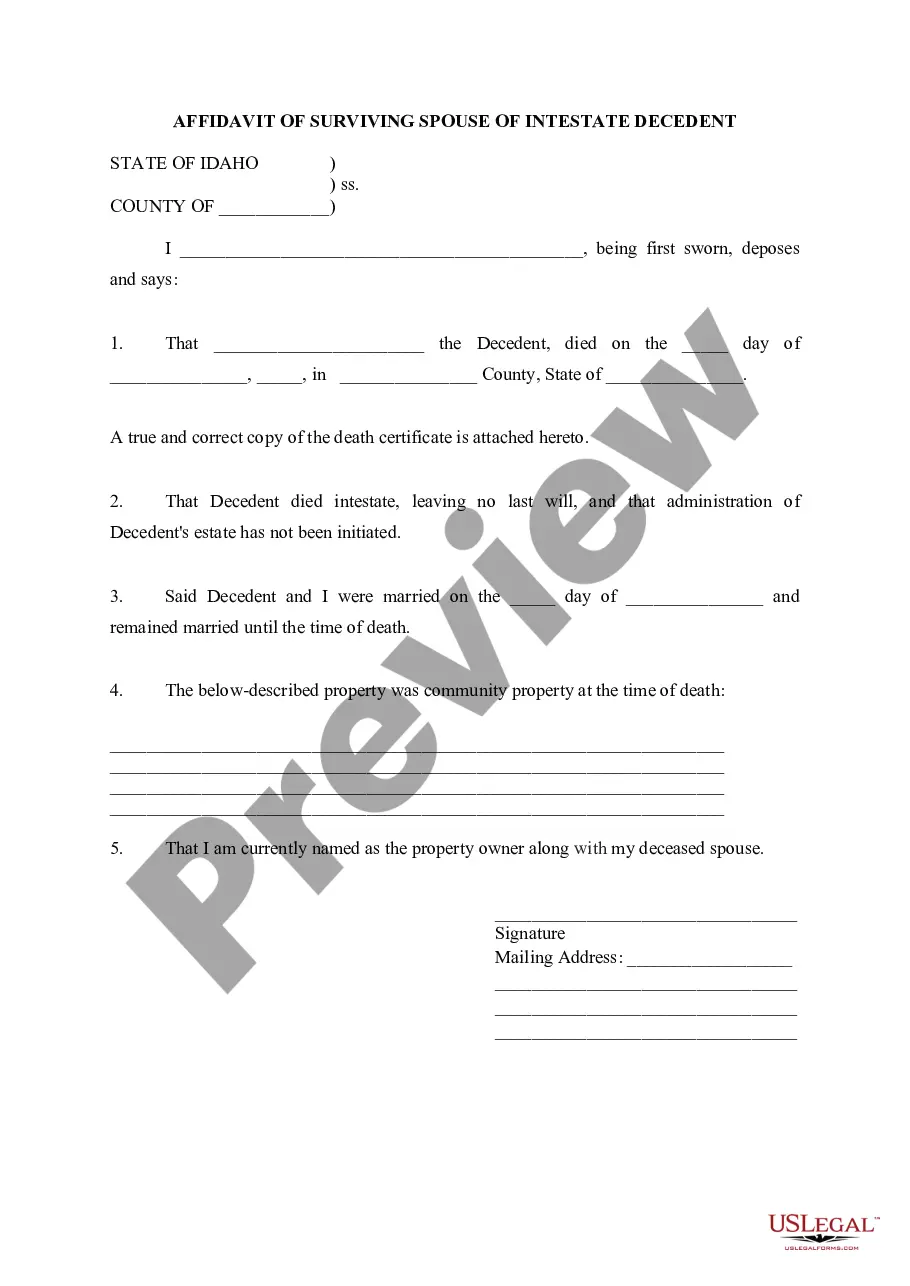

Idaho Affidavit of Surviving Spouse of Intestate Decedent

Description

How to fill out Idaho Affidavit Of Surviving Spouse Of Intestate Decedent?

Utilize US Legal Forms to obtain a printable Idaho Affidavit of Surviving Spouse of Intestate Decedent.

Our court-recognizable forms are crafted and routinely refreshed by qualified attorneys.

Ours is the most extensive forms repository available online and provides reasonably priced and precise templates for individuals, legal practitioners, and small to medium-sized businesses.

Click Buy Now if it’s the template you seek. Create your account and complete payment using PayPal or credit/debit card. Download the template to your device and feel free to reuse it multiple times. Use the Search field if you need to find additional document templates. US Legal Forms provides thousands of legal and tax templates and packages for both business and personal requirements, including the Idaho Affidavit of Surviving Spouse of Intestate Decedent. Over three million users have successfully taken advantage of our services. Select your subscription plan and receive high-quality forms within just a few clicks.

- The documents are categorized by state, and many can be viewed before downloading.

- To access templates, users must possess a subscription and Log In to their account.

- Click Download next to any template you require and locate it in My documents.

- For users without a subscription, follow the guidelines below to conveniently locate and download the Idaho Affidavit of Surviving Spouse of Intestate Decedent.

- Ensure you obtain the correct template corresponding to the required state.

- Examine the document by reading the description and utilizing the Preview option.

Form popularity

FAQ

Community Property in California Inheritance LawsCalifornia is a community property state, which is a policy that only applies to spouses and domestic partners.The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

If you don't have a will when you die, your money, property and possessions will be shared out according to the law instead of your wishes. This can mean they pass to someone you hadn't intended or that someone you want to pass things on to ends up with nothing.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

If you die without a valid will, your state's intestacy laws determine the distribution of probate assets. Some states' laws provide that a surviving spouse automatically inherits all of the assets whether or not the couple had children together.

When an individual dies intestate meaning no will or trust to bequeath assets state law determines how the assets are divided among potential heirs. For married couples with children, it is not automatic that the surviving spouse inherits all assets.Surviving children may include those from a prior marriage.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

If you die without a will in Idaho, your children will receive an intestate share of your property.For children to inherit from you under the laws of intestacy, the state of Idaho must consider them your children, legally.