Idaho Default is a type of legal action that is taken when a borrower has failed to make payments on a loan or other credit agreement. It is a way of protecting the lender's interests and may involve repossession of the property, foreclosure, or garnishment of wages. There are two primary types of Idaho Default: voluntary and involuntary. Voluntary default occurs when the borrower willingly stops making payments and is willing to negotiate with the lender, while involuntary default happens when the borrower fails to make payments despite the lender's efforts to obtain payment. In either case, Idaho Default can have serious consequences for the borrower, including damaged credit, legal fees, and loss of property.

Idaho Default

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Default?

Managing legal documentation necessitates carefulness, accuracy, and utilizing well-prepared templates.

US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you choose your Idaho Default template from our platform, you can rest assured it adheres to federal and state statutes.

All documents are formulated for multiple use cases, like the Idaho Default you find on this page. If you require them later, you can fill them out without additional payment - just visit the My documents section in your account and finish your document whenever you need it. Experience US Legal Forms and complete your business and personal documentation swiftly and in full legal conformity!

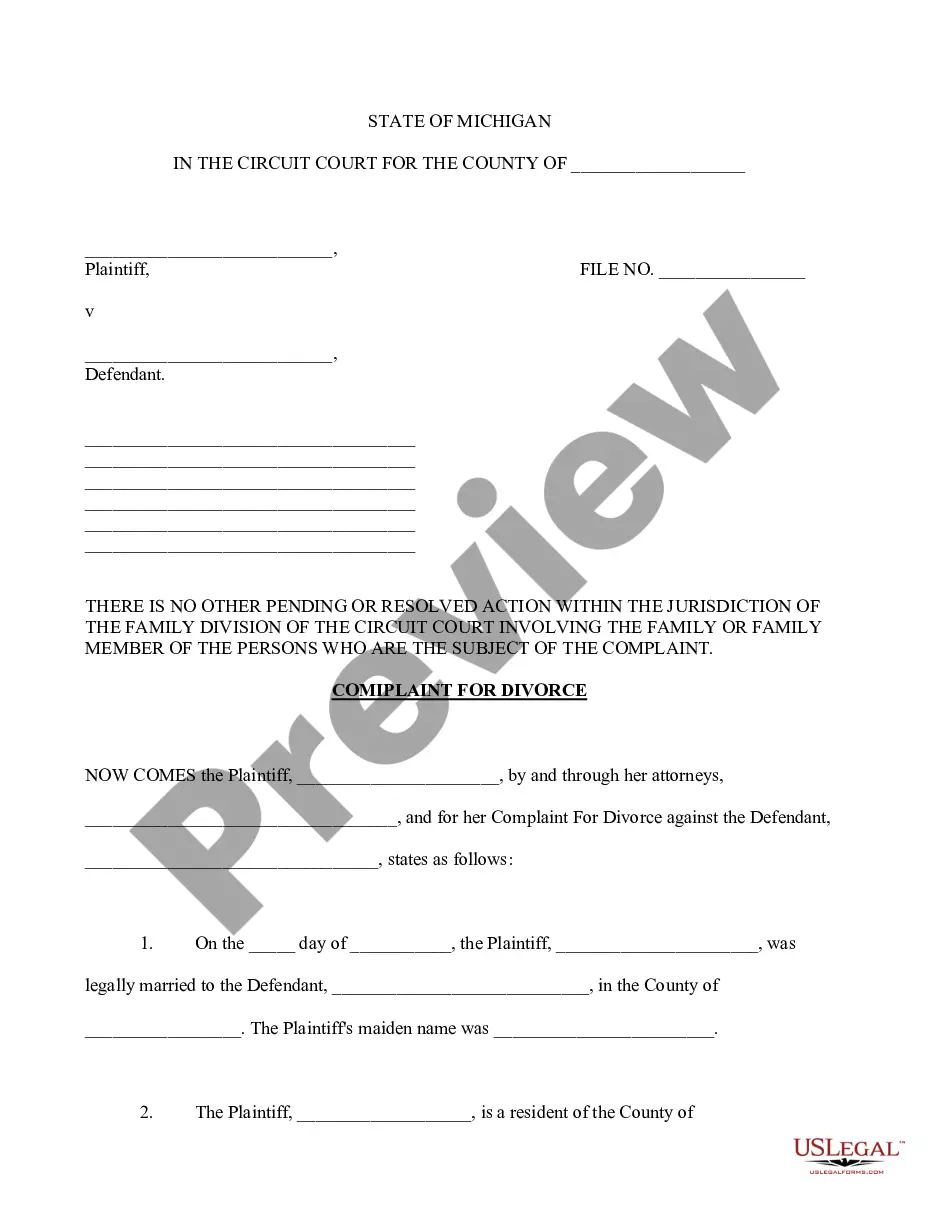

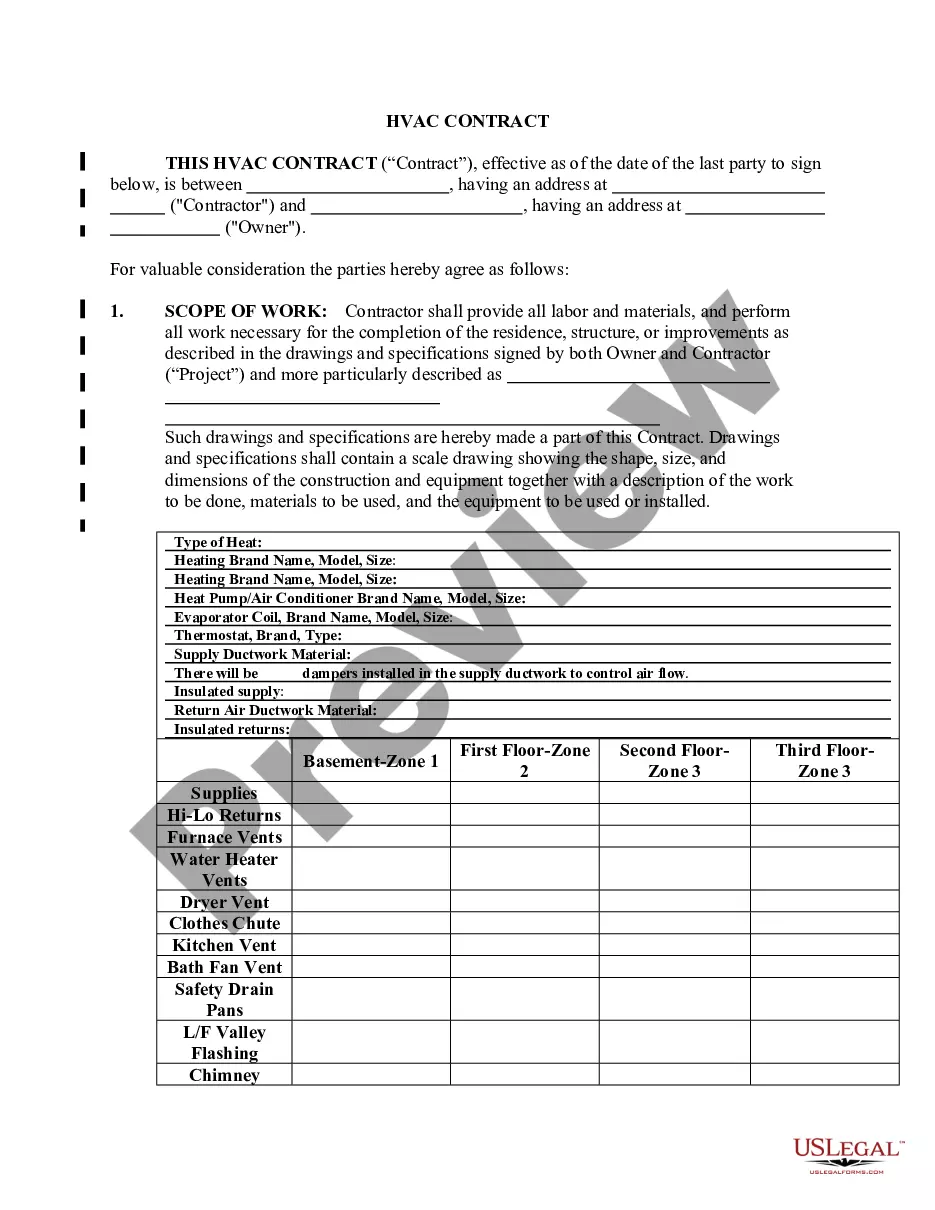

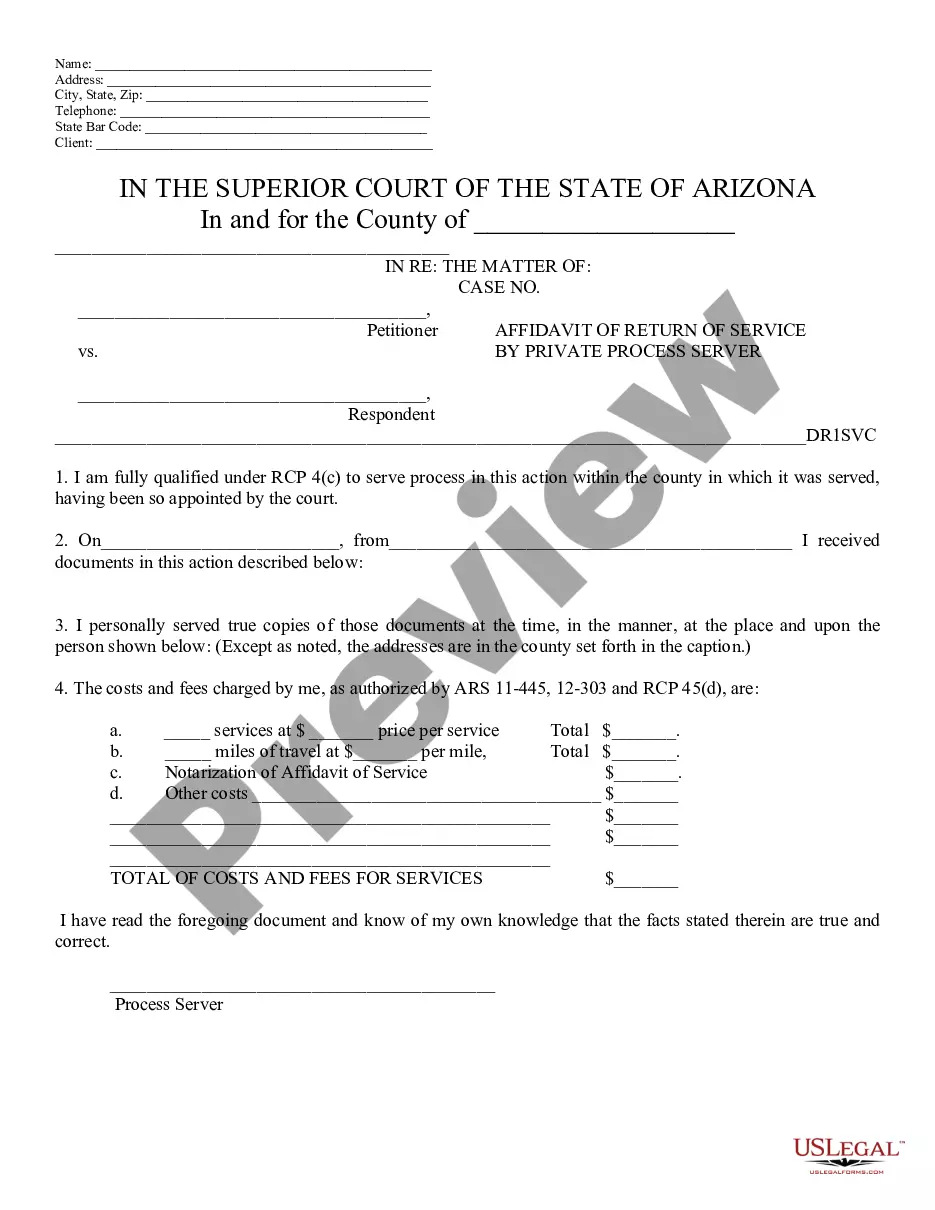

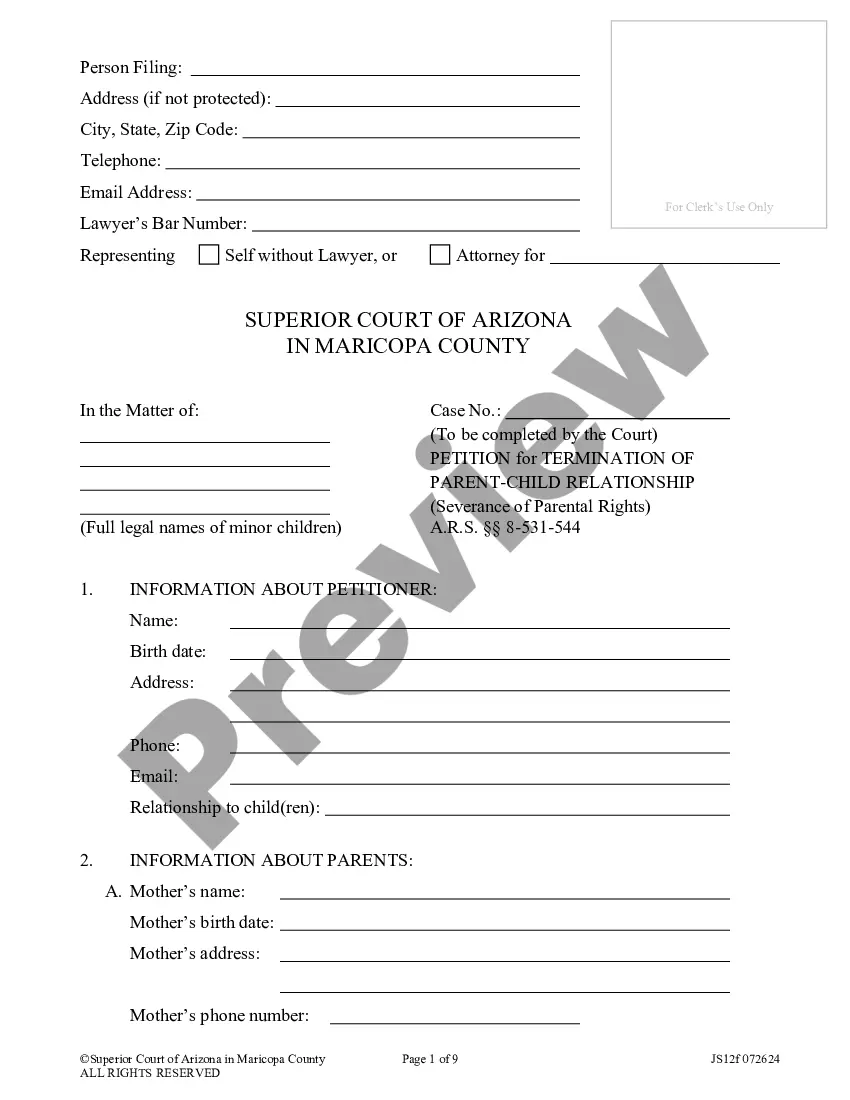

- Ensure to meticulously verify the form details and its alignment with general and legal standards by previewing it or reviewing its summary.

- Seek an alternative official template if the one previously viewed doesn't align with your circumstances or state laws (the link for that is located on the top page corner).

- Log in to your account and store the Idaho Default in your desired format. If it’s your initial experience with our platform, click Buy now to continue.

- Create an account, select your subscription option, and settle the payment using your credit card or PayPal account.

- Choose in which format you want to receive your form and click Download. Print the blank form or incorporate it into a professional PDF editor to complete it without paper.

Form popularity

FAQ

Negotiating after a default judgment can be challenging but is possible in Idaho. If both parties agree, you can negotiate terms to modify the judgment or arrange a settlement. However, keep in mind that negotiations may require the court's approval to be legally binding. Using US Legal Forms may assist you in drafting any necessary agreements post-judgment.

