowners seeking to adjust their mortgage payments. The program continues to provide necessary modifications, helping families stay in their homes during tough financial times. If you are interested in the Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, consider using resources like USLegalForms to guide you through the application process effectively.

Yes, Congress passed the Home Affordable Modification Program (HAMP) as part of the Emergency Economic Stabilization Act. This program aimed to help homeowners facing financial difficulties by offering affordable loan modification options. As you navigate the Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, it is crucial to understand this program's essential role in providing necessary relief to distressed homeowners across the country.

Obtaining approval for a loan modification can vary based on individual circumstances, but it is achievable with the right preparation. Generally, if you provide clear documentation of your financial situation and follow the process accurately, your chances improve significantly. The Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP offers numerous homeowners relief. By leveraging tools from uslegalforms, you can enhance your understanding and presentation of your case, improving the likelihood of approval.

The HAMP loan modification program is a federal initiative designed to help homeowners who are struggling to make their mortgage payments. This program aims to lower monthly payments, making it easier for homeowners to keep their homes. When you utilize the Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you can access these benefits through a streamlined process. By using platforms like uslegalforms, you can navigate HAMP and ensure you meet all criteria for assistance.

To qualify for a loan modification, you must typically demonstrate financial hardship, such as a loss of income or unexpected expenses. Lenders will also consider your ability to make future payments under the modified terms. The Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP outlines eligibility criteria, and uslegalforms can assist you in determining your qualifications and completing the necessary forms.

Applying for a loan modification involves several steps. You need to contact your lender to understand their specific process and requirements, which generally include submitting a loan modification application. The Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is a key part of your application. Using uslegalforms can provide guidance and help you prepare all necessary documentation for your application.

To request a mature modification on your loan, first gather the necessary documents, such as proof of income and any financial hardship statements. Then, complete the Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP application form. Submitting your request through the uslegalforms platform can simplify the process and ensure that you meet all requirements for a successful submission.

A HAMP loan modification adjusts the terms of your mortgage under specific guidelines set by the Home Affordable Modification Program. It aims to help you keep your home and avoid foreclosure. Through the Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you may benefit from lower payments or other restructuring options tailored to your financial situation.

As of now, the Home Affordable Modification Program (HAMP) has officially ended; however, newer programs are replacing it to assist homeowners. Alternatives may still be available for those seeking options similar to the Idaho Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. It’s best to consult with your lender or a service like US Legal Forms to find current modification programs.