Iowa Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

How to fill out Stock Appreciation Rights Plan Of The Todd-AO Corporation?

US Legal Forms - one of several most significant libraries of lawful types in the States - provides an array of lawful papers templates it is possible to obtain or print out. Utilizing the internet site, you will get thousands of types for business and specific functions, sorted by classes, states, or keywords.You will discover the most up-to-date types of types such as the Iowa Stock Appreciation Rights Plan of The Todd-AO Corporation within minutes.

If you currently have a monthly subscription, log in and obtain Iowa Stock Appreciation Rights Plan of The Todd-AO Corporation from the US Legal Forms local library. The Down load key will show up on each form you look at. You have accessibility to all earlier acquired types within the My Forms tab of the accounts.

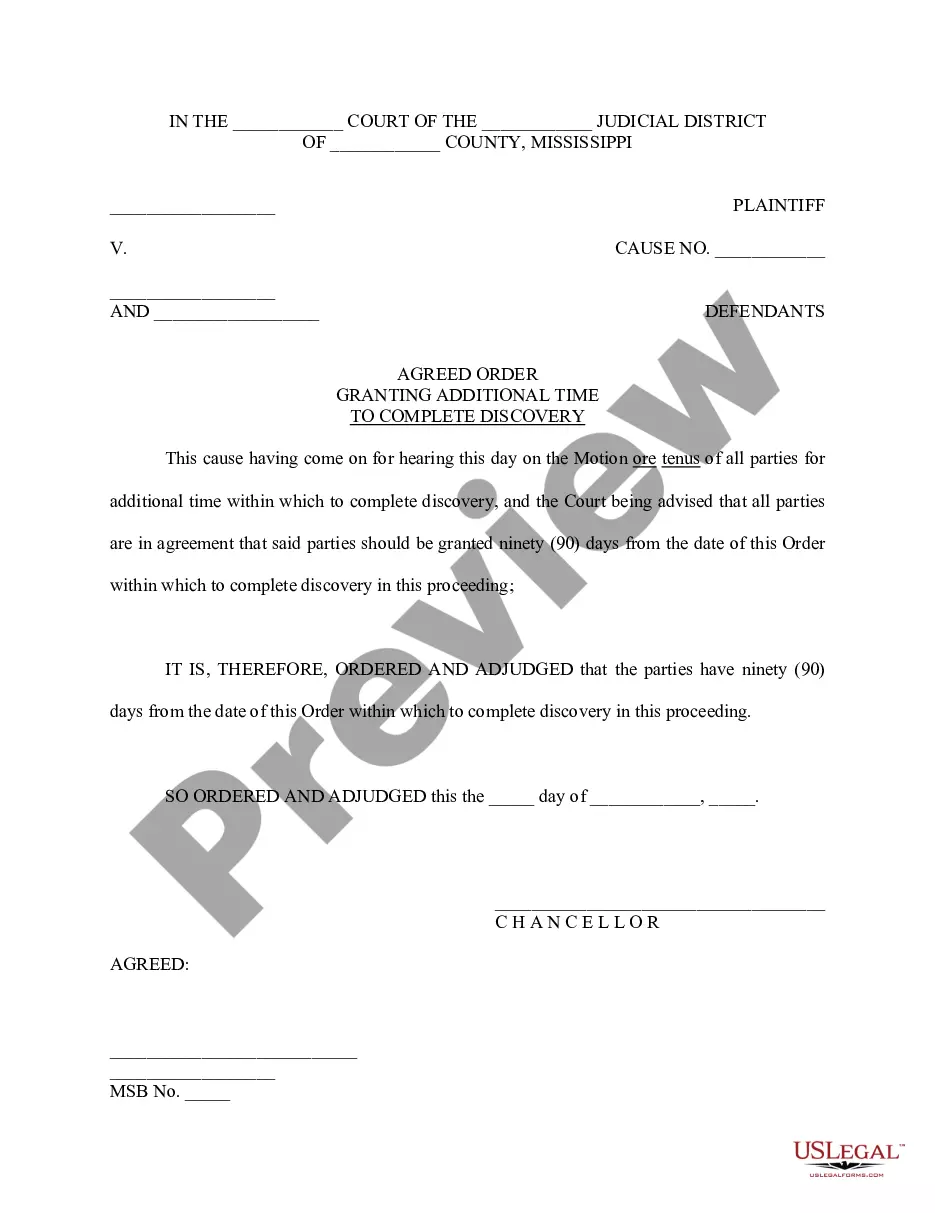

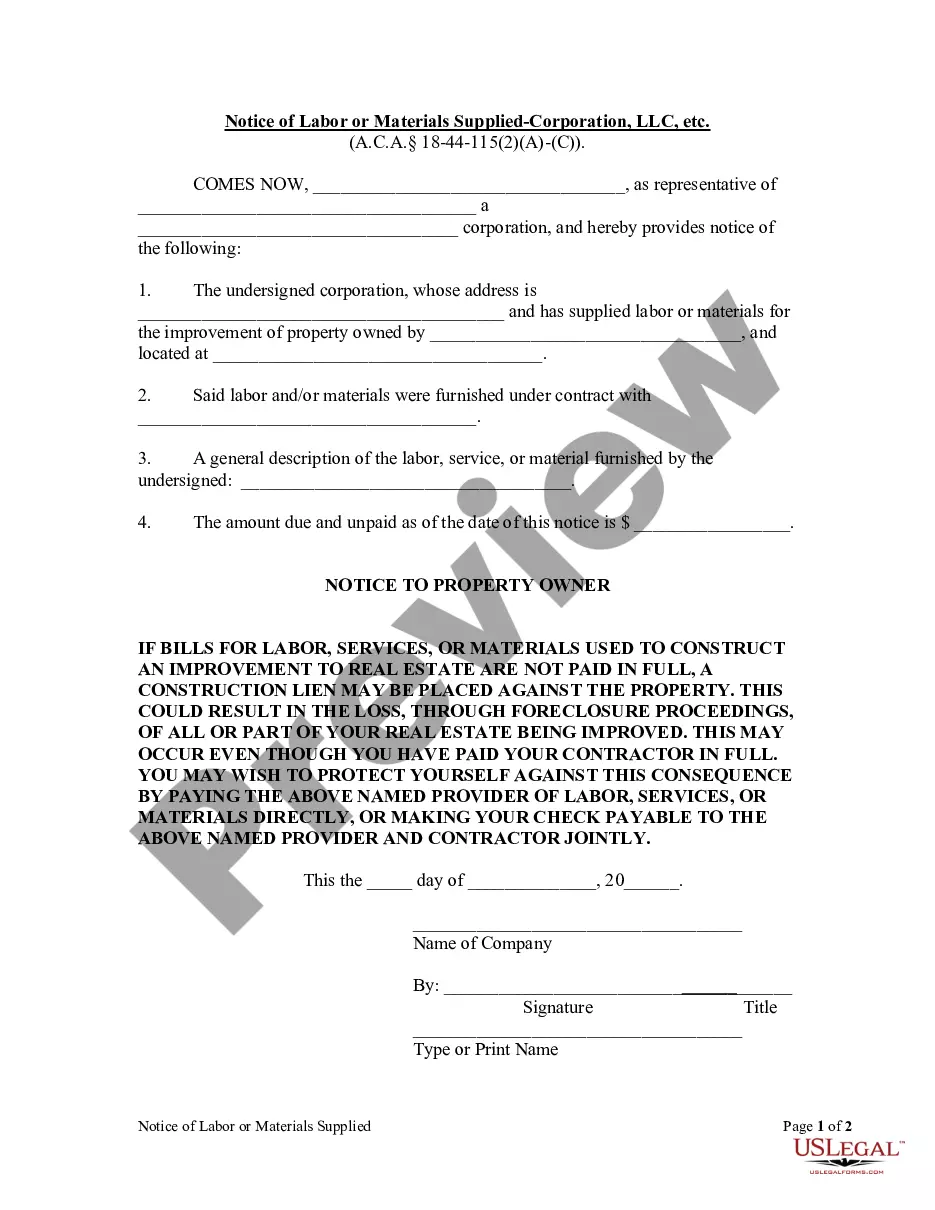

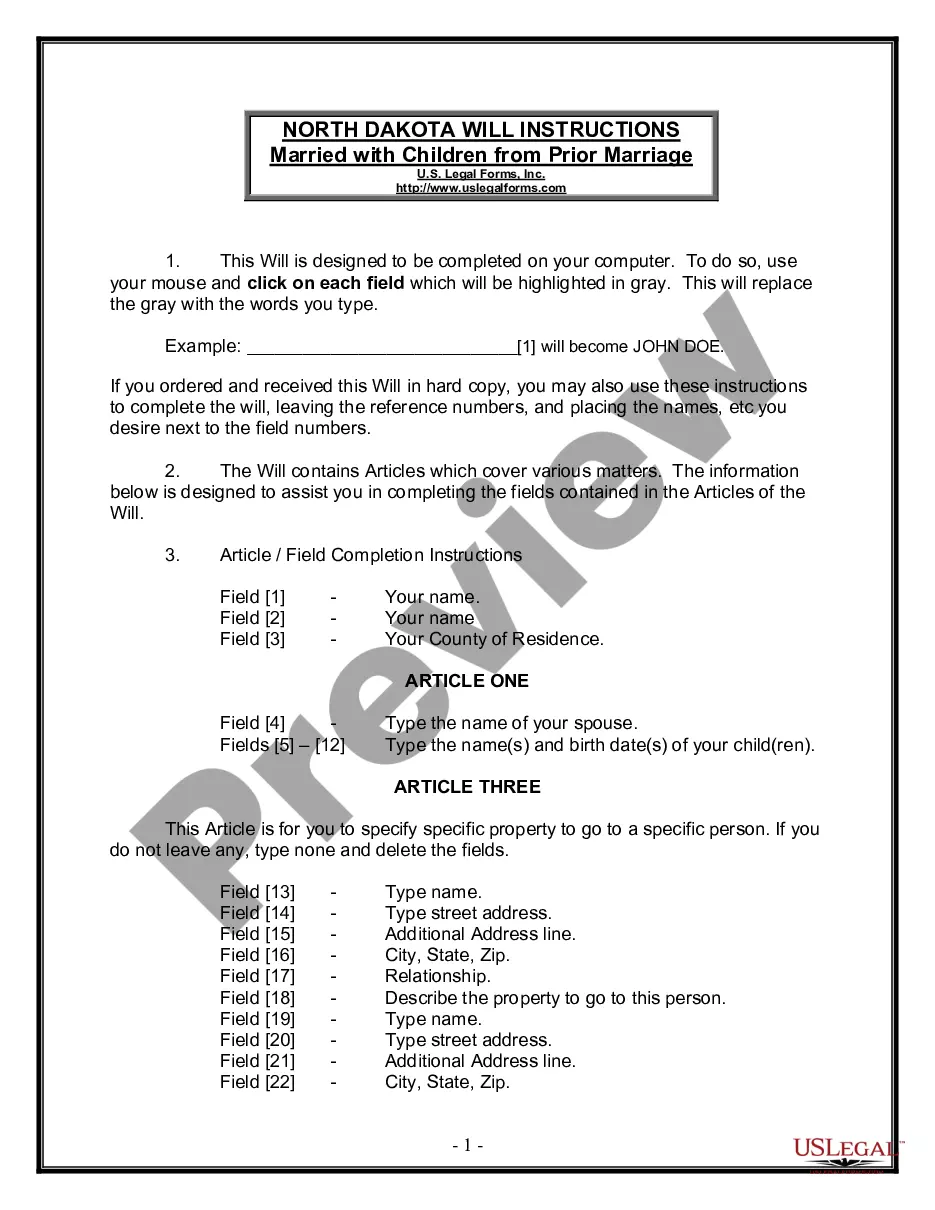

