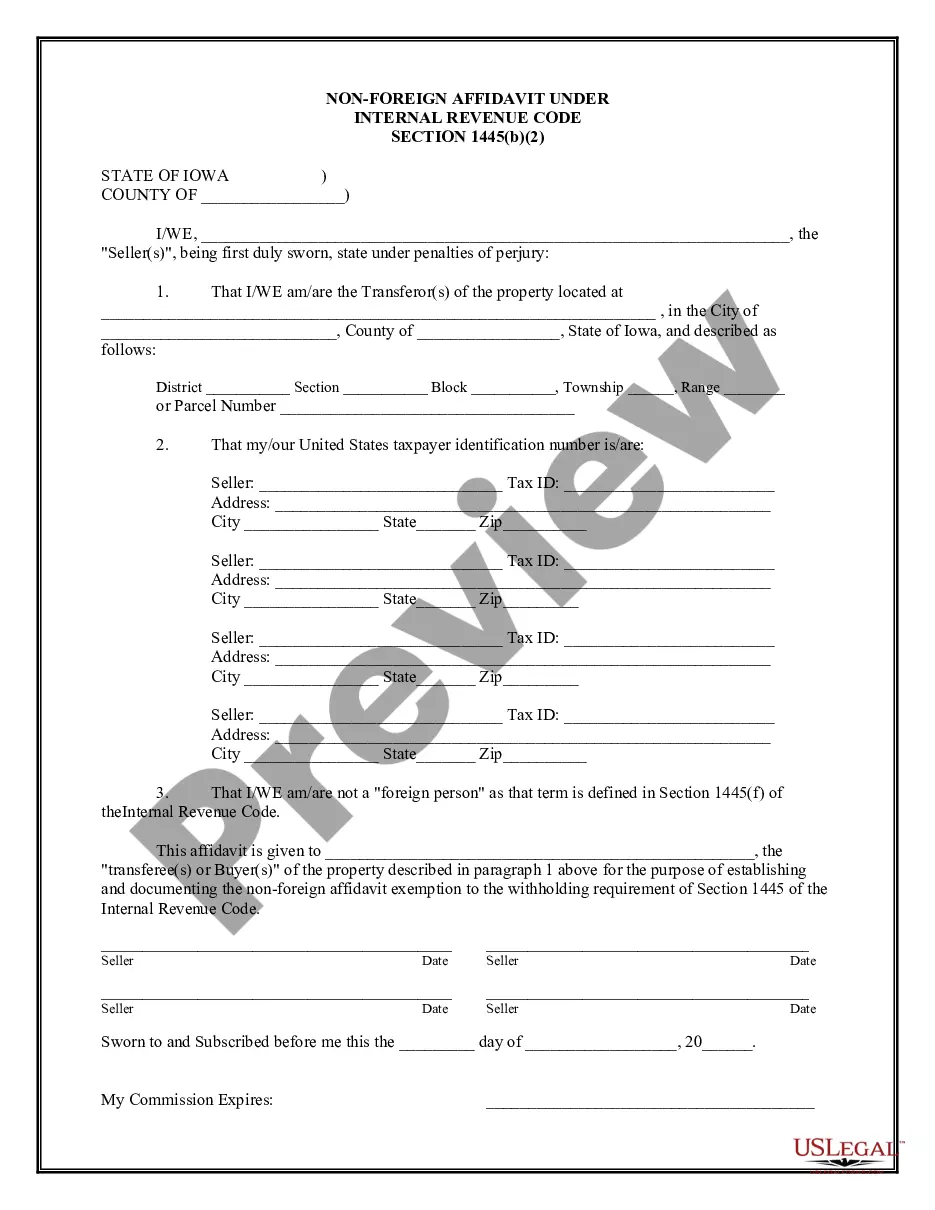

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Iowa Non-Foreign Affidavit Under IRC 1445

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Non-Foreign Affidavit Under IRC 1445?

Obtain the most extensive collection of approved documents.

US Legal Forms offers a platform where you can easily access any state-specific file, such as templates for the Iowa Non-Foreign Affidavit Under IRC 1445.

There's no need to squander hours seeking a legally admissible example. Our expert team guarantees that you receive current documents with every order.

