Iowa Independent Contractor Agreement for Accountant and Bookkeeper

Description

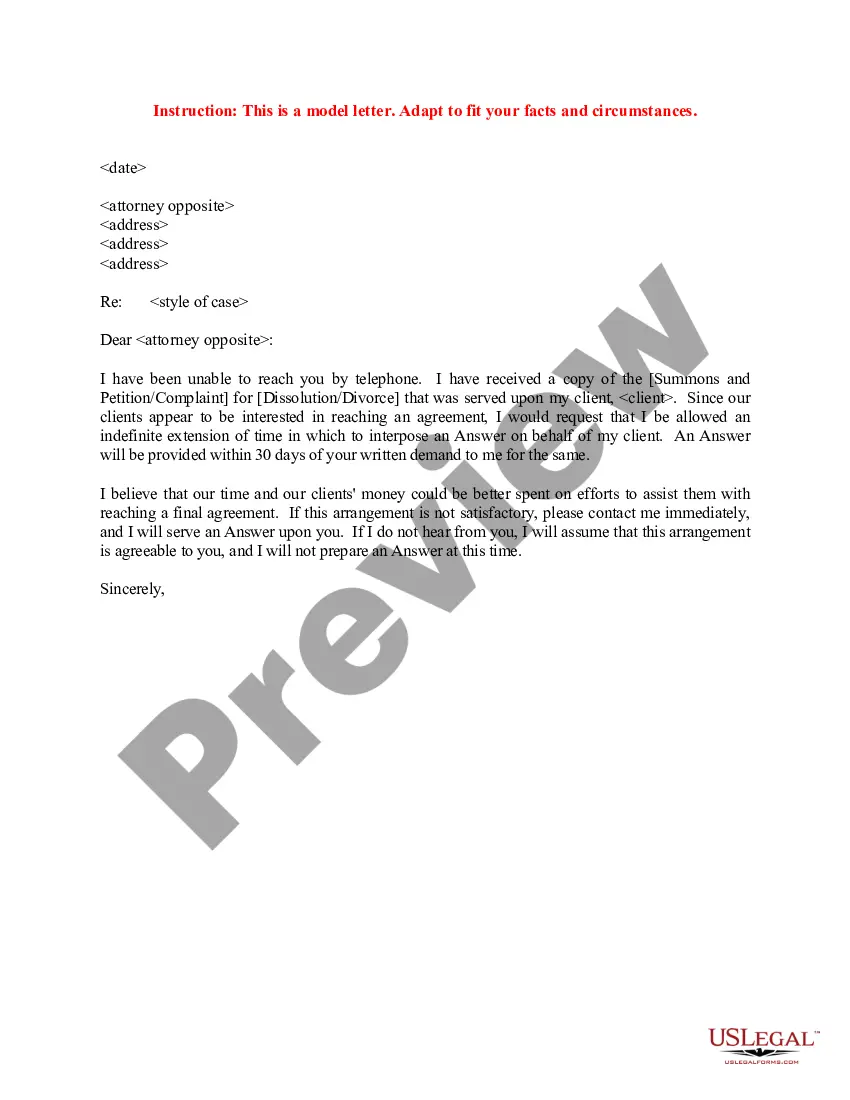

How to fill out Independent Contractor Agreement For Accountant And Bookkeeper?

US Legal Forms - one of the largest collections of official templates in the United States - offers a vast selection of legal document formats that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of documents like the Iowa Independent Contractor Agreement for Accountant and Bookkeeper in just moments.

If you already have a membership, Log In and download the Iowa Independent Contractor Agreement for Accountant and Bookkeeper from the US Legal Forms repository. The Download button will appear on every form you review. You can access all previously downloaded forms from the My documents section of your account.

Every template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the Iowa Independent Contractor Agreement for Accountant and Bookkeeper through US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and specifications.

- Make sure you have selected the correct form for your region/state. Click the Review button to examine the form's content. Review the form description to ensure you have chosen the right form.

- If the form does not satisfy your requirements, utilize the Search bar at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your credentials to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form onto your device.

- Make adjustments. Fill out, modify, print, and sign the downloaded Iowa Independent Contractor Agreement for Accountant and Bookkeeper.

Form popularity

FAQ

An account receivable clerk is a bookkeeping professional who manages a company's balance sheet and ensures that their company gets paid for the goods and services they provide to customers.

Analysis: An accountant can give you a comprehensive view of your business's financial state, along with strategies and recommendations for making financial decisions. Bookkeepers, on the other hand, are only responsible for recording financial transactions.

The average full-time bookkeeper earns nearly $40,000 per year (almost $19 an hour), according to the U.S. Bureau of Labor Statistics reports. But Robinson pointed out that as a freelancer or contractor, you can actually earn a higher hourly rate while working fewer hours.

To be a bookkeeper you need to have a money laundering license, also known as AML - Anti Money Laundering. If you don't have this you would be breaking the law if you start a bookkeeping business from home. License holders are offered a range of resources and guidance to help complying with your AML duties.

How to Become an Independent BookkeeperGet Your Degree. No one's going to trust you with their money if you haven't studied accounting and bookkeeping.Gain Practical Experience.Add Some Credentials.Handle Your Legal Issues.Start Marketing Yourself.

Bookkeepers perform some or all steps of the accounting cycle. A full-charge bookkeeper knows how to perform all the steps, and a clerical bookkeeper usually specializes in one or more steps and can also specialize in one area of operations, such as accounts payable (AP), accounts receivable (AR) or payroll.

A bookkeeper records and classifies a company's daily financial transactions (e.g., sales, payroll, payment of bills, etc.). Their focus is on accurate record keeping, and less focused on interpreting the data and analytics. An accountant builds on the information provided to them by the bookkeeper.

In Australia, you don't technically have to be certified in any way to work as a bookkeeper. That's the reason why small business owners can do their own books and BAS. Administrators with experience in bookkeeping can offer their services without having to get a qualification to formalise their experience.

Along with accounts receivable, many bookkeepers also handle their clients' accounts payable. That means the bookkeeper will handle all of the vendor bills that the company receives.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.