Montana Compensation Agreement

Description

How to fill out Compensation Agreement?

Discovering the right legal record template could be a have a problem. Naturally, there are plenty of layouts available on the Internet, but how do you discover the legal type you will need? Use the US Legal Forms web site. The services provides a huge number of layouts, such as the Montana Compensation Agreement, which you can use for enterprise and private needs. All of the types are examined by experts and meet up with federal and state needs.

In case you are already signed up, log in for your bank account and then click the Acquire switch to get the Montana Compensation Agreement. Use your bank account to check from the legal types you possess acquired formerly. Go to the My Forms tab of your own bank account and have one more copy of your record you will need.

In case you are a fresh end user of US Legal Forms, listed here are basic guidelines that you can stick to:

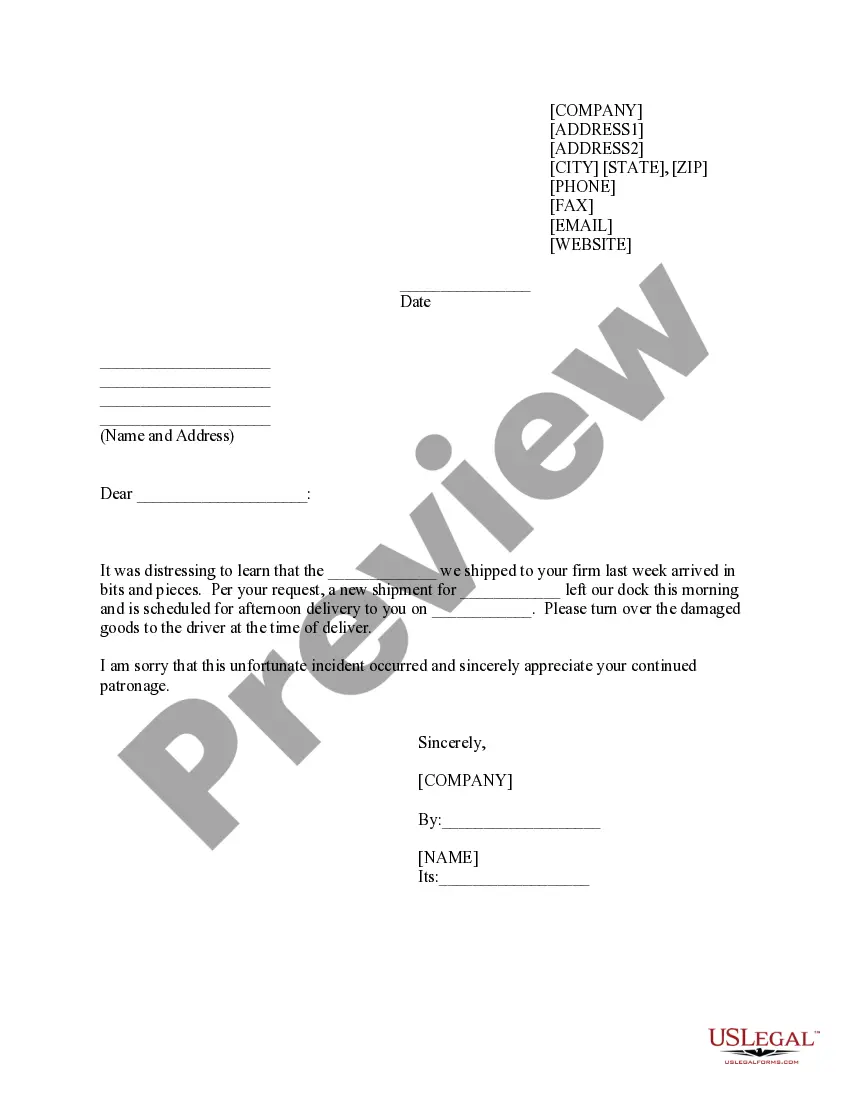

- Very first, make sure you have selected the proper type for your area/region. You are able to look through the shape utilizing the Review switch and study the shape explanation to guarantee this is basically the best for you.

- In the event the type fails to meet up with your needs, use the Seach industry to discover the proper type.

- When you are sure that the shape is proper, click on the Acquire now switch to get the type.

- Pick the rates prepare you desire and enter the needed details. Design your bank account and pay for the order making use of your PayPal bank account or credit card.

- Pick the file file format and obtain the legal record template for your gadget.

- Full, modify and printing and signal the attained Montana Compensation Agreement.

US Legal Forms is definitely the greatest local library of legal types that you can see a variety of record layouts. Use the service to obtain skillfully-created files that stick to express needs.

Form popularity

FAQ

The penalty is measured at the employee's daily rate of pay and is calculated by multiplying the daily wage by the number of days that the employee was not paid, up to a maximum of 30 days.

We recommend reporting the injury online. If you are unable to report online, call us at 800-332-6102 and a Customer Service Specialist will complete the First Report of Injury form with you over the phone.

Montana Labor Laws Guide Montana Labor Laws FAQMontana minimum wage$9.20 per hourMontana overtime laws1.5 times the rate of regular pay after working 40 hours in a workweek ($13.80 per hour for minimum wage workers)Montana break lawsMeal and rest breaks not required by law

Code § 39-2-904(1)(b). Effective October 1, 2023, if not specified by the employer, employees have an automatic probationary period during their first 12 months where an employer may terminate the employee at will, with the broadest discretion when making a decision to discharge a manager and/or supervisor. Mont.

Montana uses the federal FLSA provisions to regulate overtime requirements, as well as exceptions. Generally speaking, FLSA considers all work exceeding 40 hours in a workweek to be considered overtime.

Statute of Limitations -- (§ 39-3-207, MCA) ? An employee has 180 days from the default of the payment to file a wage claim. ? An employee may recover wages and penalties for a period of 2 years, 3 years if willful violation.

In Montana, employers are not required to provide employees with vacation benefits, either paid or unpaid. If an employer chooses to provide such benefits, it must comply with the terms of its employment contract or established policy. Once an employee earns vacation leave, it cannot be forfeited for any reason.

Montana law requires employers to provide a final paycheck to employees who are terminated or laid off within four business days. If an employee quits, the final paycheck is due on the next scheduled payday or within 15 days, whichever comes first, as stated in Montana Code 39-3-205.