Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

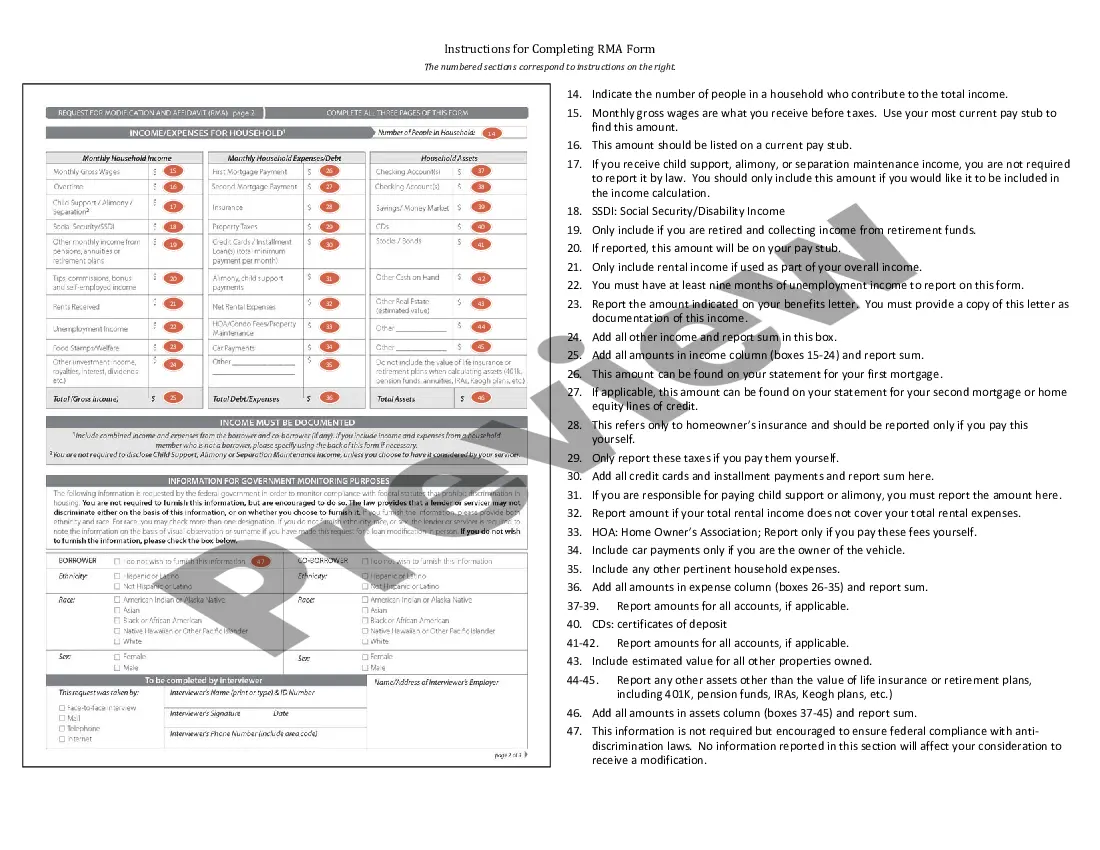

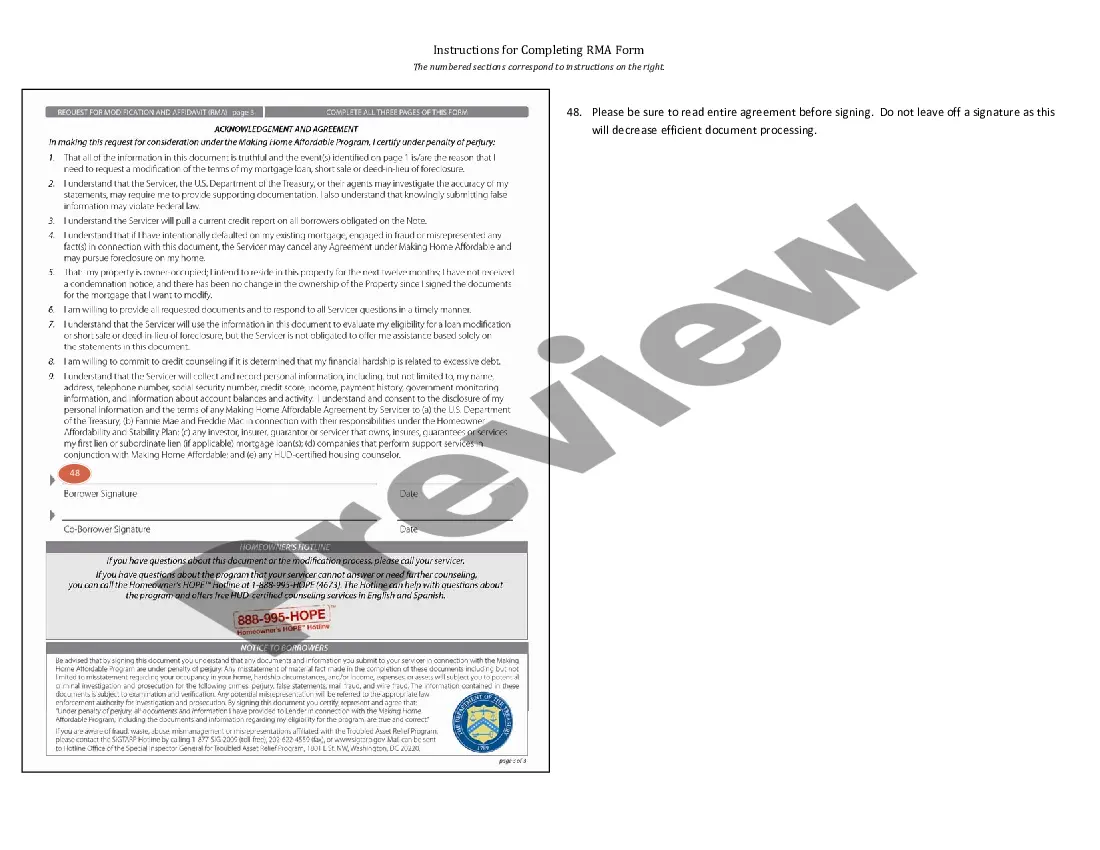

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Have you ever found yourself in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legitimate document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms provides a vast array of template forms, including the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form, which are tailored to comply with federal and state regulations.

When you find the correct form, click Get now.

Select the payment plan you need, fill in the required information to set up your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Following that, you can download the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is applicable to the correct city/region.

- Utilize the Review button to inspect the form.

- Read the description to make sure you have selected the appropriate form.

- If the form does not meet your needs, use the Research field to find the form that fits your requirements.

Form popularity

FAQ

Section 45 1506C in Idaho pertains to regulations regarding mortgage modifications for homeowners experiencing hardship. This section outlines the rights and processes that borrowers must follow to receive assistance. By understanding the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can navigate these guidelines effectively and ensure compliance while seeking help.

The RMA mortgage form is a written document that allows borrowers to apply for assistance with their mortgage payments. This form collects essential information about the homeowner's financial status and reasons for seeking help. Following the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form ensures that you submit an accurate request, enhancing your chances of receiving the support you need from your lender.

The full form of RMA in the context of mortgages is Request for Mortgage Assistance. This form is crucial for homeowners seeking modifications in light of financial hardship. Utilizing the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form guides users through the process, making it easier to approach lenders with a structured request for help.

In real estate, RMA refers to Request for Mortgage Assistance. It is a document that homeowners submit to lenders to request help with their mortgage payments. By using the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form, borrowers can effectively communicate their needs and find potential solutions with their lenders.

A hardship letter is a personal statement that outlines your financial struggles. For effective communication, start by clearly stating your current situation, include reasons for difficulties like job loss or medical issues, and express your desire for a loan modification. When you follow the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form, this letter supports your case for mortgage assistance.

