Mississippi Compensation Agreement

Description

How to fill out Compensation Agreement?

Are you within a placement the place you need documents for either business or individual reasons nearly every day? There are a variety of authorized record web templates accessible on the Internet, but locating types you can depend on is not straightforward. US Legal Forms delivers thousands of type web templates, much like the Mississippi Compensation Agreement, that happen to be written to satisfy state and federal needs.

If you are already informed about US Legal Forms web site and possess your account, simply log in. Afterward, you can obtain the Mississippi Compensation Agreement web template.

Should you not come with an bank account and want to begin using US Legal Forms, follow these steps:

- Obtain the type you need and make sure it is for that correct metropolis/county.

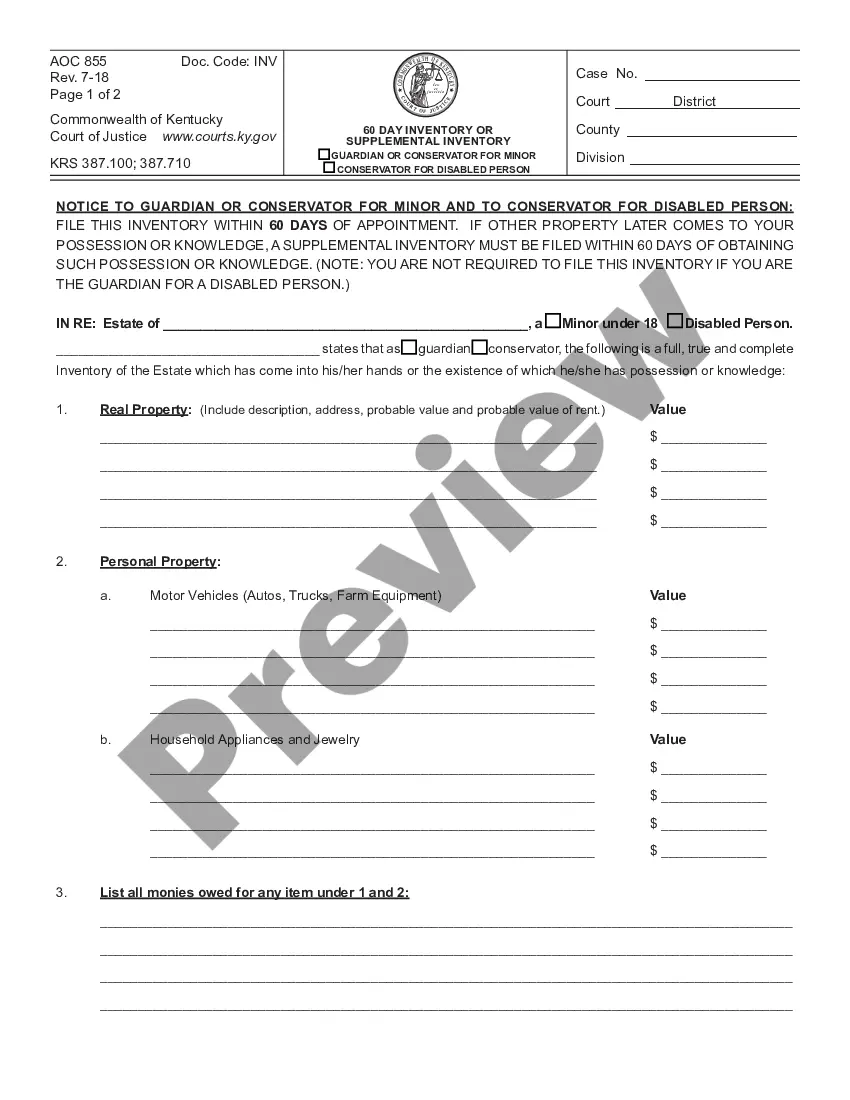

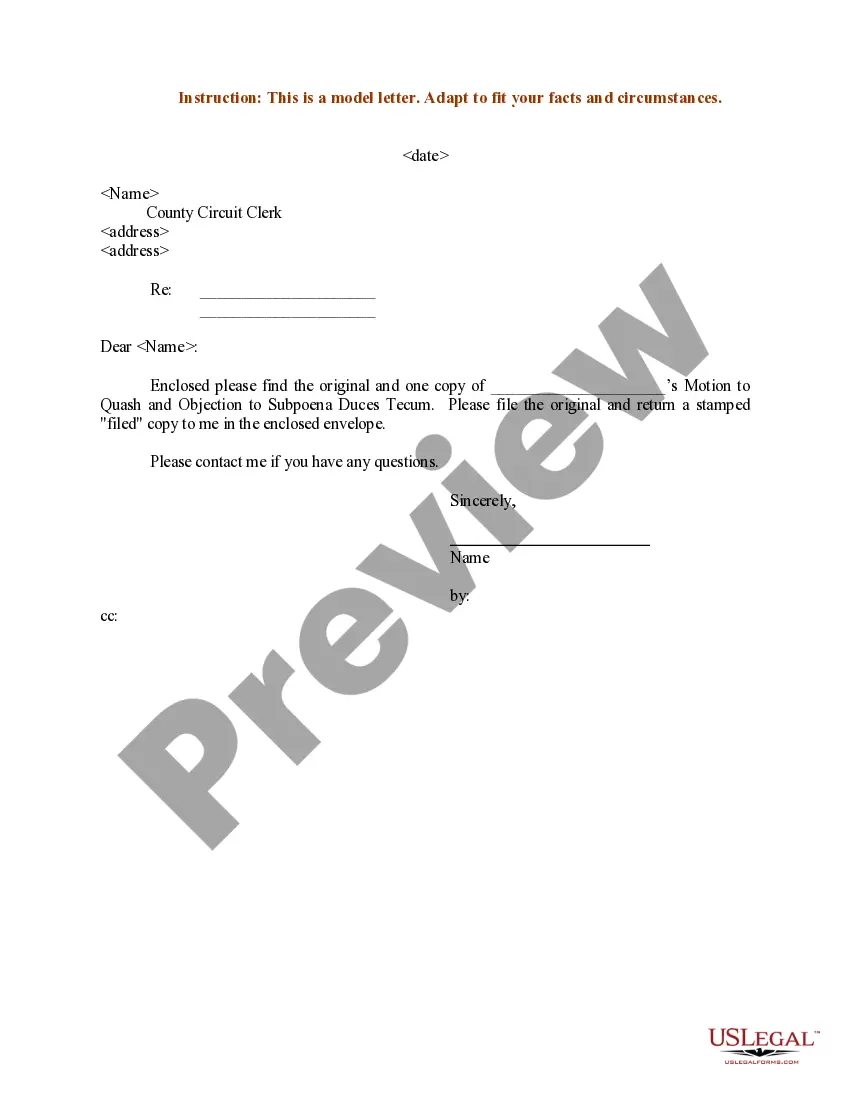

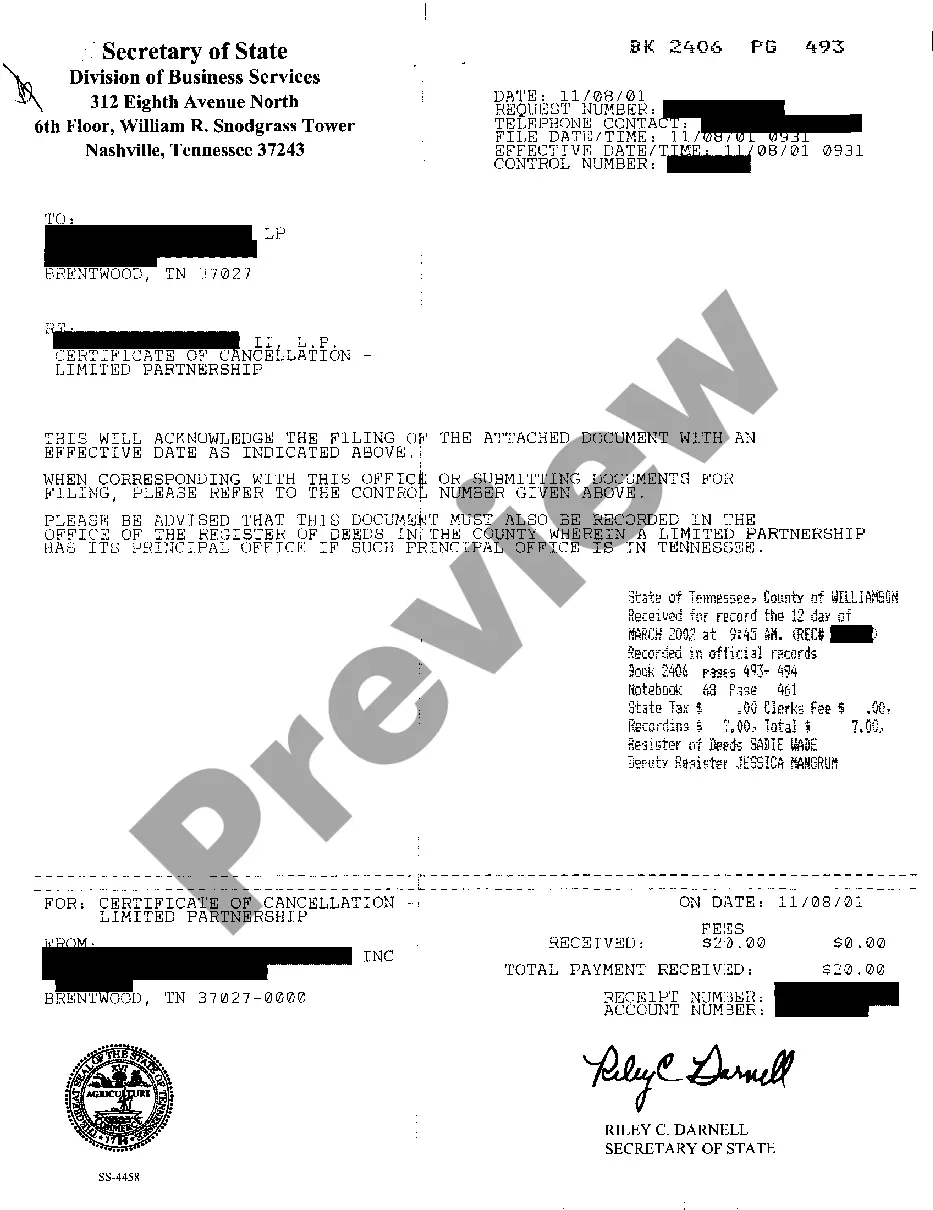

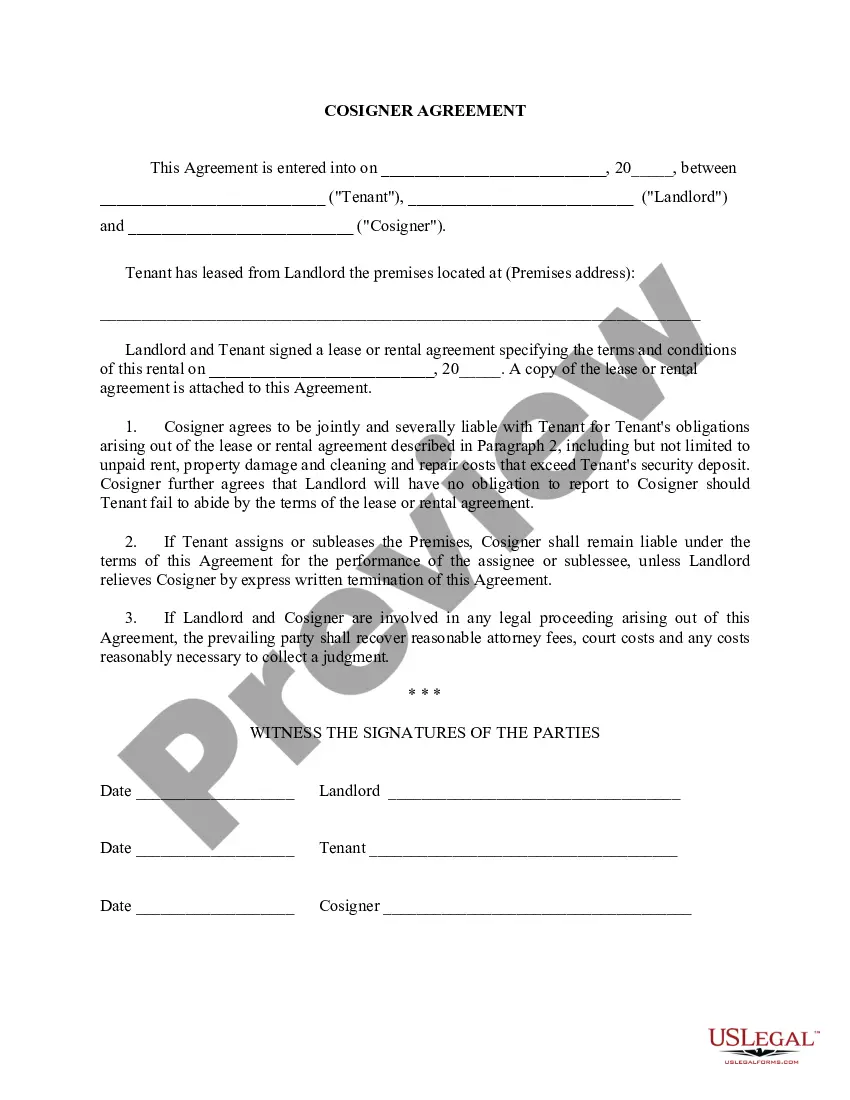