After selecting a pricing option, set up your account. Make payment via credit card or PayPal. Download the document to your device by clicking the Download button. That’s it! You should fill out the Iowa Non-Foreign Affidavit Under IRC 1445 template and review it. To confirm accuracy, consult your local legal advisor for assistance. Sign up and easily access over 85,000 useful templates.

- To access the document library, choose a subscription and create an account.

- If you have already registered, just Log In and click Download.

- The Iowa Non-Foreign Affidavit Under IRC 1445 document will be immediately saved in the My documents section (a repository for all documents you download from US Legal Forms).

- To create a new account, follow the straightforward steps outlined below.

- If you intend to use a state-specific document, make sure to select the correct state.

- If possible, review the description to understand all the details of the form.

- Utilize the Preview feature if it's available to examine the document's content.

- If everything seems accurate, click Buy Now.

Form popularity

FAQ

FIRPTA filings are essential for foreign sellers of U.S. real estate. If you are selling a property and not a U.S. citizen, you will need to provide the Iowa Non-Foreign Affidavit Under IRC 1445. This is important for ensuring compliance with U.S. tax laws and preventing withholding issues. Consulting with uslegalforms can simplify the filing process and help you understand your obligations.

An affidavit of status is a sworn statement that confirms the residency status of the seller. In the context of the Iowa Non-Foreign Affidavit Under IRC 1445, it asserts that the individual is not a foreign person and therefore not subject to FIRPTA withholding. This affidavit protects both the buyer and seller by streamlining the transaction process and avoiding unnecessary complications. You can easily create this affidavit using resources available on uslegalforms.

The FIRPTA certificate is typically mailed to the Internal Revenue Service (IRS) at the address specified in the instructions provided with the form. For the Iowa Non-Foreign Affidavit Under IRC 1445, it is essential to ensure that all required forms accompany your submission. Using a service like uslegalforms can guide you through this process, helping ensure your FIRPTA certificate reaches the correct destination without delays.

IRS Notice 1445 provides guidelines and procedures regarding the withholding tax obligations associated with foreign sellers of U.S. real property. It helps clarify what documentation is needed, including the Iowa Non-Foreign Affidavit Under IRC 1445, to ensure compliance. This notice serves as a vital resource for both buyers and sellers in understanding their tax responsibilities during real estate transactions.

IRS Section 1445 addresses the tax withholding provisions for foreign sellers of U.S. real estate. This section aims to ensure that appropriate taxes are collected when foreign individuals or entities engage in real property transactions. Utilizing the Iowa Non-Foreign Affidavit Under IRC 1445 can help sellers clarify their status and avoid unnecessary withholding.

A 1445 certificate is a document that verifies an individual or entity’s non-foreign status for tax purposes, eliminating the requirement for withholding tax. It typically accompanies real estate transactions when utilizing the Iowa Non-Foreign Affidavit Under IRC 1445. Having a valid 1445 certificate streamlines the process and assures all parties of compliance with tax laws.

Code 1445 refers to the section of the Internal Revenue Code that dictates the withholding requirements for sales involving foreign entities. Specifically, it outlines the procedures for withholding tax when a foreign seller disposes of real property. Understanding Code 1445 is vital for buyers and sellers in Iowa, particularly when utilizing the Iowa Non-Foreign Affidavit Under IRC 1445.

The FIRPTA affidavit is typically provided by the seller of the property, certifying their foreign or non-foreign status. Sellers complete this affidavit to clarify their tax obligations and ease the closing process. In Iowa, the Iowa Non-Foreign Affidavit Under IRC 1445 facilitates this process, ensuring all parties understand their roles in compliance with tax regulations.

foreign person affidavit certifies that an individual or entity does not meet the definition of a foreign person under U.S. tax laws. This affidavit is crucial for transactions involving real estate and helps determine tax withholding responsibilities. When dealing with the Iowa NonForeign Affidavit Under IRC 1445, using this affidavit ensures compliance and reduces the risk of withholding tax liabilities.

foreign affidavit is a legal document that certifies a seller's status as a domestic entity, ensuring that they are not subject to the withholding requirements outlined in IRC Section 1445. This affidavit is essential for buyers who want to confirm that they are dealing with a domestic seller, thus avoiding potential tax issues. When you engage with the Iowa NonForeign Affidavit Under IRC 1445, you secure your interests in the transaction and adhere to necessary legal protocols.