RMA stands for Request for Mortgage Assistance. This form helps homeowners facing financial difficulties in obtaining a loan modification. By completing the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can provide lenders with the necessary information to assess your situation. It's a vital step to pausing foreclosure proceedings while seeking mortgage relief.

The full form of RMA is Request for Loan Modification and Affidavit. This document is essential for homeowners seeking to modify their mortgage loans, especially during financially challenging times. By understanding the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can navigate this process more smoothly. USLegalForms offers detailed guidance and templates to help you complete this vital paperwork efficiently.

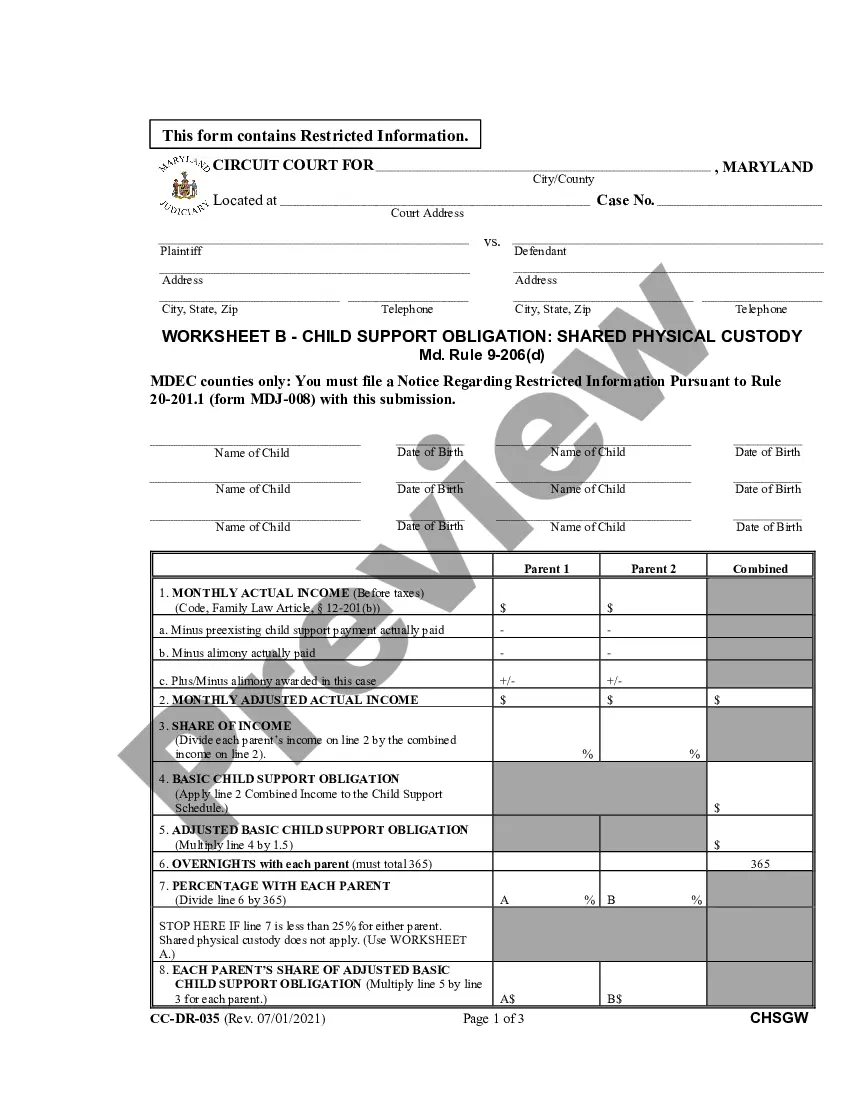

To modify child support in Idaho, you must submit an application for a modification through the appropriate court. Begin the process by completing the required forms, which can be found on the Idaho judiciary website. It's often advisable to seek legal guidance to ensure you meet all criteria and understand the Idaho Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Utilizing platforms like USLegalForms can simplify this process, providing the necessary forms and instructions to help you succeed.