If you would like use US Legal Forms for the first time, listed here are simple guidelines to help you started off:

- Be sure to have picked the correct form for the area/area. Click on the Review key to review the form`s articles. Look at the form description to actually have chosen the appropriate form.

- If the form does not suit your demands, make use of the Research discipline near the top of the display screen to find the one that does.

- When you are pleased with the shape, validate your option by simply clicking the Acquire now key. Then, choose the prices strategy you want and offer your credentials to register for the accounts.

- Procedure the transaction. Use your bank card or PayPal accounts to complete the transaction.

- Choose the format and obtain the shape on the device.

- Make modifications. Complete, modify and print out and sign the acquired Iowa Stock Appreciation Rights Plan of The Todd-AO Corporation.

Each web template you included in your account does not have an expiration particular date and it is your own property forever. So, if you want to obtain or print out an additional version, just visit the My Forms section and then click about the form you need.

Obtain access to the Iowa Stock Appreciation Rights Plan of The Todd-AO Corporation with US Legal Forms, by far the most comprehensive local library of lawful papers templates. Use thousands of expert and condition-particular templates that fulfill your company or specific demands and demands.

Form popularity

FAQ

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.

Stock appreciation rights do expire. The expiration period varies from plan to plan. Once your rights expire, they are worthless. There are often special rules for terminated, retired, and deceased employees.

A Stock Appreciation Right (SAR) is an award which provides the holder with the ability to profit from the appreciation in value of a set number of shares of company stock over a set period of time.

A Stock Appreciation Right (SAR) is an award which provides the holder with the ability to profit from the appreciation in value of a set number of shares of company stock over a set period of time.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).