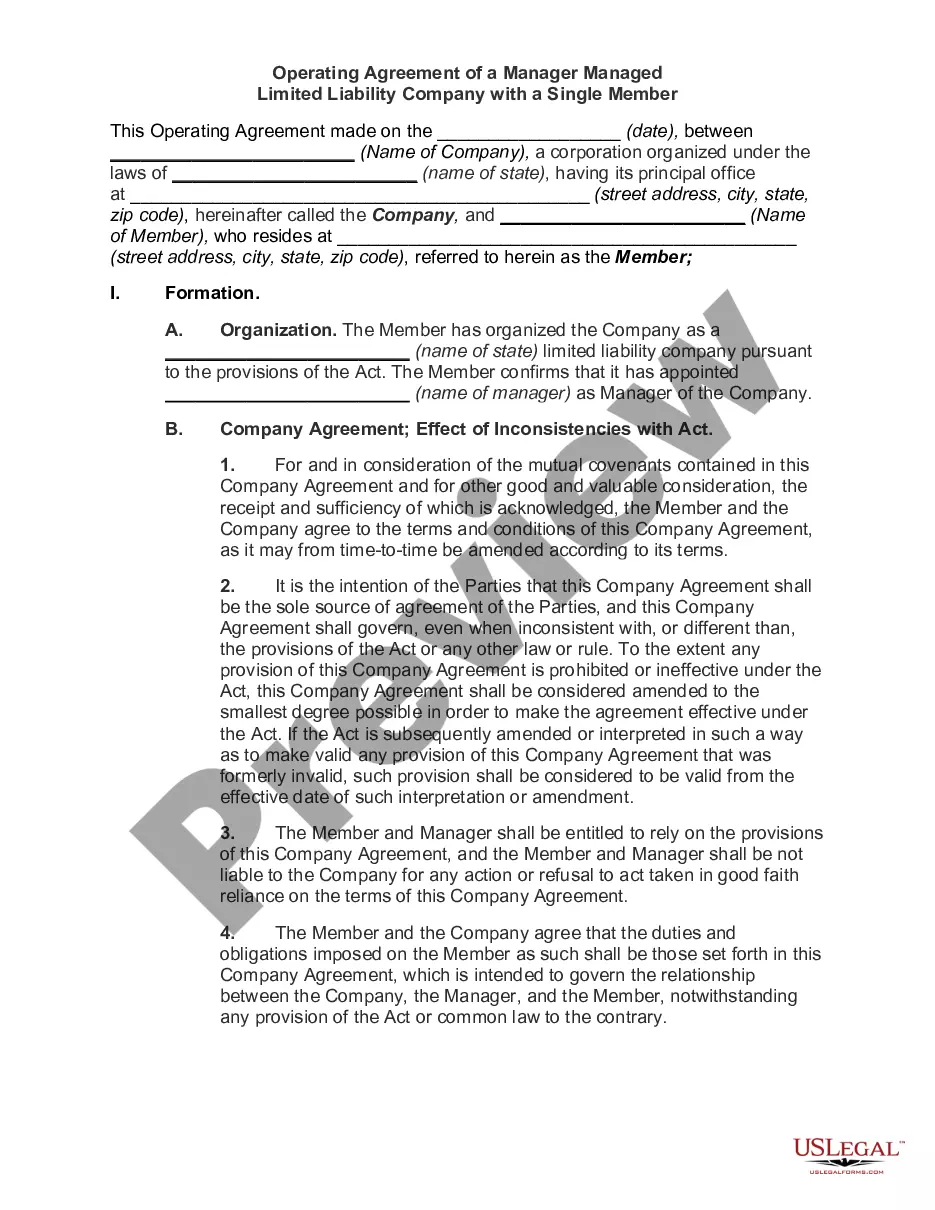

Idaho LLC Operating Agreement for Single Member

Description

How to fill out LLC Operating Agreement For Single Member?

Are you presently in a situation where you require documents for both business or personal reasons almost every day.

There are numerous legal document templates accessible online, but locating ones you can rely on is challenging.

US Legal Forms provides a vast array of form templates, including the Idaho LLC Operating Agreement for Single Member, designed to meet federal and state requirements.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- You can then download the Idaho LLC Operating Agreement for Single Member template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/state.

- Use the Preview button to view the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search section to locate the form that meets your needs.

- Once you have the correct form, click Buy now.

- Select the payment plan you need, fill out the required information to create your account, and pay for your order using PayPal or a Visa or Mastercard.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Idaho LLC Operating Agreement for Single Member anytime, as needed. Just select the desired form to download or print the document template.

- Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various reasons. Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Idaho does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Cost to Form an LLC in Idaho. The cost to start an Idaho limited liability company (LLC) is $100. This fee is paid to the Idaho Secretary of State when filing the LLC's Certificate of Organization. Use our free Form an LLC in Idaho guide to do it yourself.

How to Start an LLC in IdahoSelect a name for your Idaho LLC.Designate a registered agent. Our picks of the best LLC services.File a Certificate of Organization.Draft an Operating Agreement.Obtain an IRS Employer Identification Number (EIN)Fulfill your Idaho LLC's additional legal obligations.

What To Include in a Single Member LLC Operating AgreementName of LLC.Principal Place of Business.State of Organization/Formation.Registered Office and Agent.Operating the LLC in another state (Foreign LLC)Duration of LLC.Purpose of LLC.Powers of LLC.More items...?24 Sept 2021

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.