- Utilize the Review switch to review the shape.

- Browse the explanation to actually have selected the proper type.

- If the type is not what you`re trying to find, make use of the Look for area to discover the type that fits your needs and needs.

- If you obtain the correct type, simply click Buy now.

- Select the prices program you would like, fill in the specified details to create your bank account, and pay for the transaction utilizing your PayPal or bank card.

- Choose a convenient paper structure and obtain your backup.

Get each of the record web templates you may have bought in the My Forms food selection. You may get a further backup of Mississippi Compensation Agreement at any time, if required. Just go through the essential type to obtain or print the record web template.

Use US Legal Forms, by far the most considerable selection of authorized varieties, to conserve time and prevent faults. The assistance delivers appropriately created authorized record web templates that you can use for a range of reasons. Generate your account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

Who Must File. You must file a return if you are a nonresident alien engaged or considered to be engaged in a trade or business in the United States during the year.

If you have income earned from working in a state, you will generally have to report that income and pay taxes on it regardless of whether you are a resident.

Employees in Mississippi can receive wage loss benefits equal to as much as two-thirds of their average weekly wage. Ongoing care, such as physical therapy, if your employee suffers a severe injury with a longer recovery. Funeral expenses if an employee dies in a job-related incident. Mississippi Workers' Compensation - The Hartford thehartford.com ? workers-compensation thehartford.com ? workers-compensation

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income). RESIDENT, NON-RESIDENT AND PART-YEAR RESIDENT INCOME ... ms.gov ? sites ? files ? Forms ? Individual ms.gov ? sites ? files ? Forms ? Individual

66-2/3% COMPENSATION BENEFITS The compensation rate is 66-2/3% of the AWW, subject to statutory minimum and maximum amounts, and is based on a 5-day work week. Compensation begins on the 6th day after disability. If disability continues for 14 days, benefits must be paid retroactively, to the first date of disability. Mississippi Workers' Compensation Quick Reference Guide - Speed, Seta speed-seta.com ? resources ? ms_doc1 speed-seta.com ? resources ? ms_doc1

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.

The worker is covered and eligible for benefits as soon as he or she begins employment. There is no waiting period or minimum earnings requirement. WHAT MUST AN INJURED WORKER DO IN THE EVENT OF INJURY? In the event of an injury, you should immediately notify your supervisor or other person designated by your employer. MISSISSIPPI WORKERS' COMPENSATION FACTS ms.gov ? pdf ? WCFacts2013 ms.gov ? pdf ? WCFacts2013

Generally, if Social Security benefits were your only income, your benefits are not taxable and you probably do not need to file a federal income tax return.