Yes, a default judgment can be reversed in Idaho if the party against whom the judgment was made can show excusable neglect or a lack of proper service. The timeframe for filing a motion to set aside a judgment is generally very short, so acting quickly is crucial. It's important to gather evidence and provide a compelling reason for the court to reconsider its decision. Services like US Legal Forms can supply you the forms needed for this process.

To make a default judgment in Idaho, you need to file the necessary documents with the court where your case is pending. This usually includes a request to enter default and proof that the defendant was properly served. After that, the court will set a hearing for a judgment unless the opposing party responds before the deadline. Utilizing the US Legal Forms platform can help ensure you have all the correct forms and instructions for this process.

The Supreme Court of Idaho is the State's court of last resort. The Court hears appeals from final decisions of the district courts, as well as from orders of the Public Utilities Commission and the Industrial Commission.

When you default on a loan, your account is sent to a debt collection agency that tries to recover your outstanding payments. Defaulting on any payment will reduce your credit score, impair your ability to borrow money in the future, lead to fees, and possibly result in the seizure of your personal property.

Generally, ?when a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend, and that failure is shown by affidavit or otherwise, the court must order entry of the party's default.?ix For this reason, entry of default is not an area of discretion for the trial court but

Entry of a defendant's default simply means that the defendant is thereafter barred from defending against the lawsuit, whereas the default judgment is the court's pronouncement of what the plaintiff is entitled to against the defendant (such as money damages, declaratory relief, an injunction, or otherwise).

Generally, a default allows you to obtain an earlier final hearing to finish your case. Once the default is signed by the clerk, you can request a trial or final hearing in your case. To obtain a default, you will need to complete Motion for Default, Florida Supreme Court Approved Family Law Form 12.922(a).

With few exceptions, once a default judgment in entered in Florida, a defendant loses their chance to fight the judgment. In other words, it typically does not matter if later on the defendant asserts that the judgment is unfair, uses incorrect numbers, is based on wrong information, or any other number of excuses.

In Florida, a default judgment can be entered when a defendant is served with a lawsuit but does not respond in time. A plaintiff can ask the judge to enter the default judgment in their favor without a hearing and without any further notice to you other than the initial service.