Iowa Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

Discovering the right lawful papers template can be a struggle. Of course, there are a lot of templates accessible on the Internet, but how would you find the lawful develop you require? Utilize the US Legal Forms internet site. The assistance provides thousands of templates, including the Iowa Directors Stock Appreciation Rights Plan of American Annuity Group, Inc., that can be used for company and personal requirements. All the forms are checked out by specialists and satisfy state and federal specifications.

If you are previously signed up, log in for your profile and click the Acquire option to find the Iowa Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.. Make use of your profile to search through the lawful forms you have ordered in the past. Visit the My Forms tab of your profile and acquire another copy in the papers you require.

If you are a new consumer of US Legal Forms, listed here are straightforward directions that you should comply with:

- First, make certain you have chosen the proper develop to your area/region. You may check out the shape using the Review option and look at the shape explanation to make certain this is basically the right one for you.

- If the develop will not satisfy your expectations, use the Seach discipline to find the appropriate develop.

- Once you are positive that the shape is suitable, go through the Get now option to find the develop.

- Select the prices strategy you want and enter the essential information and facts. Build your profile and buy your order using your PayPal profile or charge card.

- Pick the file format and obtain the lawful papers template for your system.

- Total, edit and print out and indication the obtained Iowa Directors Stock Appreciation Rights Plan of American Annuity Group, Inc..

US Legal Forms will be the greatest local library of lawful forms in which you will find numerous papers templates. Utilize the service to obtain expertly-produced papers that comply with condition specifications.

Form popularity

FAQ

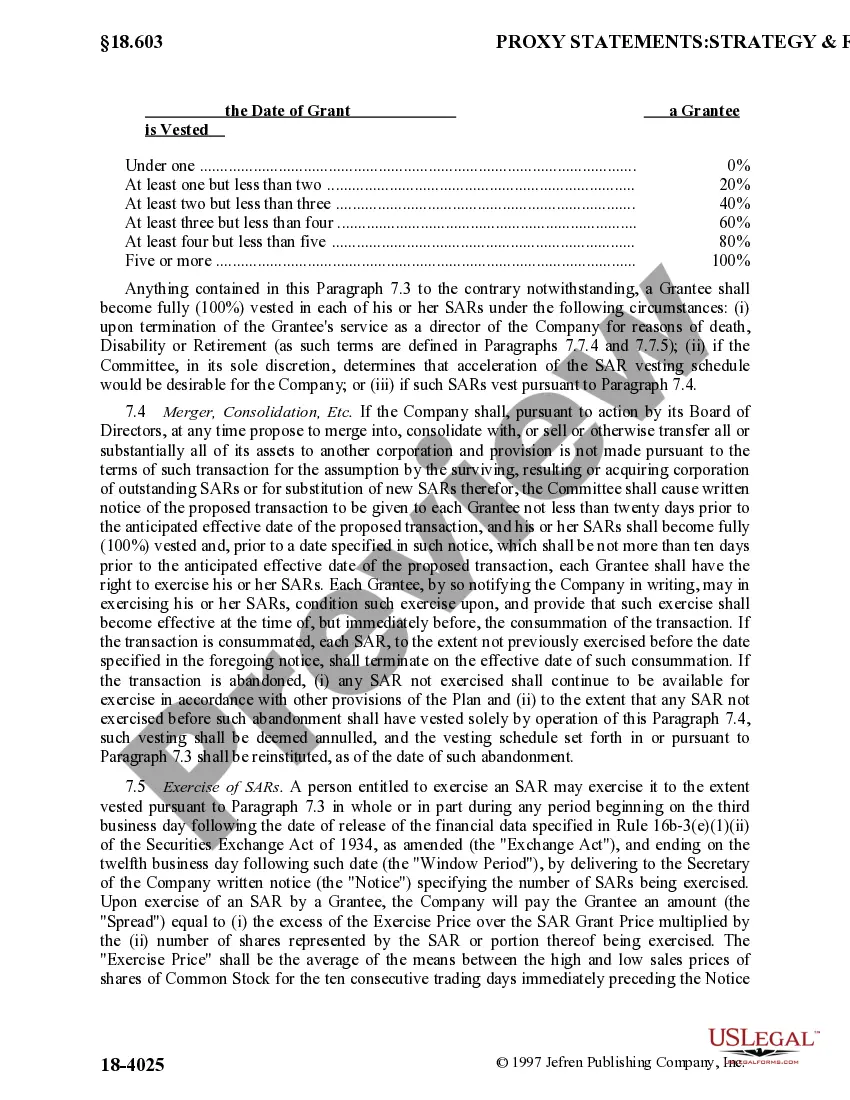

The rights are valued once, divided evenly over the vesting period and marked as rights paid in capital. For example, a company that issues $5,000 in rights with a five-year vesting period would debit compensation expense for $1,000 and credit rights paid in capital for $1,000 once a year for five years. Accounting for Stock Appreciation Rights - Small Business - Chron.com chron.com ? accounting-stock-appr... chron.com ? accounting-stock-appr...

What is a Stock Appreciation Right (SAR)? A Stock Appreciation Right (SAR) refers to the right to be paid compensation equivalent to an increase in the company's common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market.

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security. FAQs ? Stock Appreciation Rights (SARS) - Fidelity Investments Fidelity Investments ? stockoptions ? aboutsarfaq Fidelity Investments ? stockoptions ? aboutsarfaq

A ?Stock Appreciation Right? is the right to receive a payment from the Company in an amount equal to the ?Spread,? which is defined as the excess of the Fair Market Value (as defined in Plan) of one share of common stock, $1.00 par value (the ?Stock?) of the Company at the Exercise Date (as defined below) over a ...

A compensatory award granted to an employee or other service provider of a company. On exercise of a SAR, the recipient is entitled to receive an amount equal to the appreciation in the value of the underlying company shares from the date the SAR is granted until the SAR is exercised. Stock Appreciation Right (SAR) - Practical Law Canada Practical Law Canada ? ... Practical Law Canada ? ...